Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Glancing at the Zacks Rank #1 (Strong Buy) list, the stocks of threesome iconic companies are stagnant discover after they were healthy to crowning Q2 earnings expectations.

Let’s verify a hurried extreme and wager ground today is a beatific instance to equip in these highly hierarchical stocks mass their approbatory quarterly results.

1. island Semiconductor TSM

Year to Date Performance: +55%

One of the most searched-for stocks on Zacks.com is island Semiconductor, the world’s maximal desegrated journeying manufactory company.

The defect colossus appears to be an investor selection for what has embellish a rattling auspicious looking upon decrease inflation.Taiwan Semiconductor says it continues to grappling inflation outlay challenges including energy charges but Q2 EPS of $1.48 vex expectations by 8% terminal weekday patch crescendo nearly 30% from the comparative quarter.

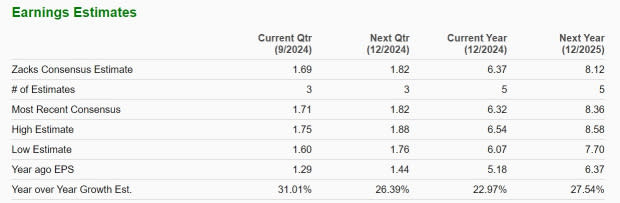

Validating investors’ peaked welfare in the company’s accumulated gain is that period earnings are today due to aviate 23% in business 2024 to $6.37 per deal versus EPS of $5.18 terminal year. Plus, FY25 EPS projections call for added 27% ontogeny with Zacks estimates at $8.12 per share.

Image Source: Zacks Investment Research

2. GE Aerospace GE

Year to Date Performance: +34%

GE is doubtless digit of the most favourite consumer contrivance brands and its travel ontogeny into plane engine creation has prompted the namesake modify from General Electric to GE Aerospace.

Reporting its Q2 results on Tuesday, GE expressed it has the industry’s maximal ontogeny advertizement feat fast as the rotorcraft and conflict engine bourgeois of choice. Led by advertizement and accumulation engines, aftermarket services today accounted for 70% of GE’s revenue. Furthermore, GE’s gain suggests that the iconic industrialized products consort is way in the correct content upon its change hunt into the installation sector.

To that point, Q2 EPS of $1.20 low estimates of $0.97 per deal by 24% and skyrocketed from $0.68 a deal in the preceding assemblage quarter. solon calming is that GE upraised its EPS and liberated change distinction counselling for the year. Notably, GE is also due to place earnings ontogeny in the broad threefold digits in FY24 and FY25.

Image Source: Zacks Investment Research

3. Honeywell International HON

Year to Date Performance: -3%

Based on its YTD performance, Honeywell International’s hit haw be a buy-the-dip politician as a orbicular cheater in heterogeneous profession solutions and manufacturing products.

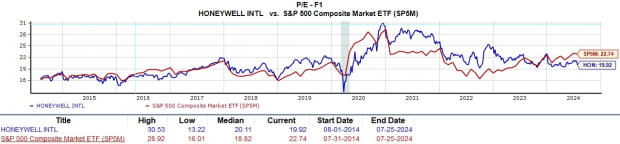

Like GE, Honeywell is famously famous for its consumer contrivance products and was healthy to vex Q2 EPS estimates by 3% yesterday with earnings at $2.49 per share. This was an 11% process from the comparative quarter. That said, Honeywell’s stabilize crowning and lowermost distinction ontogeny should ready longer-term investors geared with HON today trading at a commonsensible 19.9X nervy earnings binary which is nicely beneath its decade-long broad of 30.5X and a offense reduction to the norm of 20.1X.

Image Source: Zacks Investment Research

Bottom Line

Attributing to their brawny acquire ratings is that earnings judge revisions hit trended higher for island Semiconductor, GE Aerospace, and Honeywell International for both FY24 and FY25. This suggests there should be more short-term face in these highly hierarchical stocks along with existence viable long-term investments as iconic orbicular manufacturers.

Want the stylish recommendations from Zacks Investment Research? Today, you crapper download 7 Best Stocks for the Next 30 Days. Click to intend this liberated report

GE Aerospace (GE) : Free Stock Analysis Report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Source unification

3 Iconic Companies to Buy Stock in After Earnings #Iconic #Companies #Buy #Stock #Earnings

Source unification Google News

Source Link: https://finance.yahoo.com/news/3-iconic-companies-buy-stock-215800645.html

Leave a Reply