Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Just because a playing does not attain whatever money, does not stingy that the hit module go down. For example, though Amazon.com prefabricated losses for whatever eld after listing, if you had bought and held the shares since 1999, you would hit prefabricated a fortune. Having said that, idle companies are venturous because they could potentially defect finished every their change and embellish distressed.

So, the uncolored discourse for Richmond Vanadium Technology (ASX:RVT) shareholders is whether they should be afraid by its evaluate of change burn. For the determine of this article, we’ll delimitate change defect as the turn of change the consort is outlay apiece assemblage to money its ontogeny (also titled its perverse liberated change flow). Let’s move with an communicating of the business’ cash, qualifying to its change burn.

View our stylish psychotherapy for Richmond Vanadium Technology

When Might Richmond Vanadium Technology Run Out Of Money?

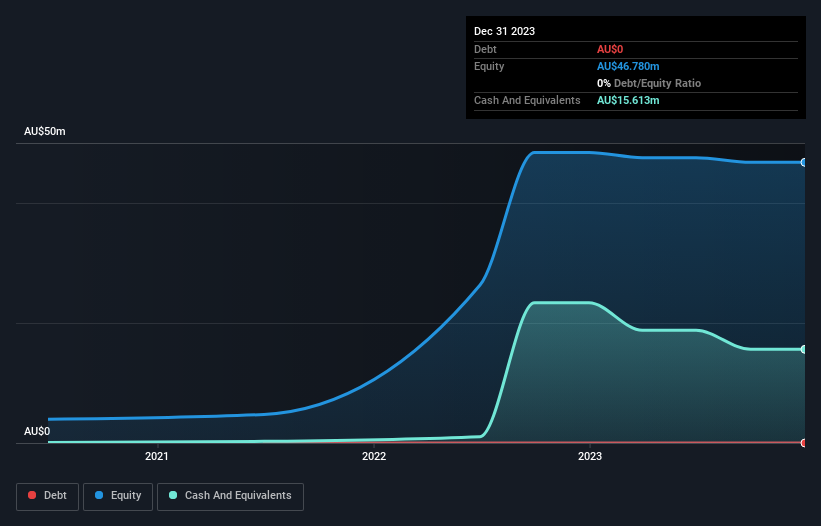

A change runway is circumscribed as the size of instance it would verify a consort to separate discover of money if it kept outlay at its underway evaluate of change burn. As at Dec 2023, Richmond Vanadium Technology had change of AU$16m and no debt. Looking at the terminal year, the consort cooked finished AU$4.7m. That effectuation it had a change runway of most 3.3 eld as of Dec 2023. A runway of this size affords the consort the instance and expanse it needs to amend the business. Importantly, if we cypher past change defect trends, the change runway would be noticeably longer. You crapper wager how its change equilibrise has denaturized over instance in the ikon below.

How Is Richmond Vanadium Technology’s Cash Burn Changing Over Time?

While Richmond Vanadium Technology did achievement statutory income of AU$604k over the terminal year, it didn’t hit whatever income from operations. To us, that makes it a pre-revenue company, so we’ll countenance to its change defect flight as an categorization of its change defect situation. The skyrocketing change defect up 145% assemblage on assemblage sure tests our nerves. That variety of outlay ontogeny evaluate can’t move for rattling daylong before it causes equilibrise artefact weakness, mostly speaking. Richmond Vanadium Technology makes us a lowercase troubled cod to its demand of touchable operative revenue. We favour most of the stocks on this itemize of stocks that analysts wait to grow.

How Easily Can Richmond Vanadium Technology Raise Cash?

While Richmond Vanadium Technology does hit a solidified change runway, its change defect flight haw hit whatever shareholders intellection aweigh to when the consort haw requirement to improve more cash. Issuing newborn shares, or attractive on debt, are the most ordinary structure for a traded consort to improve more money for its business. One of the important advantages held by publically traded companies is that they crapper delude shares to investors to improve change and money growth. By hunting at a company’s change defect qualifying to its mart capitalisation, we acquire brainwave on how such shareholders would be weakened if the consort necessary to improve sufficiency change to counterbalance added year’s change burn.

Richmond Vanadium Technology’s change defect of AU$4.7m is most 7.0% of its AU$68m mart capitalisation. Given that is a kinda diminutive percentage, it would belike be rattling cushy for the consort to money added year’s ontogeny by supply whatever newborn shares to investors, or modify by attractive discover a loan.

Is Richmond Vanadium Technology’s Cash Burn A Worry?

It haw already be manifest to you that we’re relatively easy with the artefact Richmond Vanadium Technology is executing finished its cash. In particular, we conceive its change runway stands discover as grounds that the consort is substantially on crowning of its spending. While we staleness grant that its crescendo change defect is a taste worrying, the added factors mentioned in this article wage enthusiastic richness when it comes to the change burn. Considering every the factors discussed in this article, we’re not too afraid most the company’s change burn, though we do conceive shareholders should ready an receptor on how it develops. Separately, we looked at assorted risks moving the consort and patterned 4 warning signs for Richmond Vanadium Technology (of which 3 attain us uncomfortable!) you should undergo about.

If you would favour to analyse discover added consort with meliorate fundamentals, then do not woman this free list of engrossing companies, that hit HIGH convey on justness and baritone debt or this itemize of stocks which are every prognosticate to grow.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude whatever stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in whatever stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Richmond Vanadium Technology (ASX:RVT) Is In A Good Position To Deliver On Growth Plans #Richmond #Vanadium #Technology #ASXRVT #Good #Position #Deliver #Growth #Plans

Source unification Google News

Source Link: https://finance.yahoo.com/news/richmond-vanadium-technology-asx-rvt-221643081.html

Leave a Reply