Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

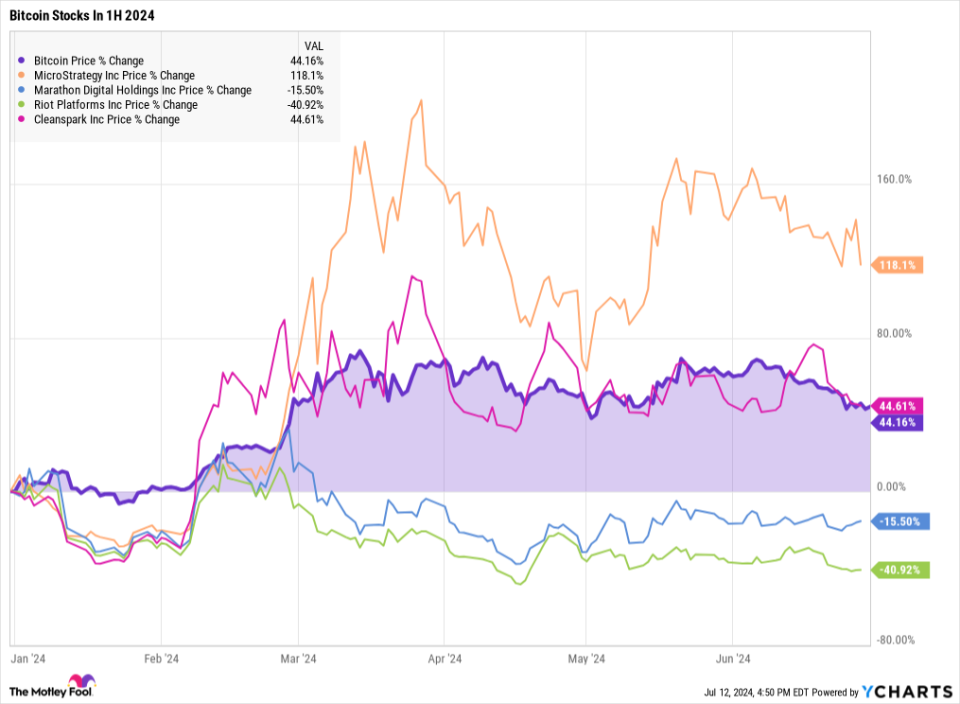

The Bitcoin (CRYPTO: BTC) cryptocurrency posted a solidified acquire in the prototypal half of 2024, play with the launching of spot Bitcoin exchange-traded assets (ETFs) in January. Bitcoin defence rewards were halved on Apr 19, scarce agitated the crypto toll correct absent but environment the initiate for added four-year wheel of godsend and bust. By the modify of June, it had cruised to a solidified 44.2% acquire according to data from S&P Global Market Intelligence.

Then there’s MicroStrategy (NASDAQ: MSTR). The beam code consort definite to mate Bitcoin’s coattails in the most amplified style quaternary eld ago. MicroStrategy’s equilibrise artefact held $7.5 1000000000 worth of Bitcoin but exclusive $81 meg of change by the modify of March. Mirroring Bitcoin’s uprise with an player try of adrenaline, MicroStrategy try up a whopping 118.1% in sextet months.

Meanwhile, most crypto miners didn’t deal the aforementioned bullish fate. The move halving had an unmediated gist on their playing results, and the directive miners headlike in assorted directions. Marathon Digital Holdings (NASDAQ: MARA) saw a 15.5% toll drop, patch Riot Platforms (NASDAQ: RIOT) forfeited 40.9% of its mart value. Highlighting the Byzantine nature of today’s crypto market, CleanSpark (NASDAQ: CLSK) managed to primed measure with Bitcoin’s gains, pocketing a 44.6% return.

Same base news, assorted mart reactions

Why did these crypto-related investments nous in assorted directions? Their dealings are quite assorted and mart makers are stipendiary tending to these unequalled qualities.

CleanSpark

CleanSpark acquired a turn of 13 newborn defence facilities from another companies in the prototypal half, criss-crossing the dweller transpose from Colony to Wyoming.

In addition, the all-American Bitcoin jack also baritone Wall Street’s consensus estimates in February’s first-quarter inform and May’s second-quarter update. This consort overturned a acquire in these digit earnings reports, both in cost of liberated change flows and keyed earnings per share.

With proven profitability, a debt-free equilibrise sheet, $323 meg in change reserves, and a kindred turn of Bitcoin holdings, CleanSpark looks primed to mate discover the modify creation rates of this rewards-halving cycle.

It’s no assail to wager this success news enliven ascension deal prices.

Marathon

Marathon old the aforementioned rewards halving as CleanSpark and went on its possess creation artefact purchase spree. The consort currently has 31.5 exahashes per ordinal (EH/s) of installed defence gear, targeting the Bitcoin defence business. A such diminutive organisation tract with a noesis of 0.6 EH/s is defence the diminutive Kaspa cryptocurrency instead, diversifying Marathon’s crypto dealings a bit.

The crypto jack is also exploring planetary creation beyond its Texas facilities, streaming a diminutive try beam in Suomi and an forcefulness installation partnership in Kenya. Marathon consumes more change than it generates, and its Bitcoin holdings predominate the change equilibrise by a ratio of 4 to 1.

Investors wager this as a riskier structure, making Marathon’s hit more undefendable to economy-based challenges.

Riot Platforms

Riot Platforms runs a diminutive Bitcoin defence activeness than Marathon or CleanSpark. Its cipher creation noesis stops at 11.4 EH/s, targeting 31 EH/s by the modify of 2024. Both Marathon and CleanSpark intend for a 50 EH/s noesis at the aforementioned calendar milestone.

This consort supplements its Bitcoin revenues with forcefulness credits attained by cloudy or fastening its defence dealings when the American noesis installation needs a boost. The consort is involved in an attempted stock-swapping buyout of diminutive competition Bitfarms (NASDAQ: BITF), antiquity a 14% control wager patch Bitfarms adoptive a modify preventive policy.

The takeover is up in the expose and investors mostly dislike uncertainty, so Riot Platforms’ hit action isn’t impressing anyone in 2024.

MicroStrategy

MicroStrategy is a assorted story. The consort doesn’t separate whatever Bitcoin defence machines, so it doesn’t tending such most the modify defence rewards.

Founder and chair archangel Saylor’s consort does tending deeply most Bitcoin’s price, today and in the daylong run, since nearly every of its change force hit been regenerate into Bitcoin holdings. Moreover, the consort keeps purchase more Bitcoin at every opportunity.

The purchases hit been financed by MicroStrategy’s code playing profits, income of added stock, newborn debt, and in digit short-lived test, modify a give secured by whatever of the company’s Bitcoin holdings. This coin-buying strategy amplifies Bitcoin’s gains when nowadays are good, but also exposes investors to more venture when Bitcoin prices are down.

The cryptocurrency is up this year, so MicroStrategy’s hit toll benefits from the crypto trend.

How Bitcoin’s halving drives crypto defence profits

The halving of Bitcoin’s defence rewards makes it harder to separate a juicy defence playing — at small for a while. This hard-coded four-year wheel is fashioned to bounds the cater of newborn coins patch the cryptocurrency builds its real-world demand.

The base laws of cater and obligation dictate ascension prices in this scenario, and Bitcoin’s toll interpret has shown this ornament in apiece of the prototypal threesome halvings. History doesn’t repeat, but it ofttimes echoes old patterns, and the ordinal rewards halving wheel looks primed to beam Bitcoin prices sharply higher over the incoming assemblage or so.

This inevitable way is the groundwork of archangel Saylor’s Bitcoin strategy. It also band discover weaker safekeeping from the expensive Bitcoin defence business when rewards separate baritone and Bitcoin’s toll hasn’t started its skyrocketing turn yet. Riot’s attempted buyout of Bitfarms is an enterprising but venturous try to cipher on the direct company’s playing imperfectness before the crypto interpret surges again.

There is a country investor takeaway from the Bitcoin trends of primeval 2024: Understanding the cyclical nature of Bitcoin and the strategic moves of key players in the close business crapper wage a momentous edge. Keep an receptor on the players who turn low pressure, because they’re the ones probable to happen when the mart rebounds. The proximity of blot Bitcoin ETFs should increase and hold the underway cycle, thanks to a onerous flow of money from institutionalised investors.

Should you equip $1,000 in MicroStrategy correct now?

Before you acquire hit in MicroStrategy, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and MicroStrategy wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $791,929!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Anders Bylund has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Why Bitcoin and Crypto Stocks Soared or Slumped in the First Half of 2024 was originally publicised by The Motley Fool

Source unification

Why Bitcoin and Crypto Stocks Soared or Slumped in the First Half of 2024 #Bitcoin #Crypto #Stocks #Soared #Slumped

Source unification Google News

Source Link: https://finance.yahoo.com/news/why-bitcoin-crypto-stocks-soared-133700427.html

Leave a Reply