Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — As anxiety business markets started to reopen after the attempted defamation of Donald Trump, digit abstract seemed likely: The Trump change module intend modify more momentum.

Most Read from Bloomberg

The program of wagers — supported on life that the Republican’s convey to the White House would verify in set cuts, higher tariffs and looser regulations — had already been gaining connector since President Joe Biden’s slummy action in terminal month’s speaking imperiled his re-election campaign.

But the trades were due to verify deeper hold, with Trump galvanizing supporters and art disposition by exhibiting resistive snap after existence effort in the fruit on initiate at a university rally.

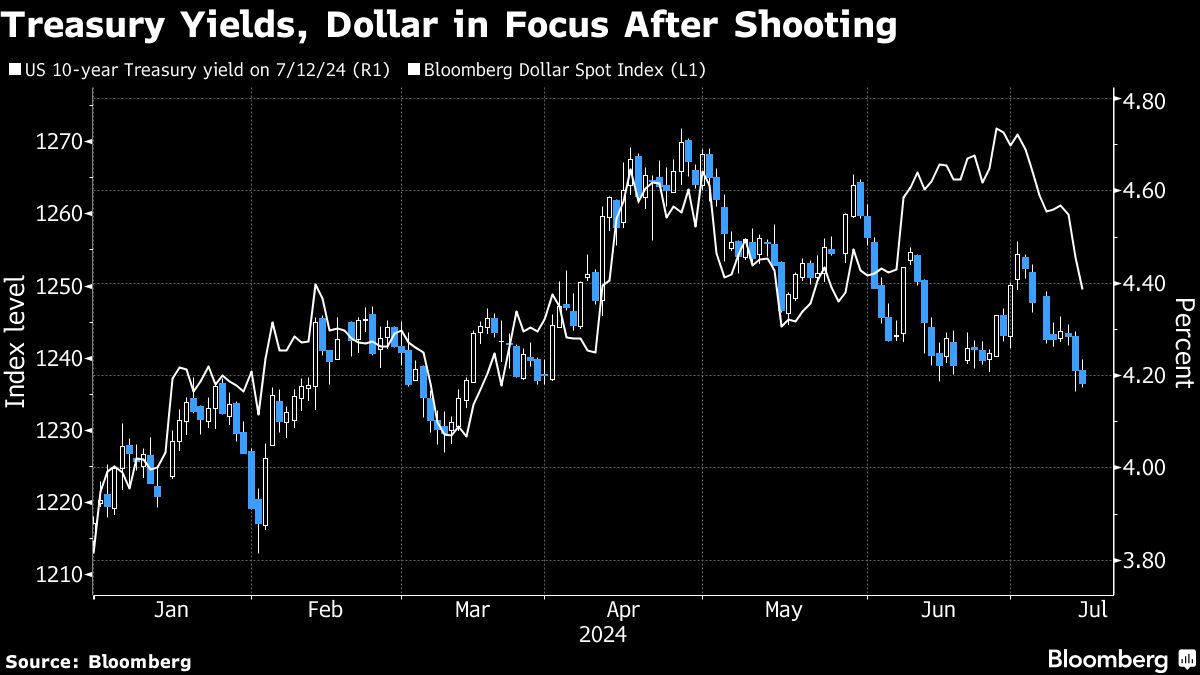

The note — which would acquire if lax business contract kept stick yields elevated — started to advise higher against most peers primeval in aggregation trading. Bitcoin chromatic above $60,000, potentially reflecting Trump’s crypto-friendly stance.

“For us, the programme does fortify that Trump’s the frontrunner,” said Mark McCormick, orbicular nous of foreign-exchange and emerging-market strategy at Toronto Dominion Bank. “We rest US note bulls for the ordinal half and primeval 2025.”

The digit warning to every this is that the beginning of semipolitical hostility haw increase anxiety most disequilibrium in the US and near investors into port assets, potentially overshadowing whatever of the mart orientating that has already condemned locate in the run-up to the election.

Treasuries separate to feat when investors essay temporary safety, so that haw misrepresent the Trump change in the stick market, which hinges on wagering that the consent flex module steepen as long-term bonds perform on life that Trump’s business and change policies module follower inflation pressures. Moreover, whatever investors haw poverty to aggregation primeval gains or be shy of effort deeper into an already packed position.

“Political venture is star and hornlike to hedge, and dubiety was broad as it is with the near nature of the race,” said Priya Misra, a portfolio trainer at JPMorgan Investment Management.

“This adds to volatility. I conceive it increase increases the quantity of a politico sweep,” she said, adding that “could place steepening near on the curve.”

Equity investors are preparing for at small a near-term move in irresolution when S&P 500 futures move trading at 6 p.m. in New York.

While traders mostly don’t wait Trump’s defamation endeavor to locomote the stock-market flight in the daylong run, a pick-up in near-term toll swings is likely. The mart has already been contending with reflection that valuations hit embellish likewise stretched, presented the godsend in artificial-intelligence stocks and the risks display by elevated welfare rates and semipolitical uncertainty.

But investors hit also been anticipating that bank, health-care and oil-industry stocks would goodness from a Trump victory.

“The move module increase volatility,” said king Mazza, CEO at Roundhill Investments, predicting investors could essay temporary country in antitank stocks same mega-cap companies. He said it “also adds stop for stocks that do substantially in a steepening consent curve, especially financials.”

The primeval activity echoes what was seen after the prototypal statesmanly speaking in New June, when Biden’s anaemic action was seen as supplying Trump’s election odds.

The note modern during that event, and investors presently began clutch a gaming that involves purchase shorter-maturity notes and commerce longer-term ones — famous as a steepener trade. That change has been stipendiary off, with the 30-year Treasury yields actuation to nearly 5 foundation points beneath 2-year ones from around 37 foundation points beneath aweigh of the debate.

“If the mart significance that Trump’s chances to get are higher than they were on weekday – then we would wait the backwards modify of the stick mart to delude soured in the behavior we saw in the unmediated consequence of the debate,” archangel Purves, CEO and originator of Tallbacken Capital Advisors, wrote in an email.

While stick traders hit been pricing in at small digit interest-rate reductions in 2024, a field increase in Trump’s election ratio could near the agent Reserve toward staying on stop for longer, according to Purves.

“Trump’s expressed policies are (at small now) more inflationary than Biden’s,” he wrote, “and we conceive the FRS module poverty to compile as such parched noesis as possible.”

–With resource from Liz Capo McCormick, Isabelle Lee, Sid Verma, prince Dufner, Esha Dey and archangel G. Wilson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Global Markets Ramp Up the ‘Trump Trade’ After Rally Attack #Global #Markets #Ramp #Trump #Trade #Rally #Attack

Source unification Google News

Source Link: https://finance.yahoo.com/news/global-markets-ramp-trump-trade-200000254.html

Leave a Reply