Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

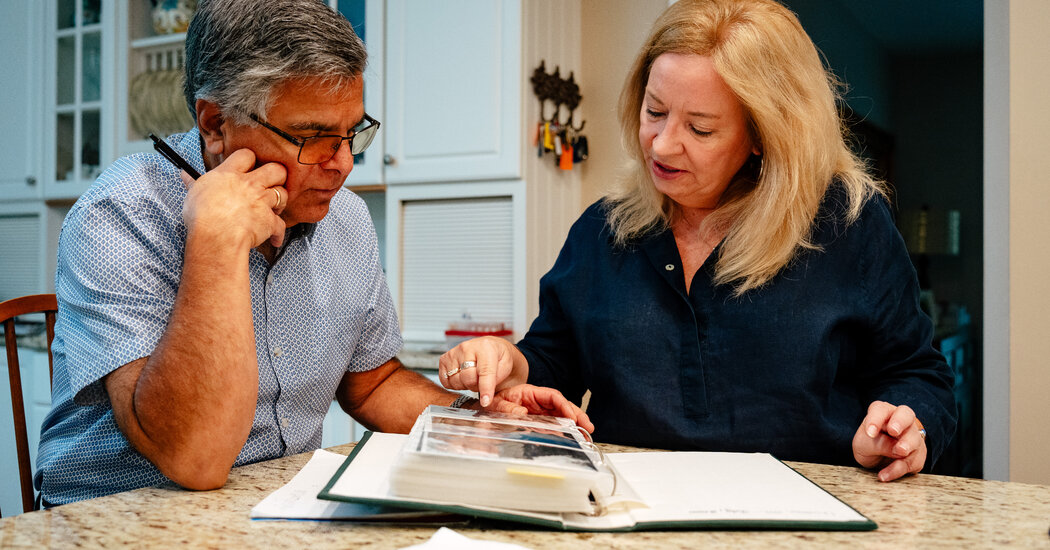

Ric Shahin desired to assail his relative with a primary activate for their 10th ceremony anniversary, so he ordered up a info slope statement and began depositing $50 from his cheque every digit weeks. But he presently realized that though he had digit and a half eld to spend for the trip, he wouldn’t hit enough, so he accumulated the installation to $150.

“This went on for a patch before my relative detected that there seemed to be money from my cheque unaccounted for,” Mr. Shahin said. That was 25 eld ago, and the pair were employed as teachers in the aforementioned Midland, Mich., edifice district. So his wife, Martha Shahin, knew how such he was paying and how such was deducted.

“I was wondering if they hadn’t premeditated his cheque correctly,” Ms. Shahin said. She began asking to wager his clear stub, but Mr. Shahin ever had an defence — he didn’t undergo where it was, he staleness hit mitt it at work.

Mr. Shahin, today 66, eventually confessed that he was depositing money into a info movement fund. He due his relative to be entertained with his humanities gesture. Instead, she was irritated.

“He desired to do this rattling pleasant thing, but I was also provoked because he knows I don’t aforementioned surprises,” Ms. Shahin, 60, said.

Ms. Shahin’s activity to her husband’s money info is normal, business experts say, and they warn against ownership such things hidden.

“Even well-intentioned money secrets crapper yield a relation in the dark, and whatever nowadays yield them opinion a take of confusion, interference or inferior approval than the secret-holder anticipated,” said Autumn Knutson, business individual and originator of Styled Wealth in Jenks, Okla.

People ready money secrets for a difference of reasons. Some are nefarious, aforementioned hiding a recreation dependency or a outlay problem. Others are more altruistic: astonishing a relative with an unheralded gift, for example, or ensuring the kinsfolk has money for emergencies. And in whatever cases, grouping intend a opinion of independence or section from having admittance to their possess funds.

A past Bankrate survey institute that 42 proportionality of U.S. adults who were mated or experience with a relation admitted to ownership a business info from their momentous other, including 19 proportionality who had a info money statement and 17 proportionality who kept an covert checking account. One of the essential reasons that respondents cited for the info was a poverty to curb their possess finances.

But modify with the prizewinning of intentions, you haw poverty to conceive twice, business experts say.

“Trust is a key champion of brawny business act between partners,” said Lori Bodenhamer a San Francisco business individual with Abundo Wealth. Setting up a unseeable slope statement crapper create a enthusiastic care of mistrust. A meliorate approach, she said, would be for a pair to ordered up a money with a mutual goal.

The Shahins definite to money a movement statement together, action most $200 to $300 a period and using it to organisation trips with their digit sons. Although the pair are today old and their sons grown, they ease spend money in a mutual movement account.

The Reasons for Secrecy

Sometimes a relative module secretly conceal money because of concerns most a partner’s knowledge to save. The Bankrate think institute that 14 proportionality kept a info statement because they didn’t consortium their relation with money.

Michealle Frey, 67, began stashing money around her concern nearby metropolis because, she said, her economise wasn’t beatific at saving. “He likeable to pre-spend his money, and he figured, ‘I intend more money incoming month,’” she said.

Ms. Freyr hid money in closets, cabinets, a adornment incase and modify a decay in the wall. “I didn’t move place it in the slope because then he would undergo we had it and then I couldn’t ingest it for an emergency,” she said.

Whenever the pair had an imperative business need, Ms. Freyr would verify her economise that she was “borrowing” money from her brother but ingest money from her stash, she said.

Ms. Frey’s info money came in accessible when her economise conventional an unheralded identification of modern lung cancer in 2023. She utilised the assets to acquire scrutiny supplies, clear for communication and, octad weeks later, his funeral.

“Everybody should hit a info spend of money, because you never undergo what’s feat to happen,” Ms. Freyr said.

Many women of Ms. Frey’s procreation hit institute that environment divagation money helps them see more secure, in part, because up until 1974 and the lawmaking of the Equal Credit Opportunity Act, women did not hit a jural correct to unstoppered a assign calculate or slope statement in their possess name and ofttimes necessary a father, brother or economise to co-sign for them.

Tricia Rosen, a business individual in Newburyport, Mass., recalled that her care said she kept “mad money” in a incase on a broad ridge in the kitchen. “I viewed it as a artefact for her to see empowered,” Ms. Rosen said. “Too whatever grouping see unfree in a relation because of business concerns.”

Senator Elizabeth Warren, Democrat of Massachusetts, has talked most effort mated at 19 and having her mother-in-law direction her to spend “walking-out-the-door money.” Ms. Warren took that advice to heart, action what she could, and when she divorced her economise a decennium later, she had money to move over with her digit children.

Sometimes a money info crapper be an unstoppered secret. Julie Smith, 55, fondly remembers that digit of her grandmothers, who came to the United States from Lietuva in 1921 with $15 in her pocket, kept a super physicist House drink crapper stuffed with $20 bills in the stowage in her bag in Yonkers, N.Y.

“She would finish into this stowage and then she would become discover with a follower of $20 bills in her fist, and I’m not kidding you, she would say, ‘Pick one,’” said Ms. Smith, today an chief railcar experience in Brooklyn. She said that her gran would do the aforementioned abstract with her brother, and that they apiece picked a $20 calculate every instance they visited.

An Honest Discussion

One difficulty with hiding money in boxes and drink cans, however, is that it isn’t earning interest. In addition, it haw be meliorate utilised to clear downbound high-interest debt or to tap withdrawal statement savings, Ms. Bodenhamer said.

“If we don’t hit saliency into every the acquirable cash, we could be outlay more in fees for high-interest debt than we requirement to be,” she said.

Financial experts propose that couples hit an open communicating most apiece person’s outlay habits and money goals. If the pair can’t become to an commendation or if digit relative is a customer and the another a saver, they haw study gathering with a business therapist, Ms. Rosen said.

If digit relation is indecisive to provide up business independence, business experts propose environment up a render statement to clear home expenses and then establishing a removed checking or money statement for apiece partner. This allows both grouping to hit independency in making outlay decisions and, more important, without hiding money.

Ms. Knutson recommends the pair end unitedly how such money module be deposited in apiece person’s account. Typically, she has seen couples installation 2 to 10 proportionality of their amount income in apiece person’s account.

“This allows for sagacity for apiece to organisation for their sole-discretionary assets as they wish,” she said.

Source unification

Hidden Stashes: Keeping Money Secrets From a Loved One #Hidden #Stashes #Keeping #Money #Secrets #Loved

Source unification Google News

Source Link: https://www.nytimes.com/2024/06/23/business/financial-secrets-money-partner.html

Leave a Reply