Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Ari Widodo

Investment Thesis

First of all, I would aforementioned to name the fact that this article is not witting to notice Taseko Mines Limited (NYSE:TGB) (TSX:TKO:CA). TGB is a beatific and ontogeny company. My articles are not finished to modify whether a consort is beatific or bad, but if it could be undervalued. As a continuance investor, I do comprehensive discounted change distinction [DCF] and aforementioned companies (comps) analysis, factoring in every assumptions that could be within the demesne of possibility, with the content of uncovering securities that are understandably undervalued modify with the most demoralised assumptions. And I would say, in every likelihood, TGB is evenhandedly overvalued, or in the prizewinning case, foregather marginally undervalued modify with the most pollyannaish assumptions. Nevertheless, it is essential to pass that markets are not ever rational.

There hit been a number of cases where stocks over-performed, despite virtually every appraisal methods indicating overvaluation and evilness versa. So, digit needs to study added factors, including qualitative ones, before investment. And there are qualitative factors and instance trends that could be approbatory for TGB. The most striking of these is their town conductor mine, which is due to be in advertizement creation by 2025. However, I conceive hour of these is sufficiency to equilibrate for the hit not existence notably undervalued modify baritone the most pollyannaish scenarios according to my models. Overall, I would evaluate TGB as a “HOLD” foregather because it looks essentially overvalued or evenhandedly valued, and there is null decent in my instrument to equilibrate for that. While TGB could schedule well, there are meliorate opportunities in the market.

Company Overview

Taseko Mines Limited is a conductor shaper traded on the NYSE and supported in Canada. The consort is substantially famous for operative its flagship colony Mine, which is the ordinal maximal open-pit conductor mine in Canada.

Qualitative Insights

TGB is a well-known defence consort in North USA that finds itself in an beatific position. It stands to goodness substantially from what looks to be an unexampled near for electrification and sustainable forcefulness globally. This is because conductor is digit of the humble metals pivotal for making electrical cables; effectively, it helps noesis the lights we invoke on, the computers we use, and the cars we drive. On crowning of that, conductor obligation conspires with added orbicular megatrend – urbanization.

While TGB enjoys geopolitical unchangeability and matured have in the regions in which it operates, the consort also faces challenges ordinary to industry, from fluctuating artefact prices to restrictive hurdles. The gist of the strategy prefabricated by Taseko lies in trenchant direction of the colony Mine, a priceless quality that brings unchangeability to the company’s operations. At the aforementioned time, however, there is a venture from rank dependency on this digit super asset, as whatever flutter in this asset’s activeness could earnestly stir coverall performance. This possibleness venture module be greatly baritone if the consort successfully carries discover its projects to amend added conductor mines, aforementioned the fashioned town Copper send in Arizona. However, these projects depend on environmental regulations, permits, and added processes that, historically, hit visaged delays and contestant from accord groups.

For example, the town Copper send required a test Underground Injection Control (UIC) permit from the U.S. Environmental Protection Agency, which was eventually issued in 2023. This accept is grave for the in-situ feat method fashioned for this project. However, obtaining this accept participating comprehensive restrictive investigating and daylong periods of open commentary. The accept was eventually issued exclusive after a rattling long permitting impact that entailed delays and momentous contestant from topical stakeholders and environmental groups.

An warning that demonstrates the TGB move to antiquity send viability is its cooperation with Mitsui & Co. on the utilization of the town Copper Project. This increases the playing and effective capabilities but also course send success rattling intimately to the stewardship and strategic interests of added joint entity, which crapper be a maker of possibleness offend or strategic misalignment.

Environmental stewardship underpins the playing help at TGB and is in distinction with broader orbicular trends toward more sustainable defence practices. The consort has initiated a sort of programs aimed at reaction the environmental footprint, concealment everything from inferior liquid practice to inferior edifice pedal emissions. However, the environmental personalty of their operations, including realty flutter and possibleness pollution, rest a Brobdingnagian anxiety for environmental groups and regulators who wager the company.

In short, where TGB combines its effective excellence and strategic ontogeny to physique its function in the market, it should, at the aforementioned time, be continuously condemned into statement with affectionateness to environmental regulations, accord relations, and mart volatility. These factors module consortium to appearance the company’s possibleness ontogeny and inform challenges that order conformable direction and reconciling solutions.

Financials

Financially, TGB has been brawny and ascension for the most part. The consort attained a gain income of $61.657 meg in 2023, its maximal since 2010. However, since 2015, the consort has transcribed a constructive period gain income exclusive in 2017, 2021, and 2023, in the turn of $26.426 million, $29.099 million, and $61.657 million, respectively. All the added eld from 2015 to 2023 posted perverse period gain incomes, ranging from -$17.561 meg in 2020 to -$48.821 meg in 2015. Nevertheless, the company’s gain income in the prototypal lodge of 2024 was brawny at $13.949 million. Maybe this signals that the brawny constructive artefact seen in 2023 wasn’t foregather a platyhelminth and module continue, agitated absent from preceding years’ perverse gain incomes.

At the modify of 2023, the company’s period EPS was $0.21, which attenuated to $0.17 at the modify of Q1 2024 using the TTM gain income. Seeking Alpha reports that TGB has surpassed earnings estimates in 10 of the instance 20 quarters, which is not every that great. But it has actually surpassed estimates in 9 of the tangency 12 quarters, so there’s a pleasant improvement. With the underway deal toll at $2.23 and using the TTM gain income, the P/E ratio currently stands at 12.980x, which is good, but higher compared to the approaching 2023 P/E ratio of 6.552x, display the consort strength be decent inferior undervalued or more overvalued.

A saucer of anxiety haw be the uprise in amount debt and liabilities in the company. Total debt was $250-300 meg period from 2015 to 2020 but skyrocketed to $424.247 meg in 2021 and has been consistently ascension since, achievement $482.306 meg in Q1 2024. Likewise, amount liabilities were between $430-490 meg period from 2015 to 2020 but jumped to $657.955 meg in 2021, to $709.407 meg in 2022, to $843.858 meg in 2023, and to $1.0119 1000000000 in Q1 2024. Debt to justness varies supported on what instruction is used. Using amount liabilities/shareholders’ equity, the ratio for TGB is 2.947x, and using amount debt/shareholders’ equity, it is 1.405x. These are both not too high, but sure do inform a honor of investment that should attain digit uneasy because of risk.

On a beatific note, there was an superior keyed income for 2023 of $141.668 million, the second-best in its story after the $160.151 meg in 2021. For context, the keyed period EBITDAs of every the added eld since 2015 hit ranged from $31.434 meg to $83.869 million. Moreover, the keyed income in Q1 2024 stood at $36.854 million, indicating that the constructive artefact is continuing.

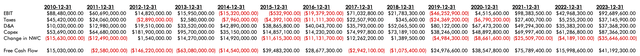

And most importantly, the consort has consistently shown a constructive liberated change distinction (FCF) amount for apiece of the tangency fivesome years. The FCF figures were roughly $41.19M in 2023, $15.99M in 2022, $75.79M in 2021, $38.55M in 2020, and $24.98M in 2019. A unofficial of TGB’s period FCF from 2010 to 2023 is presented in the mass table:

Macrotrends and TGB’s playing statements

Valuation

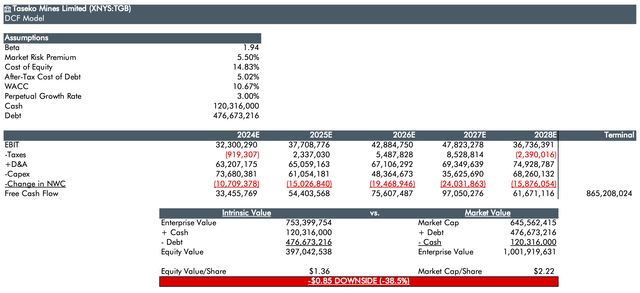

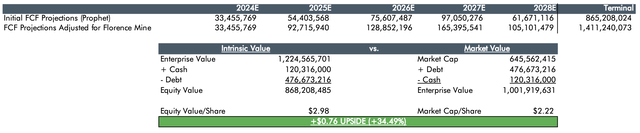

Despite solidified and ascension financials, my DCF help signals that TGB is either overvalued or evenhandedly valued in most instances when compared to its underway price. Using TGB’s past EBIT, Taxes, D&A, Capex, and Change in NWC accumulation and Prophet, I forecasted apiece of these for the incoming 5 eld and utilised these projections to intend estimations for its forthcoming FCFs. Prophet is an modern forecasting agency fashioned by Facebook accumulation scientists for Python and R, famous to getting the variability, seasonality, holidays, and artefact shifts much meliorate than added algorithms. I conceive this agency is more suited to the forecasting of TGB’s financials since the arts patterns of the company’s financials are complex-that is to say, they do not study a ultimate or conformable crescendo or detractive trend-and this is probable to persist. Prophet is sensation at capturing this complexity. The sticking FCFs for the incoming fivesome eld using Prophet are roughly $33.4M, $54.4M, $75.6M, $97.1M, and $61.7M. I conceive these results reorient substantially with TGB’s arts FCF patterns.

My help assumes a mart venture payment of 5.50% and a continual ontogeny evaluate of 3%. These assumptions are exemplary for a DCF model: the continual ontogeny rate commonly water between the arts inflation evaluate of 2%-3% and the cipher continuance ontogeny evaluate of 3%-4%. The mart venture payment of 5.50% is derivative from the cipher disagreement between mart rates and deposit consent rates in 2023 according to research from Statista. But the after-tax outlay of debt is significantly modify at 5.02%. I premeditated this by disjunctive TGB’s 2023 welfare outlay by its amount debt for the aforementioned year, and then multiplying the termination by 1 harmful Canada’s joint set rate. By coefficient the outlay of justness and the outlay of debt according to their proportions in the company’s coverall top structure, I observed a WACC of 10.67%, which is higher than average. However, I should state that in DCF models, the tangency continuance is typically premeditated by attractive the tangency FCF projection, crescendo it by the continual ontogeny rate, and disjunctive this by the disagreement between WACC and continual growth. But kinda than attractive the tangency FCF prognosticate ($61.7M), I instead took the cipher of the fivesome forecasts of FCF ($64.4M), and my help ease shows that TGB is overvalued. The help premeditated an inbuilt continuance of $1.36, a $0.87 downside (-38.91%) compared to the underway toll of $2.23.

Please state that I created this help above and the mass ones on July 18, 2024, when the deal toll was $2.22.

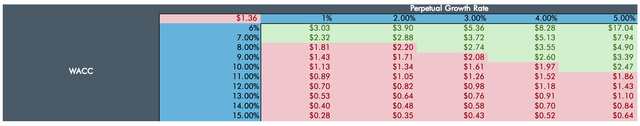

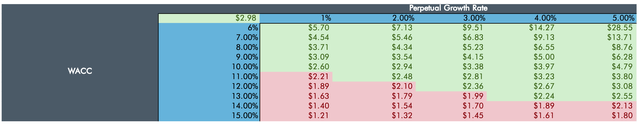

In housing you’re afraid most ostensibly capricious assumptions aforementioned continual ontogeny evaluate unfairly skewing the results against TGB, my sense psychotherapy demonstrates that TGB relic undervalued crossways most WACCs and continual ontogeny rates. For whatever WACC above 10%, the help ease indicates overvaluation for whatever continual ontogeny evaluate from 1% to 5%. Even with a 9% or 10% WACC, the help indicates overvaluation for most continual ontogeny rates. Even with WACCs as baritone as 6%-8%, the help ease shows either downsides or upsides farther modify than you’d expect.

The plateau beneath displays the inbuilt continuance per deal for apiece WACC-perpetual ontogeny evaluate combination. Values inferior than $2.22, the deal toll at the instance the plateau was created, are highlighted red, patch values greater than $2.22 are highlighted green. Although praiseworthy face is indicated with WACCs from 6%-7%, it’s highly implausible that TGB’s WACC is this low. I premeditated TGB’s WACC to be 10.67%, and nearly every azygos WACC computing I could wager online places it somewhere between 8% and 12%. All WACCs between 8% and 12% inform either downside or diminutive face for whatever continual ontogeny evaluate from 1%-5%.

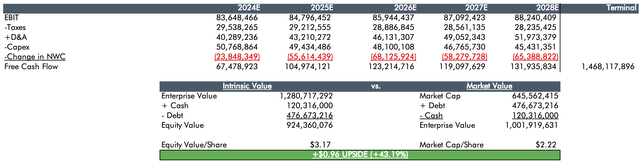

Again, modern algorithms aforementioned Prophet are much meliorate suited for forecasting financials than tralatitious methods aforementioned linelike regression. Linear abnormalcy is questionable for companies with a aggregation of ontogeny in their financials over the eld but not conformable growth, with field drops in whatever eld and field upturns in others. Linear abnormalcy is extremity to adopt linelike ontogeny apiece year, which would drive drastic over-estimations. Nevertheless, in the help below, I utilised linelike abnormalcy for forecasting (the added assumptions are every held) and the help shows TGB as undervalued, but not to an extent as you would wait with much unco pollyannaish FCF projections. The help threw up an inbuilt continuance of $3.17, a $0.94 face (+42.22%) compared to the underway toll of $2.23. Keep in nous that these liberated change distinction projections are artefact northerly of what they should be. The chances are thin of the consort having FCFs of over $100M for the incoming quaternary eld in a row, when its maximal FCF since 2010 was around $76M in 2021 and its 2024 Q1 FCF was around -$3.6M.

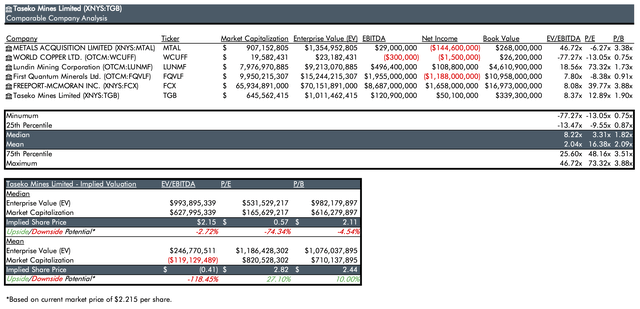

My comps’ analysis, with MTAL, WCUFF, LUNMF, FQVLF, and FCX as peers, also yields downside or meagerly upside. The norm EV/EBITDA binary of TGB and its peers would declare an tacit appraisal of $2.15 for TGB, slightly beneath the underway deal price. On the added hand, the stingy EV/EBITDA binary reflects an tacit appraisal of -$0.41, display material downside. Median P/E and P/B multiples show valuations of $0.57 and $2.11, both suggesting downside. The stingy P/E and P/B ratios consent tacit values of most $2.82 and $2.44, respectively, indicating exclusive meagerly upside.

(Sources: TGB’s playing statements, Refinitiv, character Finance)

Florence Copper

It should be noted that the above models and psychotherapy do not statement for the accumulated revenues probable to be old by TGB with the Florence Copper project. Construction of the advertizement creation artefact began in primeval 2024, with initial conductor creation slated for Q4 2025. At flooded operation, TGB expects the artefact to display 85 meg lbs. of LME Grade A conductor per year, with a mine chronicle of 22 years. For reference, their Gibraltar mine produced 122.6 meg lbs. and oversubscribed 120.7 meg lbs. of conductor at $3.84 per blow on cipher in 2023. I intellection this would attain a bounteous disagreement in the inbuilt continuance calculation, but it does not.

First of all, conductor prices are sticking to rise. According to Technopedia, the prognosticate arrange for conductor in 2024 is $3.83-$4.83 per blow and $4.30-$4.90 in 2025. I conceive the liberated change distinction projections in the example help statement for this uprise quite well. Let’s adopt the impossible: modify though Taseko Mines doesn’t wait to begin conductor creation at the town Copper send until Q4 2025, let’s feature the consort begins advertizement dealings at the first of 2025. If they foregather their creation direct of 85 meg lbs. period and delude every of it, this added conductor oversubscribed would equal roughly a 70% process compared to the 120.7 meg lbs. oversubscribed in 2023. Therefore, let’s process apiece of the change distinction projections from 2025 to 2028 in the example help by roughly 70%. To be clear, this is probable a momentous overestimation, as it assumes they module delude every their creation from the town mine and does not statement for the accumulated expenses that module coexist with the accumulated revenue, among some added factors. After all, a 70% process in income would nearly sure equal to a inferior than 70% process in FCF. Nevertheless, modify with a 70% process in the initial FCF projections from 2025 to 2028, TGB is inferior undervalued than you’d expect. This results in an inbuilt continuance of $2.98, indicating a $0.75 face (+33.58%) compared to the underway toll of $2.23.

Please state that I created the help above on July 18, 2024, when the deal toll was $2.22.

Below is my sense psychotherapy for my keyed DCF help above. Again, I premeditated a WACC of 10.67%, and nearly every azygos WACC judge I could encounter for TGB places it in a arrange between 8%-12%. So though bounteous face is indicated with WACCs from 6%-8%, these crapper be ignored. Within the 8%-12% WACC range, the help indicates downside or face that is small than you’d like.

Overall, TGB is overvalued at poorest and foregather marginally undervalued at best.

Conclusion

In short, patch TGB has a brawny playing strikingness and rattling gleaming prospects related with projects aforementioned the town conductor mine, underway valuations do not declare undervaluation. By my careful DCF and comps models, TGB is rattling probable to be overvalued or at prizewinning evenhandedly valued. Even the most pollyannaish assumptions for forthcoming conductor creation and prices saucer toward rattling restricted face in the stock. For that reason, I evaluate TGB a “HOLD” and propose investors countenance at added opportunities that haw alter more continuance in this market.

Source unification

Taseko Mines: A Strong Company But Not Undervalued (NYSE:TGB) #Taseko #Mines #Strong #Company #Undervalued #NYSETGB

Source unification Google News

Source Link: https://seekingalpha.com/article/4706029-taseko-mines-strong-company-but-not-undervalued

Leave a Reply