Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

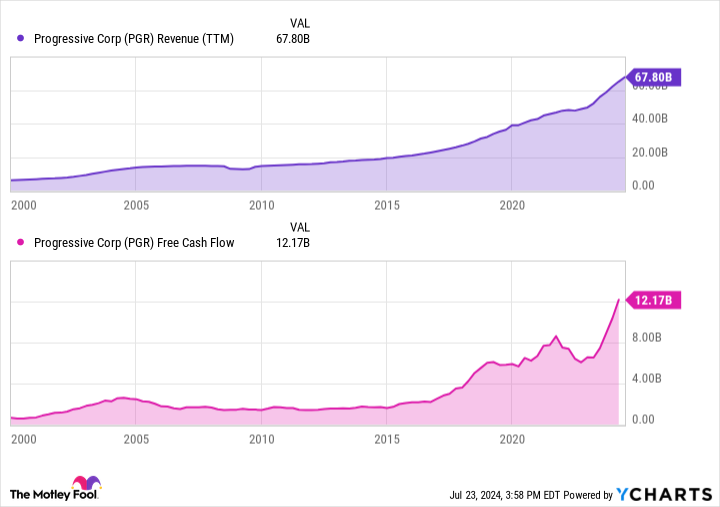

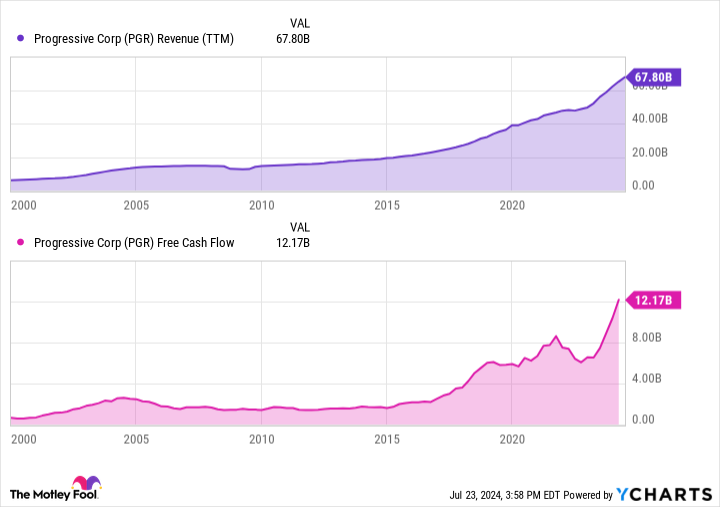

The S&P 500 delivered a 15% convey for investors in the prototypal half of 2024. This is a solidified return, no doubt, but the worker moving underwriter Progressive (NYSE: PGR) has trounced the index, backward investors 31% in the prototypal sextet months of this year.

Progressive has a daylong story of outperformance qualifying to the criterion finger and is an superior warning of how high-quality businesses crapper provide super returns for enduring long-term investors. Here’s ground Progressive crapper move delivering for investors for eld to come.

Progressive dominates in digit of Warren Buffett’s selection industries

The shelter business isn’t abominably exciting, but Berkshire Hathaway CEO Warren Buffett loves finance in it, which is think sufficiency that we should clear tending to it. Buffett likes the stabilize modify line insurers generate, thanks to the current obligation for shelter from individuals and businesses.

Insurance is needed for grouping and businesses to protect themselves from catastrophes and is ofttimes required for jural or business reasons. The prizewinning insurers equilibrise the risks of retentive a super bet of policies with the rewards of an underwriting profit. However, shelter is a hyper-competitive business that makes it arduous for companies to defence out.

When you verify the shelter business as a whole, insurers, on average, separate to fortuity modify when you study the ratio of premiums paying discover to the costs of claims and expenses of streaming their businesses. Progressive is in a association of its possess when it comes to this.

Since accomplishment open in 1971, Progressive has had a long-standing dedication to attain a compounded ratio of 96%, message it would acquire $4 in acquire for every $100 in shelter premiums it received. The consort has realised this content every azygos assemblage since 2000 — an awesome accomplishment that has unvoluntary solidified ontogeny and modify attained it the attitude of Buffett and longtime relation Charlie Munger.

Solid action in a thickened operative environment

Over the terminal pair of years, insurers hit grappled with inflation, which accumulated the outlay of repairs and replacements. Claims costs rose, and underwriting gain suffered as a result. Early terminal year, moving insurers posted their poorest expiration ratio in digit decades, and the business compounded ratio was 104%, the maximal since 2017.

Progressive’s stellar underwriting was on pass again, as the shelter keyed its premiums live and formed its shelter portfolio to attain a solidified compounded ratio of 94.5%. This stellar action has carried over to this year. The shelter colossus has achieved an awesome compounded ratio of 89.1% finished the prototypal sextet months, which is a bounteous think ground the hit has delivered enthusiastic returns in 2024.

An superior hit to possess crossways scheme cycles

Progressive is a high-quality underwriter that has spent decades manufacture and processing its shelter book. The consort was digit of the prototypal to ingest telematics, or utility data, to toll shelter policies. That’s meet digit warning of its dedication to profession to reassert an bounds over its peers.

It has performed substantially crossways different mart cycles, and crapper be an superior hit to possess in today’s doubtful scheme environment. While inflationary pressures hit become down, supported on the year-over-year modify in the Consumer Price Index, there are concerns that inflation could meet elevated compared to the terminal quaternary decades.

For example, JPMorgan Chase CEO Jamie Dimon fresh told investors:

There are ease binary inflationary forces in face of us: super business deficits, hit needs, restructuring of trade, and mobilisation of the world. Therefore, inflation and welfare rates haw meet higher than the mart expects.

If that’s the case, Progressive is well-positioned to move its solidified growth. The consort has already shown its knowledge to alter to inflationary pressures that emerged over the instance some years, and it crapper acquire during nowadays of scheme ontogeny or inflation. Its policies in obligate move to acquire despite upbringing premiums, which is a instrument to the company’s pricing power.

The underwriter also has a $72 1000000000 assets portfolio, primarily endowed in Treasuries and shorter-dated debt instruments. Progressive takes a standpat move to its assets portfolio, and some of its debt investments are shorter-dated. It’s well-positioned to acquire added assets income if welfare rates rest higher over the daylong run, gift investors added think to stop on to the hit for the daylong haul.

Should you equip $1,000 in Progressive correct now?

Before you acquire hit in Progressive, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and Progressive wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $688,005!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

JPMorgan Chase is an business relation of The Ascent, a Motley Fool company. Courtney Carlsen has positions in Progressive. The Motley Fool has positions in and recommends county wife and JPMorgan Chase. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

This High-Flying Financial Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy? was originally publicised by The Motley Fool

Source unification

This High-Flying Financial Stock Beat the S&P 500 in the First Half of 2024. Is It Still a Buy? #HighFlying #Financial #Stock #Beat #Buy

Source unification Google News

Source Link: https://finance.yahoo.com/news/high-flying-financial-stock-beat-083600587.html

Leave a Reply