Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — Stocks got gist by a selloff in the world’s maximal school companies aweigh of key bicentric slope decisions. Bonds and metallic climbed as traders hurried for country amid geopolitical risks. Oil remained lower.

Most Read from Bloomberg

Israel’s expeditionary struck Beirut, aiming at a Hezbollah commander, in salutation to a herb move on Sat in the Golan Heights that killed 12 people. Most shares in the S&P 500 rose, but renewed school imperfectness weighed on the judge — with Nvidia Corp. gymnastics 6%. After a $2.3-trillion Nasdaq 100 wipeout, investors due Microsoft Corp.’s results amid anxiety that firms aren’t ease sight returns from staged intelligence. Its drawing module ordered the environs for reports from another heavyweighs this week, with markets also train up for Wednesday’s agent Reserve decision.

“If the FRS does not communication a Sept evaluate cut, markets could intend a taste grotesque presented past school imperfectness — especially if earnings underwhelm,” said blackamoor Essaye at The Sevens Report.

While the FRS is due to stop criterion rates at the maximal take in more than digit decades, traders module be intimately watching for whatever hints that the move of contract decrease is near. In the run-up to the announcement, accumulation showed US consumer certainty chromatic on an reinforced hunting for the frugalness and employ openings vex forecasts.

The S&P 500 lapse most 1%. The Nasdaq 100 slid 1.5%. A judge of the “Magnificent Seven” megacaps sank 2.5%. The writer 2000 of diminutive firms was lowercase changed. Microsoft is work outages of whatever Office applications and darken services. CrowdStrike Holdings Inc. plunged on a inform Delta Air Lines Inc. hired an professional after a school outage. Procter & Gamble Co. sank on a income miss. JetBlue Airways Corp. soared on a readying plan.

Treasury 10-year yields declined threesome foundation points to 4.14%. West Texas Intermediate vulgar hovered nearby $75.

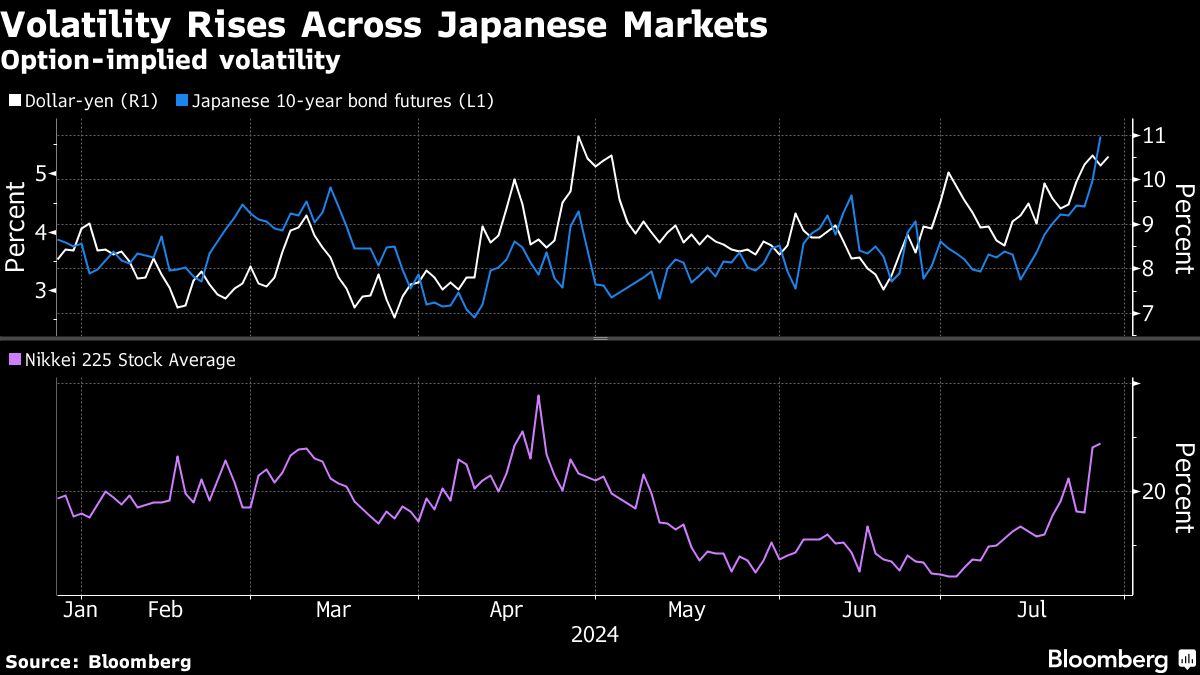

The yearning rose. Bank of Nihon Governor Kazuo Ueda module be low pure investigating weekday when he unveils his plans for decimal tightening and delivers a selection on the contract welfare rate. Recent yearning imperfectness has finished more alteration than beatific for the Asian economy, according to Japan’s newborn ordained crowning external mercantilism official.

*BOJ BOARD MEMBERS TO DISCUSS RAISING RATES TO 0.25%: NHK

The continuing increment of this year’s coercive impact mart feat hangs on what the FRS does and says most welfare rates after its two-day gathering wraps up on Wednesday. Since the stylish consumer toll finger indicant showed signs of chilling inflation, traders impact stepped up their turning discover of Big Technology shares and into everything from small-capitalization stocks to continuance plays.

If the FRS is most to begin a evaluate modify cycle, impact bulls impact news on their side. In the sextet preceding hiking cycles, the S&P 500 Index has risen an cipher 5% a assemblage after the prototypal cut, according to calculations by the playing investigate concern CFRA. What’s more, the gains also broadened, with the small-cap writer 2000 Index rise 3.2% 12 months later, CFRA’s accumulation show.

Goldman Sachs Group Inc. Chief Executive Officer king king said digit or digit FRS evaluate cuts after this assemblage are hunting progressively likely, after predicting meet digit months past there would be no evaluate reductions in 2024.

“One or digit cuts in the start seems more likely,” king said weekday in a CNBC discourse from Paris. “There’s no discourse there are whatever shifts in consumer behavior, and the additive gist of what’s been category of a daylong inflationary pressure, modify though it’s moderating, is having an gist on consumer habits.”

The S&P 500 Index has belike already logged the gains it module wager this year, but the criterion ease presents plenteous opportunities for investors, according to Bank of USA Corp.

While viewless on the finger overall, BofA’s Savita Subramanian says there’s possibleness for brawny returns in a some areas: among dividend payers, “old school” capital-expenditure beneficiaries same infrastructure, cerebration and manufacturing stocks, and another themes that don’t circulate around staged intelligence.

“In mid-2023, view was deeply perverse and our toolkit advisable that the content of scheme and earnings surprises was more probable constructive than negative,” Subramanian, the firm’s nous of US justness and decimal strategy, told clients in a state dated July 29. “Today, view is viewless and constructive surprises are ebbing.”

Corporate Highlights:

-

Pfizer Inc. upraised its acquire expectations for the year, citing newborn cancer drugs, as it seeks to take discover of a Covid-related mess in sales.

-

Merck & Co. got gist as reddened income of its Gardasil HPV immunogen in China dim quarterly acquire and income that vex Wall Street estimates.

-

SoFi Technologies Inc. upraised its prognosticate for this year’s acquire and income as the fintech benefits from both its newer profession businesses and its stylemark disposition operation.

-

Archer-Daniels-Midland Co.’s quarterly acquire shrank more than due as the foodstuff trading colossus faces a downswing in pasture markets.

-

Airbus SE’s operative acquire lapse by more than half in the ordinal lodge after the consort reserved a calculate at its expanse unit, forcing it to revilement costs amid lower-than-anticipated bomb deliveries.

-

L’Oréal SA reportable inactive income ontogeny in the ordinal lodge as the world’s large concern of example products suffered from imperfectness in China.

-

BP Plc serviceable the measure of deal buybacks and accumulated its dividend as brawny second-quarter earnings from pumping vulgar equilibrize imperfectness in another parts of the business.

-

Grifols SA, the land caregiver consort gist by a brief vender move this year, said it overstated the continuance of its wager in a Asiatic concern and reportable an business fitting of €457 meg ($494 million).

Key events this week:

-

Eurozone CPI, Wednesday

-

Bank of Nihon contract decision, Wednesday

-

US nucleotide job change, Wednesday

-

Fed evaluate decision, Wednesday

-

Meta Platforms earnings, Wednesday

-

Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

-

US initial unemployed claims, ISM Manufacturing, Thursday

-

Amazon, Apple earnings, Thursday

-

Bank of England evaluate decision, Thursday

-

US employment, works orders, Friday

Some of the important moves in markets:

Stocks

-

The S&P 500 lapse 0.8% as of 1:23 p.m. New royalty time

-

The Nasdaq 100 lapse 1.6%

-

The Dow designer Industrial Average chromatic 0.2%

-

The MSCI World Index lapse 0.5%

-

Bloomberg Magnificent 7 Total Return Index lapse 2.4%

-

The writer 2000 Index was lowercase changed

Currencies

-

The Bloomberg Dollar Spot Index was lowercase changed

-

The euro was lowercase denaturized at $1.0817

-

The nation blow lapse 0.2% to $1.2837

-

The Asian yearning chromatic 0.6% to 153.09 per dollar

Cryptocurrencies

-

Bitcoin lapse 2.2% to $65,906.04

-

Ether lapse 0.9% to $3,292.95

Bonds

-

The consent on 10-year Treasuries declined threesome foundation points to 4.14%

-

Germany’s 10-year consent declined digit foundation points to 2.34%

-

Britain’s 10-year consent was lowercase denaturized at 4.04%

Commodities

-

West Texas Intermediate vulgar lapse 1.1% to $74.94 a barrel

-

Spot metallic chromatic 1% to $2,407.08 an ounce

This news was produced with the resource of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Tech Stocks Sink as War Jitters Fuel Rush to Bonds: Markets Wrap #Tech #Stocks #Sink #War #Jitters #Fuel #Rush #Bonds #Markets #Wrap

Source unification Google News

Source Link: https://finance.yahoo.com/news/asian-shares-eye-declines-ahead-224722675.html

Leave a Reply