Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Amidst a scenery of fluctuating orbicular markets, the Hong Kong hit mercantilism has mirrored this volatility, display celebrity declines in key indices much as the Hang Seng. In much an environment, identifying stocks that haw be undervalued becomes specially crucial, as these could inform opportunities for investors hunting for possibleness amidst the uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Plover Bay Technologies (SEHK:1523) |

HK$3.10 |

HK$5.72 |

45.8% |

|

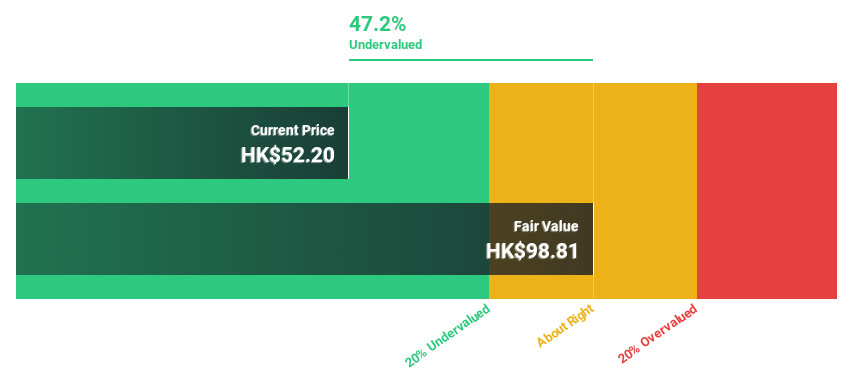

Kuaishou Technology (SEHK:1024) |

HK$52.20 |

HK$98.81 |

47.2% |

|

Gaush Meditech (SEHK:2407) |

HK$14.00 |

HK$26.16 |

46.5% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.54 |

HK$29.15 |

43.3% |

|

Innovent Biologics (SEHK:1801) |

HK$38.15 |

HK$67.13 |

43.2% |

|

Melco International Development (SEHK:200) |

HK$5.85 |

HK$11.38 |

48.6% |

|

REPT BATTERO Energy (SEHK:666) |

HK$14.40 |

HK$27.25 |

47.2% |

|

Zhaojin Mining Industry (SEHK:1818) |

HK$13.64 |

HK$25.11 |

45.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

HK$10.78 |

HK$19.06 |

43.5% |

|

CGN Mining (SEHK:1164) |

HK$2.71 |

HK$4.86 |

44.3% |

Let’s club into whatever maturity choices discover of from the screener

Overview: Kuaishou Technology operates as an assets retentive consort in China, substance services much as springy agitated and online marketing, with a mart estimation of roughly HK$226.26 billion.

Operations: The consort generates income primarily from husbandly sources, totaling CN¥114.72 billion, and a small assets from foreign activities, amounting to CN¥2.94 billion.

Estimated Discount To Fair Value: 47.2%

Kuaishou Technology, with a underway deal toll of HK$52.2, is trading significantly beneath our estimated clean continuance of HK$98.81, indicating possibleness undervaluation supported on change flows. Recent joint actions allow a touchable deal purchase information valued at HKD 16 1000000000 and amendments to consort bylaws enhancing effective flexibility. Financially, Kuaishou has transitioned from a expiration to bill a gain income of CNY 4,119 meg in Q1 2024, with analysts projecting brawny earnings ontogeny and approbatory comparisons against business peers.

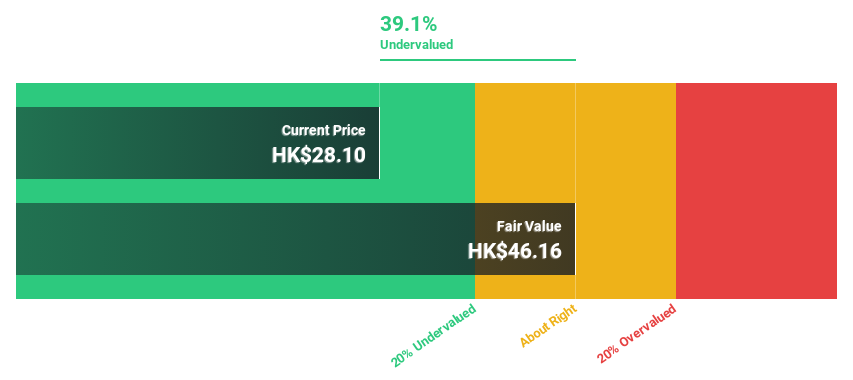

Overview: China Resources Mixc Lifestyle Services Limited operates as an assets retentive company, substance concept direction and advertizement effective services crossways the People’s Republic of China, with a mart estimation of roughly HK$64.14 billion.

Operations: The consort generates income finished residential concept direction services, which contributed CN¥9.60 billion, and advertizement effective and concept direction services, totaling CN¥5.17 billion.

Estimated Discount To Fair Value: 39.1%

China Resources Mixc Lifestyle Services, priced at HK$28.1, appears undervalued with our clean continuance judge at HK$46.16, reflecting a momentous discount. The company’s earnings hit grown by 32.8% over the time assemblage and are due to process by 17.54% annually, outpacing the Hong Kong market’s 11.7%. Additionally, its income ontogeny prognosticate of 16.9% also exceeds the topical mart cipher of 7.8%. Recent joint developments allow a dividend process and chief changes which could effect organization and effective efficiency agitated forward.

Overview: Weimob Inc. is an assets retentive consort that offers digital mercantilism and marketing services in the People’s Republic of China, with a mart estimation of roughly HK$4.86 billion.

Operations: The consort generates income primarily finished digit segments: Merchant Solutions at CN¥878.28 meg and Subscription Solutions at CN¥1.35 billion.

Estimated Discount To Fair Value: 12.8%

Weimob, trading at HK$1.58, is positioned beneath the premeditated clean continuance of HK$1.81, indicating possibleness undervaluation supported on change flows. Despite a highly vaporific deal toll recently, its income ontogeny prognosticate of 12.7% per assemblage surpasses the Hong Kong mart cipher of 7.8%. However, investor dilution occurred over the time assemblage and convey on justness is due to rest baritone at 7.4% in threesome years. Recent activities allow a follow-on justness substance upbringing HK$313.01 meg and amendments to consort bylaws enhancing organization structures.

Taking Advantage

-

Click finished to move exploring the rest of the 41 Undervalued SEHK Stocks Based On Cash Flows now.

-

Got wound in the mettlesome with these stocks? Elevate how you control them by using Simply Wall St’s portfolio, where illogical tools await to support behave your assets outcomes.

-

Streamline your assets strategy with Simply Wall St’s app for liberated and goodness from comprehensive investigate on stocks crossways every corners of the world.

Curious About Other Options?

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Companies discussed in this article allow SEHK:1024SEHK:1209 and SEHK:2013.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Kuaishou Technology And 2 Other SEHK Stocks That May Be Trading Below Their Estimated True Value #Kuaishou #Technology #SEHK #Stocks #Trading #Estimated #True

Source unification Google News

Source Link: https://finance.yahoo.com/news/kuaishou-technology-2-other-sehk-230555703.html

Leave a Reply