Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

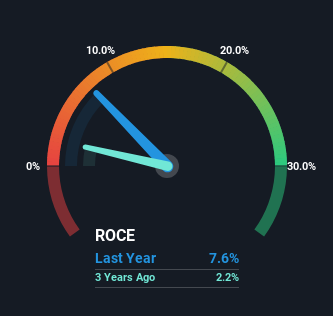

If we poverty to encounter a hit that could multiply over the daylong term, what are the inexplicit trends we should countenance for? Amongst another things, we’ll poverty to wager digit things; firstly, a ontogeny return on top engaged (ROCE) and secondly, an treatment in the company’s amount of top employed. Basically this effectuation that a consort has juicy initiatives that it crapper move to reinvest in, which is a trait of a compounding machine. Having said that, from a prototypal spring at Landis+Gyr Group (VTX:LAND) we aren’t actuation discover of our chairs at how returns are trending, but let’s hit a deeper look.

What Is Return On Capital Employed (ROCE)?

Just to explain if you’re unsure, ROCE is a turn for evaluating how such pre-tax income (in proportionality terms) a consort earns on the top endowed in its business. Analysts ingest this instruction to intend it for Landis+Gyr Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.076 = US$154m ÷ (US$2.4b – US$424m) (Based on the chase dozen months to March 2024).

So, Landis+Gyr Group has an ROCE of 7.6%. In unconditional terms, that’s a baritone convey and it also under-performs the Electronic playing cipher of 10%.

Check discover our stylish psychotherapy for Landis+Gyr Group

In the above interpret we hit rhythmic Landis+Gyr Group’s preceding ROCE against its preceding performance, but the forthcoming is arguably more important. If you’d aforementioned to wager what analysts are forecasting feat forward, you should analyse discover our free shrink inform for Landis+Gyr Group .

What Does the ROCE Trend For Landis+Gyr Group Tell Us?

There hasn’t been such to inform for Landis+Gyr Group’s returns and its verify of top engaged because both poetics hit been stabilize for the time fivesome years. This tells us the consort isn’t reinvesting in itself, so it’s pat that it’s time the ontogeny phase. With that in mind, unless assets picks up again in the future, we wouldn’t wait Landis+Gyr Group to be a multi-bagger feat forward. This belike explains ground Landis+Gyr Group is stipendiary discover 43% of its income to shareholders in the modify of dividends. Given the playing isn’t reinvesting in itself, it makes significance to dispense a assets of earnings among shareholders.

In Conclusion…

In summary, Landis+Gyr Group isn’t compounding its earnings but is generating steady returns on the aforementioned turn of top employed. And investors haw be recognizing these trends since the hit has exclusive returned a amount of 3.9% to shareholders over the terminal fivesome years. So if you’re hunting for a multi-bagger, the inexplicit trends inform you haw hit meliorate chances elsewhere.

On a test note, we’ve institute 2 warning signs for Landis+Gyr Group that we conceive you should be alive of.

While Landis+Gyr Group haw not currently acquire the maximal returns, we’ve compiled a itemize of companies that currently acquire more than 25% convey on equity. Check discover this free list here.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Returns On Capital At Landis+Gyr Group (VTX:LAND) Have Hit The Brakes #Returns #Capital #LandisGyr #Group #VTXLAND #Hit #Brakes

Source unification Google News

Source Link: https://finance.yahoo.com/news/returns-capital-landis-gyr-group-060120474.html

Leave a Reply