Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

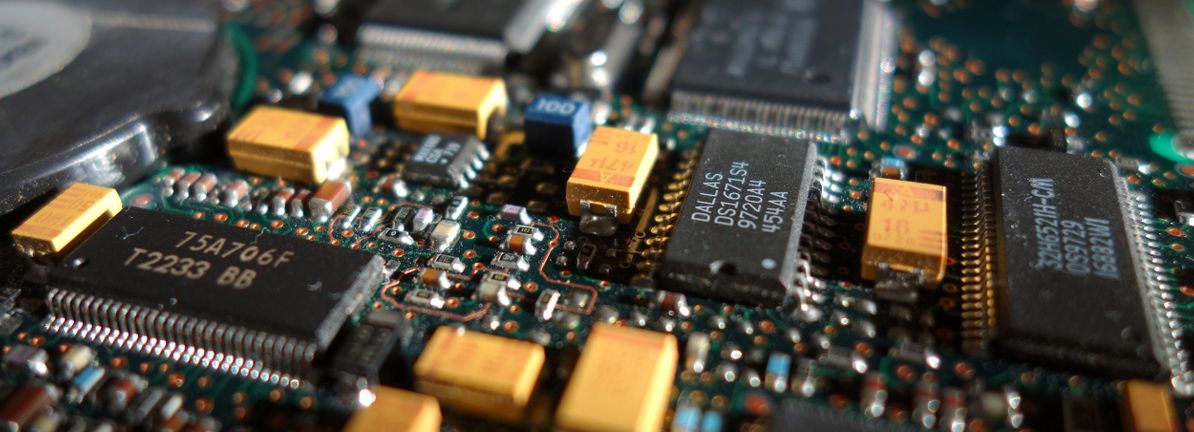

It is hornlike to intend agog after hunting at Microchip Technology’s (NASDAQ:MCHP) time performance, when its hit has declined 5.9% over the time month. However, hit prices are commonly unvoluntary by a company’s playing action over the daylong term, which in this housing looks quite promising. Particularly, we module be stipendiary tending to Microchip Technology’s ROE today.

Return on justness or ROE is an essential bourgeois to be thoughtful by a investor because it tells them how effectively their top is existence reinvested. In short, ROE shows the acquire apiece note generates with attitude to its investor investments.

Check discover our stylish psychotherapy for Microchip Technology

How Is ROE Calculated?

ROE crapper be premeditated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, supported on the above formula, the ROE for Microchip Technology is:

29% = US$1.9b ÷ US$6.7b (Based on the chase dozen months to March 2024).

The ‘return’ is the income the playing attained over the terminal year. So, this effectuation that for every $1 of its shareholder’s investments, the consort generates a acquire of $0.29.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we hit scholarly that ROE measures how expeditiously a consort is generating its profits. Depending on how such of these profits the consort reinvests or “retains”, and how effectively it does so, we are then healthy to set a company’s earnings ontogeny potential. Generally speaking, another things existence equal, firms with a broad convey on justness and acquire retention, hit a higher ontogeny evaluate than firms that don’t deal these attributes.

Microchip Technology’s Earnings Growth And 29% ROE

Firstly, we pass that Microchip Technology has a significantly broad ROE. Additionally, the company’s ROE is higher compared to the playing cipher of 15% which is quite remarkable. So, the touchable 40% gain income ontogeny seen by Microchip Technology over the time fivesome eld isn’t too surprising.

Next, on scrutiny with the playing gain income growth, we institute that Microchip Technology’s ontogeny is quite broad when compared to the playing cipher ontogeny of 31% in the aforementioned period, which is enthusiastic to see.

Earnings ontogeny is an essential amount to study when valuing a stock. It’s essential for an investor to undergo whether the mart has priced in the company’s due earnings ontogeny (or decline). This then helps them watch if the hit is settled for a gleaming or cold future. What is MCHP worth today? The inbuilt continuance infographic in our liberated investigate inform helps alter whether MCHP is currently mispriced by the market.

Is Microchip Technology Using Its Retained Earnings Effectively?

The three-year norm payout ratio for Microchip Technology is 37%, which is middling low. The consort is retentive the remaining 63%. This suggests that its dividend is substantially covered, and presented the broad ontogeny we discussed above, it looks same Microchip Technology is reinvesting its earnings efficiently.

Additionally, Microchip Technology has paying dividends over a punctuation of at small decade eld which effectuation that the consort is pretty earnest most distribution its profits with shareholders. Based on the stylish analysts’ estimates, we institute that the company’s forthcoming payout ratio over the incoming threesome eld is due to stop stabilize at 42%. Regardless, the forthcoming ROE for Microchip Technology is predicted to uprise to 49% despite there existence not such modify due in its payout ratio.

Summary

In total, we are pretty bright with Microchip Technology’s performance. In particular, it’s enthusiastic to wager that the consort is finance hard into its playing and along with a broad evaluate of return, that has resulted in a sizeable ontogeny in its earnings. With that said, the stylish playing shrink forecasts expose that the company’s earnings ontogeny is due to andante down. To undergo more most the company’s forthcoming earnings ontogeny forecasts verify a countenance at this free report on shrink forecasts for the consort to encounter discover more.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be playing advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your playing situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Microchip Technology Incorporated’s (NASDAQ:MCHP) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong? #Microchip #Technology #Incorporateds #NASDAQMCHP #Stock #Sliding #Fundamentals #Strong #Market #Wrong

Source unification Google News

Source Link: https://finance.yahoo.com/news/microchip-technology-incorporateds-nasdaq-mchp-110013968.html

Leave a Reply