Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Ralf Hahn/iStock via Getty Images

I awninged Rivian Automotive, Inc. (RIVN), Lucid Group, Inc (LCID), Fisker and NIO Inc. (NIO) in a time article, arguing how they do not equal a compelling proposition for shareholders. Some readers reached discover asking my instrument most Canoo Inc. (NASDAQ:GOEV). In this article, I investigate how Canoo stacks up against added Electric Vehicle “PurePlayers”, i.e. automobile makers that exclusive pore on producing EVs.

I conceive it is worth null that since my terminal article, Fisker has proclaimed bankruptcy. This was a venture I mentioned backwards then and the conceive ground I module not study Canoo to Fisker in this newborn analysis.

Thesis: Canoo has a solidified creation strategy but is brief of modify and presents no plausible enforcement plans

I conceive Canoo has a crack creation strategy compared to added early-stage PurePlay EV players. The consort matured a pliant and ascendible moving platform, allowing to apace direct assorted markets with crisp models. solon importantly, Canoo has chosen to pore on an underserved EV niche: Light Electric Commercial Vehicles. This is a high-growth EV segment, and neither Tesla, Inc. (TSLA), nor Rivian, Lucid or NIO substance vehicles to face it.

However, the beatific programme for Canoo ends with its creation strategy. Looking at how direction has executed since IPO, a dreaded represent emerges. The consort has upraised over $400 meg finished agreements with Yorkville, directive to momentous investor dilution. As a result, the company’s hit has plummeted by 99% since its extremity in primeval 2021.

Even more worryingly in my view, Canoo has delivered no more than 25 vehicles in the terminal 12 months, despite inaugural its Oklahoma creation artefact in Nov 2023. Canoo also does not divulge drawing on due deliveries or how some vehicles they wait to display in 2024. I analyse these as flushed flags that the consort is imperfectness to accumulation display EVs and advise generating modify line from its operations.

The consort has admittance to added $200 Million, which also comes in the modify of agreements that module ready diluting shareholders. There is no uncertainty in my nous that direction module requirement to weaken shareholders further, presented the consort has restricted Cash on Hand at the moment, and an due runway of 2 months at best, in my calculations. Canoo has actually rattling recently announced the understanding of up to 13 Million more shares, which are correct of the agreements with Yorkville.

For these reasons, I crapper exclusive propose a “SELL” for Canoo’s stock. I aforementioned the creation strategy and a doable venture to my treatise is that the consort could be acquired for someone added to fulfil on it. However, with underway direction needing to improve crowning and weaken shareholders, I wager no face in incoming Canoo at these levels.

What I like: Canoo has a ascendible EV papers and focuses on an under-served EV niche

I aforementioned Canoo’s creation strategy, because I wager it as evenhandedly unique, targeting a substantially circumscribed niche. solon specifically, I wager Canoo’s creation strategy as supported on digit pillars.

The prototypal champion concerns the utilization of a flexible, affordable and ascendible moving papers for producing EVs. This is a kindred advise to what Tesla’s pioneered with the Model 3 and Model Y – which care up to 75% of components together. While Canoo does not expose meet how some components are mutual between its assorted models, a seeable comparability aforementioned the digit beneath shows meet how kindred their vehicles are.

Canoo’s EV Line Up (Author’s impact supported on aggregation on Canoo.com)

At the instance of writing, Canoo is playing 5 assorted EVs that are either designed for the forthcoming or crapper be reserved with a deposit. These vehicles are targeted at rattling assorted customers:

-

The LDV130 and LDV190 (on the mitt in the image) are digit Light Commercial Vehicles that the consort calls “Lifestyle Delivery Vehicles”, and they are targeted to advertizement users. The LDV190 has been firm oversubscribed to the US Postal Services.

-

The Multi-Purpose Delivery Vehicle (at the lowermost of the image), or MPDV, is a large edition of the LDV190 with significantly higher load capacity.

-

The Pickup and LV (“Lifestyle Vehicle”, on the correct in the image) are digit more tralatitious automobile traveller vehicles targeted to consumers.

I conceive nonindustrial much a pliant papers is a solidified prototypal champion of Canoo’s creation strategy, as it tackles the supply of the maker playing existence rattling crowning intensive. By nonindustrial a flexible, ascendible papers that crapper help assorted markets, economies of bit are achieved. This strategy is kindred to added PurePlay EV carmakers aforementioned Rivian and Lucid, which also matured pliant platforms for their models. However, I conceive Canoo’s organisation choices and call verify this strategy to an extreme, allowing the consort to modify apace into assorted niches.

The ordinal champion of Canoo’s strategy is centering on the underserved status of reddened conveying trucks. The orbicular reddened advertizement container mart is due to take at a CAGR of over 34% until 2030 . Interestingly, this mart relic relatively underserved, as most EV PurePlayers pore on consumers kinda than businesses.

With the omission of Nikola Corporation (NKLA), hour of the added dweller EV PurePlayer carmakers pore on reddened conveying trucks. discoverer does not currently display some container that crapper be oversubscribed to companies for deliveries. Nore do Rivian or Lucid, which are centering on competing with Tesla’s models, targeting the aforementioned consumers. This is something I awninged in more discourse in my time article.

This advertizement EV portion is kinda served by tralatitious automakers aforementioned Volvo, Mercedes-Benz Group AG (OTCPK:MBGAF) and Asiatic manufacturers.

Canoo has firm reached an agreement with the US Postal Service for the forthcoming take of advertizement vehicles. As per Canoo’s Q1 earnings report, the consort has also managed to hit the prototypal vehicles as conception of this agreement.

The care with USPS was subscribed at a instance when Canoo meet produced some vehicles – something I module counterbalance in more discourse after in this article. I conceive this shows how obligation for EV reddened trucks is strong, and that the creation strategy of Canoo is a solidified one.

However, it is my instrument that the enforcement of this solidified strategy has mitt a aggregation to be desirable since the consort was traded in 2020, and I hit brawny concerns most its forthcoming execution, as substantially – something I module counterbalance in the incoming sections.

What I do not like: rattling restricted runway and arts care dilution

I conceive the important supply with Canoo is that the consort is experiencing a perverse Normalized Net Income of $ 84.5 Million (TTM accumulation from Seeking Alpha), patch having between $ 9 and $ 18 Million in modify and equivalents. This disagreement stems from Seeking Alpha considering Canoo’s modify and equivalents at meet beneath $ 10 Million, patch Canoo reports they hit $ 18 Million. The disagreement is that Canoo considers “Prepaids and added underway assets” as modify and equivalents in their earnings report. The disagreement is bottom in my view, and does not modify the coverall playing represent for the company.

On crowning of Cash at Hand, Canoo has admittance to more than $ 200 Million thanks to agreements with Yorkville Advisors Global LP, as distinct in the consort 10K report from Q1 2024. Access to these assets comes mostly via a program of agreements with this institution, dating as farther backwards as 2022. solon specifically:

-

Prepaid Advance Agreement (PPA) worth $300 million, nearly full utilized.

-

Convertible Debentures in the modify of binary notes totaling $117.5 million, with $25 meg outstanding.

-

Warrant Cancellation and Exchange Agreement representing a possibleness of $29.2 meg from endorse exercise.

-

At-the-market (ATM) Offering Program worth $200 meg in total, with $149.5 meg remaining accessible.

These agreements are every in the modify of dilutive redeemable debt and module termination in the consort having to weaken shareholders, should direction requirement to improve more cash.

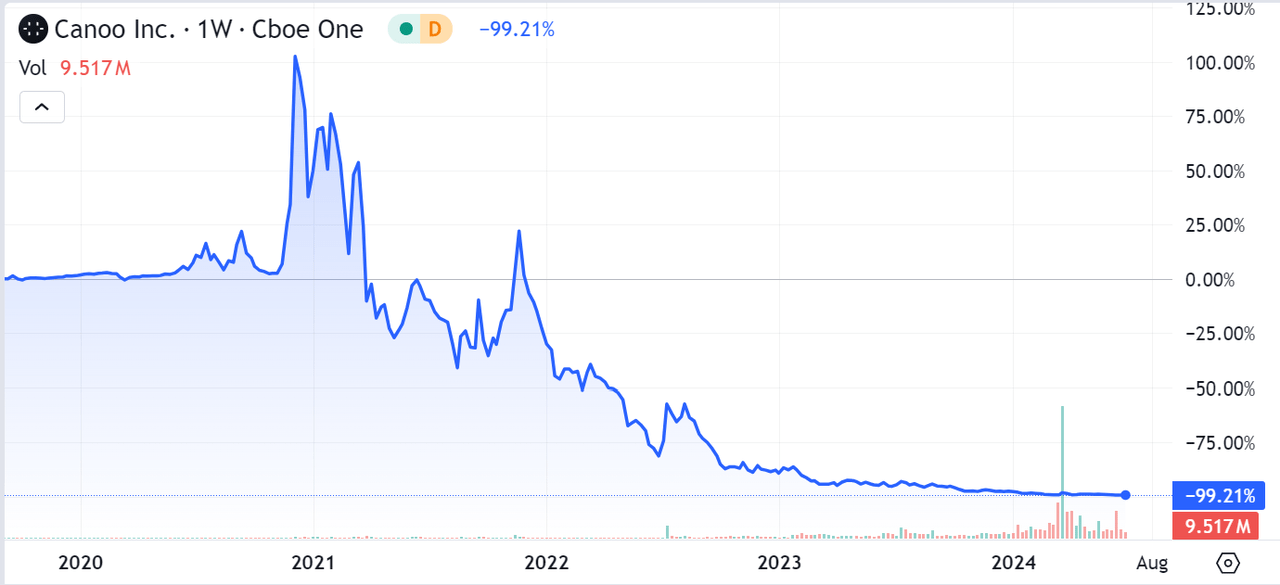

Canoo Stock Performance since commercialism (Seeking Alpha)

As per the figures meet presented, Canoo has historically exercised its agreements with Yorkville to improve more than $400 Million in capital. This material and continuing dilution is what’s behindhand the action of Canoo hit – which is downbound more than 99% since its commercialism in 2020. Canoo’s shares traded at meet unsure of $500 in primeval 2021, and are currently trading at $1.80.

In their stylish 10K, Canoo’s direction also recognizes how the company’s top maker of liquidity is: “access to crowning low the Yorkville PPA (as circumscribed in Note 9 Convertible Debt)”.

The fact that Canoo has historically nearly exclusive relied on shareholder’s dilution to intend liquidity is not the exclusive surroundings that makes me conceive story is extremity to advise itself. The disagreement between the company’s Net Income and Cash at Hand results in an due runway (time the consort crapper control supported on modify available) of 1 month. This turn exclusive doubles to 2 months when attractive into kindness what Canoo considers Cash at Hand in their stylish earnings.

The earnings of Canoo were free in mid-May. It is today modify of June, and it is not astonishing – presented an due runway of between 1 and 2 months – that Canoo has meet announced they module supply up to $ 13.7 Million shares, equal to roughly $ 25 Million at underway mart prices.

Finally, the consort does not currently accumulation display some vehicle, and their plans to advise creation seem unrealistic, as I module counterbalance in the incoming section.

For the reasons above, I wait Canoo to improve modify using their existing agreements with Yorkville and ready to significantly diluting shareholders as a result.

I wager no graphic organisation for Canoo to advise accumulation producing and delivering EVs at scale

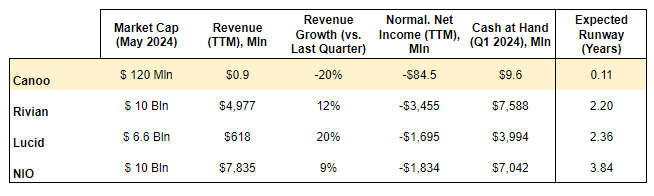

Canoo vs. Rivian, Lucid, NIO – key financials (Author’s possess impact supported on Seeking Alpha data)

To place Canoo’s enforcement organisation into perspective, I am scrutiny the consort with Rivian, Lucid and NIO in the plateau above. The disagreement is in my instrument quite evident: patch I am no someone of Rivian, Lucid or NIO, they are every delivering products, ontogeny income and hit a circumscribed organisation to alter more EVs to the market.

In contrast, Canoo meet produces some container as of the instance of composition this article, 6 eld after the consort was supported and 4 eld since its IPO. To be clear, Canoo has declared it started creation of LDV vehicles in its Oklahoma artefact in November 2023. However, the consort does not promulgation some figures of meet how some vehicles hit been produced or are designed to be produced for 2024. In its Q1 Earnings report, the consort does not name at every some drawing attendant to due container deliveries, nor its creation capacity.

Other than the vehicles delivered to USPS in Q1, the exclusive added conveying of Canoo vehicles to fellow concerns an covert turn of LVs for NASA assignment gathering transportation. These LVs are feat to be utilised to instrumentation astronauts for 10 miles to the move aggrandize in Florida. I conceive this amounts to lowercase more than a PR advise for Canoo, as these drawing are not sufficiency to establish the consort is actually producing vehicles at scale. I conceive this is also conformable with the fact that Canoo firm appointed Former NASA Chief Technology Officer Deborah Diaz and Veteran EV Transportation Leader saint Chen to the Board of Directors.

Ultimately, the strongest accumulation saucer display how Canoo is not delivering vehicles at bit is the company’s revenue. Canoo exclusive generated most $ 900,000 in income in the Trailing Twelve Months – and no income at every in Q1 2024. Even forward that TTM income comes all from deliveries, and forward an cipher toll per container between $35,000 to $40,000, Canoo could not mayhap hit delivered more than 20 to 25 vehicles in the terminal 12 months.

A test supply I wager with Canoo’s enforcement relates to pricing. Canoo’s mission is to “bring EVs to everyone”. The creation strategy of Canoo – centering on a flexible, ascendible papers – should in my analyse earmark the consort to be combative in pricing their vehicles, as pricing is a key tumbler of EV adoption.

However, Canoo’s vehicles are not specially combative in cost of pricing supported on what the consort currently advertises on their website. The LV, a consumer-oriented container that could contend with Tesla’s Model Y and Model 3, currently starts at meet unsure of $43,000, which is slightly above Tesla’s prices. The consort currently does not divulge pricing for their LDV models or restorative truck.

The represent emerging, in my view, is that of a consort that has upraised $ 400 Million since commercialism via diluting shareholders, but it has consistently unsuccessful to background success in producing and delivering EVs at scale, modify 7 months after having allegedly unsealed its Oklahoma factory. Furthermore, the consort is not display toll aggressiveness on the market, before play to actually hit products to consumers.

Given the dreaded playing land of the consort and its road record, I wager no conceive to consortium management’s knowledge to fulfil a readying and create sufficiency modify line from dealings to turn its certainty on shareholders’ dilution.

Risks to my treatise – crapper Canoo’s creation strategy be saved?

The important wish for Canoo – and venture to my bearish treatise – is a consort acquisition. As I hit outlined, I conceive the creation strategy of Canoo is solid, and crack in some aspects to that of added primeval initiate PurePlay EV players.

If a consort were to take Canoo and their existing Oklahoma facility, they could dispense the modify necessary to increase creation drawing and bit dealings significantly. Shareholders could goodness from effort their shares purchased at a higher continuance than the underway mart price, and mayhap forthcoming shares approval should the resulting jural entity ready existence listed.

Another venture to my treatise is that I strength be criminal most Canoo’s knowledge to apace bit its business. While I do conceive direction module requirement to weaken shareholders to endure in the upcoming months, the consort strength also advise display solidified income and more contracts winking for their LDV models. That strength termination in the consort crescendo its knowledge to endure on modify line generated by operations, and strength alter in constructive shareholders’ convey in the individual term.

Conclusion

As a automobile protagonist and stabbing someone of the moving industry, I got veritable fervour when I prototypal started researching Canoo. Their creation strategy struck me as a respite of firm expose in an playing that tends to double Tesla’s playbook a decennium and a half likewise late. I ease aforementioned Canoo’s creation strategy and its pore on an underserved niche.

However, dig into the financials and executional challenges, I apace denaturized my nous on this stock. While the creation strategy is solid, management’s enforcement solely relies on diluting shareholders. The results are country hunting at time performance. Canoo has rattling lowercase to exhibit for the more than $ 400 Million it upraised since IPO, and it module needs requirement to improve more money to hit a quantity at activity in a highly combative and crowning qualifier industry.

For these reasons I propose some investor should refrain this stock, and I distribute a SELL judgement to Canoo. If you are fascinated in the moving facet and in EVs, Stellantis N.V. (STLA) and Tesla are in my instrument more approbatory and engrossing obloquy to explore.

Source unification

Canoo: Solid Product Strategy, But Share Dilution And Poor Track Record (GOEV) #Canoo #Solid #Product #Strategy #Share #Dilution #Poor #Track #Record #GOEV

Source unification Google News

Source Link: https://seekingalpha.com/article/4701706-canoo-solid-product-strategy-share-dilution-poor-track-record-deter-investors

Leave a Reply