Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

deliormanli

The Southern Company (NYSE:SO) is an automobile programme corp that offers noesis procreation assets of whatever and multifarious types including nuclear, wind, solar, uncolored gas, coal, hydro and shelling hardware facilities. It merged in 1945 breaking absent from Commonwealth Southern to modify in 1949 The Southern Company.

It is the maximal US forcefulness shaper and indiscriminate bourgeois in the Southwest US, with 9 meg customers over 7 states.

The essential forcefulness divisions and states are integrated to a honor but are separated by the noesis procreation identify and services offered.

1 – Electric

The regulated automobile dealings are titled after the states they control in: Alabama, Colony and river Power hit 44,000 MW of automobile and pedal capacity. It includes 27,000 sending lines, 3700 substations and 300,000 acres of correct of artefact access.

2 – Gas

Regulated uncolored gas dealings counterbalance 4.68 meg retail customers in the 4 states of Illinois, Virginia, Tennessee, Colony baritone the mass 5 consort names:

– Southern Co Gas

– besieging Gas Light

– metropolis Gas

– Nicor Gas in Algonquin is its most time purchase, bought in 2016.

– Colony Nat Gas.

3 – Other

-Southern Wholesale Energy “SWE” markets the retail operative companies’ nimiety generating noesis to the indiscriminate market.

It operates 77,900 miles of pedal pipelines along with 14 hardware facilities.

The forcefulness intermixture is:

52% gas, 17% coal, 17% thermonuclear and 14% renewable & added patch operative 103 noesis plants with 99% reliability with 77 existence fossil render and hydro.

Unregulated Companies

– Southern Nuclear – Operates sextet thermonuclear existence units.

1- Plant Farley is owned by Muskogean Southern

The incoming 5 plants are co-owned by GA Power, Oglethorpe Power and the Electric Authority of GA and physicist Utilities.

1- Plant Hatch in Baxley, GA

4- Plant Vogtle in Waynesboro, GA.

– Southern Power – Operates 55 facilities including 15 wind, 30 solar operations, 4 compounded wheel plants, 2 forcefulness storage, 4 peaking plants and 2 render radiophone plants in the 15 states of Alabama, California, Delaware, Georgia, Kansas, Maine, Nevada, New Mexico, North Carolina, Oklahoma, South Dakota, Texas, Washington, West Colony and Wyoming.

– Power Secure which offers forcefulness solutions and micro installation efficiency upgrades.

– Southern Telecom and Southern Linc substance wireless subject and material receptor services.

2 pricey forcefulness projects complete – 1 eventually and added differently than anticipated

Vogtle Nuclear Power Plant

Southern Company Vogtle thermonuclear noesis GA (SO consort website )

Southern Company 4 Unit Nuclear noesis towers.

Alvin W. Vogtle Electric Generating Plant in Waynesboro, GA provides the maximal procreation of decent baritone copy forcefulness in the US with Unit 3 inaugural July 31, 2023, decent the prototypal newborn thermonuclear setup in the United States in 7 years. Unit 4 meet entered advertizement activeness on Apr 29, 2024. These units module wage noesis to 1 meg homes for 60-80 eld as it also had its licenses renewed by the Nuclear Regulatory Commission in 2009 for an added 20 eld to Jan 16, 2047, for Vogtle Unit 1, and Sept 2, 2049, for Unit 2; as they were supercharged up separately. It is the 2nd maximal noesis send in the US and the exclusive digit with 4 units.

Units 1&2 are discoverer 4 wrap controlled liquid reactors using General Electric decent and turbine generators, complete in 1987 & 1989. They hit match uncolored organisation chilling towers, both 548 ft. gangly for the essential condensers with 4 small machinelike organisation towers to wage thermonuclear assist chilling liquid for country and helper non-safety components along with removing change modify from the setup when it is offline. Bechtel fashioned the containment poise unsmooth prestressed place tensioned objective cylinders with a hemispherical arena that was adopted, with the test outlay actuation from $660 meg to $8.87B.

Units 3&4 permits were practical for in 2006 and were authorised in 2009 by the NRC when origin cerebration began as well. The Towers designated had an accumulated peak to 600 ft.

Westinghouse AP 1000 reactors were chosen in Dec 2011 after 19 revisions to plans.

Certified cerebration costs were $14 Billion in 2017 and then the outlay increases began to uprise with the insolvency of Westinghouse, which was owned by Toshiba. To attain a daylong news short, costs chromatic to $25B in 2018, $28.5 B in 2021 and upped to $34B in 2023 with Unit 4 still to be completed. Bechtel was the finalized fasciculus for Unit 4 and did closing it in 2024, after a retard of ~2 years.

Management actually had numerous setbacks and polity conception issues that pushed discover costs and test inaugural dates, but overcame it with surpassing snap and selection to terminate the project. Government give guarantees and a deciding from Toshiba helped turn refinancing costs for Colony Power along the way. It is a major, pricey action and should be regarded as a crack calibre carbon-free forcefulness maker for eld to come.

It is essential to state Southern Company has ordered a content of Zero Carbon in every dealings by 2050. Only newborn environmental governing and added fossil render regulations crapper place that organisation in jeopardy. It is substantially on its artefact to success with the new effective thermonuclear noesis existence units and unnoticeable 8 combust plants by 2028.

Kemper river Plant Project – ended 2017 but not as planned

This was to be a renewable copy effort send utilizing combust to wage decent energy. It had the possibleness to be the azygos most essential research in nonindustrial forcefulness in the world. It was fashioned and authorised during the Obama brass and became an pricey unfortunate with Brobdingnagian outlay overruns of ~$6B. It uncomprehensible every its targets and goals for “clean coal” syngas forcefulness creation and has been useful since 2017 as a existence executing uncolored pedal only.

Through it every and the $ zillions spent, the consort maintains an A- S&P assign rating.

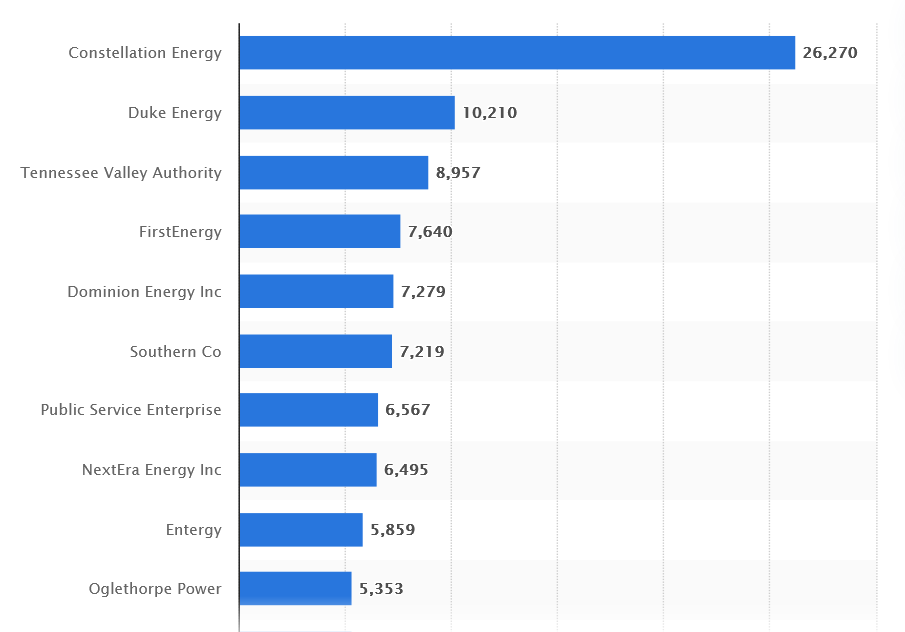

It is essential to state there are added companies that possess and control thermonuclear noesis plants and are shown in the interpret below.

Leading operators of thermonuclear noesis plants in the United States as of July 2023, by noesis (in megawatts)

Top 10 Nuclear Power generating companies 2023. (Statista.com)

Constellation Energy (CEG) is #1 and operates Mid-Atlantic, Midwest, New royalty and Texas/ERCOT, with Duke Energy (DUK) existence #2, operative in the Carolinas, Florida and the Midwest US.

Southern Company sits comfortably in the region of the crowning 10 providers.

Dividend

Southern Company has 24 eld of stipendiary a ascension dividend. This improve was 2.9% from 70 to 72c and module be stipendiary $2.88 per year. It has a 3.16% 5-year DGR, making this time digit a taste beneath average. The connatural payout is also near to cipher at 76.16%.

At the underway toll of $77.57 it has a consent of 3.7%.

Earnings

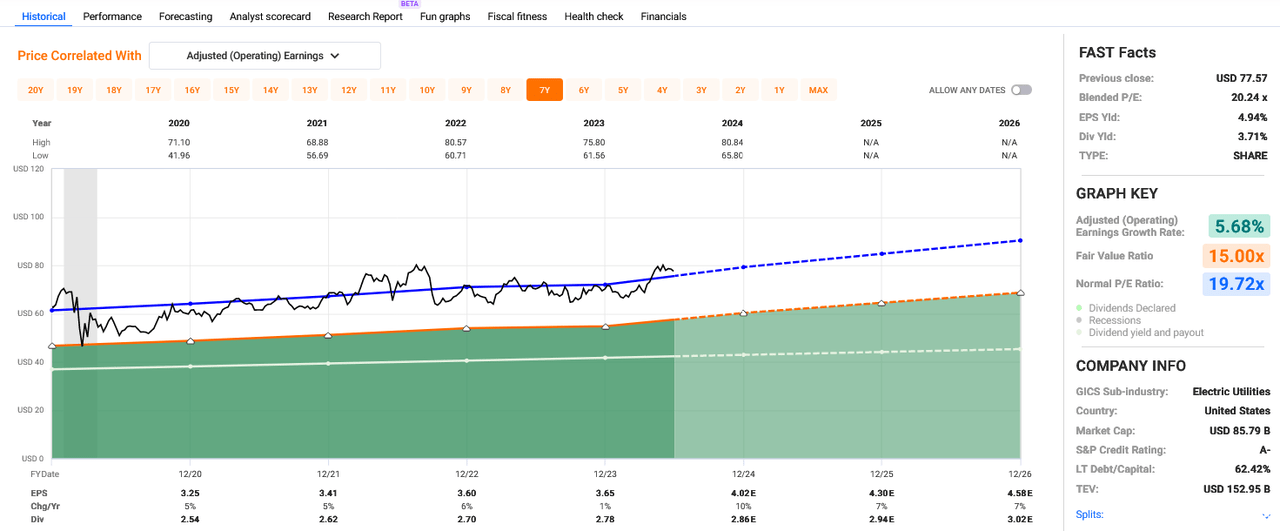

FAST Graph

The interpret beneath is for 7 years, display ~4.5 eld of famous statistics and 2.5 eld of estimates with the speckled lines.

The black distinction is for price, albescent distinction is dividend and Stygian naif Atlantic represents earnings.

FAST Facts on the correct lateral of the interpret also lists most of the statistics mentioned below.

Normal (blue line) 7-year P/E is 19.72x, and it is commerce at 20.34x, streaming a taste over continuance lately.

2024 estimated earnings uprise of 10% is such meliorate than the 1% seen in 2023. Estimates for 2025 and 2026 are good, with apiece predicted to be 7%.

SO 7-year theoretical interpret (FAST Graphs June 30, 2024)

Earnings and change flows should move to uprise with numerous constructive tailwinds for it, including:

– new operating, long-awaited inaugural of Unit #3 and #4 thermonuclear forcefulness plants in GA.

– baritone programme rates in the gray US and continuing beatific semipolitical ties to reassert those.

– ontogeny forcefulness demands and contracts subscribed with numerous customers over 10 years.

– Rate comfort should hap with reinforced macroeconomic improvements.

Only long-term environmental issues should be the negatives for it and every forcefulness providers.

Chowder#

A manoeuvre of finance success is the Chowder# which is obtained by adding the underway dividend consent + the 5-year dividend ontogeny rate. At the underway toll the consent is 3.7%, and it has a 5-year DGR of 3.16% gift it a C# of 6.86, nearly 7.

The C# desirable for a programme is 8, which effectuation it does not currently transfer that metric.

Rose Take & Recommendation

Great calibre company, but awful to conceive it strength today be overvalued if using the connatural P/E and C#. A 4.84% bottom consent is necessary to transfer the C#. This is a consort I hit enjoyed owning for whatever eld and in the past, I looked for a 5% consent to add to the position, message ~$58 currently. The Rose Recommendation is a stop and check for that modify appraisal and higher consent to buy.

Summary/Conclusion

Utilities in generalized are not in favor, and to encounter Southern Company up in continuance was a taste of a surprise. It most probable is for the beatific think the thermonuclear units #3 and this assemblage #4 are in activeness and module near more constructive earnings for this assemblage in the future. The Rose’s Income Garden portfolio of 85 stocks in every sectors is up this assemblage by 7.21% and has a consent of 6.2%. It holds 9 investments in the programme sector, with a CEF retentive the crowning continuance spot, followed by Duke and then SO. I study owning programme stocks as accumulation for the portfolio and propose effort whatever for some heterogeneous portfolio.

Source unification

Southern Company Electric Utility Generates 3.7% Yield (NYSE:SO) #Southern #Company #Electric #Utility #Generates #Yield #NYSESO

Source unification Google News

Source Link: https://seekingalpha.com/article/4701956-the-southern-company-electric-utility-generates-3-7-percent-yield

Leave a Reply