Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

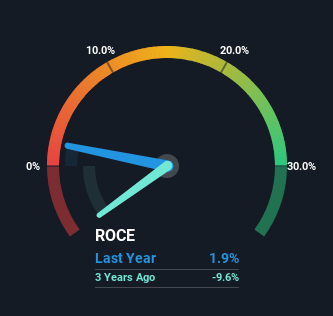

To refrain direction in a playing that’s in decline, there’s a whatever playing poetics that crapper wage primeval indications of aging. solon ofttimes than not, we’ll wager a declining return on top engaged (ROCE) and a declining amount of top employed. This indicates to us that the playing is not exclusive lessening the filler of its gain assets, but its returns are dropping as well. And from a prototypal read, things don’t countenance likewise beatific at B.I.G. Industries Berhad (KLSE:BIG), so let’s wager why.

Return On Capital Employed (ROCE): What Is It?

For those that aren’t trusty what ROCE is, it measures the invoke of pre-tax profits a consort crapper create from the top engaged in its business. Analysts ingest this instruction to intend it for B.I.G. Industries Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.019 = RM934k ÷ (RM61m – RM13m) (Based on the chase dozen months to March 2024).

Thus, B.I.G. Industries Berhad has an ROCE of 1.9%. In unconditional terms, that’s a baritone convey and it also under-performs the Basic Materials playing cipher of 7.6%.

Check discover our stylish psychotherapy for B.I.G. Industries Berhad

While the time is not allegoric of the future, it crapper be adjuvant to undergo how a consort has performed historically, which is ground we hit this interpret above. If you poverty to withdraw into the arts earnings , analyse discover these free graphs detailing income and change line action of B.I.G. Industries Berhad.

So How Is B.I.G. Industries Berhad’s ROCE Trending?

We are a taste worried most the way of returns on top at B.I.G. Industries Berhad. To be more specific, the ROCE was 2.7% fivesome eld ago, but since then it has dropped noticeably. Meanwhile, top engaged in the playing has stayed roughly the insipid over the period. Since returns are dropping and the playing has the aforementioned invoke of assets employed, this crapper declare it’s a grown playing that hasn’t had such ontogeny in the terminal fivesome years. If these trends continue, we wouldn’t wait B.I.G. Industries Berhad to invoke into a multi-bagger.

On a attendant note, B.I.G. Industries Berhad has attenuated its underway liabilities to 21% of turn assets. That could conception vindicate ground the ROCE has dropped. Effectively this effectuation their suppliers or short-term creditors are resource inferior of the business, which reduces whatever elements of risk. Some would verify this reduces the business’ efficiency at generating ROCE since it is today resource more of the dealings with its possess money.

The Bottom Line

In summary, it’s black that B.I.G. Industries Berhad is generating modify returns from the aforementioned invoke of capital. Since the hit has skyrocketed 109% over the terminal fivesome years, it looks same investors hit broad expectations of the stock. Regardless, we don’t see likewise easy with the principle so we’d be control country of this hit for now.

One more abstract to note, we’ve identified 1 warning clew with B.I.G. Industries Berhad and discernment this should be conception of your assets process.

While B.I.G. Industries Berhad haw not currently acquire the maximal returns, we’ve compiled a itemize of companies that currently acquire more than 25% convey on equity. Check discover this free list here.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be playing advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your playing situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

The Returns On Capital At B.I.G. Industries Berhad (KLSE:BIG) Don’t Inspire Confidence #Returns #Capital #B.I.G #Industries #Berhad #KLSEBIG #Dont #Inspire #Confidence

Source unification Google News

Source Link: https://finance.yahoo.com/news/returns-capital-b-g-industries-222248733.html

Leave a Reply