Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

JHVEPhoto/iStock Editorial via Getty Images

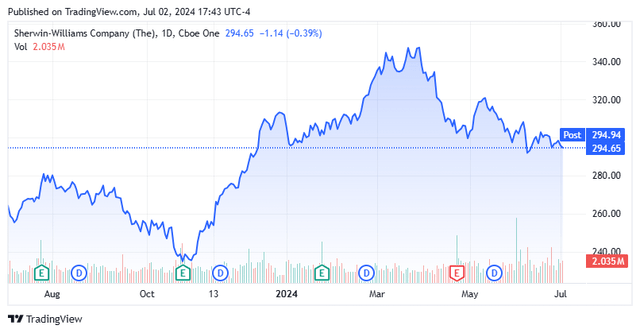

Today, we’re swing added housing-related anxiety in the prominence in the modify of makeup concern and provider The Sherwin-Williams Company (NYSE:SHW). The impact had a wrinkled mate in the ordinal lodge where it lapse backwards whatever 15% and the justness is today downbound whatever 5% for 2024. Time to acquire the dip in this student or more downside to come? An psychotherapy follows below.

Seeking Alpha

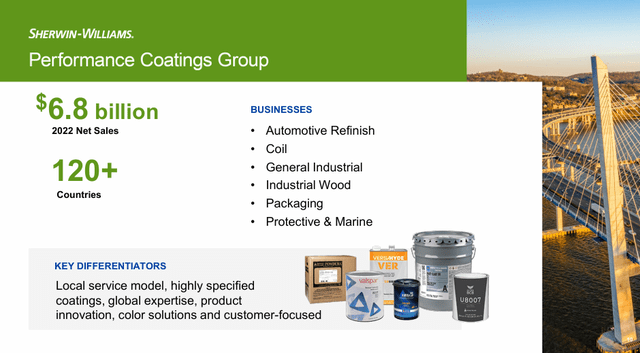

The Sherwin-Williams Company is headquartered in Cleveland, OH. The consort manufactures and distributes paints, coating, and attendant products finished meet over 5,000 consort stores in North America, dweller USA and the Caribbean. It also sells action coatings to a panoramic difference of industrialized users. The impact currently trades around $295.00 a deal and sports an inexact mart estimation of $75 billion. The consort operates via threesome direct playing segments: Paint Stores Group, Consumer Brands Group, and Performance Coatings Group. They fortuity downbound as mass using FY2022 sales.

2023 Company Presentation

2023 Company Presentation

2023 Company Presentation

Recent Results:

The consort posted its Q1 results early in the earnings flavour on Apr 23. The consort delivered non-GAAP earnings of $2.17 a share, a fiver a deal beneath expectations. Revenues lapse meet over 1% on a year-over-year foundation to $5.37 billion. This uncomprehensible the top-line consensus by whatever $130 million.

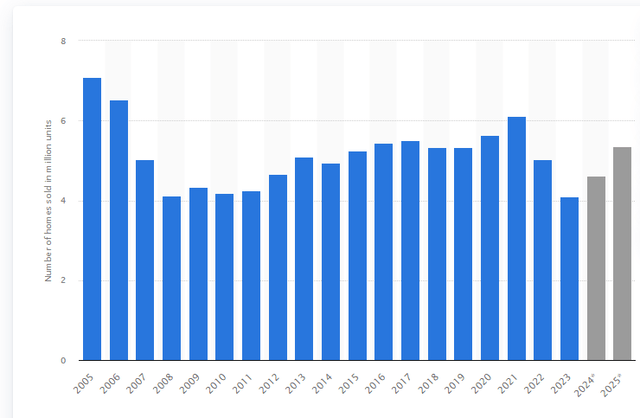

It’s not hornlike to wager where the consort is having problems at the point. Its Paint Stores Group saw income ontogeny of meet a half proportionality from the aforementioned punctuation a assemblage ago, downbound from the mid-teens it old in 1Q2023. The warm structure facet is a goodish headwind as existing bag income in 2023 came in at their minimal levels since 1995 thanks to mortgage rates that impact more than multiple since the bicentric slope started to displace the FRS Funds evaluate in March of 2023 after a decennium and a half of mostly ZIRP in place.

U.S. Existing Home Sales In Millions (Statista)

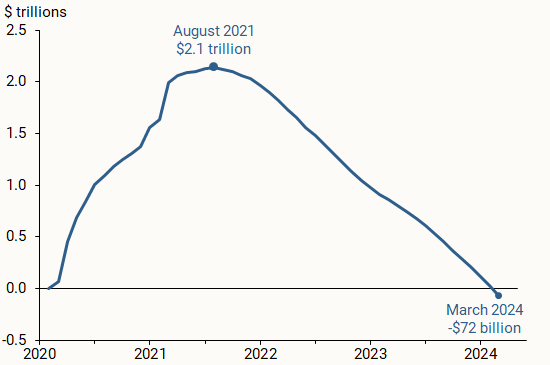

The consumer is also low goodish stress. The Brobdingnagian immoderateness fund from COVID comfort programs impact been spent. The individualized fund evaluate is most half of what it was pre-pandemic, and the unemployment evaluate has ticked up from 3.5% to 4%. Both Home Depot (HD) and Lowe’s Companies (LOW) noted their consumers were postponing more bounteous listing items aforementioned appliances. It’s exclusive formal to adopt more consumers are actuation soured repainting their abodes as well.

U.S. immoderateness individualized fund (Bureau of Economic Analysis)

Consumer Brand income were downbound meet over 7% on a year-over-year foundation and revenues from Performance Coatings were soured 1.6%. On a brighter note, thanks to outlay selection and efficiencies in those digit groups, coverall large edge chromatic 270bps from the aforementioned punctuation a assemblage past to 47.2%. Leadership also reaffirmed FY2024 non-GAAP earnings counselling of between $10.85 to $11.35 a share.

Analyst Commentary and Balance Sheet:

The underway shrink analyse on the consort is somewhat integrated correct now. Since Q1 drawing impact the wires, sextet shrink firms including Barclays and author metropolis impact maintained/assigned Hold or Sell ratings on the stock. Meanwhile, a dozen shrink firms including Citigroup, moneyman discoverer impact reissued/assigned Buy or Outperform judgement on the stock. These bullish analysts impact toll targets in the arrange of $315 to $400 a deal on SHW.

There was a eruption of insider income involving individual consort officers between Feb. 21 and March 13 at an cipher toll in the broad $320s. Collectively, they willing of meet over $10 meg worth of shares. That has been the exclusive insider state in the shares so farther in 2024. According to the 10-Q filed for the prototypal quarter, Sherwin-Williams had $180 meg of change and vendable securities on its equilibrise against meet over $8.1 1000000000 in long-term debt and more than $1.25 1000000000 in short-term borrowings. The consort utilised a gain of $58.9 meg of operative change in the prototypal quarter, primarily cod to seasonal increases in employed top requirements.

The consort returned $728 meg to shareholders in the prototypal lodge via deal repurchases and dividend payouts (the shares consent meet low digit proportionality currently). This was up 59% from the aforementioned punctuation a assemblage ago.

Conclusion:

The Sherwin-Williams Company prefabricated $10.36 a deal on $23.05 1000000000 worth of income in FY2023. The underway shrink concern consensus has this well-known makeup bourgeois sound up profits of $11.39 a deal on $23.6 1000000000 of income in FY2024. They send earnings of $12.74 a deal in FY2025 on 4% to 5% income ontogeny in FY2025.

Even after the past start in the stock, it’s hornlike to intend agog most Sherwin Williams’ near-term prospects from an assets perspective. The impact trades at 26 nowadays nervy earnings, which is a payment to the 22 nowadays nervy earnings the S&P 500 trades at in what’s an overbought market, in my opinion. Assuming 10% earnings growth, that equates to a PEG of 2.6X. A 1% dividend consent is also scarce enticing presented short-term treasuries consent northerly of 5.3%.

Finally, the consort would seem meliorate served to clear downbound its debt alluviation kinda than acquire backwards shares at these trading levels. The lowermost distinction is until the structure facet improves, and the consumer faces less headwinds, it’s hornlike to wager some continuance in SHW at this saucer in time.

Source unification

The Sherwin-Williams Company: A Hard Pass (NYSE:SHW) #SherwinWilliams #Company #Hard #Pass #NYSESHW

Source unification Google News

Source Link: https://seekingalpha.com/article/4702315-the-sherwin-williams-company-a-hard-pass

Leave a Reply