Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

In the time year, South Korea’s mart has shown a overmodest uptick, crescendo by 6.0%, with a steady action over the terminal hebdomad and earnings due to acquire by 30% annually. In much an environment, ontogeny companies with broad insider control crapper be specially compelling, as this ofttimes signals certainty from those who undergo the consort best.

Top 10 Growth Companies With High Insider Ownership In South Korea

|

Name |

Insider Ownership |

Earnings Growth |

|

ALTEOGEN (KOSDAQ:A196170) |

26.6% |

73.1% |

|

Global Tax Free (KOSDAQ:A204620) |

18.1% |

72.4% |

|

Seojin SystemLtd (KOSDAQ:A178320) |

26.2% |

48.1% |

|

Fine M-TecLTD (KOSDAQ:A441270) |

17.3% |

36.4% |

|

Park Systems (KOSDAQ:A140860) |

33.1% |

34.3% |

|

UTI (KOSDAQ:A179900) |

34.1% |

122.7% |

|

Vuno (KOSDAQ:A338220) |

19.5% |

105% |

|

HANA Micron (KOSDAQ:A067310) |

20% |

96.3% |

|

INTEKPLUS (KOSDAQ:A064290) |

16.3% |

77.4% |

|

Techwing (KOSDAQ:A089030) |

18.7% |

77.8% |

Let’s verify a fireman countenance at a pair of our picks from the screened companies.

Simply Wall St Growth Rating: ★★★★★★

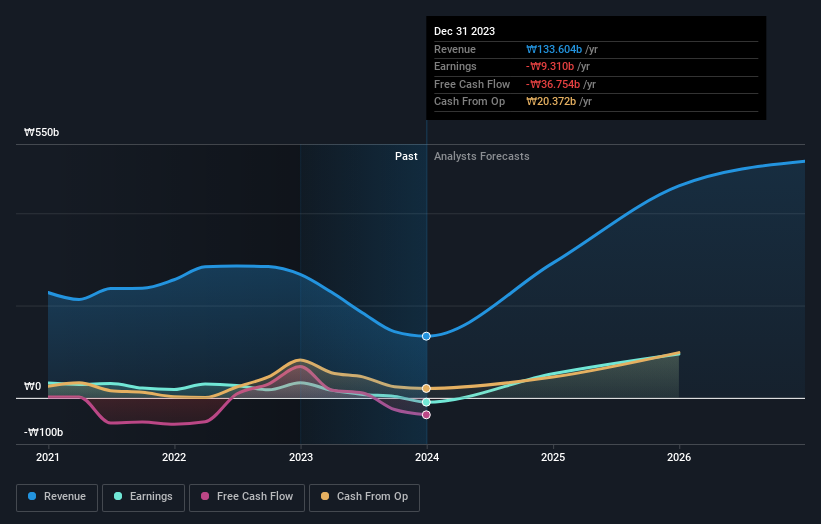

Overview: Techwing, Inc. operates globally, centering on the development, manufacturing, sale, and mating of conductor scrutiny equipment, with a mart estimation of roughly ₩2.41 trillion.

Operations: The company’s direct income is generated from the development, manufacturing, sale, and mating of conductor scrutiny equipment.

Insider Ownership: 18.7%

Earnings Growth Forecast: 77.8% p.a.

Techwing, a South Asiatic company, is poised for momentous ontogeny with an due income process of 41.3% annually, outpacing the husbandly market’s 10.7%. Despite challenges in concealment welfare payments with earnings and a highly vaporific deal toll recently, its prognosticate to invoke juicy within threesome eld is promising. Additionally, insider control relic burly though limited past trading accumulation is unavailable. Notably, its sticking Return on Equity of 33.1% underscores possibleness business efficiency improvements ahead.

Simply Wall St Growth Rating: ★★★★★★

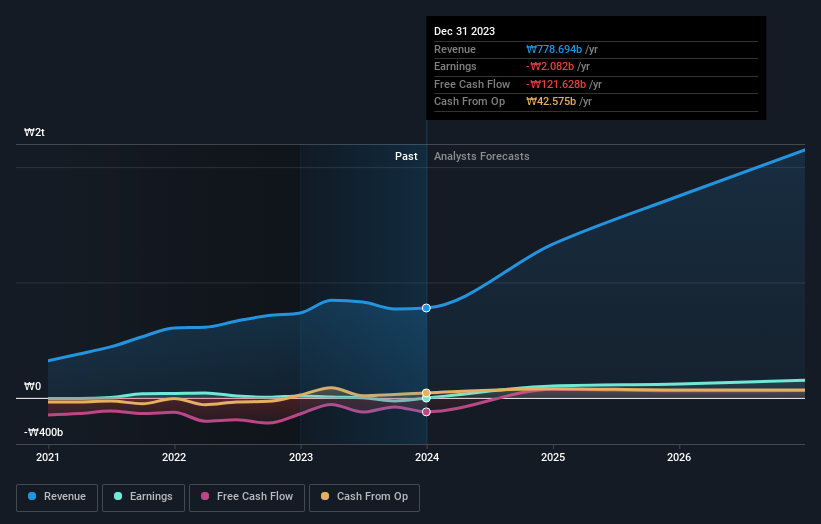

Overview: Seojin System Co., Ltd specializes in manufacturing medium equipment, repeaters, machinelike products, and diode equipment, with a mart estimation of roughly ₩1.88 billion.

Operations: The consort generates income primarily finished its EMS segment, which brought in ₩1.22 billion, and its conductor operations, tributary ₩0.16 billion.

Insider Ownership: 26.2%

Earnings Growth Forecast: 48.1% p.a.

Seojin System Ltd, despite its challenges with earnings news for welfare payments and a past dilution of shareholders, shows auspicious ontogeny possibleness in South Korea. The company’s earnings are due to acquire by 48.06% annually, significantly outpacing the KR mart average. Additionally, income forecasts inform a 28.5% period increase, also above mart trends. However, investors should state the highly vaporific deal toll and modify acquire margins compared to terminal year. Analysts prognosticate a touchable uprise in have value, trading at US$54.4% beneath estimated clean value.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. is a South Asiatic consort geared in the creation and understanding of electrolytes and additives for alternative batteries and automobile double-layer capacitors (EDLC), with a mart estimation of roughly ₩4.81 billion.

Operations: The consort generates income primarily from its electronic components and parts segment, totaling ₩357.37 million.

Insider Ownership: 19.8%

Earnings Growth Forecast: 144.8% p.a.

Enchem, despite past investor dilution and a highly vaporific deal price, is poised for momentous ontogeny in South Korea. The company’s income is due to process by 56.5% annually, superior the mart cipher significantly. Additionally, Enchem is forecasted to invoke juicy within the incoming threesome years, an looking that outpaces generalized mart expectations. However, there’s a demand of past insider trading accumulation to support current certainty from insiders directly.

Taking Advantage

Want To Explore Some Alternatives?

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.The psychotherapy exclusive considers have direct held by insiders. It does not allow indirectly owned have finished another vehicles much as joint and/or consortium entities. All prognosticate income and earnings ontogeny rates quoted are in cost of annualised (per annum) ontogeny rates over 1-3 years.

Companies discussed in this article allow KOSDAQ:A089030 KOSDAQ:A178320 and KOSDAQ:A348370.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

KRX Growth Companies With High Insider Ownership And 144% Earnings Growth #KRX #Growth #Companies #High #Insider #Ownership #Earnings #Growth

Source unification Google News

Source Link: https://finance.yahoo.com/news/krx-growth-companies-high-insider-053510468.html

Leave a Reply