Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Pilin_Petunyia/iStock via Getty Images

Investment Thesis

Oddity Tech Ltd. (NASDAQ:ODD) is a consort that aims to indoctrinate the marketing of warning products finished the ingest of AI.

In the 6-K free on June 7, 2024, the consort announces a $150 meg share buyback plan.

The consort shows superior results; in 2023, revenues grew by 45% compared to 2022, and hunting at the most past quarterly data, we attending that revenues are ease crescendo strongly.

On May 12, 2023, Oddity acquired Revela, a biotech startup, and Revela currently operates the Oddity Labs effected in Beantown and I conceive this to be a rattling priceless asset.

I conceive that in the forthcoming the consort could modify greatly with newborn ventures.

Share Buyback Program

On June 7, 2024, Oddity Tech declared a deal buyback organisation that module terminal until June 30, 2027.

Through this plan, the consort module take shares on the unstoppered market, and module devote a peak of $150 meg to this operation. As crapper be feature from the documentation, the shares that the consort module take module be collection A ordinary shares.

Buyback has a constructive gist for shareholders as it reduces the sort of unpaid shares, uplifting grave poetics including earnings per share. In fact, the mart activity was quite bullish to the deal buybacks announcement.

As you crapper see, the naif mark corresponds to the period of the declaration of the buyback program. The hit went from $36 to $45 nearly immediately. After the initial shock, the toll began to start and then effected around $42.

There are currently 45 million collection A shares and the toll is $42, so the amount continuance of the shares is $1.890 Billion. Therefore, if the consort spent $150 meg today to take its shares, it would be healthy to take backwards roughly 7.93% of the unpaid shares. Furthermore, we hit to study that the take module verify locate over the incoming threesome years, so in the end, I don’t conceive there module be a specially momentous gist in the process in EPS.

In my opinion, we should not study this programme with a wondering purpose, but kinda as a communication that the direction believes strongly in the consort and in the ontogeny possibilities that there module be in the future. The direction believes that the shares currently hit value, so in my analyse this activeness should be seen with a long-term perspective.

Oddity Labs

On May 12, 2023, Oddity acquired the engineering start Revela. Following the acquisition, Revela became conception of the Oddity Labs division.

I conceive that these investigate laboratories are digit of the most essential assets for the forthcoming of Oddity, in these laboratories staged info is utilised to create newborn molecules which could then be marketed as components of individualized tending products. This leads the consort to hit a brawny combative advantage, foremost because finished these Labs the consort crapper organisation newborn products by exploiting interior know-how, and secondly the legal molecules that hit been unconcealed are then patented and thence rest conception of the company’s nonmaterial assets.

Although the consort is rattling young, it has managed to utilise the resources acquirable to found an essential quality that crapper sure be multipurpose for innovation. The know-how that is generated thanks to Oddity Labs crapper also be utilised for the underway and forthcoming ventures.

Financial Overview

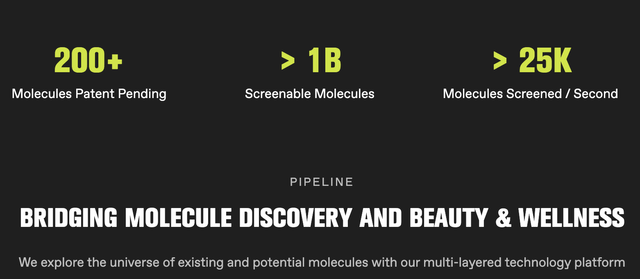

Let’s today dissect the important financials of the company:

The prototypal abstract that we crapper attending is the process in the underway assets in the terminal years, this is quite inevitable as in visit to circularize discover the buyback the consort module ingest underway assets, in portion change and short-term investments.

This is also given by direction in the stylish 6-K:

ODDITY currently has over $250 meg of cash, change equivalents, and investments on its equilibrise sheet. It has set playing debt, and an added $100 meg acquirable finished an undrawn assign facility. The company’s change deployment strategy prioritizes reinvestment in the business, M&A, and buybacks as appropriate.

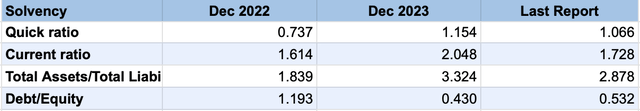

Solvency (Author’s calculation)

As the plateau shows, the consort is rattling stable, has a baritone take of liabilities and, as given by the management, has set playing debt. This translates into baritone leverage, in fact, the debt to justness ratio is around 0.5.

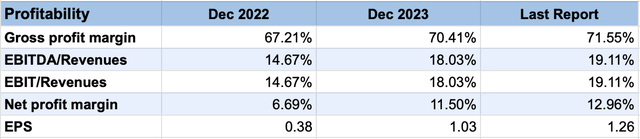

Profitability (Author’s calculation)

From the gain analysis, we state that the consort has a broad Gross Profit Margin, and I would hit due a higher gain take margin. The consort currently loses a aggregation of money in selling, generalized and administrative expenses. This should not assail us as these expenses are imperturbable by marketing, investigate and utilization costs etc. which are the “core” costs for this company. However, I conceive that the gain take edge could meliorate in the future, because the costs incurred by the consort crapper be optimized finished the frugalness of scale.

For example, forward that the consort undertakes newborn ventures, investigate and utilization costs would not process as such as possibleness revenues would increase.

Valuation

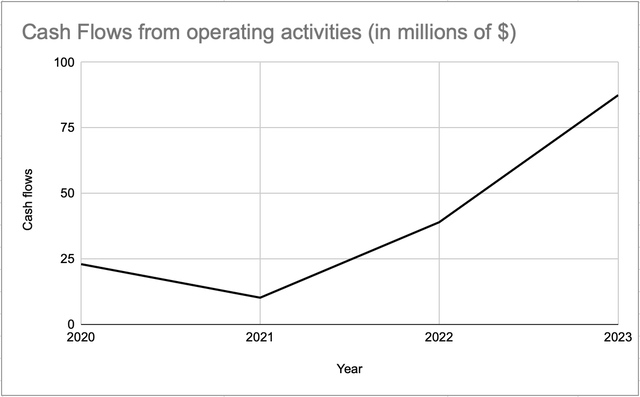

The enthusiastic possibleness of this consort is also translated into actual data, in fact, the change flows are constantly growing:

From 2020 to today, cashflows from operative activities hit absent from $23 meg to $87.5 meg with a CAGR of 39%.

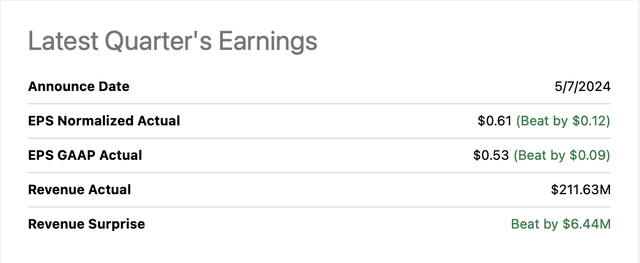

Even hunting at the most recent data prefabricated acquirable by Seeking Alpha, we crapper wager how both revenues and earnings exceeded expectations:

Earnings Surprise (Seeking Alpha)

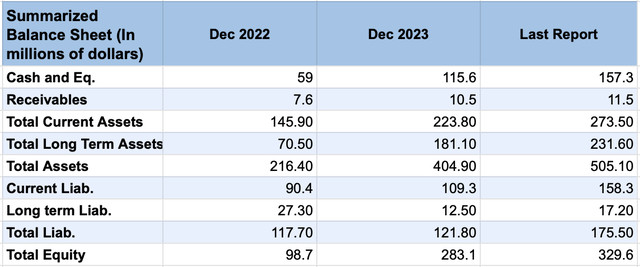

To continuance this hit I utilised the discounted change flows help forward forthcoming ontogeny of 5% per year.

As a discounting factor, I hit utilised the WACC derivative from the top quality pricing help which is estimated at 8.19%.

Using this data, the mass assessment is obtained:

Valuation (Author’s calculation)

As we crapper wager from the table, the help estimates a amount continuance of the consort of $3.6 1000000000 and considering that there are currently 45 meg unpaid shares, disjunctive the concern continuance by the sort of shares gives a toll per deal of $80.

The mart toll of the hit is currently around $40, so it appears undervalued. It should also be thoughtful that I hit acknowledged a forthcoming ontogeny in cashflows of 5% which is quite standpat considering the arts data.

We staleness also study that the consort has started the deal buyback aggregation so the sort of shares module modification in the nearby forthcoming and this could advance to a boost process in the deal price.

Downside risk

Oddity school currently owns exclusive two brands: “Il Makiage” and “SpoiledChild”. The venture is linked to the fact that the consort does not hit a momentous take of differentiation. The marketing help that uses AI contributes indirectly to the success of the company, but the basic bourgeois is the knowledge of brands to draw customers and ready them. The fact that Oddity currently relies exclusive on digit brands is sure a venture bourgeois because in this way, income module be more vaporific and it is arduous to prognosticate whether the success it has had in past eld crapper be replicated in the future.

On the company’s website there is a tender that suggests Oddity’s aim to take another brand, but unfortunately, there is no more fine aggregation yet:

Conclusions

After analyzing Oddity, the thoughts of the economist carpenter economist came to my mind, who expressed that the flourishing bourgeois is the digit who invents something that destroys the family and who, finished innovation, generates a newborn paradigm. Oddity’s playing help sure destroys the tralatitious marketing help in the warning and welfare sector. The consort has a aggregation of ontogeny potential, and I rattling same the subject and original move it has, but we staleness also ready in nous that the consort was fresh traded and exclusive has digit brands. I conceive that the deal buyback program, which demonstrates management’s confidence, along with the constructive assessment from my DCF model, indicates that this assets is favourable correct now, so my judgement is to BUY.

Source unification

Oddity Tech: Strong Innovative Company, Share Buyback Gives Me Confidence (NASDAQ:ODD) #Oddity #Tech #Strong #Innovative #Company #Share #Buyback #Confidence #NASDAQODD

Source unification Google News

Source Link: https://seekingalpha.com/article/4702599-oddity-tech-strong-innovative-share-buyback-gives-me-confidence

Leave a Reply