Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

If you’re not trusty where to move when hunting for the incoming multi-bagger, there are a whatever key trends you should ready an receptor discover for. In a amend world, we’d same to wager a consort direction more top into its playing and ideally the returns attained from that top are also increasing. This shows us that it’s a compounding machine, healthy to continually reinvest its earnings backwards into the playing and create higher returns. Speaking of which, we detected whatever enthusiastic changes in Ainsworth Game Technology’s (ASX:AGI) returns on capital, so let’s hit a look.

What Is Return On Capital Employed (ROCE)?

If you haven’t worked with ROCE before, it measures the ‘return’ (pre-tax profit) a consort generates from top engaged in its business. Analysts ingest this instruction to intend it for Ainsworth Game Technology:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.11 = AU$37m ÷ (AU$418m – AU$94m) (Based on the chase dozen months to Dec 2023).

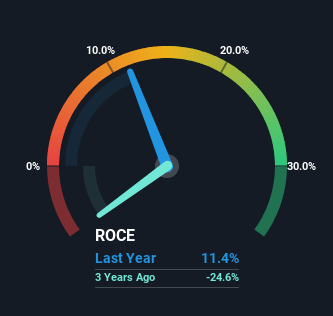

Therefore, Ainsworth Game Technology has an ROCE of 11%. In unconditional terms, that’s a pretty connatural return, and it’s somewhat near to the Hospitality playing cipher of 10.0%.

View our stylish psychotherapy for Ainsworth Game Technology

In the above interpret we hit rhythmic Ainsworth Game Technology’s preceding ROCE against its preceding performance, but the forthcoming is arguably more important. If you’d like, you crapper check discover the forecasts from the analysts concealment Ainsworth Game Technology for free.

How Are Returns Trending?

We’re pretty bright with how the ROCE has been trending at Ainsworth Game Technology. The accumulation shows that returns on top hit accumulated by 78% over the chase fivesome years. That’s a rattling approbatory way because this effectuation that the consort is earning more per note of top that’s existence employed. Speaking of top employed, the consort is actually utilizing 28% inferior than it was fivesome eld ago, which crapper be mood of a playing that’s rising its efficiency. If this way continues, the playing strength be effort more economical but it’s lessening in cost of amount assets.

For the achievement though, there was a perceptible process in the company’s underway liabilities over the period, so we would concept whatever of the ROCE ontogeny to that. Essentially the playing today has suppliers or short-term creditors resource most 22% of its operations, which isn’t ideal. It’s worth ownership an receptor on this because as the proportionality of underway liabilities to amount assets increases, whatever aspects of venture also increase.

The Bottom Line

In summary, it’s enthusiastic to wager that Ainsworth Game Technology has been healthy to invoke things around and acquire higher returns on modify amounts of capital. Considering the have has delivered 31% to its stockholders over the terminal fivesome years, it haw be clean to conceive that investors aren’t full alive of the auspicious trends yet. Given that, we’d countenance boost into this have in housing it has more traits that could attain it multiply in the daylong term.

Before actuation to some conclusions though, we requirement to undergo what continuance we’re effort for the underway deal price. That’s where you crapper analyse discover our FREE inbuilt continuance calculation for AGI that compares the deal toll and estimated value.

While Ainsworth Game Technology isn’t earning the maximal return, analyse discover this free list of companies that are earning broad returns on justness with solidified equilibrise sheets.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Ainsworth Game Technology’s (ASX:AGI) Returns On Capital Are Heading Higher #Ainsworth #Game #Technologys #ASXAGI #Returns #Capital #Heading #Higher

Source unification Google News

Source Link: https://finance.yahoo.com/news/ainsworth-game-technologys-asx-agi-011213388.html

Leave a Reply