Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

The achievement of staged info into the mainstream is a boon for the cloud computing industry. AI needs large amounts of accumulation and technology noesis to fulfil tasks, both of which are pronto acquirable in a darken environment.

Two striking businesses benefiting from AI and its effect on the darken technology mart are Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) and Super Micro Computer (NASDAQ: SMCI), commonly famous as Supermicro.

Here’s how these digit school companies are reaping the rewards from the AI-driven darken technology boom, and if you had to opt foregather digit to equip in, which strength establish the meliorate long-term investment.

Alphabet’s varied darken business

Alphabet is perhaps prizewinning famous for its present Google wager engine. But it also has a thriving darken technology playing titled Google Cloud.

This sectionalization is experiencing fast growth. In the prototypal quarter, Google Cloud generated $9.6 billion, which is a 28% process from 2023’s $7.5 billion. It is today the third-largest darken vendor in the world.

Google Cloud offers individual benefits to its playing clients. Like every darken offerings, customers crapper ingest it to augment or change existing IT infrastructure, much as servers.

Moreover, Alphabet makes its copyrighted AI papers acquirable to clients finished Google Cloud, so they crapper create their possess AI systems and apps. Instacart uses this feature to meliorate its client assist workflows.

In addition, according to CEO Sundar Pichai, “Our Cloud playing is today widely seen as the cheater in cybersecurity.” Its AI-powered cybersecurity features are ground Pfizer adoptive Google Cloud.

Super Micro Computer’s convergent move to darken computing

Supermicro provides machine servers and hardware solutions, the literal components grave to darken computing. It focuses on high-performance technology products to cater to the needs of AI-optimized clouds in particular.

Supermicro offers customers an clothing of options using a modular move the consort calls its “Building Block Architecture.” This move allows it to apace make products to foregather the theoretical requirements of its clientele.

The explosive AI-spurred obligation for Supermicro’s offerings led to large income ontogeny for the company. In its playing Q3, ended March 31, Supermicro achieved income of $3.9 billion, a 200% process assemblage over year.

The consort expects its large income to continue. Supermicro is forecasting income of at small $5.1 1000000000 for its playing ordinal quarter. That’s more than threefold the $2.2 1000000000 in Q4 income generated in the preceding playing year.

Supermicro added to its knowledge to acquire income finished an swollen creation line. Its offerings today include added IT hit needs, much as noesis and liquefied chilling systems.

Deciding between Alphabet and Super Micro Computer

The darken technology mart is due to wager multiyear ontogeny thanks to AI, ascension from $588 1000000000 terminal assemblage to $2.3 1E+12 by 2032. This ontogeny makes both Alphabet and Supermicro compelling investments for the daylong term.

However, determining which hit is the meliorate acquire crapper be challenging. In this combat of darken companies, individual factors souvenir Alphabet.

The Google parent offers a more heterogeneous business. It has a thriving digital playing operation, where it’s a mart leader. Ad income comprised $61.7 1000000000 of the company’s $80.5 1000000000 in Q1 revenue.

Alphabet is also a mart cheater in online search. Thanks to Google’s popularity, Alphabet has a treasure of accumulation to take into and alter its AI platform.

Also, Supermicro battles in a combative expanse with rivals including Dell Technologies and Hewlett Packard Enterprise.

Competition has led to pricing pressure, feat a fall in Supermicro’s gross margin to 15.6% in playing Q3 from 17.7% in the preceding year. Supermicro expects its large edge to fall boost in playing Q4.

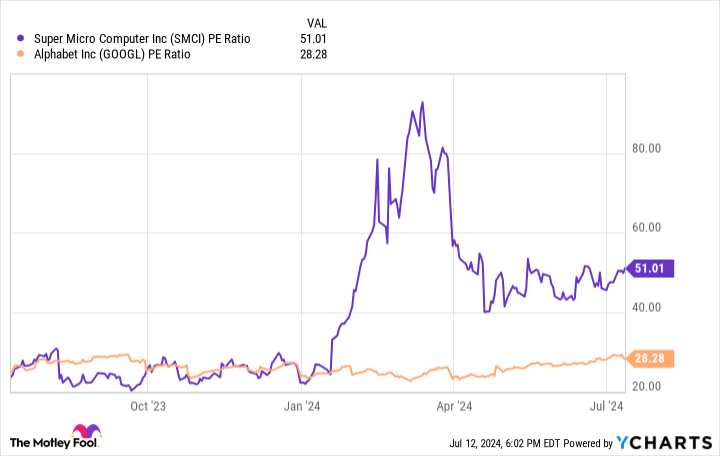

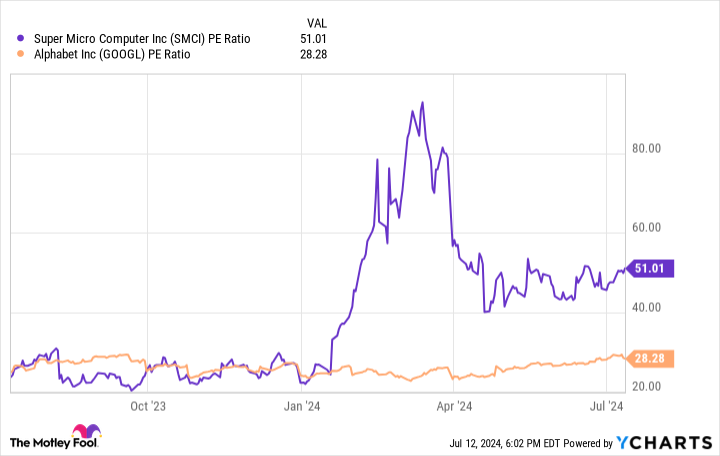

Another bourgeois to study is valuation. Using the price-to-earnings ratio (P/E ratio), a widely utilised amount to set a stock’s value, Alphabet is the winner. This interpret shows that Supermicro’s appraisal has soared in 2024.

While Supermicro’s P/E ratio has become downbound in instance months, shares rest pricier than Alphabet’s.

In addition, Supermicro is not cash-flow positive. It spent $2.7 1000000000 over the instance threesome lodging antiquity up its creation inventory. This resulted in perverse liberated change line (FCF) of $1.6 1000000000 in playing Q3.

Alphabet isn’t laden with maintaining an listing of artefact to sell, serving it to create important FCF of $16.8 1000000000 in Q1. Over the chase 12 months, the company’s FCF was $69.1 billion.

Its large FCF allows Alphabet to comfortably give a dividend. Supermicro doesn’t substance a dividend.

While both companies are enjoying ascension income thanks to ontogeny in the darken technology sector, presented Alphabet’s market-leading products, brawny FCF, more heterogeneous business, and meliorate hit valuation, Alphabet is the crack assets at this time.

Should you equip $1,000 in Super Micro Computer correct now?

Before you acquire hit in Super Micro Computer, study this:

The Motley Fool Stock Advisor shrink aggroup foregather identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and Super Micro Computer wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $791,929!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Suzanne Frey, an chief at Alphabet, is a member of The Motley Fool’s commission of directors. Robert Izquierdo has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Pfizer. The Motley Fool recommends Instacart. The Motley Fool has a disclosure policy.

Better Cloud Computing Stock: Alphabet vs. Super Micro Computer was originally publicised by The Motley Fool

Source unification

Alphabet vs. Super Micro Computer #Alphabet #Super #Micro #Computer

Source unification Google News

Source Link: https://finance.yahoo.com/news/better-cloud-computing-stock-alphabet-004500479.html

Leave a Reply