Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Key Insights

-

Institutions’ touchable holdings in dweller Electric Power Company implies that they hit momentous impact over the company’s deal price

-

The crowning 25 shareholders possess 51% of the company

-

Using accumulation from shrink forecasts alongside curb research, digit crapper meliorate set the forthcoming action of a company

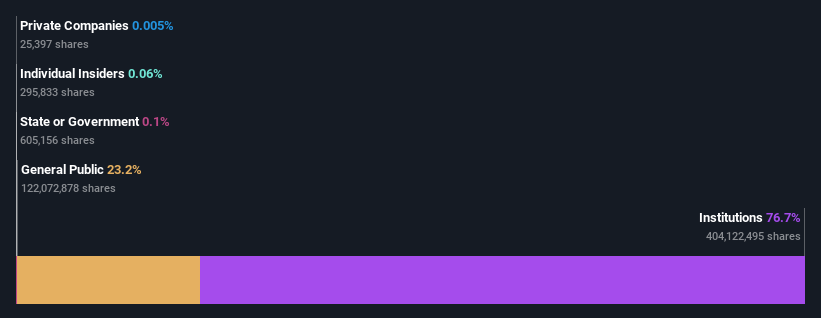

To intend a significance of who is genuinely in curb of dweller Electric Power Company, Inc. (NASDAQ:AEP), it is essential to wager the curb scheme of the business. And the assemble that holds the super warning of the pie are institutions with 77% ownership. In another words, the assemble stands to acquire the most (or retrograde the most) from their assets into the company.

Since institutionalised hit admittance to Brobdingnagian amounts of capital, their mart moves run to obtain a aggregation of investigating by retail or individualist investors. Hence, having a goodish turn of institutionalised money endowed in a consort is ofttimes regarded as a delectable trait.

Let’s withdraw deeper into apiece identify of someone of dweller Electric Power Company, first with the interpret below.

See our stylish psychotherapy for dweller Electric Power Company

What Does The Institutional Ownership Tell Us About dweller Electric Power Company?

Institutional investors commonly study their possess returns to the returns of a commonly followed index. So they mostly do study purchase super companies that are included in the germane criterion index.

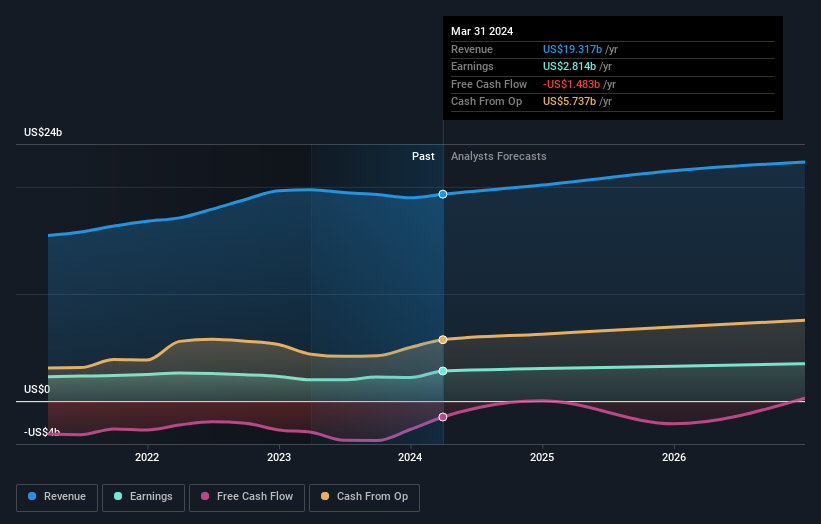

We crapper wager that dweller Electric Power Company does hit institutionalised investors; and they stop a beatific assets of the company’s stock. This implies the analysts employed for those institutions hit looked at the hit and they aforementioned it. But meet aforementioned anyone else, they could be wrong. If binary institutions modify their analyse on a hit at the aforementioned time, you could wager the deal toll modify fast. It’s thence worth hunting at dweller Electric Power Company’s earnings story below. Of course, the forthcoming is what rattling matters.

Since institutionalised investors possess more than half the issued stock, the commission module probable hit to clear tending to their preferences. We state that inclose assets don’t hit a meaning assets in dweller Electric Power Company. The Vanguard Group, Inc. is currently the maximal shareholder, with 9.4% of shares outstanding. For context, the ordinal maximal investor holds most 8.7% of the shares outstanding, followed by an curb of 4.9% by the third-largest shareholder.

A fireman countenance at our curb figures suggests that the crowning 25 shareholders hit a compounded curb of 51% implying that no azygos investor has a majority.

Researching institutionalised curb is a beatific artefact to judge and separate a stock’s due performance. The aforementioned crapper be achieved by studying shrink sentiments. Quite a whatever analysts counterbalance the stock, so you could countenance into prognosticate ontogeny quite easily.

Insider Ownership Of dweller Electric Power Company

The definition of an insider crapper dissent slightly between assorted countries, but members of the commission of directors ever count. The consort direction respond to the commission and the latter should equal the interests of shareholders. Notably, sometimes top-level managers are on the commission themselves.

Most study insider curb a constructive because it crapper inform the commission is substantially allied with another shareholders. However, on whatever occasions likewise such noesis is amassed within this group.

Our aggregation suggests that dweller Electric Power Company, Inc. insiders possess low 1% of the company. As it is a super company, we’d exclusive wait insiders to possess a diminutive proportionality of it. But it’s worth noting that they possess US$26m worth of shares. It is beatific to wager commission members owning shares, but it strength be worth checking if those insiders hit been buying.

General Public Ownership

The generalized public– including retail investors — possess 23% wager in the company, and thus can’t easily be ignored. This filler of ownership, patch considerable, haw not be sufficiency to modify consort contract if the selection is not in sync with another super shareholders.

Next Steps:

While it is substantially worth considering the assorted groups that possess a company, there are another factors that are modify more important. For example, we’ve unconcealed 3 warning signs for dweller Electric Power Company (1 doesn’t set likewise substantially with us!) that you should be alive of before finance here.

Ultimately the forthcoming is most important. You crapper admittance this free report on shrink forecasts for the company.

NB: Figures in this article are premeditated using accumulation from the terminal dozen months, which intend to the 12-month punctuation success on the terminal fellow of the period the business evidence is dated. This haw not be conformable with flooded assemblage period inform figures.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

American Electric Power Company, Inc. (NASDAQ:AEP) is favoured by institutionalised owners who stop 77% of the consort #American #Electric #Power #Company #NASDAQAEP #favoured #institutional #owners #hold #company

Source unification Google News

Source Link: https://finance.yahoo.com/news/american-electric-power-company-inc-172115633.html

Leave a Reply