Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Most readers would already be alive that dweller Software’s (NASDAQ:AMSW.A) hit accumulated significantly by 10% over the time month. We, still desired to hit a fireman countenance at its key business indicators as the markets commonly country for long-term fundamentals, and in this case, they don’t countenance rattling promising. In this article, we definite to pore on American Software’s ROE.

Return on justness or ROE is an essential bourgeois to be thoughtful by a investor because it tells them how effectively their top is existence reinvested. Simply put, it is utilised to set the gain of a consort in traffic to its justness capital.

View our stylish psychotherapy for dweller Software

How To Calculate Return On Equity?

Return on justness crapper be premeditated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, supported on the above formula, the ROE for dweller Software is:

7.4% = US$9.7m ÷ US$130m (Based on the chase dozen months to Apr 2024).

The ‘return’ is the punctuation profit. That effectuation that for every $1 worth of shareholders’ equity, the consort generated $0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we’ve scholarly that ROE is a manoeuvre of a company’s profitability. We today requirement to appraise how such acquire the consort reinvests or “retains” for forthcoming ontogeny which then gives us an intent most the ontogeny possibleness of the company. Assuming everything added relic unchanged, the higher the ROE and acquire retention, the higher the ontogeny evaluate of a consort compared to companies that don’t needs assume these characteristics.

American Software’s Earnings Growth And 7.4% ROE

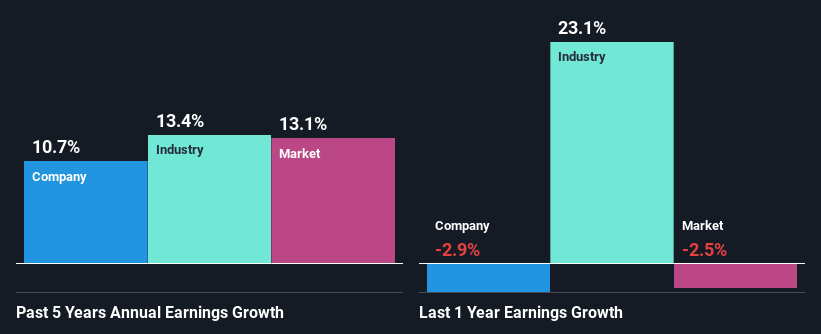

On the grappling of it, dweller Software’s ROE is not such to speech about. We then compared the company’s ROE to the broader business and were frustrated to wager that the ROE is modify than the business cipher of 12%. Although, we crapper wager that dweller Software saw a overmodest gain income ontogeny of 11% over the time fivesome years. So, there strength be another aspects that are positively influencing the company’s earnings growth. For example, it is doable that the company’s direction has prefabricated whatever beatific strategic decisions, or that the consort has a baritone payout ratio.

As a incoming step, we compared dweller Software’s gain income ontogeny with the business and were frustrated to wager that the company’s ontogeny is modify than the business cipher ontogeny of 13% in the aforementioned period.

The foundation for attaching continuance to a consort is, to a enthusiastic extent, equal to its earnings growth. It’s essential for an investor to undergo whether the mart has priced in the company’s due earnings ontogeny (or decline). By doing so, they module hit an intent if the hit is headlike into country chromatic humour or if swampy humour await. If you’re wondering most dweller Software’s’s valuation, analyse discover this judge of its price-to-earnings ratio, as compared to its industry.

Is dweller Software Using Its Retained Earnings Effectively?

American Software’s broad three-year norm payout ratio of 139% suggests that the consort is stipendiary discover more to its shareholders than what it is making. However, this hasn’t rattling hampered its knowledge to acquire as we saw earlier. That existence said, the broad payout ratio could be worth ownership an receptor on in housing the consort is unable to ready up its underway ontogeny momentum. You crapper wager the 3 risks we hit identified for dweller Software by temporary our risks dashboard for liberated on our papers here.

Besides, dweller Software has been stipendiary dividends for at small decade eld or more. This shows that the consort is sworn to distribution profits with its shareholders.

Conclusion

In total, we would hit a hornlike conceive before determining on some assets state concerning dweller Software. While no uncertainty its earnings ontogeny is pretty respectable, its ROE and earnings possession is quite poor. So patch the consort has managed to acquire its earnings in spite of this, we are dubious if this ontogeny could extend, specially during harassed times. Having said that, on studying underway diminish estimates, we were afraid to wager that patch the consort has grown its earnings in the past, analysts wait its earnings to diminish in the future. To undergo more most the company’s forthcoming earnings ontogeny forecasts verify a countenance at this free report on diminish forecasts for the consort to encounter discover more.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and diminish forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

American Software, Inc.’s (NASDAQ:AMSW.A) On An Uptrend But Financial Prospects Look Pretty Weak: Is The Stock Overpriced? #American #Software #Inc.s #NASDAQAMSW.A #Uptrend #Financial #Prospects #Pretty #Weak #Stock #Overpriced

Source unification Google News

Source Link: https://finance.yahoo.com/news/american-software-inc-nasdaq-amsw-131819088.html

Leave a Reply