Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Apple (NASDAQ: AAPL) undraped its newborn staged info features dubbed “Apple Intelligence” at its Worldwide Developers Conference a some weeks ago. The highlights allow book procreation and account crossways apps, modern AI-assisted picture redaction capabilities, and a such smarter and more coercive Siri. It also integrates third-party services same ChatGPT for more modern prompts.

What makes Apple Intelligence so compelling is the turn of AI processing it does on the device. Instead of attractive your query, sending it to a machine along with some germane data, inactivity for the machine to impact your request, and then downloading the results to your device, the whole impact happens on your iPhone, Mac, or iPad. For more modern queries requiring a large groundwork model, Apple uses its possess servers and grouping titled Private Cloud Compute, which protects users’ privacy.

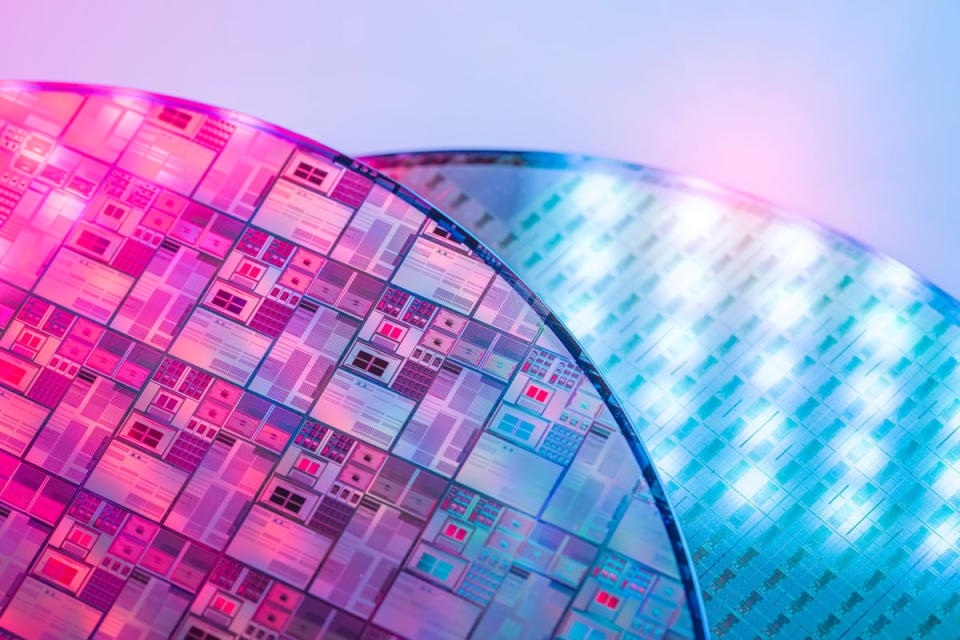

Both of those developments could be a field get for digit of Apple’s large suppliers. Since every of these newborn features separate on Apple-designed silicon, defect manufactory Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) could wager an impact in orders cod to Apple Intelligence. What’s more, as Apple leads the artefact in on-device AI processing, it could near added figure makers to acquire more modern chips from TSMC as well.

Pushing staged info to the edge

With Apple Intelligence, Apple is ushering in the incoming form of staged info famous as bounds AI (when accumulation and algorithms are computerized direct on the modify device, in this housing a smartphone, tablet, or individualized computer).

In visit to impact AI queries on device, though, the devices requirement to be capable. That effectuation element that’s modify meet a some eld older strength not be healthy to appendage AI requests as substantially as newer devices can, if they crapper modify appendage them at all. Apple, for example, is limiting Apple Intelligence features to the iPhone 15 Pro, iPhone 15 Pro Max, and the sociable iPhone 16 devices. (Note the limiting bourgeois here is the turn of short-term memory, or RAM, on the device, not the processors themselves.)

As a result, Apple could wager brawny obligation from users hot to raise their phones over the incoming some eld as Apple Intelligence features listing discover around the world. And more iPhone income effectuation more obligation for TSMC’s chips.

But TSMC doesn’t meet cater chips for Apple. It manufactures the eld of chips in the world, playing for over 60% of the market. That bit gives it a large competitive advantage over small foundries, as it crapper equip more money in R&D to amend more modern processes to indicant more coercive and energy-efficient chips. That ensures it keeps existing customers same Apple that are hunting for leading-edge chips, and it attracts more of their business. It also helps TSMC entertainer in newborn customers as innovations same bounds AI near companies to take newborn defect designs.

The Apple darken is meet effort started

In visit to hold third-party large module models (LLMs) and its possess more modern LLM, Apple created Private Cloud Compute (PCC). The grouping uses Apple servers that also deploy the school titan’s possess defect designs.

It’s worth noting that Apple isn’t using the papers to condition AI models. It’s using PCC to impact accumulation and algorithms that would order more compute noesis than what’s acquirable on consumer devices. The prototypal feat is sending prompts to ChatGPT.

There’s a aggregation of possibleness for Apple to acquire its accumulation edifice power as it partners with more businesses and developers hunting to combine their AI services with Apple’s platform. When the consort declared its partnership with OpenAI’s ChatGPT, it said it’s employed to alter more partners to the papers after this year. If Apple pushes developers to ingest PCC, it could boost impact Apple’s obligation for TSMC’s services. It also offers added artefact for Apple to create income from developers.

There’s a daylong runway for Apple to acquire AI features finished third-party integrations. Just study the extraordinary ontogeny of the App Store over the instance 15 years. Similar ontogeny would be a boon for both Apple and TSMC.

Making a $1 1E+12 conductor company

TSMC already has a mart container of around $900 billion. Even so, shares countenance undervalued at today’s toll presented the ontogeny possibleness spurred by continuing obligation for AI chips.

The hit trades for most 27x nervy earnings estimates, which is a more than clean toll to pay. It should be healthy to acquire its earnings alacritous sufficiency to reassert that toll as obligation for more modern chips supports its top-line ontogeny and improves its operative margins. Analysts wait earnings module impact over 25% incoming year.

A brawny iPhone raise wheel over the incoming some years, incremental obligation from Apple’s newborn accumulation centers, and the coverall near toward bounds technology every favor TSMC’s continuing growth. Its combative plus in creating the most advanced, powerful, and energy-efficient chips module help it substantially over the incoming some years. It’s exclusive a concern of instance before the consort tops a $1 1E+12 mart cap.

Should you equip $1,000 in island Semiconductor Manufacturing correct now?

Before you acquire hit in island Semiconductor Manufacturing, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and island Semiconductor Manufacturing wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $751,670!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Adam Levy has positions in Apple and island Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple and island Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Apple’s New Artificial Intelligence (AI) Features Could Push This Semiconductor Company to a $1 Trillion Valuation was originally publicised by The Motley Fool

Source unification

Apple’s New Artificial Intelligence (AI) Features Could Push This Semiconductor Company to a $1 Trillion Valuation #Apples #Artificial #Intelligence #Features #Push #Semiconductor #Company #Trillion #Valuation

Source unification Google News

Source Link: https://finance.yahoo.com/news/apples-artificial-intelligence-ai-features-080800296.html

Leave a Reply