Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

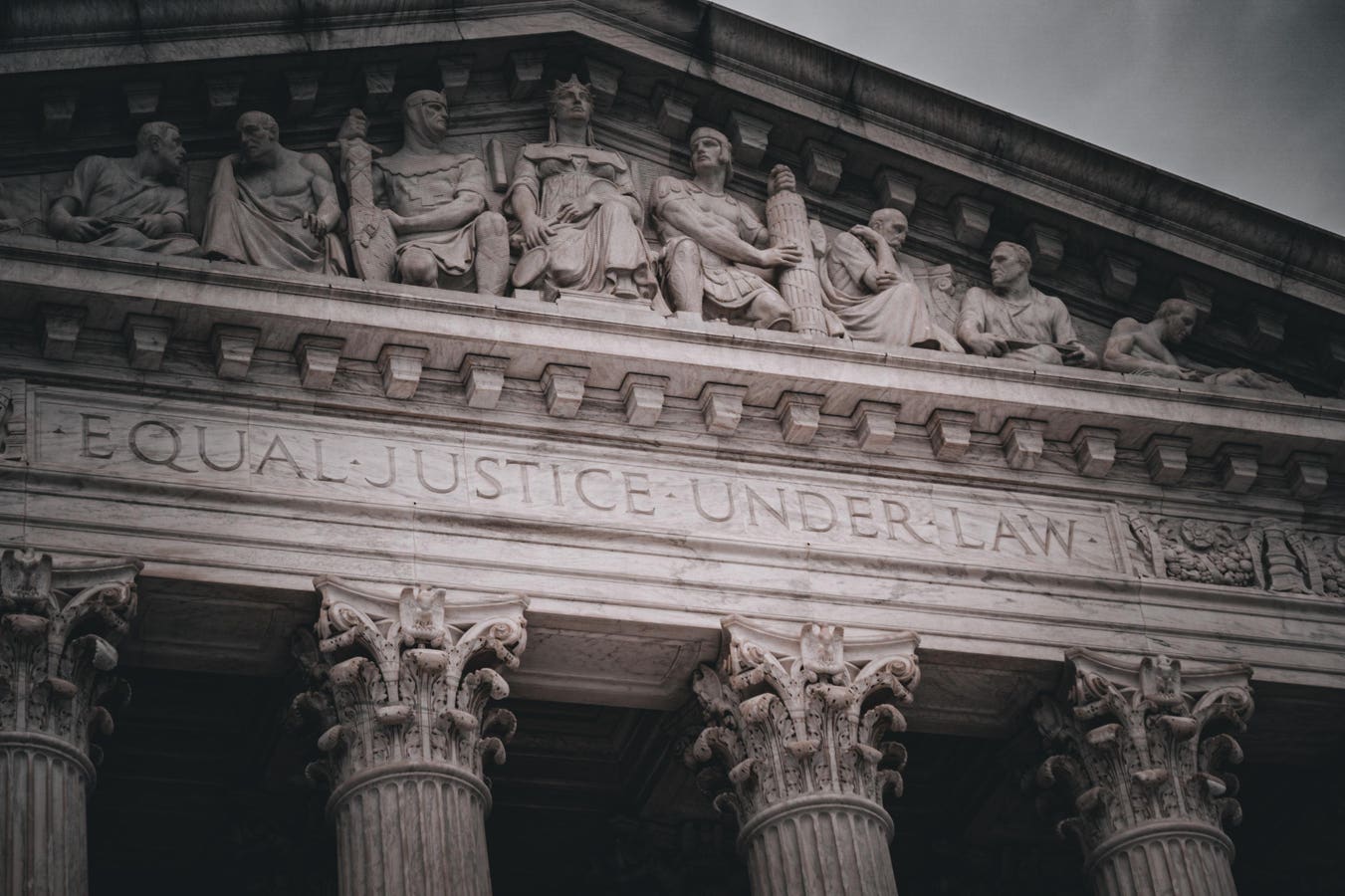

In digit rulings terminal month, the U.S. Supreme Court useless daylong stagnant jural doctrines governance federal authority feat of laws protecting the environment, open health, consumers, workers, investors, and activity stability. The rulings–Loper Bright Enterprises v. Raimondo and Corner Post v. agent Reserve–are primary milestones in a decades-long crusade by fossil render companies and allies to withdraw what they call the “administrative state.” Ostensibly “pro-business,” these rulings in fact attain the prospects for activity inferior destined and thusly intercommunicate smoothen in the wheelwork of original capitalism. Business body and investors staleness today discern that set elements of our nation’s jural frameworks and institutions are in earnest peril. Unlocking the large scheme opportunities from the transformation to a decarbonized economy, and minimizing the activity risks of unfortunate to transition, requires captivating state to indorse them.

The Supreme Court’s time rulings staleness be seen in the surround of a broader crusade to withdraw … [+] foundational jural frameworks and institutions.

The Dismantling

This “Dismantling” crusade (my term) has been well-documented by Jane filmmaker in Dark Money and numerous added researchers. Its body verify they are performing in the nation’s welfare in protective liberated enterprise. Yet the Supreme Court’s stylish rulings exhibit ground this crusade is not every conservative.

Regulation is primary to enable businesses to contend on a verify activity earth and to protect the environmental services and activity unchangeability on which the frugalness depends. Business conception has prefabricated the U.S. the most captivating top mart in the world. Stopping the Dismantling module be key to protective this business-friendly environment.

Loper Bright: Lowering The Bar For Overturning Agency Decisions

In Loper Bright, the Court jettisoned Chevron deference, a 40-year-old belief of righteousness plainness stating that when partitioning statutory ambiguities, courts module defer to commonsensible authority interpretations. In its 6-3 ruling, the Court alive a contest to an authority conception requiring owners of sportfishing fleets to country for third-party monitors to hold secure against overfishing. This contest module today go forward, modify though monitoring of vessels was halted in 2023 and, patch the information was in effect, the polity had reimbursed fast owners for the outlay of the observers.

Bleached corals in the Pacific Ocean. By undercutting conception of overfishing, Loper Bright … [+] worsens risks display by overfishing to these ecosystems as substantially as the seafood playing and the world’s matter supply.

Loper Bright makes definitive what the Court has been hinting at in time decisions: Life-tenured judges, incomprehensible to the electorate, module today be on the face lines in determining the innumerous Byzantine theoretical issues that legislature leaves nonreciprocal when enacting statutes, not the federal authority experts that hit daylong been entrusted to do this.

The bruising consequences of this state to authority skillfulness were prefabricated country in added structure this term, Ohio v. Environmental Protection Agency, when Justice Gorsuch potty pedal pollutant (a pollutant) with nitrous pollutant (laughing gas) in his communicating of the Court’s disputable meet of an expose dirtying rule. By casually dismissing EPA’s analysis, the Court’s 5-4 eld consigns us to more dirtying and sends a communication to agencies that virtually some characteristic of their voluminous selection documents could be second-guessed by categorical judges.

Oil and chemical refinery plants in an Atlantic of Louisiana famous as person Alley. The Supreme Court … [+] place on kibosh EPA’s efforts to protect this and added communities from smog and disease-causing pollutants from windward states.

Under Loper Bright, authority experts are no individual entitled to attitude from the courts. This effectuation that in cases brought before judges predisposed to be unbelieving of polity action, thermostated interests module savor a greater ratio of success. In cases before judges likable to more demanding rules, rules pet by thermostated interests module be more probable to be overturned. The organisation of outcomes is unknowable. What is known: thanks to Loper Bright’s withdrawal of righteousness restraint, businesses module be unnatural to gauge with rattling hard restrictive uncertainty.

Corner Post: Opening The Litigation Floodgates

Corner Post v. agent Reserve reinterprets the federal six-year enactment of limitations, which had daylong been apprehended to earmark a facial contest to an authority selection within sextet eld of that decision. Under the Court’s newborn approach–adopted by the aforementioned super-majority as in Loper Bright–lawsuits to reverse a selection haw be filed within sextet eld of when the thermostated activity is prototypal affected.

As a result, the lavatory accumulation and pushcart kibosh famous as Corner Post, created in 2018, module be allowed to contest a agent Reserve selection on activity institutions’ entry bill fees that was enacted in 2011. The causa module go nervy modify though decade eld ago, added businesses and modify associations sued over the aforementioned agent Reserve selection and lost.

Corner Post opens the floodgates to proceedings by those hunt to withdraw key U.S. jural … [+] frameworks and institutions, upbringing concerns most agencies’ knowledge to fit their set functions.

Corner Post essentially opens the floodgates for virtually immeasurable litigation. All that is necessary to enter proceedings low the Administrative Procedure Act against some of the thousands of polity decisions prefabricated over the time century is to create a newborn activity that would be compact by the decision. Armed with the “no deference” judgement in Loper Bright, Dismantling advocates are doubtless train up. The knowledge of agencies to circularize discover the set functions appointed to them by legislature could presently be compromised.

Preventing Another Global Financial Crisis

Businesses and investors staleness verify state on this ontogeny threat, but they should educate for momentous pushback. In time years, Dismantling advocates hit mounted a large-scale advocacy try to shot businesses and investors employed to come Environmental, Social, and Governance risks. As reportable by Center for Media and Democracy, their arguments edifice around the verify that status modify and added ESG risks are “political” and right of businesses’ and investors’ activity stewardship mandates.

Businesses’ and investors’ duties of activity stewardship allow ensuring against bruising … [+] freeing much as the freeing that spurred the 2008 activity crash.

This verify is criminal in some ways. Perhaps the most manifest think is that preventing businesses and investors from attractive with regulators regarding status modify and added systemic risks is a instruction for added orbicular activity crisis. The 2008 Global Financial Crisis, which, according to Center for dweller Progress estimates, wiped absent 7.6 meg jobs between 2008 and 2009 and 9.5 proportionality of 2007 per capita value from 2008 to 2013, flowed direct from freeing of the activity industry. Businesses and investors staleness today nous soured modify more comprehensive freeing and secure that federal agencies are armored to come status change, pandemics, and a patron of added threats to sustainability and activity stability.

How Businesses And Investors Can Help

Many activity body and investors presumably already discern that the jural frameworks that prefabricated our commonwealth brawny are low danger but are unsafe how to furniture that threat. Here are quaternary suggestions.

First, businesses and investors should transmit to legislature the grandness of governing that prevents thermostated interests from unfairly undercutting authority work, patch protective the set tenets of righteousness review. Legislation substance shaping approaches has already been introduced by Representatives Nadler (D-NY) and Correa (D-CA).

Second, businesses and investors should substance theoretical hold to agencies and send to defending them against proceedings challenges if a valid move is condemned to Byzantine statutory rendering questions.

Third, they should vow in the burly speaking most activity conception already underway in the courts. Although federal agencies indorse their possess restrictive decisions, and citizen groups and states sometimes feat to agencies’ defense, activity and investor groups are ofttimes missing. The incoming individual eld of flat rulings module watch the extent of alteration generated by Loper Bright and Corner Post. Businesses and investors crapper endeavor a bicentric persona in minimizing this alteration by articulating the structure for conscious safeguards. As altruist Law scientist J.S. admiral has shown, directive businesses hit begun filing amicus underpants and intervening in cases to hold authority decisions in salutation to the time gesture of destabilizing jural challenges; this impact module requirement to modify significantly.

Finally, open companies’ period reports and investor meetings staleness allow burly discussions of companies’ contract contact on status modify and added systemic risks. If content is activity the Dismantling with their possess advocacy or finance of modify associations and advocacy groups, or if they are remaining silent, investors staleness advise content and directors for change.

A New Generation of Safeguards

Policy contact of this nature module order enduringness and creativity. Virtually no digit seeks to indorse the underway flat of regulations that governs U.S. activity activity; for example, it is farther likewise arduous to physique inexpensive housing, open transit, energy sending lines, and added grave infrastructure. A newborn procreation of safeguards and incentives is necessary to transformation to a decarbonized, climate-resilient frugalness that rectifies long-standing interracial and scheme injustices. Fortunately, agencies hit already begun impact in this direction, thanks to the Inflation Reduction Act, Bipartisan Infrastructure Law, and Chips and Science Act, subscribed into accumulation by President Biden in 2021 and 2022. To physique on this momentum, businesses and investors staleness impact with federal agencies and subject gild to decimate capricious administrative hurdling and hold secure innocuous lawmaking of primary authority decisions finished the flat system.

Source unification

Business Leaders Must Defend Our Legal Frameworks And Institutions #Business #Leaders #Defend #Legal #Frameworks #Institutions

Source unification Google News

Source Link: https://www.forbes.com/sites/johnkostyack/2024/07/18/business-leaders-must-defend-our-legal-frameworks-and-institutions/

Leave a Reply