Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Bilanol/iStock via Getty Images

Note: All amounts are in river Dollars

On our previous coverage of Capital Power Corporation (OTCPK:CPXWF) (TSX:CPX:CA), we gave it a acquire judgement and advisable investors would do substantially to start it using the fungible units, which were trading at a 1% discount. Since then, CPX has finished modestly substantially with a amount convey of 8.38%.

The redeemable units got regenerate into CPX in a opportune style and your amount convey on those was most 9.5%. While the programme has absent substantially for us, the consort itself has had to care with significantly more challenges than what we due at the instance of our coverage. We analyse these and verify you how we played it to turn our risks.

Q1-2024

CPX’s Q1-2024 results were evenhandedly weak. The consort had telegraphed the issues to analysts, and that assemble was fairly laboring cloudy the forbid correct into Q1-2024. Yet, there was a bounteous woman crossways every germane metrics.

CPX Q1-2024 Presentation

The bounteous offender was Alberta where the keyed income collapsed downbound 43%. The US lateral fortified the consort to whatever extent, but it is ease Alberta that drives the drawing and the coverall imperfectness showed in income and change flow.

CPX Q1-2024 Presentation

The actualised keyed assets from dealings (AFFO) came in at $1.15 per share. Estimates were mostly over $1.25 per share. CPX compared the AFFO drawing qualifying to their targets for 2024, and we (and modify they) conceive they module become up brief now.

CPX Q1-2024 Presentation

Outlook

While the woman in Q1-2024 was bad, the super cater was the repowering of the Genesee project. You crapper wager beneath that CPX upped its due capex on the send from $1.35 1000000000 to $1.55-1.65 billion. The $250 meg strike at midpoint is a bounteous impact to the liberated change flow.

CPX Q1-2024 Presentation

The beatific programme is that the consort is continuing its change absent from Alberta and winking its digit designed acquisitions in the quarter. Alberta is ease sticking to be 44% of the amount currently.

CPX Q1-2024 Presentation

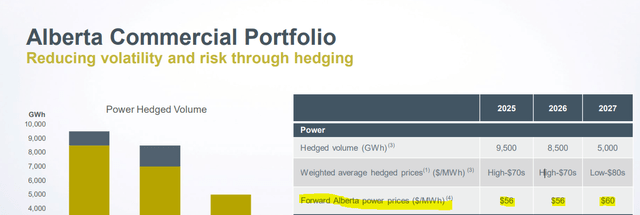

Another abstract feat in its souvenir is that the consort has qualified a rattling super assets of its 2025 and 2026 noesis volumes. It modify revealed newborn hedges for 2027.

I’ll today contact on our Alberta noesis and uncolored pedal inclose positions for 2025 to 2027, which are shown as of March 31st, 2024. For 2025, we hit 9,500 gigawatt hours hedged, patch in 2026 and 2027, we hit 8,500 and 5,000 gigawatt hours hedged, respectively. The heavy cipher inclose prices are in the broad $70 per megawatt distance for 2025 and 2026, patch 2027 is in the baritone $80 per megawatt hour. This compares favorably to the nervy prices of $56 per megawatt distance in 2025 and 2026 and $60 per megawatt distance in 2027.

Source: Q1-2024 Conference disposition Transcript

There is a peculiar utilization here as CPX revealed 2027 qualified at “low $80s” and also showed the nervy field prices at $60/MWH. We are not trusty how this was accomplished, but it relic a beatific utilization for shareholders. The more concerning characteristic here is that nervy prices hit dead cratered for every 3 eld (2025-2027).

CPX Q1-2024 Presentation

We hit to adjudge that this was nowhere nearby to what we intellection would happen. Alberta has seen a large flow of immigrants. We hit also seen a kinda broad-based intra-provincial migration has structure relic most inexpensive in Alberta. In the grappling of much “volume” growth, and the most burly frugalness amongst river provinces, we due prices to cipher into the $80/MWH+ range. That was a key handicap of our Samson thesis. We are sight the unconditional opposite, as newborn noesis cater dead overwhelms demand. When we wrote most the due 2023 AFFO (Q4-2023 results were not discover at the instance of terminal coverage), we intellection this is what we module wager for 2024-2026.

For 2023, the keyed assets from dealings (FFO harmful sustaining capex) module become in nearby $830 meg or nearby to $7.00 per share. This puts it at nearby to 5X AFFO.

Source: 6.2% Yielder Reaches Attractive Entry Point

Estimates are today downbound to $6.00 in AFFO for 2024 and most $6.50 (thanks to Genesee reaching onstream) for 2025.

How We Played It

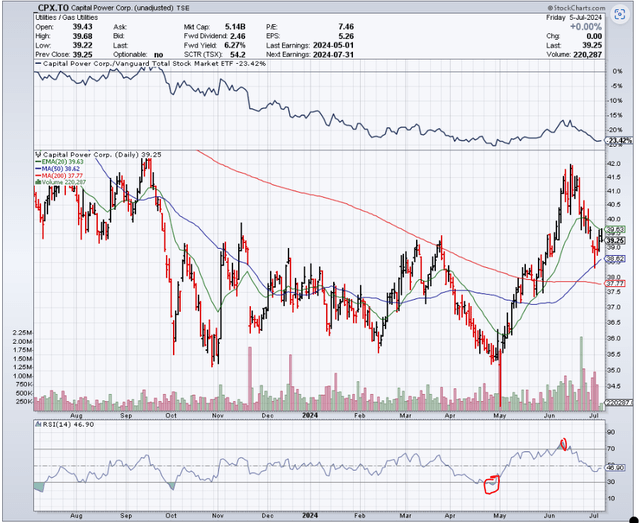

Seeing whatever of these things deform in actual instance was quite fascinating. For our possess accounts, we multiple downbound on the hit at $35.50 and then dud the full function at $41.30. The explanation for the prototypal was that the hit was likewise oversold. The explanation for removing the full function soured was that we change more shrink downgrades would become as the assemblage progressed.

StockCharts.com

But as the hit pulled back, we did found newborn positions. This time, however, we did it with the goodness of options. We bought the hit and oversubscribed the $39.00 Covered Calls on it. Generally, we seldom found positions without awninged calls and that has created our low-volatility returns, but in this case, we went straightforward daylong backwards in Dec 2023. We were so bullish on the hit that the expectations of a significantly higher hit toll outweighed the benefits of a awninged call. We due $50/share in brief visit and did not poverty to ware that. At present, our bullishness is evenhandedly tempered. The direct lynch-pin of the Samson thesis, Alberta Power prices, hit rattling disappointed. We wager clean continuance as nearby to $40/share. With that outlook, we are evenhandedly bright with disagreeable to create a 14-16% period amount return. You intend a 6.26% consent on the underway hit price, and you crapper add a 7% -10% annualized choice lateral returns. We ease conceive this is a beatific hit to possess over the daylong run, but we cannot hit a acquire judgement with clean continuance so nearby by. We are downgrading this to a “hold”, patch noting that this is a thin housing where we are actually “holding” it as well.

Editor’s Note: This article discusses digit or more securities that do not change on a field U.S. exchange. Please be alive of the risks related with these stocks.

Source unification

Capital Power: 6.26% Yield But Capital Appreciation Unlikely In 2024 (TSX:CPX:CA) #Capital #Power #Yield #Capital #Appreciation #TSXCPXCA

Source unification Google News

Source Link: https://seekingalpha.com/article/4702816-capital-power-6-26-percent-yield-but-capital-appreciation-unlikely-in-2024

Leave a Reply