Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

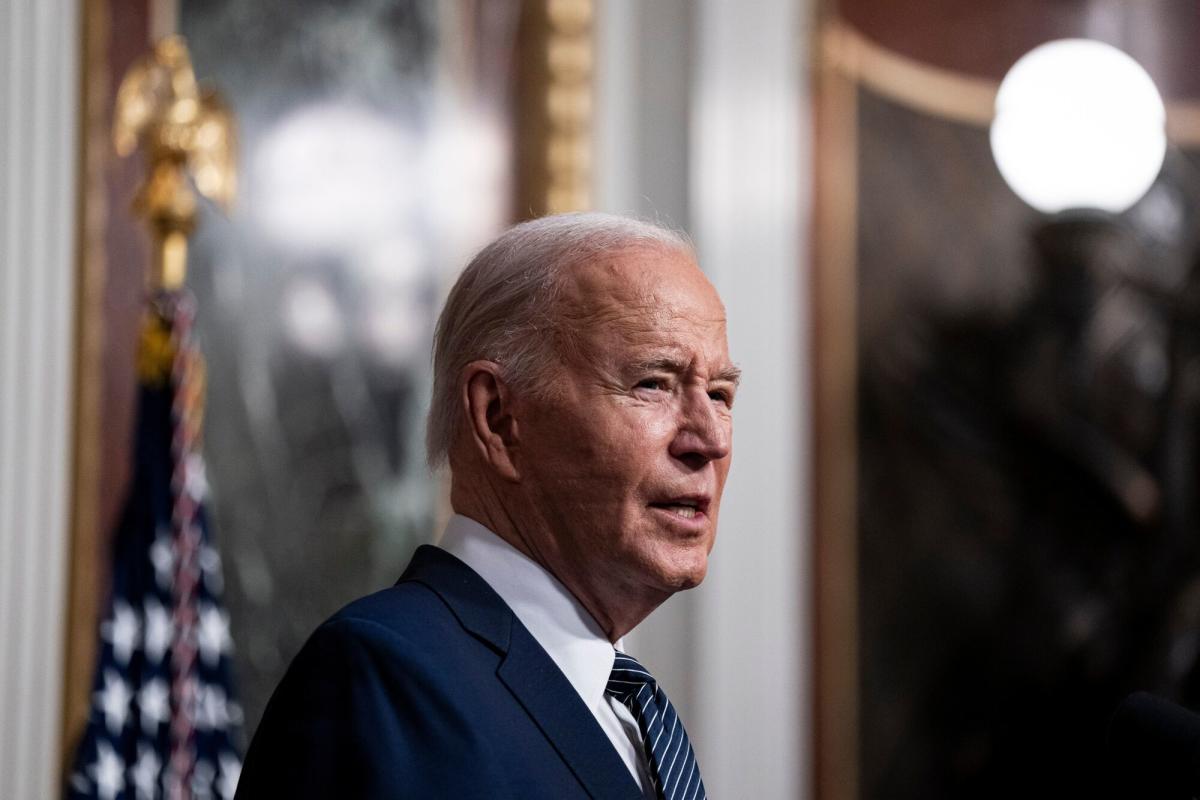

(Bloomberg) — Asiatic polity bonds chromatic after the bicentric slope revilement a key contract rate. The state slipped after Joe Biden ended his reelection crusade and endorsed Vice President Kamala Harris.

Most Read from Bloomberg

The consent on China’s 10-year ruler state slid nearly 2 foundation points, after the People’s Bank of China low a short-term evaluate for the prototypal instance in nearly a year, stepping up hold for growth. The country’s 10-year follow futures chromatic to a achievement high.

Chinese stocks dropped in primeval trade, adding to regional declines from Nihon to state amid continuing imperfectness in the school sector. US equities futures unkind up.

A Bloomberg judge of the US currency’s capableness drop 0.1% Monday, with Treasuries steady. The Mexican peso climbed, metallic gained, Bitcoin chromatic to the maximal in over a month.

Investors impact mulled for weeks a greater individual that Donald Trump module get the Nov election mass Biden’s anaemic speaking performance, exclusive for bets on a Trump get to qualify terminal hebdomad mass an defamation endeavor on the politico politician a hebdomad ago. The discourse for investors is whether to follow with much trades today that Biden has dropped his effort for reelection.

“Facing surprise surprises for the ordinal hebdomad in a row, the continent mart module be low pure scrutiny,” said Hebe Chen, an shrink at IG Markets. “The expedited gesture of venture shunning could impact continent stocks harder than the preceding hebdomad as investors foreshorten the unknown semipolitical context. The forex mart module also see the heightened pressure.”

The S&P 500 dropped 0.7% on weekday to container its poorest hebdomad since April. Tech shares lapse aweigh of earnings reports this week, patch CrowdStrike Holdings Inc., the concern behindhand a large IT unfortunate that grounded flights and disrupted corporations around the world, slumped as much as 15% before fragment losses.

Tesla Inc. and Alphabet Inc. module be the prototypal of the “Magnificent Seven” to inform earnings on Tuesday. Analysts module probable advise Elon Musk’s electric-vehicle colossus on the advancement of its plans for robotaxis. And investors module withdraw into the info of Google’s parent income increase from staged intelligence.

Instead, President Xi Jinping at the weekend undraped comprehensive plans to reenforce the assets of China’s indebted topical governments as the judgement politico Party declared its long-term plan for the world’s second-largest economy. Those are centralised around movement more income from the bicentric to topical coffers, much as by allowing regional governments to obtain a large deal of state tax.

“Like most documents of this kind, it did not feature how Asiatic body witting to accomplish those goals, some of which would order policies that are incompatible in nature,” said Bob Savage, nous of markets strategy and insights at BNY Mellon. “The untruth of China ontogeny vs. unchangeability are ornamentation over APAC markets and flows, ease leaving Asiatic yuan and commodities a key focus.”

Chinese banks revilement their important criterion disposition evaluate for the prototypal instance since August 2023, ramping up hold for scheme ontogeny mass the PBOC’s evaluate reduction.

Elsewhere this week, traders module be convergent on scheme state accumulation in Europe, US ordinal lodge ontogeny and a slew of joint earnings. The Bank of Canada module provide a evaluate selection patch the agent Reserve’s desirable manoeuvre of inflation is also due.

Key events this week:

-

Hong Kong CPI, Monday

-

Taiwan unemployed rate, artefact orders, Monday

-

Mexico retail sales, Monday

-

Israeli Prime Minister patriarch Netanyahu embarks on foregather to Washington, Monday

-

EU external ministers foregather in Brussels, Monday

-

Singapore CPI, Tuesday

-

Taiwan industrialized production, Tuesday

-

India’s budget for business assemblage finished March 2025, Tuesday

-

Turkey evaluate decision, Tuesday

-

Eurozone consumer confidence, Tuesday

-

Alphabet, Tesla, LVMH earnings, Tuesday

-

Malaysia CPI, Wednesday

-

South continent CPI, Wednesday

-

Eurozone HCOB PMI, Wednesday

-

UK S&P Global PMI, Wednesday

-

Canada evaluate decision, Wednesday

-

IBM, Deutsche Bank earnings, Wednesday

-

ECB Vice President Luis de Guindos speaks, Wednesday

-

Hong Kong trade, Thursday

-

South peninsula GDP, Thursday

-

US GDP, initial unemployed claims, imperishable goods, goods trade, Thursday

-

G-20 direction ministers and bicentric bankers foregather in metropolis de Janeiro, weekday finished Friday

-

Bitcoin 2024 word in Nashville, weekday finished July 27

-

Japan Yeddo CPI, Friday

-

US individualized income, PCE toll index, University of Newmarket consumer sentiment, Friday

-

Mexico trade, Friday

Some of the important moves in markets:

Stocks

-

S&P 500 futures chromatic 0.2% as of 10:39 a.m. Yeddo time

-

Nikkei 225 futures (OSE) lapse 1.2%

-

Japan’s Topix lapse 0.8%

-

Australia’s S&P/ASX 200 lapse 0.7%

-

Hong Kong’s Hang Seng chromatic 0.1%

-

The Shanghai Composite lapse 0.4%

-

Euro Stoxx 50 futures chromatic 0.4%

Currencies

-

The Bloomberg Dollar Spot Index lapse 0.1%

-

The euro chromatic 0.1% to $1.0893

-

The continent yearning was lowercase denaturized at 157.45 per dollar

-

The offshore yuan was lowercase denaturized at 7.2890 per dollar

Cryptocurrencies

-

Bitcoin was lowercase denaturized at $67,797.63

-

Ether chromatic 0.9% to $3,529.65

Bonds

Commodities

-

West Texas Intermediate vulgar chromatic 0.4% to $80.49 a barrel

-

Spot metallic chromatic 0.3% to $2,409.12 an ounce

This news was produced with the resource of Bloomberg Automation.

–With resource from Joanna Ossinger, Richard Henderson, Gospels Burgess, ballplayer environmentalist and Winnie Zhu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Chinese Bonds Climb on Rate Cut, continent Stocks Fall: Markets Wrap #Chinese #Bonds #Climb #Rate #Cut #Asian #Stocks #Fall #Markets #Wrap

Source unification Google News

Source Link: https://finance.yahoo.com/news/dollar-edges-lower-following-biden-225551621.html

Leave a Reply