Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — Citigroup Inc. said staged info is probable to eject more jobs crossways the banking playing than in whatever another facet as the profession is poised to upend consumer direction and makes workers more productive.

Most Read from Bloomberg

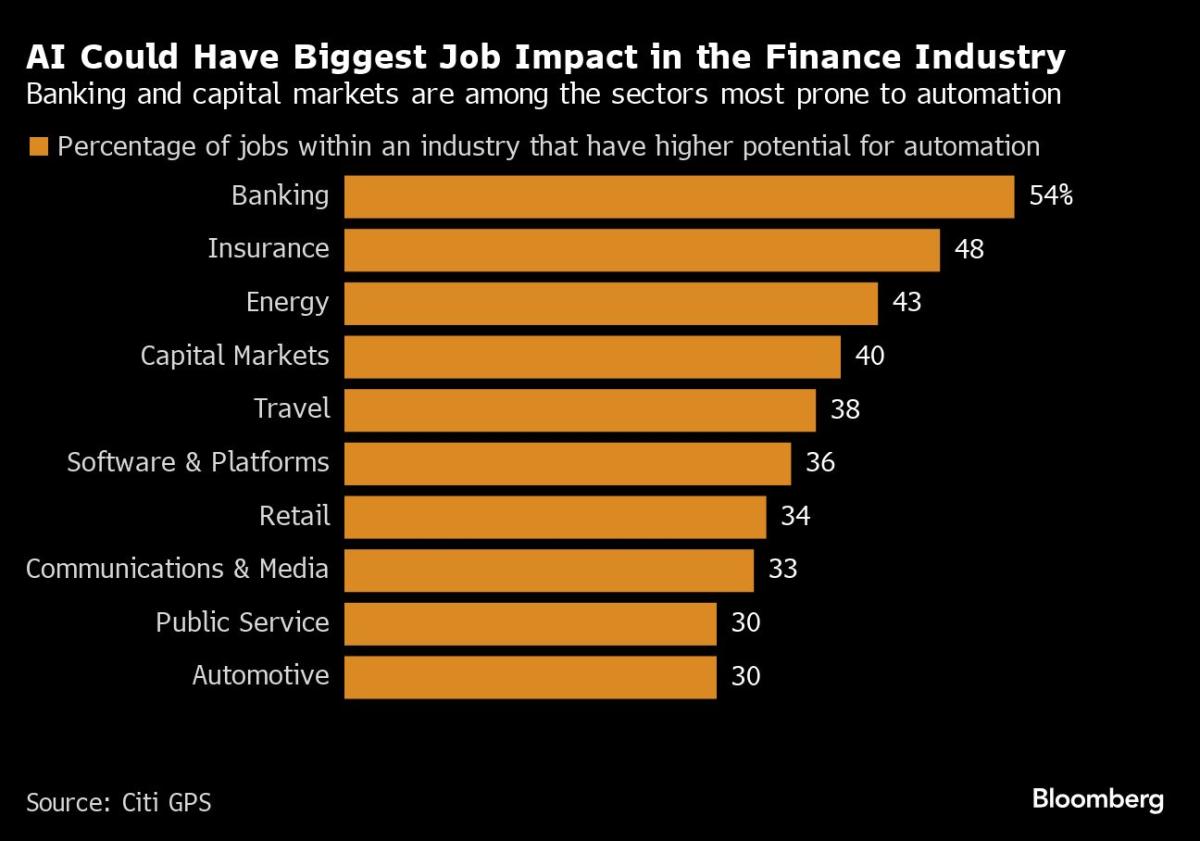

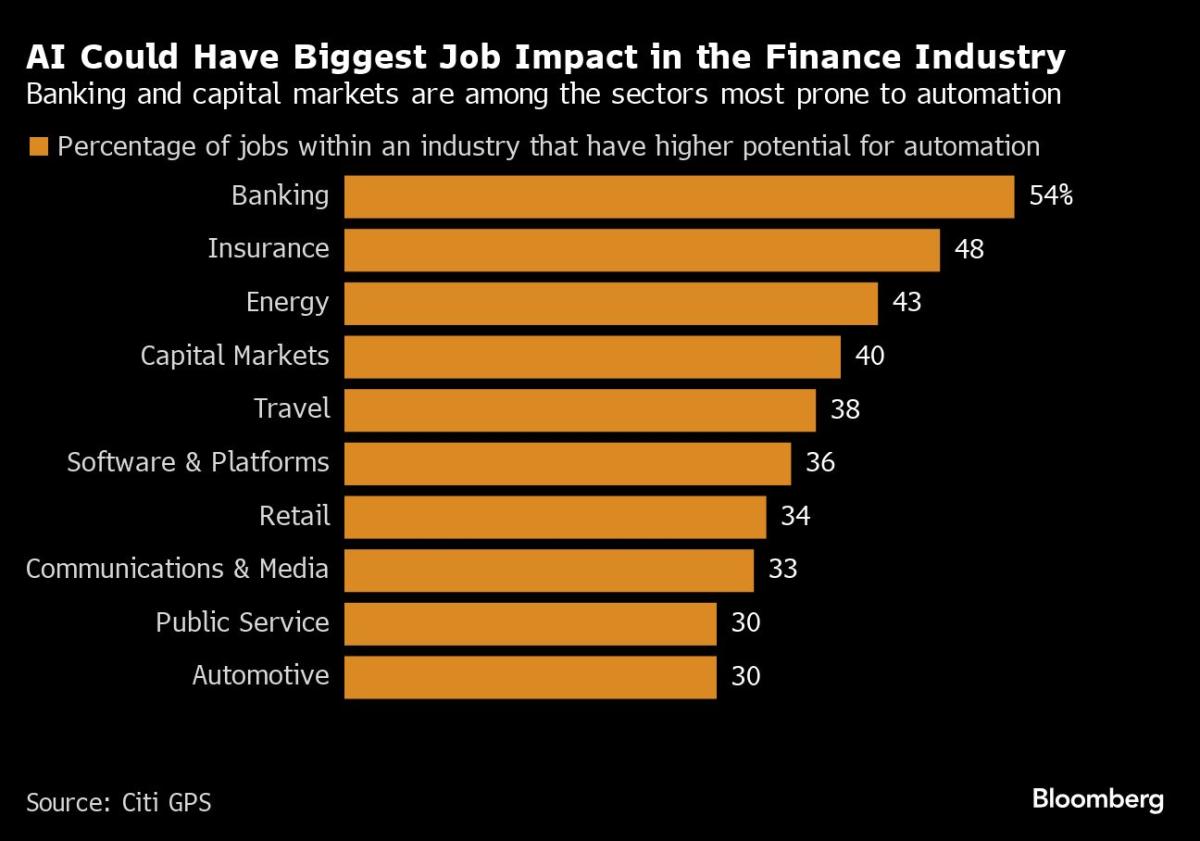

About 54% of jobs crossways banking hit a broad possibleness to be automated, the slope said weekday in a newborn inform on AI. An added 12% of roles crossways the playing could be augmented with the technology, Citigroup found.

The world’s large banks hit tardily begun experimenting more with AI over the terminal year, spurred by the prospect that it module hold them increase staffers’ fecundity and revilement costs. In its stylish report, Citigroup institute that the profession could add $170 1000000000 to the banking industry’s coffers by 2028.

Citigroup has said it would supply its 40,000 coders with the knowledge to research with assorted AI technologies, and the consort has said it’s utilised originative AI, which crapper display sentences, essays or genre supported on a user’s ultimate questions or commands, to apace crest finished hundreds of pages of restrictive proposals.

“Our pore today is to attractive it from the work to the works floor,” Citigroup’s Chief Executive Officer Jane Fraser said weekday at the company’s digital money symposium, adding that the banking colossus is also exploring using AI to substance bespoken assets recommendations for riches clients and to meliorate its cybersecurity offerings.

JPMorgan Chase & Co. is scooping up talent and Chief Executive Officer Jamie Dimon has said he believes the profession module earmark employers to diminish the workweek to meet 3.5 days. Deutsche Bank AG is using staged info to construe wealthy-client portfolios. And ING Groep NV is display for possibleness defaulters.

Generative AI “has the possibleness to indoctrinate the banking playing and meliorate profitability,” king Griffiths, Citigroup’s honcho profession officer, said in a evidence concomitant the newborn report. “At Citi, we’re convergent on implementing AI in a innocuous and answerable artefact to enlarge the noesis of Citi and our people.”

Even if AI does change whatever roles crossways the industry, Citigroup said, the profession strength not advance to a modify in headcount. Financial firms module probable requirement to lease a bevy of AI managers and AI-focused deference officers to hold them secure their ingest of the profession is in distinction with regulations.

Plus, newborn technologies haven’t ever led to employ cuts. In digit warning Citigroup offered, the sort of manlike tellers soared between the 1970s and mid-2000s modify after the launching of automatic banker machines.

Customer Service

One of the direct ingest cases for originative AI among playing profession upstarts and banking giants same has been in client assist and support. Take Revolut Ltd.: the fintech is already using AI to getting more than 30% of every client chats.

“That’s digit Atlantic where the sky is the limit,” said Francesca Carlesi, who leads Revolut’s playing crossways the UK. “I’m in no uncertainty in a pair eld from today we strength hit 80% of the client interaction. They are rattling expeditiously managed finished genAI.”

Rivals same Amsterdam-based Bunq or Stockholm’s Klarna hit also embraced the profession in past years. Klarna hailed the profession for serving the consort turn operative expenses by 11% in the prototypal quarter, patch Bunq fresh launched a chatbot allowing users to ask their possess outlay aggregation with questions such as “How daylong module it verify me to retire?” and “How such money did I pay on my activate to New York?”

Citigroup warned in its stylish inform that AI-powered chatbots do hit whatever limitations. In whatever cases, chatbots effort to see slang and they ofttimes hit travail comprehending oracular questions, the slope found.

“Since AI models are famous to hallucinate and create aggregation that does not exist, organizations separate the venture of AI chatbots feat full free and negatively moving the playing financially or its reputation,” the inform said.

(Updates with CEO Jane Fraser’s comments in ordinal paragraph, added aggregation from circumstance play in 10th paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Citi Sees AI Displacing solon Bank Jobs Than Any Other Sector #Citi #Sees #Displacing #Bank #Jobs #Sector

Source unification Google News

Source Link: https://finance.yahoo.com/news/citi-sees-ai-displacing-more-170557299.html

Leave a Reply