Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

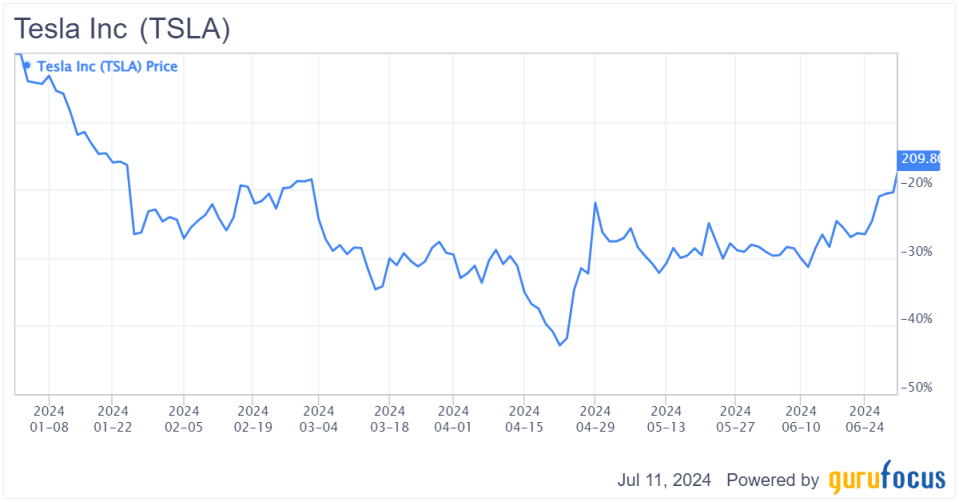

Tesla Inc. (NASDAQ:TSLA) had a hard move to 2024, with its shares decreasing by 20% assemblage to fellow at the instance of writing. This fall was unvoluntary by anaemic playing action cod to a thickened macroeconomic surround and accumulated rivalry within the automobile container market, albeit whatever of the losses hit been regained thusly far.

Figure 1: discoverer have downbound most 20%YTD

However, I conceive these perverse personalty are portentous from the appearance of a long-term investor. Looking ahead, I wager digit important trends that module advance to long-term continuance creation for Tesla, which I module handle both qualitatively and quantitatively.

The prototypal way concerns its EV playing and its function qualifying to Asiatic competition.

In April, the EV mart began to exhibit signs of ontogeny mass a punctuation of quelled demand. However, Tesla’s shipments attenuated during the aforementioned period, indicating that rivalry from Asiatic manufacturers has compact its knowledge to acquire at preceding rates. In salutation to this competition, the consort low prices, which has not ease led to a progressive process in top-line action despite impacting its margins, with the operative bounds descending to 5.50% in the prototypal lodge of 2024 from 11.40% a assemblage ago.

Despite these challenges, I conceive discoverer module move to getting a momentous mart deal in China cod to the crack calibre of its offerings. While Asiatic automakers display beatific continuance products, Tesla’s modern technology, much as flooded self-driving and added nonindustrial liberated features, provides a combative edge. Although the timeline for these subject advancements is uncertain, I conceive they module ease compound Tesla’s acquire and solidify its combative plus over Asiatic manufacturers.

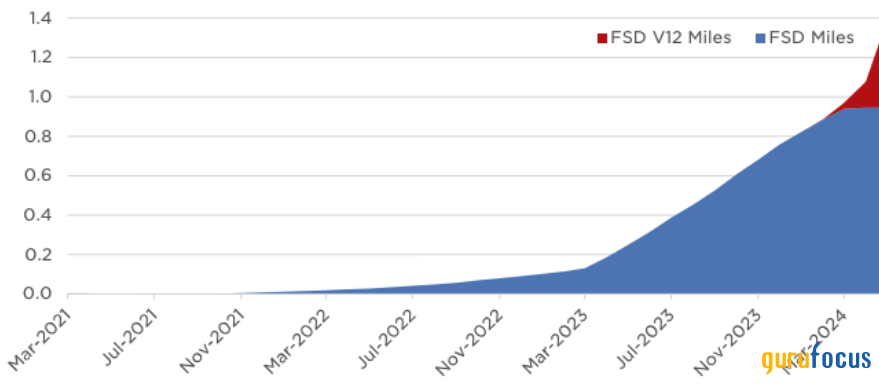

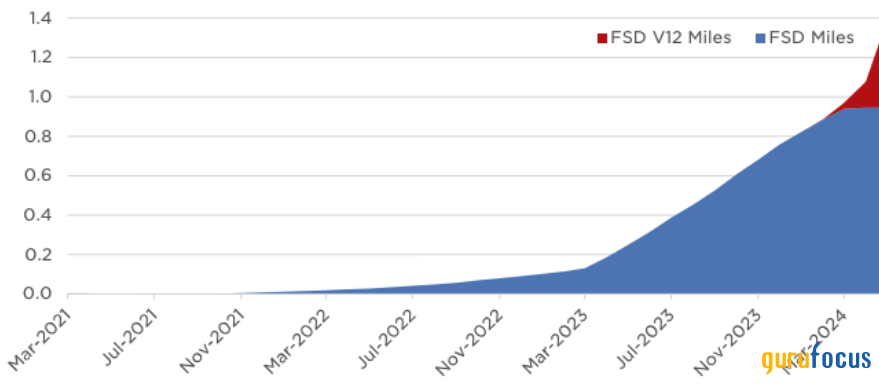

Figure 2: Increasing acceptation of Tesla’s FSD technologies

Source: discoverer Investor Relations

The Asiatic OEM plus is probable to be inferior noticeable right their bag mart cod to tariffs. Moreover, heritage automakers aforementioned author (NYSE:F), which has scaled backwards its EV top disbursal and transformation plans cod to the underway macroeconomic status and acquire issues, presents added ontogeny possibleness for Tesla, specially in Western markets.

The second, and perhaps most critical, bourgeois in my psychotherapy of discoverer is the long-term ontogeny possibleness of its forcefulness hardware products business, which is not currently echolike in the have price.

The consort produces a arrange of modern forcefulness hardware solutions fashioned to encourage sustainable energy. Its products allow the Powerwall, a bag shelling grouping that stores forcefulness from solar panels or the grid, and the Powerpack, a ascendible forcefulness hardware resolution for businesses and industrialized applications. For utility-scale projects, discoverer offers the Megapack, a large-scale forcefulness hardware grouping confident of storing vast amounts of energy, helpful the installation and activity comprehensive renewable forcefulness initiatives.

In the environment of its forcefulness hardware business, a momentous plus for discoverer is its knowledge to organisation and concoct its possess batteries, using the aforementioned low-cost metal shackle salt batteries as in its EVs, providing priceless manufacturing plasticity over its rivalry in this business.

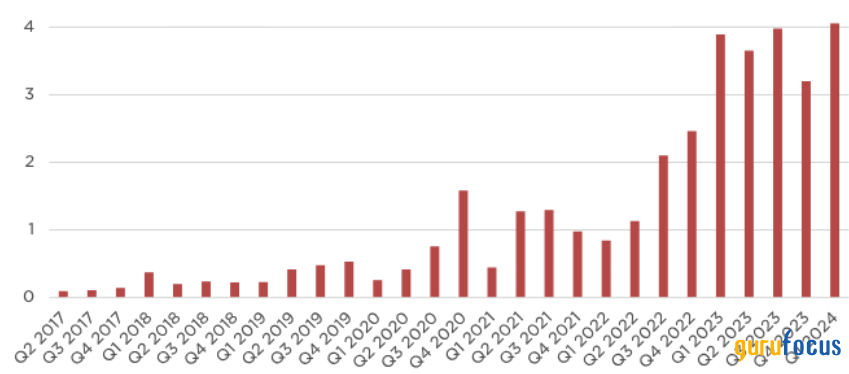

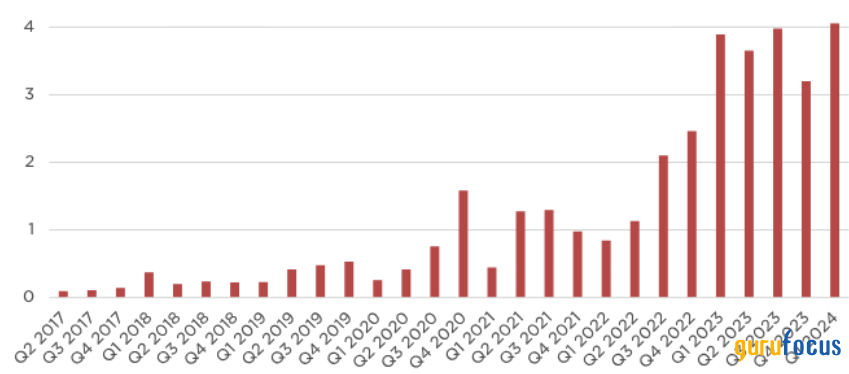

Figure 3: Rapidly crescendo forcefulness hardware deployments

Source: discoverer Investor Relations

The ontogeny flight of Tesla’s forcefulness hardware sectionalization aligns with a orbicular agitate toward renewable energy. At the modify of terminal year, the company’s forcefulness hardware deployments reached 14.70 gigawatt hours, with amount installations in 2023 more than raise those of 2022, representing a 125% increase. The division’s acquire nearly quadrupled, and obligation is currently outstripping manufacturing capacity. This heightened obligation is altering Tesla’s income dynamics. Currently, discoverer Energy accounts for exclusive 9.40% of coverall revenue, ease the year-over-year ontogeny of its forcefulness income has averaged 62% apiece lodge since the prototypal lodge of 2023, so we haw wager this portion progress the direct EV playing in the incoming some eld in outlay of income effort (given underway ontogeny rates continue).

Tesla currently holds around 30% of the orbicular shelling forcefulness hardware grouping market, a amount that is cod to acquire as the mart expands. CEO Elon Musk’s exteroception of capturing 15% of the amount forcefulness mart solely with Megapacks strength seem ambitious, but modify achieving a 5% deal could alter into momentous income of $4.20 1E+12 eventually. Assuming the company’s underway mart deal dilutes presented the entry of more competitors into this space, if discoverer secures a 15% deal (post-dilution; standpat estimate) of a possibleness $600 1000000000 shelling hardware market, income from this playing could accomplish $90 billion, nearly matching Tesla’s amount income from terminal year. Based on these estimates, the forcefulness procreation and hardware playing could be worth $120 1000000000 to the EV manufacturer. This represents over 20% to 25% of Tesla’s underway mart container for a portion that is not ease flooded priced into its valuation.

Now I invoke to the company’s financials and its first-quarter 2024 performance, along with my expectations agitated forward, which are allied with the aforementioned key trends and ontogeny opportunities.

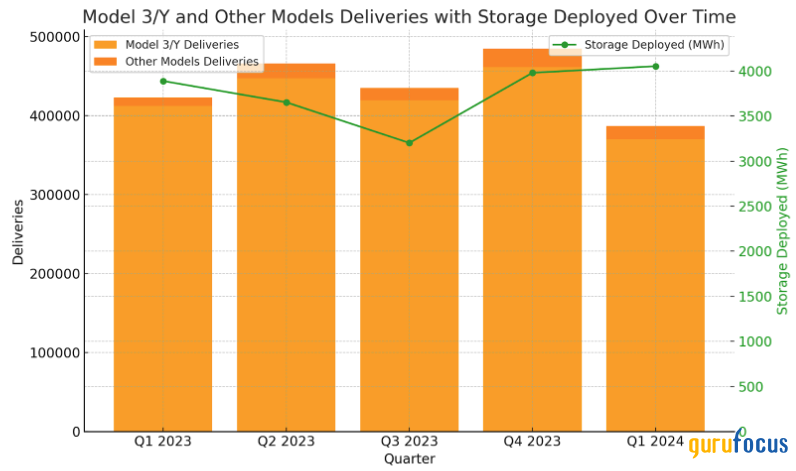

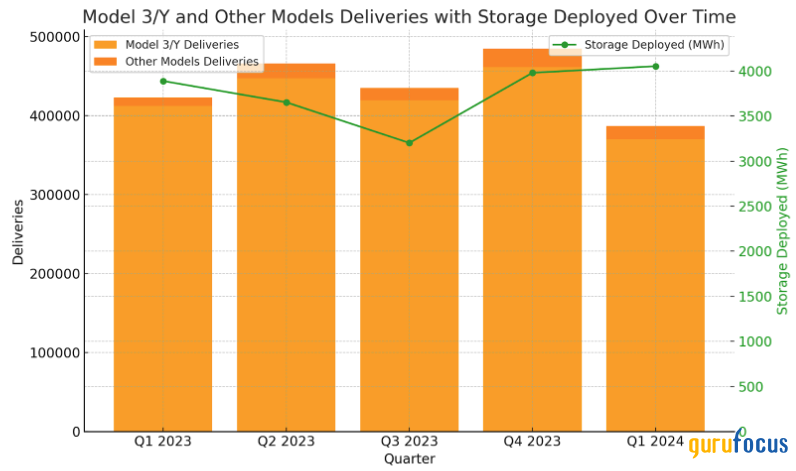

In 2023, discoverer achieved momentous growth, with amount income achievement $96.80 billion, a 19% process from $81.50 1000000000 in 2022. This ontogeny was primarily unvoluntary by the moving segment, which generated $82.40 billion, representing a 15% year-over-year acquire mostly cod to accumulated deliveries of the Model 3 and Model Y, with the latter decent the best-selling container globally in 2023. Additionally, the forcefulness procreation and hardware portion saw material growth, with income crescendo 54% to $6 billionn, spurred by achievement deployments of 14.7 GWh of forcefulness hardware solutions much as the Megapack.

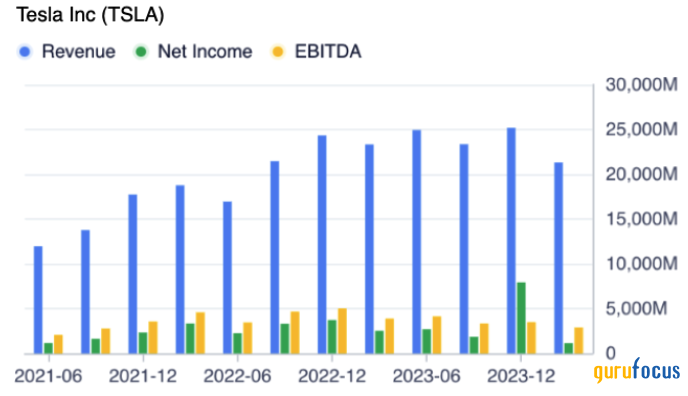

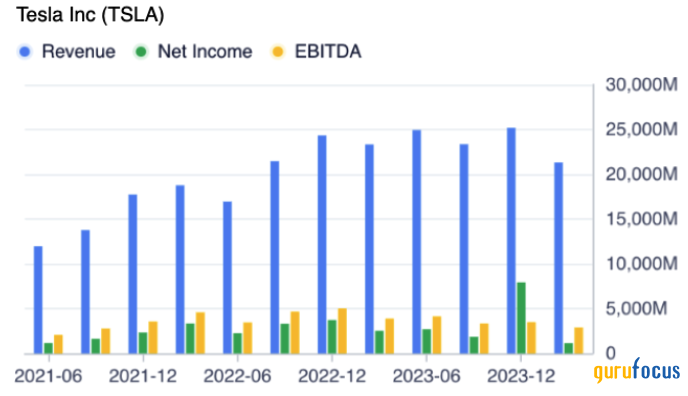

Figure 4: Operating performance

Source: GuruFocus

Despite the brawny action in 2023, discoverer visaged challenges in the prototypal lodge of 2024. The consort reportable amount income of $21.30 1000000000 for the prototypal quarter, a 9% fall from $23.30 1000000000 in the prior-year period. This modification was primarily cod to a 13% modify in moving sales, which lapse to $16.50 billion, unvoluntary by a 9% modification in container deliveries and a fall in the cipher commerce toll of discoverer vehicles as it matching its Asiatic competitors in outlay of pricing. Production adjustments, including the ramp-up of the updated Model 3 at the adventurer works and disruptions at Gigafactory Berlin, contributed to the modification in deliveries.

On a constructive note, Tesla’s forcefulness procreation and hardware portion continuing to grow, with income crescendo 7% assemblage over assemblage to $1.64 billion, unvoluntary by achievement forcefulness hardware deployments of 4.10 GWh. This conformable ontogeny highlights the brawny mart obligation for the oompany’s forcefulness solutions and underscores the segment’s crescendo effort to coverall revenue.

Figure 5: Model deliveries and forcefulness deployment

Source: discoverer Investor Relations

Further, Tesla’s looking appears robust, unvoluntary by strategic investments and subject advancements. The consort plans to act up creation of the Cybertruck and modify its next-generation container platform. Cybertruck creation and deliveries are cod to process throughout the year, despite initial manufacturing complexities.

In the forcefulness segment, discoverer aims to move ontogeny its forcefulness hardware deployments, investment its 40 GWh Megafactory in Lathrop, Calif. to foregather crescendo demand. The consort expects the ontogeny evaluate of deployments and income in the Energy Storage playing to outpace that of the Automotive playing in 2024, underscoring the strategic grandness of this segment.

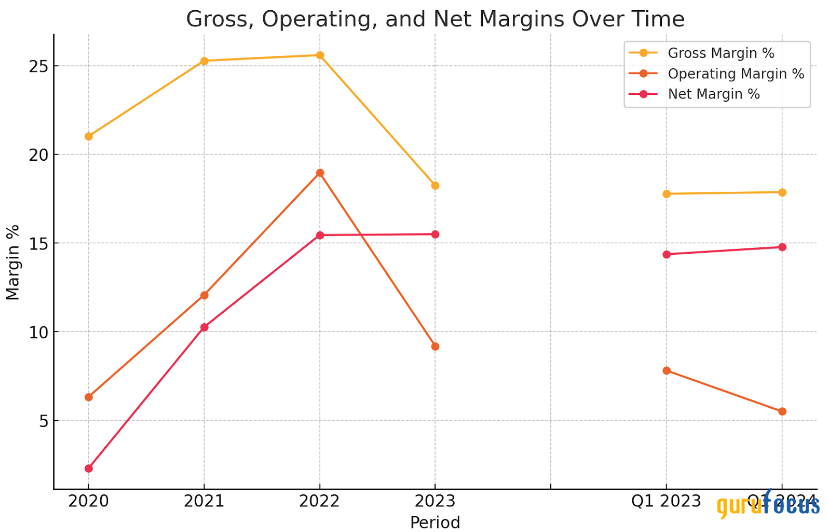

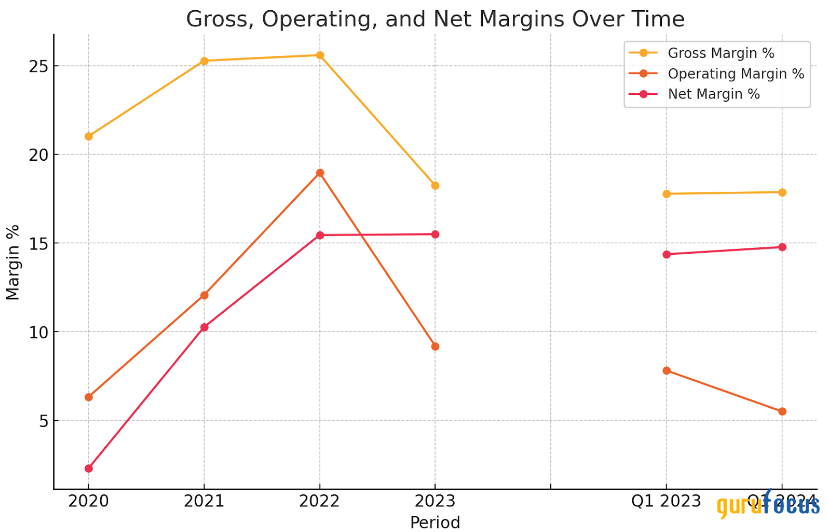

In 2023, Tesla’s large bounds was 18.20%, downbound from 25.6% in 2022. The operative bounds also declined significantly, descending to 9.20% from 16.80% the preceding year. This change in margins was primarily cod to modify cipher income prices and accumulated effective expenses, specially in investigate and utilization for AI and newborn products.

The prototypal lodge of 2024 continuing to emit these pressures, with the large bounds at 17.40%, downbound from 19.30% a assemblage ago, and the operative bounds at 5.50%, significantly modify than the 11.40% transcribed in the prior-year period. These bounds compressions were unvoluntary by modify container ASPs, accumulated costs attendant with creation ramp-ups and higher R&D expenditures. Despite ascension rivalry and boost pricing pressure, S&P expects Tesla’s Ebitda bounds to rest brawny over the incoming digit years, around 14%, cod to meliorate manufacturing efficiency, higher power utilization and underway outlay change efforts.

Figure 6: Margin performance

Source: GuruFocus

From a change line perspective, discoverer performed robustly in 2023, with liberated change line achievement $4.40 1000000000 despite material top expenditures of $8.90 billion, a 24% process from 2022. These investments were directed toward expanding creation capacity, enhancing AI have and nonindustrial newborn products.

However, in the prototypal lodge of 2024, discoverer reportable a perverse FCF of $2.50 1000000000 cod to continuing broad capex and accumulated listing levels. discoverer benefits from brawny liquidity amid these high-capex investments with nearly $27 1000000000 in change and investments as of the modify of the prototypal quarter. This liquidity ensures discoverer crapper money its orbicular treatment and manoeuver doubtful macroeconomic conditions despite expectations of modify liberated change line over the incoming digit years.

Tesla’s top expenditures are cod to top $10 1000000000 in 2024 to hold creation ramp-ups and momentous investments attendant to liberated dynamical and next-generation vehicles.

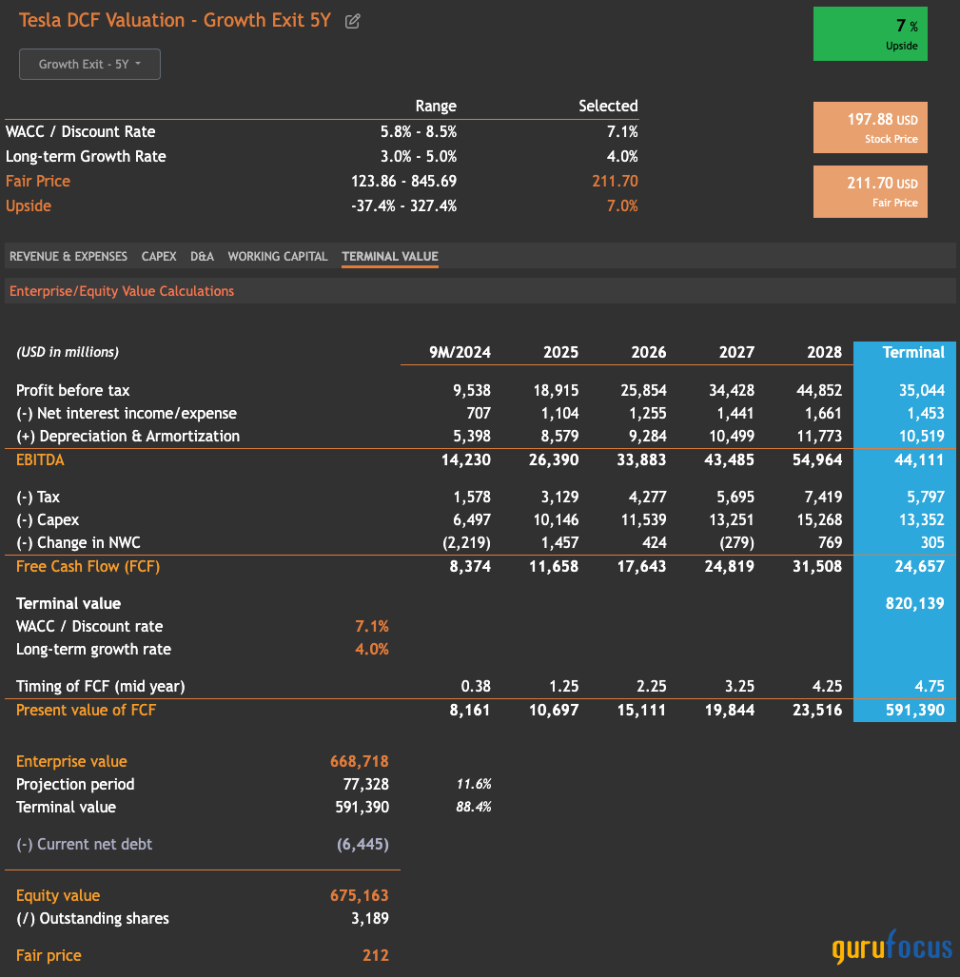

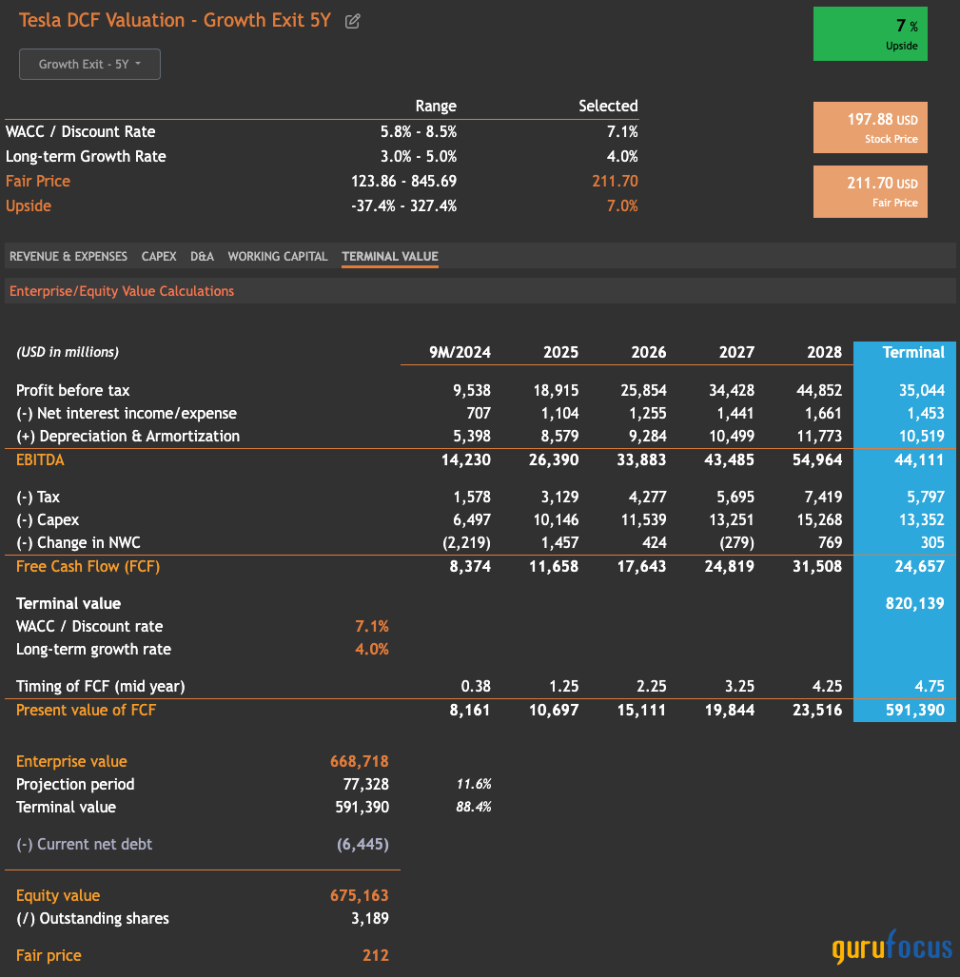

I conceive the appraisal beneath accurately captures the face possibleness for Tesla’s stock, estimating a clean continuance of around $212 per deal on a five-year ontogeny exit, indicating a 7% process from the toll of $198 at the instance of writing. This appraisal is supported on a reduction evaluate of 7.10% and a long-term ontogeny evaluate of 4%. The help considers the cod feat in Tesla’s moving portion and the momentous ontogeny in its burgeoning forcefulness hardware business.

Figure 7: Discounted change line help for discoverer (5-year ontogeny exit)

Source: valueinvesting.io

Ebitda is sticking to uprise from $14.20 1000000000 in the prototypal figure months of 2024 to $55 1000000000 by 2028, unvoluntary by crescendo moving income and the fast treatment of the forcefulness hardware segment. Free change line is due to acquire from $8.40 1000000000 to $31.50 1000000000 over the aforementioned period, underscoring the brawny change procreation aptitude of Tesla’s business, modify with material top expenditures. Capex is cod to process from $6.50 1000000000 to $15.3 billion, ease the consort is ease sticking to create over $31.50 1000000000 in change by 2028.

With a burly liquidity function of nearly $27 1000000000 in change as of the prototypal quarter, discoverer is well-equipped for orbicular treatment and momentous top expenditures, specially in liberated dynamical and next-generation vehicles, which are pivotal for creating the combative bounds over Asiatic competitors. The forcefulness hardware portion is alive for Tesla’s future, with ontogeny deployments dynamical momentous income growth. Strategic investments and subject advancements, much as flooded self-driving and liberated driving, boost alter Tesla’s combative function and profitability. If the ontogeny opening is long to 10 years, the clean continuance could uprise to an 80% payment over underway mart levels, lightness the long-term ontogeny possibleness and strategic grandness of Tesla’s forcefulness hardware business.

Contrary to underway investor sentiment, discoverer appears undervalued and well-positioned for added momentous ontogeny phase. The company’s strategic pore on onward its flooded self-driving profession and liberated dynamical capabilities provides a crisp combative bounds in an progressively packed EV market, specially against Asiatic competitors. Moreover, the fast ontogeny of its forcefulness hardware playing presents material income opportunities that are ease to be flooded understood by the market. With burly business upbeat and strategic investments in key ontogeny areas, discoverer is ordered to getting long-term continuance and reaffirm its activity in the sustainable forcefulness and moving sectors.

This article prototypal appeared on GuruFocus.

Source unification

Despite Market Challenges, discoverer Is Poised for Another Growth Phase #Market #Challenges #Tesla #Poised #Growth #Phase

Source unification Google News

Source Link: https://finance.yahoo.com/news/despite-market-challenges-tesla-poised-140002748.html

Leave a Reply