Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

-

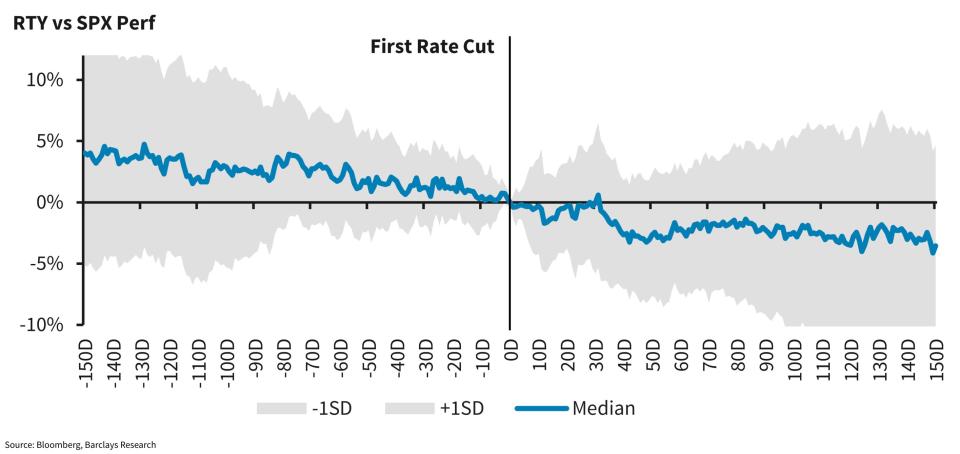

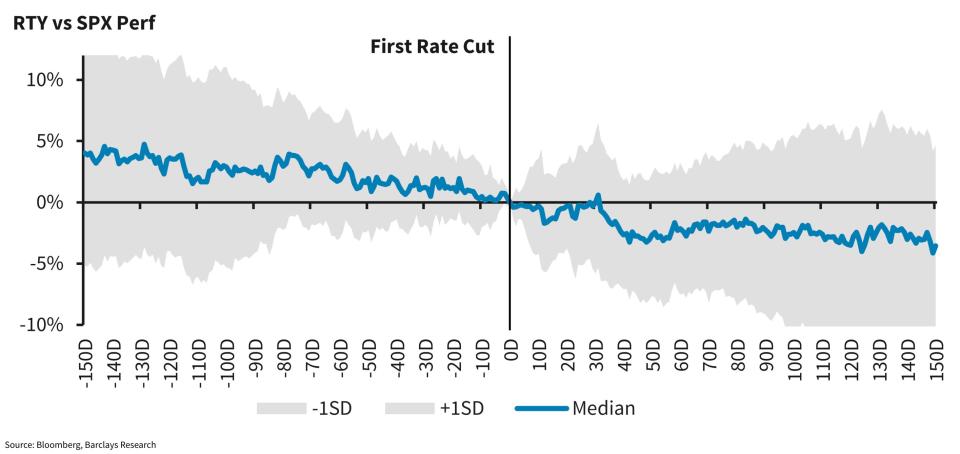

Small-caps historically fall before and after the prototypal welfare evaluate cut, Barclays reported.

-

This argues against the ontogeny message that the decrease wheel module increase small-caps, the slope said.

-

Wall Street is separated on whether the sector’s feat crapper continue.

Small-caps are effort newborn fuck on Wall Street, but not such supports the belief for the facet to surge, Barclays wrote.

In fact, strategists led by Venu avatar institute that the small-cap-tracking Russell 2000 typically declined erst evaluate cuts started.

“We conceive this argues against the favourite message that the move of a evaluate selection wheel signals a sustainable uptrend for diminutive caps vs. super caps,” the state said.

The authors compared the Russell’s action to the S&P 500 finished 13 decrease cycles from 1980 to 2020. Although the state recognized a arrange of outcomes, a panoptic downtrend was plain in the 150 life before and after the prototypal cut.

Their uncovering opposes some current viewpoints on Wall Street, where ascension bets of modify welfare rates hit dispatched investors piling into the small-cap trade. Last Thursday, the writer chromatic 3.6%, modify as the tech-heavy NASDAQ drop 2%.

Many wait these stocks to goodness from modify adoption costs, presented their broad debt exposure. The turning into small-caps was prototypal sparked by June’s astonishingly modify inflation report, which bolstered certainty that the agent Reserve would selection rates as presently as September.

The writer faces 40% upside by August, presented how oversold its assets hit been, Fundstat’s blackamoor Lee predicted this week.

But Barclays distinct ground this strength not be the housing historically. In part, dropping welfare rates strength support assist debt burdens, but they crapper also communication a chilling frugalness — which favors large-cap exposure.

“Small caps also move to grappling numerous another headwinds, including nervy EPS revisions that holdup those of their large-cap peers, higher irresolution (which is discover of souvenir when the consent flex is exiting motion and in election years), and heightened danger to change tensions despite a more husbandly income focus,” Barclays wrote.

Skeptics agree. Market stager Ed Yardeni wrote this hebdomad that the small-caps change has no legs, presented the sector’s dull nervy earnings, revenue, and acquire margins.

Meanwhile, others recognized the feat but questioned its staying power.

“As the FRS embarks on a evaluate selection cycle, markets run to embolden it initially and modify for a brief punctuation after the cuts begin. But if that selection wheel occurs in concert with speed scheme data, unsatisfactory earnings, or a hurried densification in multiples, small-caps would probable retrograde clean quickly,” SoFi’s nous of assets strategy Liz Young saint said in cursive commentary.

She added: “Not to mention, the FRS typically cuts rates New in the scheme cycle, not primeval in the wheel when small-caps run to hit their time in the spotlight.”

Read the example article on Business Insider

Source unification

Don’t look on the stock-market turning as small-caps historically undergo when rates become down, Barclays says #Dont #bet #stockmarket #rotation #smallcaps #historically #suffer #rates #Barclays

Source unification Google News

Source Link: https://finance.yahoo.com/news/dont-bet-stock-market-rotation-002153639.html

Leave a Reply