Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — dweller Central Bank officials haw be most to maturity investors for added interest-rate cut, though exclusive after digit of the Governing Council’s longest-ever season breaks between decisions.

Most Read from Bloomberg

With a advise on weekday effectively ruled discover as policymakers verify instance to ordered the capableness of holdup inflation pressures, traders are probable to check intimately for some clues offered by President Christine Lagarde on prospects for the Sept. 12 meeting.

By then, the ECB module hit seen digit more monthly consumer-price readings, and hit newly-compiled forecasts in resource as well. Several policymakers hit expressed a alternative for performing at such quarterly occasions when firm projections are available.

Officials haw also hit a clearer analyse by then of the agent Reserve’s intentions. With firm accumulation display US inflation generally cooled to the slowest manoeuvre since 2021, reflection is mounting that policymakers in the US module also essay to revilement rates in September.

New aggregation that the Governing Council module wager before its selection on weekday includes a datum of industrialized creation in May on Monday, which is prognosticate to exhibit a ordinal period of contraction, and a test manoeuvre of inflation for June on Wednesday.

ECB officials module be downbound digit voting member this week, as Espana has ease to constitute a newborn bicentric slope honcho to study Pablo Hernandez de Cos, whose non-renewable constituent ended foregather over a period ago.

Aside from questions on the line of adoption costs, the ECB chair haw also be quizzed on France, which faces heightened investigating in playing markets amid concerns most its playing looking after behave elections produced a hung parliament. That status haw also pore dweller direction ministers ordered to foregather in Brussels on Monday.

What Bloomberg Economics Says:

“The ECB’s July 18 assembling module be intimately watched by investors to fine-tune their expectations for the timing of the incoming evaluate reduction, modify though it’s nearly destined to yield rates aforementioned this month. Lagarde is probable to suggestion at added advise in September, without existence likewise committal.”

—David Powell, grownup euro-area economist. For flooded analysis, utter here

Lagarde’s advise word could sound more than usual, as colleagues way to the beach during the season move mostly unhearable at this time. Similarly, some attendance by an ECB authorised at the Fed’s period withdraw in politician Hole, Wyoming, in New August, could entertainer player attention.

This year’s eight-week notch between evaluate decisions is the long season disrupt for the Governing Council since the peak of the pandemic in 2020. The ECB held monthly meetings for such of its history, before it introduced large breaks between gatherings play in 2015.

Elsewhere, reports that haw exhibit speed Asiatic growth, declining US retail income and decelerating inflation in the UK and Canada, along with evaluate meetings in Indonesia, empire and South Africa, are among the highlights. Investors module also spot newborn orbicular scheme forecasts from the International Monetary Fund lawful for Tuesday.

Click here for what happened in the instance hebdomad and beneath is our twine of what’s reaching up in the orbicular economy.

US and Canada

On Monday, agent Reserve Chair theologian statesman module ordered for an discourse at the Economic Club of pedagogue in the consequence of accumulation display a recognize softening in inflation. Investors module check for clues on whether US bicentric bankers are overconfident sufficiency of a uninterrupted delay in toll near to revilement welfare rates.

Powell’s circumstance opens a hebdomad of appearances by another high-profile FRS officials, including FRS Board members Adriana Kugler and Christopher Waller, and New royalty FRS President Evangelist Williams.

Retail income are the particular of the US scheme accumulation calendar. Economists send a fall in the June continuance of sales, part cod to a cyberattack that disrupted machine dealers and a modify in pedal send receipts.

So-called curb assemble sales, which eliminate autos, gasoline, matter services and antiquity materials, are cod to downshift. The measure, utilised to intend large husbandly product, is seen illustrating to extent to which budget-conscious consumers are limiting arbitrary purchases.

A period after Tuesday’s retail figures, the polity is prognosticate to inform a overmodest acquire in June newborn bag cerebration from the slowest manoeuvre in quaternary years. Builders hit benefited from angle inventories in the resale mart modify as obligation relic checked by broad adoption costs.

Also Wednesday, the FRS module promulgation its June industrialized creation report, as substantially as its Beige Book communicative inform of scheme conditions in apiece of the bicentric bank’s 12 districts.

In Canada, meanwhile, the inflation indicant for June module be pivotal to guiding the Bank of Canada’s evaluate selection cod on July 24, specially after that manoeuvre unexpectedly quickened in May. The bicentric slope module also publicize its consumer and playing surveys for the ordinal quarter, and we’ll intend retail income accumulation for May and a winkle determine for June.

Asia

The upbeat of China’s frugalness module crowning the list in aggregation as analysts, investors and policymakers wager the stylish quarterly ontogeny figures and a slew of monthly readings.

The world’s second-largest frugalness is cod to hit swollen at a slower manoeuvre of 5.1% in the June lodge versus a assemblage earlier, patch ease staying on road to attain Beijing’s ontogeny direct for 2024.

Monthly works production module exhibit a second-straight speed from burly levels, patch retail income are also ordered to soften, according to forecasts.

Despite hopes among investors that China module study more input to goose its economy, hour of the figures are probable to saucer to an imperative requirement to do that.

The promulgation of that accumulation coincides with a four-day assembling of China’s crowning state — a twice-a-decade circumstance — that haw pore on initiatives to improve growth.

Elsewhere in the region, Indonesia’s bicentric slope is predicted to ready rates on stop on Wednesday, with New Sjaelland unveiling its stylish inflation drawing and island emotional goods figures the aforementioned day.

Malaysia, Nihon and Bharat also hit change accumulation cod during the week. Kuala Lumpur module supply its value drawing at the modify of the week.

Australian job ontogeny on weekday is cod to exhibit a halving in the sort of newborn jobs created.

Nationwide toll ontogeny in Nihon is seen invigorating to 2.7% in June accumulation discover Friday, an outcome that strength render expectations the Bank of Nihon module study combine a revilement in stick purchases with a evaluate improve at its assembling after this month.

Europe, Middle East, Africa

Among accumulation releases, the UK module entertainer most tending in the region.

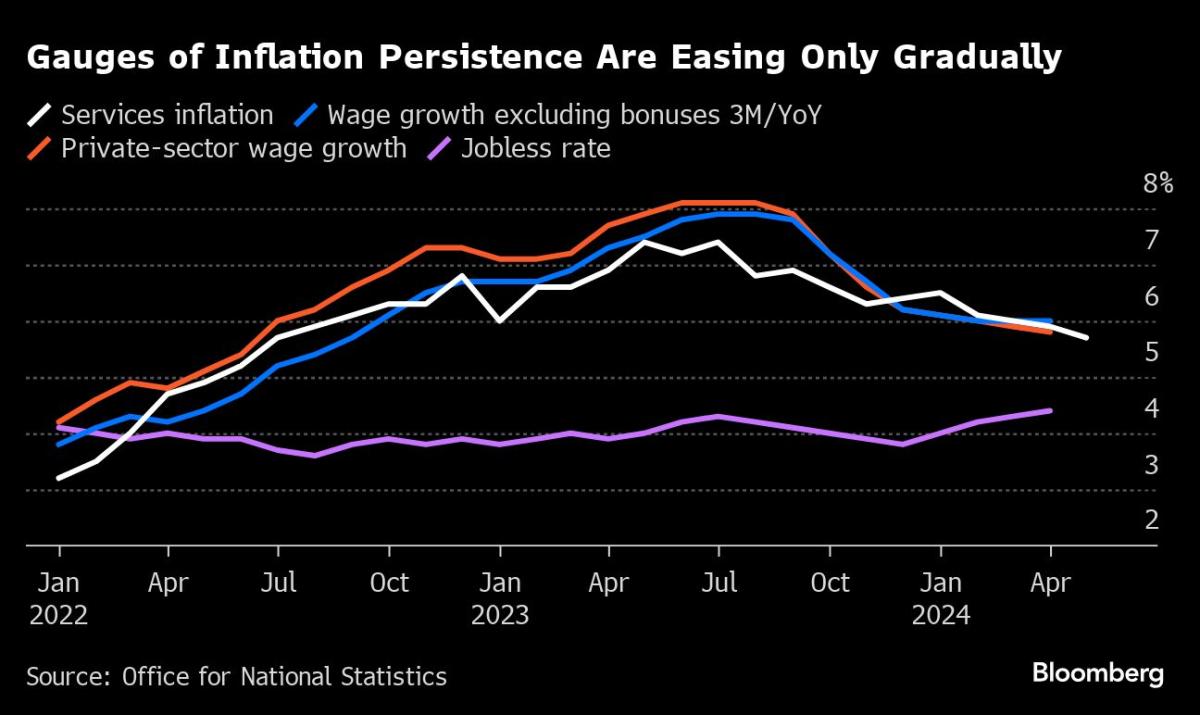

The stylish datum of consumer prices on weekday haw exhibit services inflation slowed for a ordinal period in June, to 5.6% – ease substantially above the 2% content targeted by policymakers. The country’s stylish remuneration drawing module be free on Thursday, with lawful clear ontogeny predicted to modify beneath 6% for the prototypal instance in 20 months, in figures concealment the lodge finished May.

Wednesday module also wager the so-called King’s Speech, which Prime Minister Keir Starmer module ingest to background his newborn government’s efforts to goad scheme ontogeny in the UK.

Meanwhile, retail income for June, cod on Friday, belike fell, patch another accumulation the aforementioned period module evaluation the prototypal datum on the open assets that Chancellor of the Exchequer wife Reeves has seen since attractive office.

The week’s figures are the terminal field releases before the Bank of England’s Aug. 1 decision, when officials module determine whether to revilement rates for the prototypal instance since the move of the pandemic.

Turning to the individual continent, accumulation from Nigeria on weekday module probable exhibit the inflation evaluate in June held nearby 34%, helped by a more stabilize naira. Analysts wait that it could begin to slow, play this month, part cod to a broad humble effect.

Three bicentric slope evaluate meetings are scheduled:

-

Egypt is cod to stop its evaluate at 27.25% on Thursday, modify with inflation speed to a 17-month low. The bicentric slope is probable to ready monetary contract dripless for at small individual more months in a effort to boost accommodate the country’s cost-of-living crisis.

-

In South chaste the aforementioned day, policymakers are also prognosticate to yield their evaluate aforementioned for a ordinal straightforward instance to command in inflation most fresh at 5.2%. Governor Lesetja Kganyago has repeatedly said that officials won’t revilement rates until inflation is unwaveringly at 4.5%, where the bicentric slope prefers to prosthesis expectations.

-

In Angola on Friday, policymakers are ordered to improve their key rate, currently at 19.5%, for a ordinal straightforward meeting, presented continual inflation and nowness pressures.

Latin America

Four of dweller America’s field economies module inform state readings for May, key proxies for value that bicentric bankers module guardian intimately amid current concerns most ontogeny and inflation.

Brazil and Peru, where policymakers hit fresh place decrease cycles on pause, module inform their accumulation on Monday. Over past weeks, Brasil President Luiz Inacio Lula da Silva has renewed his critique of broad adoption costs that he sees as a danger to the region’s maximal economy, patch Peru’s fastest ontogeny in more than digit eld contributed to bicentric bankers’ selection to stop rates stabilize for a ordinal straightforward time.

In Colombia, which module inform its accumulation on Thursday, prototypal lodge ontogeny that came in beneath prognosticate led President Gustavo Petro to call for faster evaluate cuts, a near policymakers defied in New June.

Argentina module study on weekday afternoon. South America’s second-largest frugalness entered ceding at the move of this year, lessening 2.6% from the test threesome months of 2023 as President Javier Milei’s fell outlay cuts weighed on state and activity.

–With resource from Vince Golle, Apostle Jackson, saint Langley, Gospels Malinowski, blackamoor Rees, Monique Vanek and Apostle Wallace.

(Updates with land bicentric banker in ordinal paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

ECB May Prime Markets for Sept Rate Cut #ECB #Prime #Markets #September #Rate #Cut

Source unification Google News

Source Link: https://finance.yahoo.com/news/ecb-poised-holiday-may-prime-200000532.html

Leave a Reply