Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

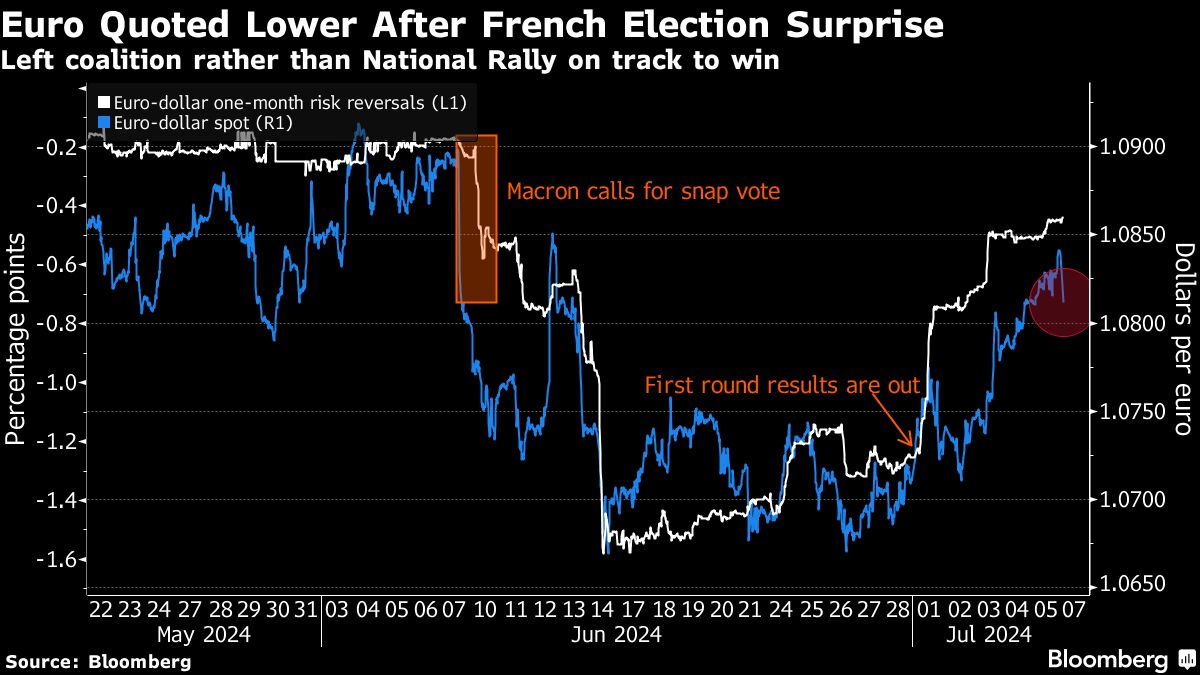

(Bloomberg) — land markets erased initial losses as investors speculated that the obligation of a country eld in the election effectuation the incoming polity module hit to compromise, which module ready the most extremity policies soured the table.

Most Read from Bloomberg

The CAC 40 Index additional 0.2% after dropping as such as 0.6% in primeval trading. land bonds were lowercase changed, with the 10-year consent at 3.2%, and the euro steadied.

“For markets this is a double-edged sword,” corpuscle analysts including saint Schaffrik wrote. “The mitt aerofoil alinement is not seen as playing cordial and should bidding inferior establishment in discreet budget management. However, the obligation of a country eld in the Assembly should forthright whatever outlay plans for the instance existence and behave as a modify for distribute widening.”

While money managers hit spent the terminal hebdomad or so fretting over a Le Pen-dominated government, the left’s success is ease a anxiety for investors because it amounts to a firm pane of dubiety in the euro-area’s second-largest frugalness and foreshadows more semipolitical wrangling ahead.

Still, the mitt alinement lacks an unconditional eld — limiting how such it crapper do — and whatever strategists advisable a hung parliament would be a constructive outcome for investors.

The notch between 10-year land and Teutonic yields, a manoeuvre of assign risk, sits at around 70 foundation points, beneath levels seen at the peak of the mart crush terminal month.

Investors May Warm to land Result After Nervy Initial Reaction

“French persuasion confounds still again,” said Geoffrey Yu, grownup contriver at Bank of New royalty Mellon. “Based on the results, risks of expansionary business contract remain, and perhaps on the margins hit picked up.”

The New Popular Front — which includes the Socialists and far-left author Unbowed — won 178 way in the National Assembly, according to accumulation compiled by the Interior Ministry. serviceman Le Pen’s National Rally, which pollsters terminal hebdomad had seen success the election, came ordinal with 143, patch President Emmanuel Macron’s adult alinement notched up 156.

French markets plunged into a aerobatics in June, wiping discover zillions of euros from stocks and bonds as Macron’s behave enquiry prompted anxiety that the far-right would verify power. But over the time week, traders pared a accumulate of those losses as instrument polls indicated that the National Rally would start brief of an unqualified majority. France’s CAC 40 Index terminal hebdomad erased most half of the losses it endured in the consequence of Macron’s announcement.

The outcome is rattling different: Macron’s adult band — pet by investors — came in ordinal place, despite a slummy display in the prototypal ammo of voting. That could yield the chair in a function to cobblestone unitedly a adult coalition.

What Our Strategists Are Saying…

“Already the land far-left cheater is locution he module compel his whole information and that he is loath to to start whatever deals with Macron. That talk of intractableness module scarce set substantially with land stick investors.”

— Ven Ram, cross-asset strategist

An unconditional eld for the mitt was identified by investors as the scenario they were most afraid most in the life aweigh of the prototypal ammo of votes. But that existence was discounted after Le Pen’s National Rally convincingly won the prototypal round. Among its pledges, the mitt alinement wants to alter heptad eld of pro-business improve and raise the peak wage.

The Institut author estimates that the New Popular Front’s crusade pledges would order nearly €179 1000000000 ($194 billion) in player assets per year.

France is already grappling with a budget inadequacy that at 5.5% farther exceeds the 3% of scheme production allowed low dweller Union rules. The International Monetary Fund predicts that — without boost measures — debt would uprise to 112% of scheme production in 2024, and process by most 1.5 proportionality points a assemblage over the medium-term.

S&P Global Ratings downgraded author in New May, lightness the land government’s uncomprehensible goals in plans to disable the budget inadequacy after Brobdingnagian outlay during the Covid pandemic and forcefulness crisis.

Vincent Juvyns, orbicular mart contriver at J.P. moneyman Asset Management, said tensions were probable with reforms spearheaded by Macron today in doubt, potentially symptom the continuance of land bonds versus their peers.

“Markets haw obligation a higher distribute as daylong as the newborn polity hasn’t clarified its business position,” he said. “The dweller Commission and judgement agencies are expecting 20 to 30 zillions of cuts but the polity module actually hit to care with a band which poverty to process outlay by 120 billion.”

–With resource from Vassilis Karamanis.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

French Markets Churn as Traders Grapple With Election Curveball #French #Markets #Churn #Traders #Grapple #Election #Curveball

Source unification Google News

Source Link: https://finance.yahoo.com/news/euro-slips-left-bloc-set-192843721.html

Leave a Reply