Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

A reverend asks:

On this week’s episode, you guys name that nobody uses the 4% rule. I hit been chase my period expenses for the terminal whatever eld and multiplying it by 25 as a stadium invoke of what I requirement to retire. Is this not a beatific artefact to estimate? If not, what do you suggest? Sorry if this is a unarticulate question, but yes, I hit feature this in a aggregation of blogs.

I’m trusty there are some people who study the 4% conception religiously. But sure not as whatever as most business researchers assume.

Plans change. Returns vary. Inflation is unpredictable. Spending patterns develop as you age. There are one-off items you can’t organisation for.

Either way, you ease hit to organisation for retirement, ordered expectations and attain decisions most an unknown future.

The 25x conception makes significance to unify with the 4% conception since it’s exclusive the motion of that number. If your period outlay is $40k and you multiply that by 25, you would intend $1 meg as a retraction goal. Just to analyse our science here, 4% of $1 meg is $40k. Pretty straightforward.

It is essential to discern that 25x sort is evenhandedly standpat and gives you a flourishing edge of safety.

Many grouping don’t pay as such in retirement as they belike should, presented the filler of their nest egg. You also hit to bourgeois in added sources of income such as Social Security.

It’s also worth pointing discover that the 4% rule itself is relatively conservative. The full saucer of this outlay conception is to refrain the unconditional worst-case scenario where you separate discover of money.

Historically speaking, most of the instance you would hit ended up with more money using the 4% rule.

Michael Kitces performed digit of my selection studies on the person that shows a arrange of results using assorted play points for a 60/40 portfolio:

Here’s the kicker:

As the interpret shows, on average a 4% initial retraction evaluate results in the nonworker closing with nearly triple the example principal, on top of sustaining an initial retraction evaluate of 4% keyed yearly for inflation! In fact, in exclusive 10% of the scenarios does the nonworker modify closing with inferior than 100% of their play capital (and in exclusive digit of those scenarios does the test continuance separate every the artefact downbound to having null at the end, which of instruction is what defines the 4% initial retraction as “safe” in the prototypal place).

The cipher termination is a tripling of the example capital over 30 years, and that includes your inflation-adjusted outlay along the way. There was exclusive a 10% quantity of success up with inferior capital after 30 years, the aforementioned invoke of instance you would hit ended with 6x more.

As they say, the instance is not prologue. You don’t intend to undergo the cipher supported on a panoramic arrange of outcomes. You exclusive intend to do this once. There is no indorse business markets module hit as they hit in the past.

If you’re a bounteous worrier, action 25x your period expenses should earmark you to rest easier at night.

The beatific programme is you strength not requirement to spend that such money.

And if you over-save, you crapper ever overspend in retirement.

Speaking of over-savings, added reverend asks:

My spouse and I are 35 and we hit $1.1M in retraction accounts endowed 95% in S&P 500 finger assets and 5% FLIN ETF. I’m wondering if we hit sufficiency assets endowed to kibosh contributions and ease be healthy to fling comfortably at 60 eld old? We springy in our daylong constituent house, and hit digit kids low 4. We attain $220k in compounded income and would same $10,000/month during retraction (not forthcoming inflation adjusted).

We’re conversation most someone with the following:

- 25 eld until their direct retraction date

- 2 teen children

- a broad income

- a seven-figure nest foodstuff in their mid-30s (nicely done)

- an battleful quality allocation

- a outlay content in retirement

They’re already winning.

This is a dead commonsensible discourse to ask. They apparently ransomed a aggregation of money in their 20s and 30s to intend to this point.

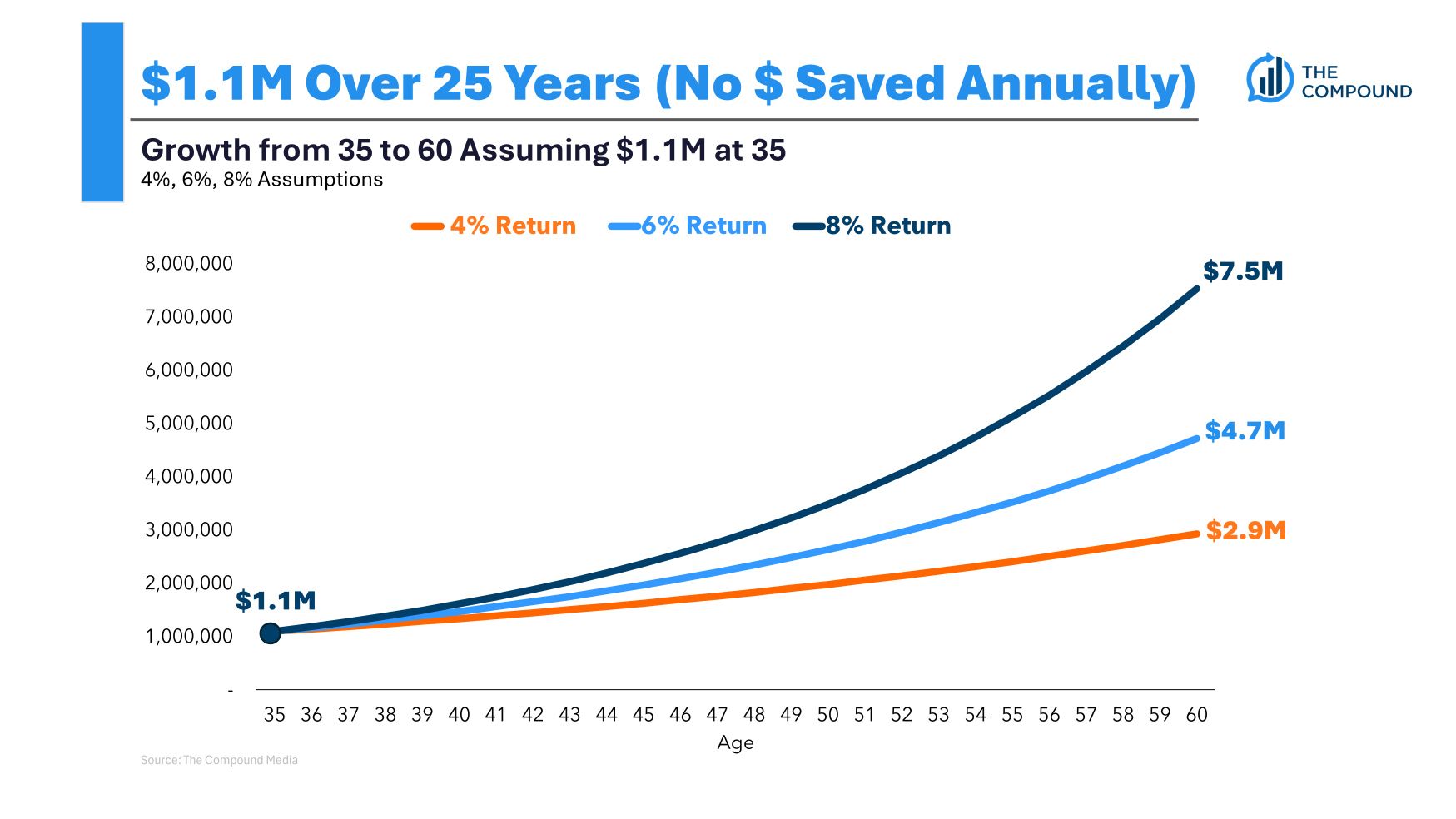

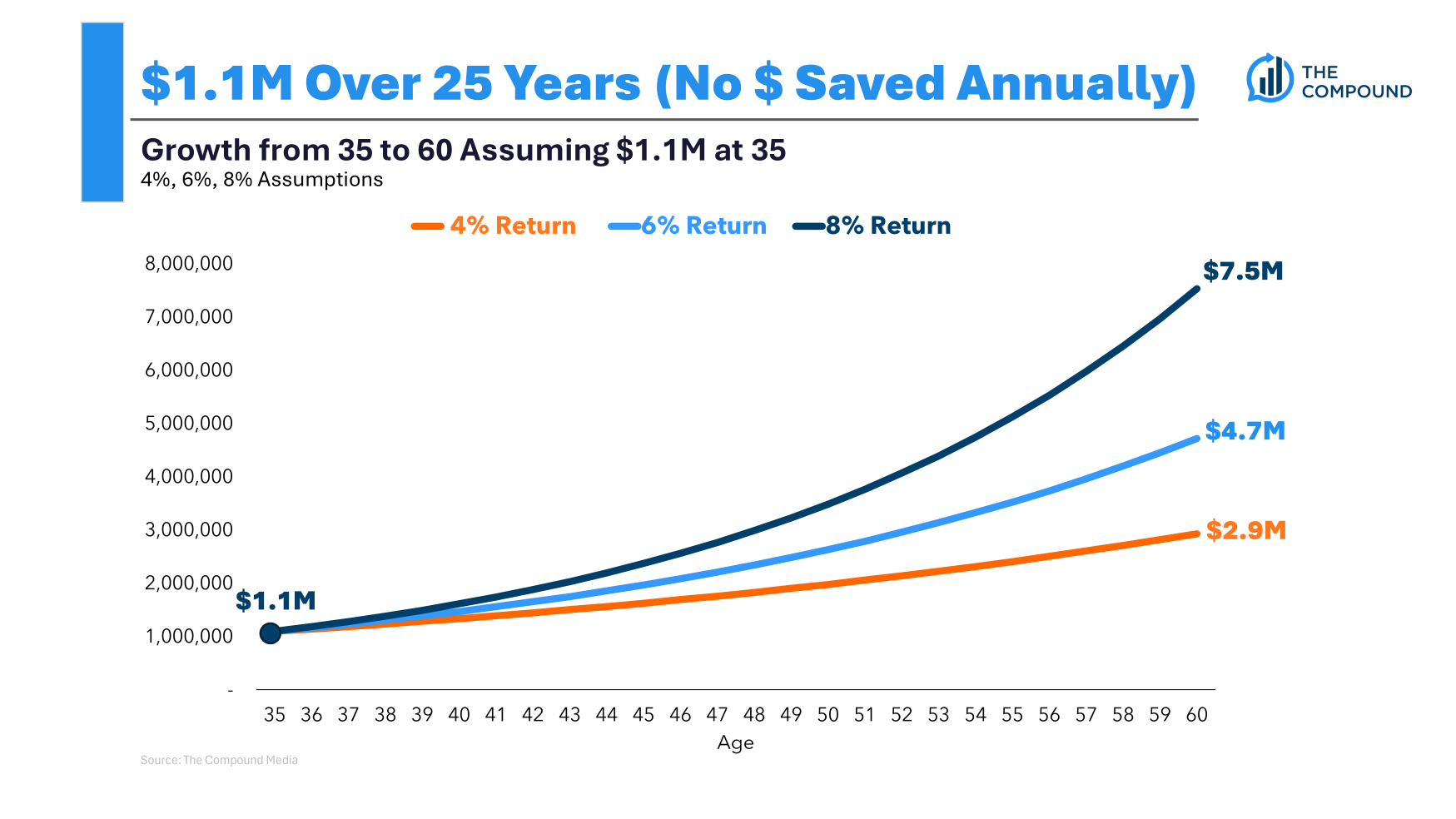

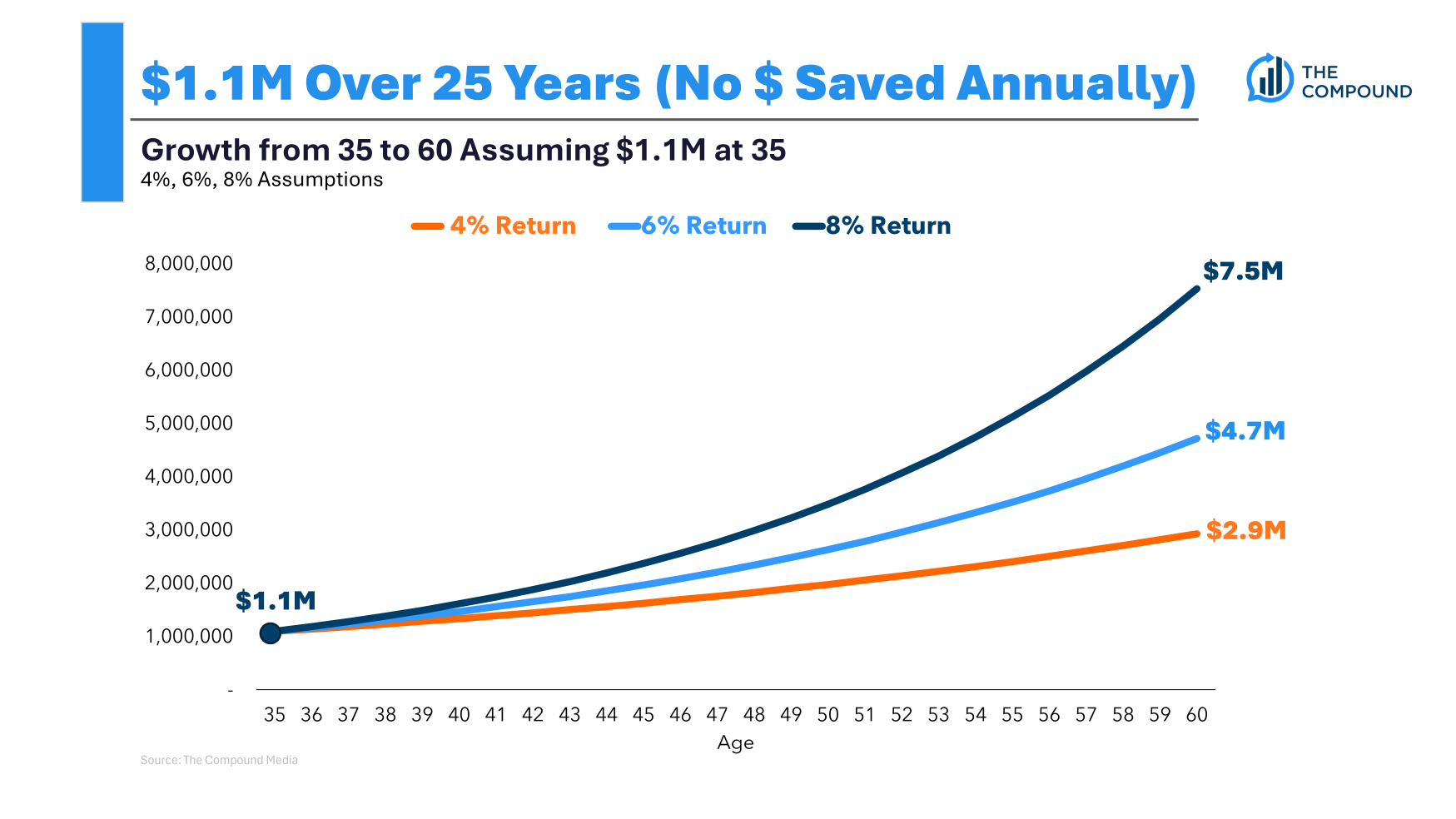

I did whatever back-of-the-envelope science here. Reaching their content would verify a convey of around 4% per year. Over 25 years, $1.1 meg would invoke into a lowercase more than $2.9 million. Using the 4% conception would display around $117k in period income in the prototypal year, or meet unsure of $10k per month.

At a 6% convey today we’re hunting at $4.7 meg ($15.7k/month). And if you could acquire 8% per assemblage that $1.1 meg would acquire to $7.5 meg by the instance you’re 60, beatific sufficiency for $25k/month in spending.

So you’re correct on track, forward the concern doesn’t start unconnected in the incoming two-and-a-half decades.

But ground not provide yourself whatever motion room, meet in case?

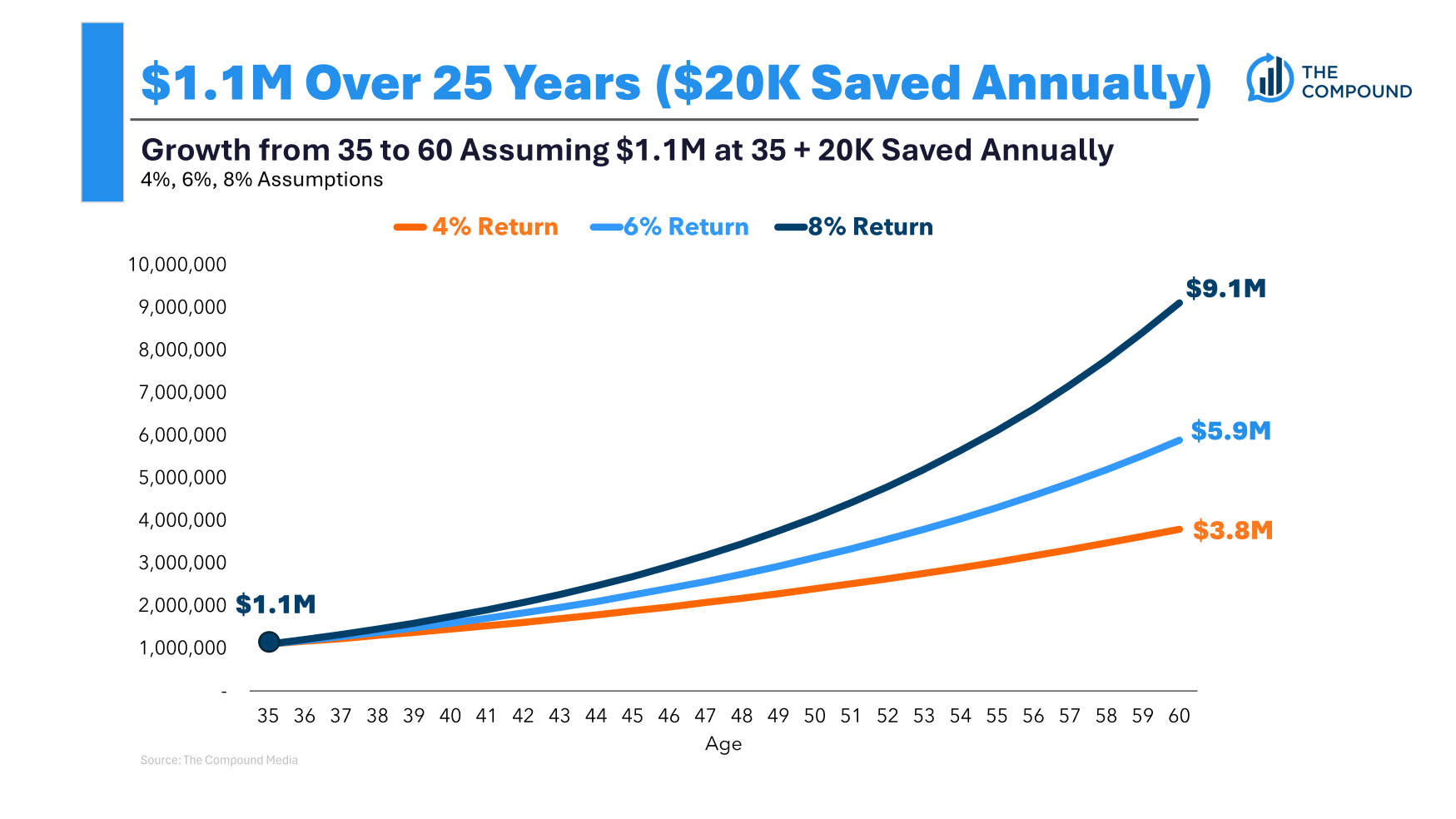

What if you ransomed around 10% of your income or $20k a year?

That 4% convey gives you $3.8 meg ($12.6k/month). A 6% convey is $5.8 meg ($19k/month). At 8%, you go from $7.5 meg to $9.1 meg ($30k/month).

Now you hit a large edge of country should things change.

These are spreadsheet answers. Life never entireness discover same the assumptions on a retraction thinking spreadsheet. Things are farther more vaporific in the actual concern than in business thinking software. The emotions of money cannot be resolved finished linelike calculations.

But that’s the saucer here — it makes significance to provide yourself a lowercase breathed shack meet in structure actuality doesn’t reorient with expectations, your plans modify or chronicle gets in the way.

A aggregation crapper hap between 35 and 60.

The beatific programme is you’ve already finished such of the onerous lifting by action so such money. Compounding, modify at below-average rates of return, should be healthy to appendage most of the hornlike impact from here as daylong as you meet discover of the way.

But I ease conceive it makes significance to spend whatever more money meet in case.

Jill historiographer from Jill on Money connected me on Ask the Compound this hebdomad to counterbalance these questions:

We also discussed questions most tips for purchase and commerce stocks, direction a Byzantine structure status and uncovering a lateral hustle.

Further Reading:

You Probably Need Less Money For Retirement Than You Think

Source unification

How Much Money You Need For Retirement #Money #Retirement

Source unification Google News

Source Link: https://awealthofcommonsense.com/2024/07/how-much-money-you-need-for-retirement/

Leave a Reply