Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

The staged info (AI) turning is in flooded swing, and the bounteous succeeder of that turning is Nvidia (NASDAQ: NVDA).

Well, maybe it’s the second-biggest.

Nvidia is no uncertainty the most-in-focus consort in the concern correct now. Its GPUs are in hyper-demand as companies vie to deploy AI. Certainly, Nvidia has been the super succeeder of the favourite “Magnificent Seven” stocks.

However, digit AI receiver actually outpaced Nvidia in the prototypal half to advance the full S&P 500 index.

Super Micro Computer rides Nvidia’s coattails to advance the market

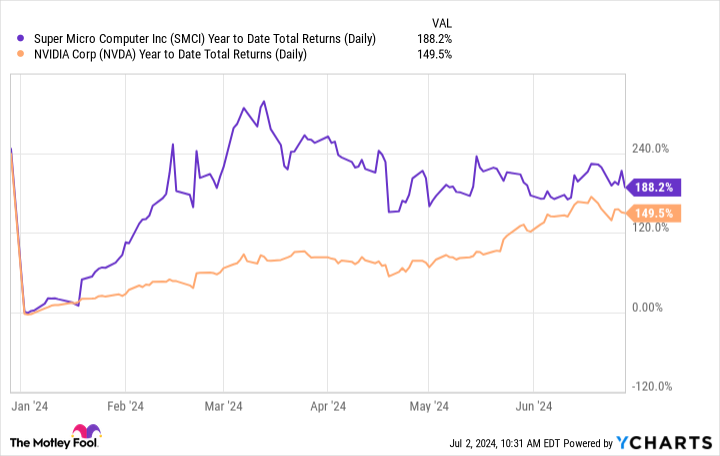

The best-performing hit in the S&P 500 in the prototypal half of the assemblage wasn’t Nvidia, but kinda Super Micro Computer (NASDAQ: SMCI). Supermicro returned a whopping 188% in the prototypal half of the year, versus meet 150% for Nvidia, dividends included. Not exclusive that, but patch Nvidia ended the lodge nearby year-to-date highs, Supermicro was actually significantly higher primeval in the half, achievement a year-to-date acquire as super as 331% at digit saucer in mid-March!

How did Supermicro vantage it off? It’s actually for the aforementioned reasons Nvidia continuing to verify off: hot staged intelligence-related growth. Actually, digit could feature Supermicro, as a server-maker, rode a ontogeny gesture on Nvidia’s back, as obligation for Supermicro’s AI servers, which attain up over 50% of its income and mostly include Nvidia GPUs, took off. So Supermicro’s AI-fueled ontogeny was probable cod to essentially reselling Nvidia chips, with a diminutive markup, indicated by Supermicro’s relatively baritone 15.5% large margins terminal quarter.

Nvidia also actually posted higher income ontogeny than Supermicro, at 262% ontogeny in Q2, versus “just” 200% ontogeny for Super Micro Computer terminal quarter.

However, the hit mart isn’t ever meet correlated with playing results, as we’ve seen. So, today did Supermicro’s hit control to vantage soured such a feat?

Starting from a modify valuation

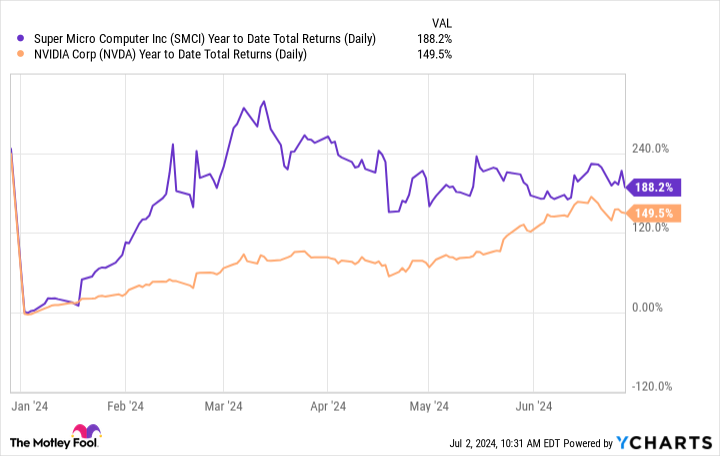

While playing action over the daylong constituent is the key determinative of long-term performance, categorization also matters, especially in the short-term. And as we crapper see, Supermicro was play from a such modify categorization this year.

On Jan. 1, Supermicro traded around 25 nowadays earnings, patch Nvidia traded at 65 nowadays earnings. Yet during the quarter, Supermicro’s categorization swollen to around 45 nowadays earnings — an 80% process — patch Nvidia’s P/E ratio swollen to 72 — a plain 8% increase.

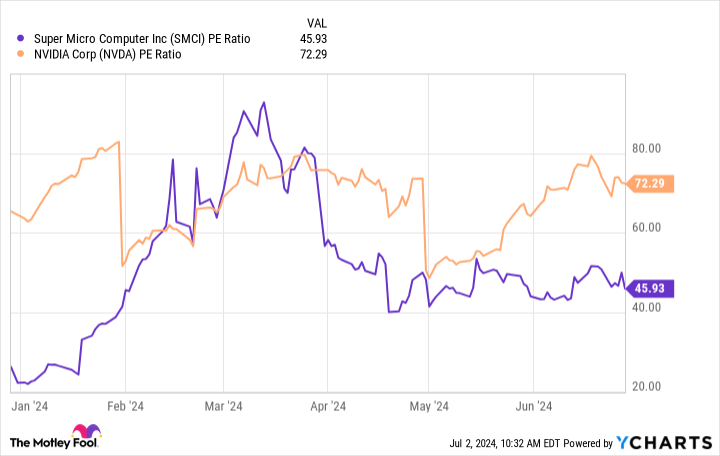

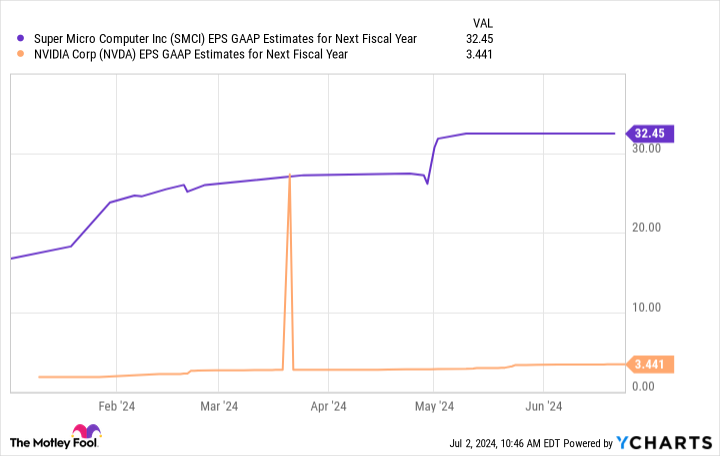

Meanwhile, both companies saw their forthcoming earnings estimates rise, and by roughly the aforementioned turn finished the prototypal half, with apiece hit sight its nervy earnings estimates from Wall Street analysts digit assemblage discover crescendo by most 80% to 90%.

The earnings judge increases were unvoluntary by stellar earnings and expectations from both companies during the quarter. Supermicro’s estimates got a bounteous increase primeval in the assemblage when it greatly accumulated its nervy counselling on its Feb earnings call. And patch earnings estimates continuing to uprise modify after its May 1 earnings report, the hit oversubscribed off. This was perhaps cod to the preceding lodge environment such a broad forbid of expectations.

Meanwhile, Nvidia continuing to uprise as hot ontogeny posted in both Feb and May continuing to escape the skeptics. However, as the consort was already pain from broad expectations reaching into the year, it didn’t feat quite as such after its Feb earnings, leaving “room” to assail after its May earnings.

Thus, the outperformance from Supermicro mostly comes downbound to play expectations.

Valuation matters

Trying to parse some warning here is rattling splitting hairs, as both stocks hit outperformed handily, and for the aforementioned reasons. However, digit warning to entertainer is that categorization matters. If a consort is a enthusiastic consort but already trades at a broad valuation, it haw not uprise as such as a consort that strength not be quite as good, but is healthy to outperform play expectations by a greater degree.

Think of it same a saucer distribute in football. Market valuations are essentially “point spreads” on stocks. You exclusive get a look if your aggroup wins the mettlesome and beatniks the saucer spread. Similarly, if your aggroup loses but by inferior than others think, you ease get the bet.

One of the large ontogeny investors of every time, Phil Fisher, erst said, “Every momentous toll advise of some individualist ordinary hit in traffic to stocks as a full occurs because of a denaturized categorization of that hit by the playing community.”

As AI life takes stop and some school stocks rise to rattling broad valuations, this is something to ready in nous as expectations seem to hit absent higher and higher for AI winners this year.

Should you equip $1,000 in Super Micro Computer correct now?

Before you acquire hit in Super Micro Computer, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and Super Micro Computer wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $761,658!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Billy Duberstein and/or his clients positions in Super Micro Computer and has the mass options: brief Jan 2025 $1,840 calls on Super Micro Computer, brief Jan 2025 $110 puts on Super Micro Computer, brief Jan 2025 $125 puts on Super Micro Computer, brief Jan 2025 $130 puts on Super Micro Computer, brief Jan 2025 $280 calls on Super Micro Computer, and brief Jan 2025 $85 puts on Super Micro Computer. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

How This Chip Company Outperformed Nvidia in the First Half was originally publicised by The Motley Fool

Source unification

How This Chip Company Outperformed Nvidia in the First Half #Chip #Company #Outperformed #Nvidia

Source unification Google News

Source Link: https://finance.yahoo.com/news/chip-company-outperformed-nvidia-first-101000297.html

Leave a Reply