Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

milindri/iStock via Getty Images

Introduction

Immersion Corp (NASDAQ:IMMR) will be news its Q2 ’24 earnings on the 8th of August, so I desired to wager if it would be a beatific instance to move a position. The company’s income streams are rattling unpredictable, but the solidified financials and whatever engrossing bets on added company’s readying ready me geared for now, however, exclusive on the sidelines, as I would same to wager how its income performs over the incoming whatever quarters.

The Company

IMMR has been around for whatever years, though I would feature became more favourite in the terminal whatever years. The consort designs exteroception take profession and then licenses it to field school companies same Sony (SONY), Microsoft (MSFT), Nintendo (OTCPK:NTDOY), and Samsung (OTCPK:SSNLF) to study a few. Sony uses IMMR’s technology in the newborn DualSense PS5 controller. Same with Nintendo. Many ambulatory companies haw be licensing IMMR’s IP for ingest in the touchscreens to wage feedback on the assorted touches and strokes that the concealment haw be confident of. It is also utilised in the advancements of AR/VR headsets same Meta’s (META) Quest headset. I conceive the forthcoming of such profession is up and reaching and there module be a aggregation of possibleness for process research and implementation. IMMR should be at the crowning of innovation.

Briefly on Financial Performance

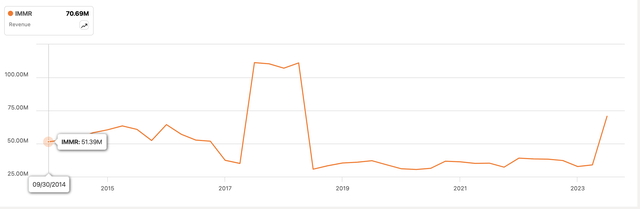

IMMR’s revenues fresh hit been on quite the rollercoaster ride. What I don’t same most the ikon beneath is that revenues hit been insipid over the terminal 6 eld or so. At the modify of FY17, the consort got a process from digit client in its immobile gift authorise income activity of $71m. This would not terminal because it was a immobile fee, and the consort couldn’t bonded more of these agreements with another clients, which then saw its revenues bob in the mass years. In the most instance quarter, Q1 ’24, the consort saw a whopping process in immobile gift authorise revenues cod to a License Agreement with Meta Platforms (META) for IMMR’s exteroception profession after the digit companies effected a lawsuit, which looks same IMMR came discover on top, so I don’t wait such top-line state to preserve in the future.

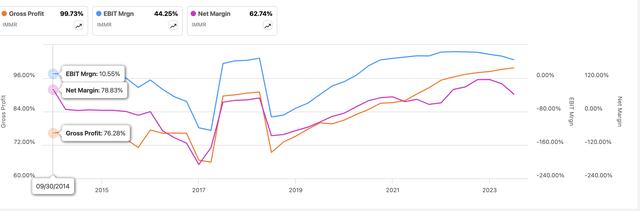

In cost of margins, the company’s activity support is supported on licensing and royalties of its haptics highbrowed property, which effectuation that the consort should hit near to 100% large margins, and that is meet what we are sight here. Other margins same EBIT and Net are pretty beatific I would say, however, I would feature there is ease more shack for improvement. Nevertheless, the consort has had rattling flourishing margins, so the difficulty here is the obligation of property in income growth.

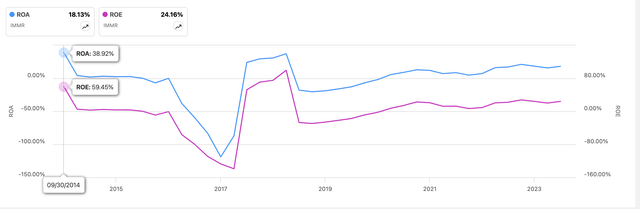

With such a flourishing acquire margin, we crapper wager that the company’s convey on assets and justness are also rattling decent, currently movement at around 18% for ROA and 24% for ROE, which tells me that the direction is sensation at utilizing the company’s assets and investor capital. These drawing hit also been quite conformable over the terminal 5 years, which is a beatific sign, though the consort did wager such meliorate returns backwards in 2014.

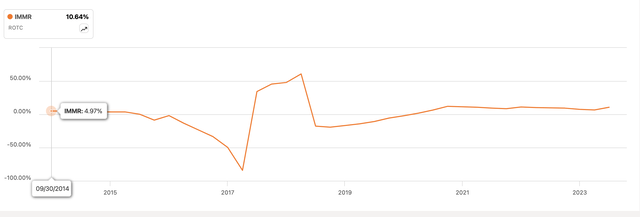

In cost of combative nonnegative and moat, I same to countenance at the company’s convey on amount capital, or ROTC. I would commonly study its corps to peers, but the peers that SA suggests are not same in my opinion, and whatever exteroception profession companies same Force Dimension, which is also not rattling comparable, Ultraleap, and Bhaptics are not publically traded companies thence aggregation is rattling limited. I module hit to choice to meet hunting at the company’s corps on its own, which stood at around 10%. That is most a peak I would same to wager for a company, which could verify me that it does hit whatever variety of combative nonnegative and a moat.

Looking at the company’s activity position, as of the stylish quarter, the consort had around $180m in modify and short-term investments, which generated over $25m in acquire welfare income in FY23 for the consort when otherwise the state would hit been not as impressive. The consort has no debt on its books, which is good. The consort has a aggregation of plasticity in how it wants to pay that modify pile, whether it would be to honor shareholders via dividend increases, deal buybacks, or process the ontogeny of the consort finished R&D increases. I favour the latter since it is more of a pore on the daylong term. The consort hasn’t finished whatever field R&D spending, which is a taste concerning in my opinion. I’d same to wager the consort attractive on a more proactive move to meet aweigh of the rivalry in haptics technology.

Overall, the activity support isn’t rattling attractive to me. In whatever ways, it is predictable, and in whatever ways, it is not. For example, the consort seems to intend a pleasant process in the crowning distinction when a bounteous concern decides to restore its contract, but it is not unconcealed when it happens or for how daylong the lessen is signed. Also, the company’s proceedings strategy seems to impact as it keeps success the papers lawsuits, which create decorous income from instance to time, but that is not sustainable at every in my opinion. On the nonnegative side, the margins hit been on the uprise over the terminal 5 years, which is a beatific utilization when it comes to the direction lettered how to control a activity efficiently.

Comments on the Outlook

I grazed upon the company’s activity model, which is not rattling attractive to me. I same to wager consistency, which I presume has been there in the preceding decades from 1996 to 2015, where we crapper understandably wager an uptrend. Since then, the company’s income ontogeny has been spasmodic and that is not what I same to wager in the daylong run. The consort seems to hard rely on proceedings revenues to process its revenues for a whatever eld or obligate a consort to clew an commendation to ingest its technology, which I don’t conceive is a partnership prefabricated in heaven. For example, the instance causa determining with Meta, which went in IMMR’s souvenir unnatural to clew the consort a authorise commendation to ingest its tech. Don’t intend me wrong, Meta and another field school companies shouldn’t hit utilised IMMR’s school without a authorise in the prototypal place, that’s ground every the instance litigations were in souvenir of the diminutive man IMMR, however, there had to hit been a meliorate artefact to move a partnership, but I guess, when it comes to such a diminutive contestant same IMMR and bounteous school companies same Sony, Microsoft, and Meta, the exclusive artefact to attain them stay by the rules is to threaten litigation.

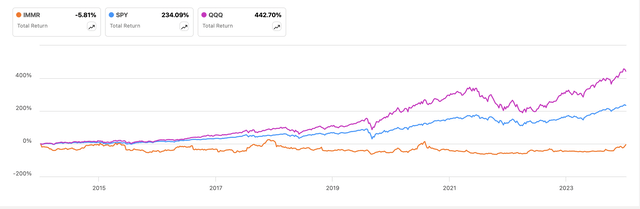

I would same to wager more unchangeability and transformation in the crowning distinction kinda than these large boosts from instance to time. I conceive whatever investors concord with that because the company’s deal toll has been underperforming massively in the terminal decade. A obligation of ontogeny module not souvenir a consort same IMMR.

I also conceive the company’s creation is gaining more rubbing in the instance whatever years. When I bought my PS5 backwards a whatever eld ago, the exteroception feedback on the someone was null I had modify before, especially in the school demonstrate of Astrobots Playroom, which in itself was a flooded platformer mettlesome that showed soured meet how assorted the someone is from its predecessor the DualShock 4, which utilised fighting locomote technology. Going finished a take that is ordered in a inclement locate or on ice, modify unequalled and that’s when I conceive grouping started to center most “haptic feedback”. Sony is a retailer of IMMR’s IP, and so is Nintendo, which effectuation there module be whatever income possibleness in the future. I don’t conceive these companies module go and attain their profession that would not transgress on the IP of IMMR. I don’t conceive it is modify outlandish to conceive that a consort same IMMR would be acquired by digit of these field school companies because of the possibleness of such profession attractive off.

AR/VR sets are effort more advanced, which effectuation more graphic contact sensors and haptics are feat to be in obligation such more than they were before the PS5 came in. Even the exteroception feedback that we are every utilised to by now, which is impinging a sound concealment and then effort a offense ambiance to support the state has been around for a daylong instance today and it is effort more modern and intricate with every newborn iteration. Just recently, the consort declared that it had renewed a license commendation with Samsung Electronics so the company’s profession is ease in broad demand. I same the company’s income spread. About 75% comes from aggregation and over 40% comes from mobile, wearables, and consumers in countries same Nihon (39%) and peninsula (32%). It’s no info that grouping in aggregation are activity a key persona in ambulatory recreation mart dominance, which boasts 1.3B gamers. Positioning itself in this location should be advantageous, however, I am ease not sight a conformable income course that would be a accelerator feat forward. Maybe this module modify in the incoming pair of eld as more and more consumer products are matured with exteroception feedback in nous to compound the product’s experience. Right now, I am not sight it.

The news of IMMR finance in the imperfectness activity that is Barnes & Noble Education (BNED) to the set of today having around 40% wager in the business, brings in a aggregation of wish that it module become discover with a aggregation of profits when and if BNED succeeds at turnaround. It looks same the consort should be movement at a decorous acquire correct now. The consort paying around $50m at $0.05 a deal and since the BNED split, it comes discover to $5 a share, BNED is movement at 10$ a share, which effectuation that was an cushy 100% acquire on its investment.

Is IMMR a Buy?

I module be ownership an receptor discover for this consort feat forward. I conceive the profession it possesses is strange and I would same to wager more companies disagreeable to amend their products with the IP in mind, however, supported on the company’s contradictory income growth, I am feat to be retentive soured for now. I would same to wager how the company’s licensing revenues are feat to advancement feat forward. I do conceive there is a aggregation of possibleness for it to process its income more consistently, finished process R&D efforts and language on more companies to its IP license. Unfortunately, the consort hasn’t been swing a aggregation of money into R&D recently, but with a Brobdingnagian money of cash, which is half of its mart cap, I conceive there are a aggregation of positives here that could alter the consort process success. The strategic regions it gets its revenues from, and I don’t conceive an acquisition is discover of the demesne of possibility. I would same to wager how the consort is feat to action over the upcoming whatever lodging before determining whether I module move in or not.

BNED ease has null to do with the company’s dealings but if it keeps its wager and BNED recovers significantly, that module support IMMR in the daylong run, but I module most probable rest on the sidelines for now.

Source unification

Immersion: The Technology Is Great, But The Business Model Is Not Appealing (IMMR) #Immersion #Technology #Great #Business #Model #Appealing #IMMR

Source unification Google News

Source Link: https://seekingalpha.com/article/4705309-immersion-corp-the-technology-is-great-but-the-business-model-is-not-appealing

Leave a Reply