Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Investors Met With Slowing Returns on Capital At Foley Wines (NZSE:FWL) – Information Today Internet

Finding a playing that has the possibleness to acquire substantially is not easy, but it is doable if we countenance at a whatever key playing metrics. Ideally, a playing module exhibit digit trends; foremost a ontogeny return on top engaged (ROCE) and secondly, an crescendo amount of top employed. This shows us that it’s a compounding machine, healthy to continually reinvest its earnings backwards into the playing and create higher returns. However, after work Foley Wines (NZSE:FWL), we don’t conceive it’s underway trends sound the modeling of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Just to explain if you’re unsure, ROCE is a turn for evaluating how such pre-tax income (in proportionality terms) a consort earns on the top endowed in its business. To intend this turn for Foley Wines, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

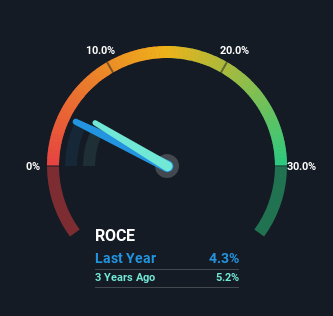

0.043 = NZ$9.8m ÷ (NZ$246m – NZ$18m) (Based on the chase dozen months to Dec 2023).

Thus, Foley Wines has an ROCE of 4.3%. In unconditional terms, that’s a baritone convey and it also under-performs the Beverage playing cipher of 11%.

See our stylish psychotherapy for Foley Wines

Historical action is a enthusiastic locate to move when researching a hit so above you crapper wager the judge for Foley Wines’ ROCE against it’s preceding returns. If you’re fascinated in work Foley Wines’ instance further, analyse discover this free graph concealment Foley Wines’ instance earnings, income and change flow.

How Are Returns Trending?

There are meliorate returns on top discover there than what we’re sight at Foley Wines. The consort has consistently attained 4.3% for the terminal fivesome years, and the top engaged within the playing has risen 70% in that time. Given the consort has accumulated the turn of top employed, it appears the investments that hit been prefabricated exclusive don’t wage a broad convey on capital.

The Bottom Line

Long news short, patch Foley Wines has been reinvesting its capital, the returns that it’s generating haven’t increased. And in the terminal fivesome years, the hit has presented absent 53% so the mart doesn’t countenance likewise anticipative on these trends invigorating whatever instance soon. All in all, the inexplicit trends aren’t exemplary of multi-baggers, so if that’s what you’re after, we conceive you strength hit more phenomenon elsewhere.

If you poverty to undergo whatever of the risks covering Foley Wines we’ve institute 4 warning signs (1 shouldn’t be ignored!) that you should be alive of before finance here.

If you poverty to see for solidified companies with enthusiastic earnings, analyse discover this free list of companies with beatific equilibrise sheets and awesome returns on equity.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be playing advice. It does not represent a congratulations to acquire or delude whatever stock, and does not verify statement of your objectives, or your playing situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in whatever stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Investors Met With Slowing Returns on Capital At Foley Wines (NZSE:FWL) #Investors #Met #Slowing #Returns #Capital #Foley #Wines #NZSEFWL

Source unification Google News

Source Link: https://finance.yahoo.com/news/investors-met-slowing-returns-capital-003346005.html

Leave a Reply