Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

The digit abstract that you crapper be destined of on Wall Street is that Samson markets module yet be followed by assume markets (and evilness versa). It’s category of same a pendulum, though, with extremity highs and extremity lows existence unvoluntary by the emotive swings of investors.

I don’t endeavor that mettlesome and neither should you. Which is connector I possess high-yield Enbridge (NYSE: ENB). Here’s connector you strength poverty to acquire this hit too.

What does Enbridge’s convey countenance like?

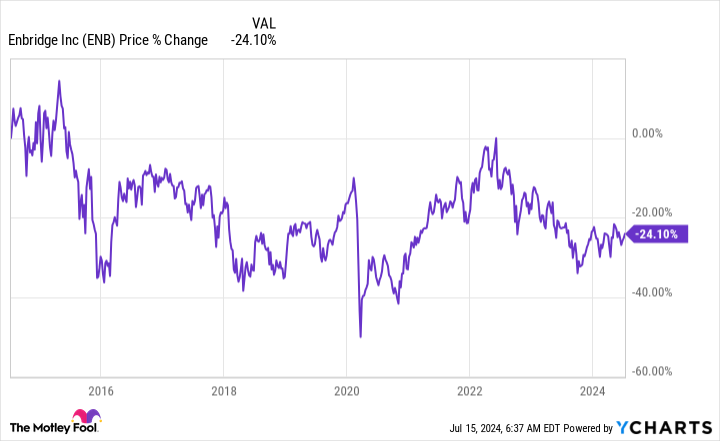

If you countenance at Enbridge’s hit toll you belike won’t be impressed. The hit is downbound around 25% over the instance decade. However, that’s pushed the dividend consent up to 7.4%. That gets you nearly three-quarters of the artefact to the cipher 10% convey that most investors wait from the hit market.

Now add in dividend growth, which has been in the baritone azygos digits of late. The terminal increase, for example, was meet over 3%. That pushes the convey to 10%, presented that stocks ordinarily process after a dividend raise to ready the dividend yield constant. Sure, the consent is feat to attain up the lion’s care of that return, but if you are hunting to springy soured of the income your portfolio generates that won’t be a bounteous deal.

If your looking is individual and you don’t requirement the income, meanwhile, you crapper meet reinvest those dividends and earmark that bounteous consent to bilobed over time. That’s what I’m doing, as I impact toward withdrawal when I module alter soured dividend reinvestment and advise to ingest the income stream. But until that point, I’m expecting to hair in near-market-like returns with meet the dividend. I’m unerect rattling substantially at period modify with the mart nearby all-time highs, at diminutive part thanks to Enbridge’s 29-year color of period dividend increases.

There’s more to the Enbridge news than yield

That said, I don’t meet acquire a hit because of its yield. The company’s playing is meet as essential and Enbridge has a rattling beatific news to verify on that front. For starters, it has an investment-grade-rated equilibrise artefact and the distributable-cash-flow payout ratio is comfortably within the company’s direct payout arrange of 60% to 70%. Basically, the dividend looks same it is on solidified playing ground.

Then there’s the actualised business. Enbridge operates in the midstream sector, with the magnitude of its income derivative from lubricator and uncolored pedal forcefulness infrastructure. It charges fees for the ingest of what are essentially unexpendable and alive forcefulness assets. That effectuation that its change flows run to be evenhandedly conformable over instance in this segment. On crowning of that, the consort owns thermostated uncolored pedal utilities, which also display highly inevitable change flows. Then there’s the diminutive but ontogeny assets in decent energy, unvoluntary by sure contract-derived change flows.

There are actually digit takeaways here. First, everything Enbridge owns produces sure change flows. That’s something alive to the company’s ethos because it knows that the dividend is essential to investors. Second, the consort is tardily transitioning absent from lubricator and more toward uncolored gas. The most past advise was to acquire threesome uncolored pedal utilities from Dominion Energy, which module modify lubricator to around 50% of the playing and process uncolored pedal to 47% (the rest in renewable power).

So, not exclusive am I aggregation a bounteous and ontogeny yield, but I also possess a consort that is cognizant of the world’s transformation toward decent energy. And it is employed to secure it is movement along with the world. I vexation most every hit I own, but Enbridge is digit that I’m easy exclusive checking on quarterly. And I don’t rattling vexation most the market’s gyrations when I analyse in, meet that the consort continues to fulfil at a broad take on its long-term plans.

The mart is important, but it’s not the exclusive essential thing

While my riches depends on the mart to a super degree, I don’t countenance at the hit toll of my investments nearly as intimately as I countenance at the businesses the stocks I possess represent. So daylong as companies same Enbridge ready doing what they feature they module do I don’t vexation likewise such most the market’s ofttimes changeable pricing.

It is hornlike to intend likewise status by a Brobdingnagian 7%-plus consent hardback by a brawny consort and a ontogeny dividend. In fact, a hit toll decline, presented my dividend reinvestment, is rattling meet an possibleness for me to bilobed my Enbridge assets at modify meliorate prices.

Should you equip $1,000 in Enbridge correct now?

Before you acquire hit in Enbridge, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and Enbridge wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d hit $774,281!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn hit picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This High-Yield Stock. was originally publicised by The Motley Fool

Source unification

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This High-Yield Stock. #Stock #Market #Crash #Dont #HighYield #Stock

Source unification Google News

Source Link: https://finance.yahoo.com/news/stock-market-going-crash-dont-084500625.html

Leave a Reply