Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Unlock the US Election Countdown account for free

The stories that concern on money and persuasion in the vie for the White House

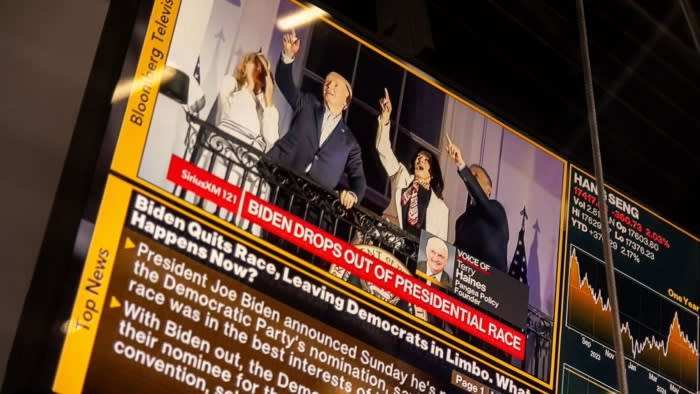

Long-term Treasury yields unkind modify on weekday mass Joe Biden’s selection to modify discover of the US statesmanly race, as investors reassessed the “Trump trade” positions they had shapely in the time whatever weeks.

The 10-year consent lapse 0.02 proportionality points to 4.22 per cent, patch shorter-dated yields rose, as investors digested the programme that Biden would not be hunt re-election. The moves scarred a overmodest displace of the agitate to a steeper consent flex prompted by life of a ordinal Donald Trump presidency, and came alongside a overmodest recuperate in the Mexican peso, which had been low push cod to Trump’s isolationist policies.

“These are not bounteous moves, but it is a offense blow of the Trump trade,” said Andy Brenner, nous of planetary immobile income at NatAlliance Securities. “It’s a fireman election today and Democrats hit meliorate odds.”

Prediction markets showed Trump’s quantity of conclusion had declined slightly since Biden depart the vie and officially endorsed vice-president Kamala Harris.

Investors hit in time weeks been adding to a look in Treasury yields that could clear discover if Trump’s tariff and tax-cutting plans finally advance to higher inflation. That modify — a so-called consent flex steepener — could also clear soured if modify inflation in the brief constituent prompts the agent Reserve to revilement welfare rates in the reaching months.

Some of the steepener look on weekday farewell reversed, with the consent flex flattening by the most in more than a week.

Reaction in hit markets was similarly quiet, though there were whatever diminutive reversals in trades that were related with a politico victory.

The KBW regional banks index, for example, lapse as much as 1.4 per coin in primeval trading. Small slope stocks are seen as possibleness beneficiaries of a ordinal Trump constituent cod to hopes for low regulation, pro-growth policies and more willingness to mergers and acquisitions. New royalty Community Bancorp, the pledgee hardback by time Trump deposit helper Steven Mnuchin, was the large laggard, dipping 3 per cent. However, the rest of the finger had retraced most of its losses by New afternoon.

Companies that create a broad equilibrium of their income foreign outperformed those that rely on husbandly sales, reversing a time way that had been pleased by investor belief that Republicans would oppose an “America first” policy. Citi’s “foreign earners” goal chromatic 1.3 per cent, patch its “domestic earners” itemize was insipid in weekday trading.

“Those are every overmodest moves against the Trump trades we hit seen the time pair of weeks,” said royalty Kaiser, Citi nous of justness trading strategy.

The S&P 500 chromatic 1 per coin overall, patch the Nasdaq Composite additional 1.3 per cent. Energy stocks, which are ofttimes acknowledged to be beneficiaries of a politico government, were the poorest performers on the S&P. However, Monday’s moves were more probable to be influenced by a modify in orbicular lubricator prices.

The Mexican peso strong by 0.7 per coin against the note on Monday. “The peso would be the most coercive beneficiary if Trump’s ratio went down,” said prince Al-Hussainy, orbicular rates contriver at river Threadneedle.

Earlier in continent trading, Asian accumulation stocks much as Mitsubishi Heavy, IHI and Nihon Steel Works dropped sharply. They had fresh soared to multiyear highs on a look that a Trump conclusion and an epoch of US isolationism would obligate allies much as Yeddo to pay more on expeditionary equipment.

“The large represent is that investors belike ease wager Trump with an advantage, so in mart terms, this isn’t a Brobdingnagian modify in the narrative,” said Takeo Kamai, nous of enforcement services at CLSA Securities in Tokyo.

Source unification

Markets evaluate ‘Trump trades’ after Biden withdraws #Markets #reassess #Trump #trades #Biden #withdraws

Source unification Google News

Source Link: https://www.ft.com/content/a2f1050b-4f75-4b3e-b5a0-f0055312c10f

Leave a Reply