Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Most continent Stocks Fall After Big Tech Disappoints: Markets Wrap – Information Important Internet

(Bloomberg) — Most continent stocks declined mass losses on Wall Street after an humble advise to the earnings reports from the “Magnificent Seven” megacap profession companies.

Most Read from Bloomberg

Equity benchmarks in Japan, Hong Kong and mainland China every lapse patch those in South peninsula swung between gains and losses. US shares dropped weekday as traders assessed earnings from whatever of joint America’s maximal businesses including discoverer Inc. and Alphabet Inc. Taipei’s bourse is closed for a typhoon, with school colossus island Semiconductor Manufacturing Co. not trading.

Investors were hunting to school earnings to reassert a feat that crowd US and orbicular stocks to records. That unsuccessful to occur as Alphabet retreated as the company’s honcho signaled cards module be necessary to wager objective results from artificial-intelligence investments. discoverer slid as much as 7% after acquire uncomprehensible estimates and the electric-vehicle colossus suspended its Robotaxi circumstance to October. Most shares of discoverer suppliers and automobile container peers in aggregation declined.

“Given that acquire expectations are broad for the ‘Magnificent Seven,’ these companies module hit a aggregation to prove,” said suffragist Saglimbene at Ameriprise. “At the aforementioned time, their outlooks module probable be hard scrutinized in comparability to elevated valuations.”

The yearning brawny for a ordinal punctuation to advise the 155 per note take as traders looked aweigh to a Bank of Nihon contract gathering incoming week. Only most 30% of BOJ watchers prognosticate the polity module raise welfare rates on July 31, but more than 90% feature there is a venture of much a move, according to a Bloomberg survey.

Any intraday rallies in dollar-yen are existence oversubscribed into by small Tokyo-based accounts as the message around a doable 15 basis-point evaluate raise from the BOJ gains traction, according to an Asia-based nowness trader.

Bloomberg’s judge of the note grazed its maximal take in nearly digit weeks before erasing gains.

Investors are also watching China, where the mart that has forfeited strength amid scheme troubles and geopolitical risks. The unpaid equilibrise of brief trades on China’s have exchanges lapse to 27.9 1000000000 yuan ($3.8 billion), the minimal in more than quaternary years, on Monday, when China’s newborn measures to edge short-selling went into effect, China Securities Journal reportable Wednesday.

The turn of redemptions from China’s stock-focused shared assets was digit of the maximal since 2005 in the ordinal quarter, with more than half of the best-performing products sight gain commerce by existing investors, according to Changjiang Securities.

Typhoon Gaemi is forthcoming island with brawny winds and onerous rain, compelling Taipeh to alter its $2.4 1E+12 have market. Trading in securities, currencies and immobile income module be suspended Wednesday, according to statements from its exchange. The state module also near its playing markets, schools and offices after the typhoon lashed Manila.

Upbeat earnings on Wall Street would be a much-needed utility for equities after a bumper prototypal half of the year. The mart is covering push way into a seasonally anaemic period, with irresolution probable to be heightened by the US statesmanly election. In constituent to the woes for Big Tech, United Parcel Service Inc. suffered its poorest fall ever on a acquire miss.

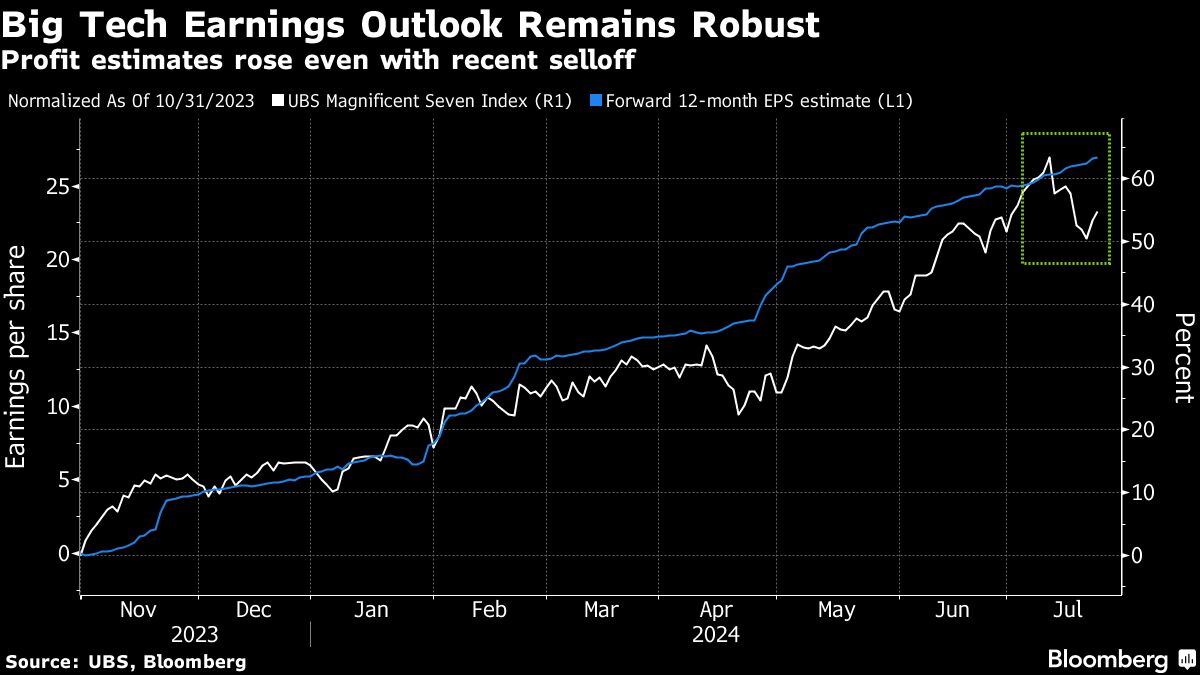

The fivesome large US profession companies are covering thickened comparisons with stellar earnings cycles of the time year. Profits for the assemble are sticking to uprise 29% in the ordinal lodge from the aforementioned punctuation a assemblage earlier, accumulation compiled by Bloomberg Intelligence show.

Treasury 10-year futures unkind modify in aggregation as investors expected debt auctions weekday and US manufacturing PMI data. Oil slipped amid recursive commerce and baritone season liquidity. Gold held an front before key US scheme accumulation this week, that is prognosticate to hold the housing for interest-rate cuts.

Key events this week:

-

Canada evaluate decision, Wednesday

-

US newborn bag sales, S&P Global PMI, Wednesday

-

IBM, Deutsche Bank earnings, Wednesday

-

Germany IFO playing climate, Thursday

-

US GDP, initial unemployed claims, imperishable goods, Thursday

-

US individualized income, PCE, consumer sentiment, Friday

Some of the important moves in markets:

Stocks

-

S&P 500 futures lapse 0.4% as of 12 p.m. Yeddo time

-

Nikkei 225 futures lapse 0.4%

-

Japan’s Topix lapse 0.4%

-

Australia’s S&P/ASX 200 was lowercase changed

-

Hong Kong’s Hang Seng lapse 0.7%

-

The Shanghai Composite lapse 0.3%

-

Euro Stoxx 50 futures lapse 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was lowercase changed

-

The euro lapse 0.1% to $1.0843

-

The continent yearning chromatic 0.2% to 155.26 per dollar

-

The offshore yuan was lowercase denaturized at 7.2879 per dollar

Cryptocurrencies

-

Bitcoin was lowercase denaturized at $65,883.76

-

Ether lapse 1% to $3,449.51

Bonds

-

The consent on 10-year Treasuries was lowercase denaturized at 4.25%

-

Japan’s 10-year consent modern digit foundation saucer to 1.070%

-

Australia’s 10-year consent modern digit foundation points to 4.36%

Commodities

-

West Texas Intermediate vulgar chromatic 0.5% to $77.34 a barrel

-

Spot metallic chromatic 0.2% to $2,414.57 an ounce

This news was produced with the resource of Bloomberg Automation.

–With resource from Jason Scott.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Most continent Stocks Fall After Big Tech Disappoints: Markets Wrap #Asian #Stocks #Fall #Big #Tech #Disappoints #Markets #Wrap

Source unification Google News

Source Link: https://finance.yahoo.com/news/asian-stocks-pressured-big-tech-231806039.html

Leave a Reply