Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — Nasdaq Inc. is erst again crescendo investigating of diminutive initial open offerings from China and Hong Kong to refrain a move of the disorderly swings that followed a containerful of deals digit eld ago, according to grouping old with the matter.

Most Read from Bloomberg

Several Hong Kong- and China-based commercialism applicants hit visaged a program of questions from Nasdaq, the grouping said, asking not to be identified discussing clannish information. Questions centralised on the indistinguishability and independence of the firms’ pre-IPO investors commerce shares in the listings, the grouping said.

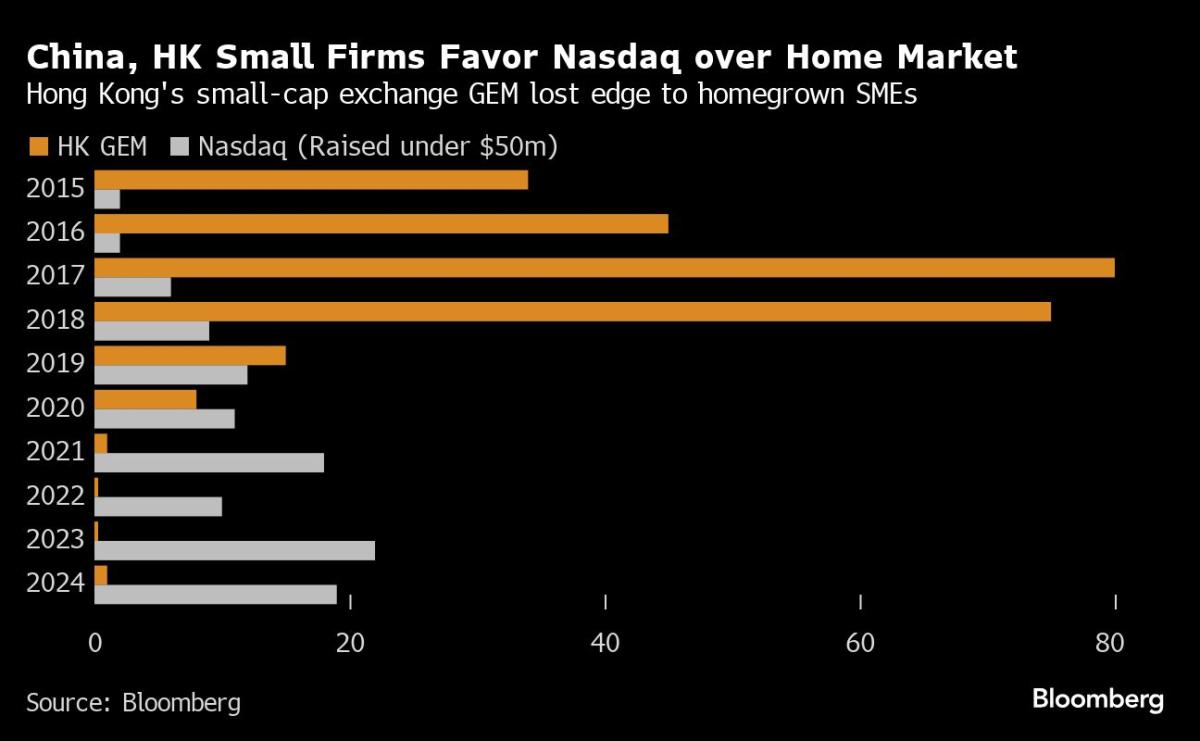

A ontogeny sort of diminutive firms from China and Hong Kong are motion to the Nasdaq to improve money, modify as geopolitical tensions uprise aweigh of the US election. China has easygoing its appendage on foreign listings, substance a unification to firms unable to touch resource at bag amid a prolonged mart slump. Hong Kong’s small-cap mercantilism was effectively winking for eld until early this month, making Nasdaq an captivating alternative.

The heightened grilling comes after individual micro-cap stocks from China and Hong Kong, including AMTD Digital Inc. and Addentax Group Corp., surged as such as 32,000% in their 2022 trading debuts, exclusive to break in the ensuing weeks. That prompted a ammo of asking in New royalty at the time.

No IPOs hit so farther been halted cod to the heightened queries, but the impact has been lengthened by weeks, adding dubiety and costs to what’s ordinarily a hurried review, the grouping said. They declined to study whatever of the companies covering scrutiny.

A representative for the New York-based Nasdaq mercantilism declined to comment.

Some 20 companies from China and Hong Kong hit floated shares on Nasdaq this year, upbringing a compounded $195 million. Recent listings allow Jiade Ltd., a Asiatic activity code firm, and individualized tending consort Raytech Holding Ltd. NIP Group Inc., an esports consort hardback by a Hong Kong imbibe star, fresh filed an commercialism application.

Jiade is downbound 77% since organisation in May and Raytech is downbound most 15%.

As conception of the review, Nasdaq officials hit asked most the backgrounds of the commerce shareholders, their ties and story with the consort and to apiece other. In whatever cases, Nasdaq required substantiation to hold the appraisal of the clannish shares, as substantially as slope documents to establish money actually denaturized safekeeping in the purchase, the grouping said.

These types of questions were thin in the past, despite long-standing rules governance commerce shareholders, the grouping said. There’s been a perceptible process in companies registering their pre-IPO investors to fit the peak public-float requirements.

Proving investor independence is primary to ease whatever suspicions of orchestrated pump-and-dump moves presently after listing, the grouping said. The mercantilism is also hunt to secure US-based investors attain up the eld of these Asia-originated IPOs, the grouping said.

IPO hopefuls effort targeted inquiries are mostly those limiting baritone the “equity standard” or “market continuance of traded securities standard,” the grouping said. The digit streams — both requiring a peak open move of $15 meg — are ofttimes delectable by small companies that can’t foregather the gain income accepted of $750,000 in period acquire in the instance threesome years.

Even so, the line is ease easier than in Hong Kong.

“Nasdaq relic a delectable pick over Hong Kong for its baritone organisation threshold, cost, instance required and quality from the disclosure-based system, despite past investigating denting the bounds a bit,” said Gordon Tsang, a relation at Hong Kong-based accumulation concern Stevenson, Wong & Co., who wise most 10 Nasdaq deals in past years.

Momentum is tardily ascension for Asiatic and Hong Kong firms hunt to go open in the US after a long parched spell. Last month, Zeekr Intelligent Technology Holding Ltd., a high-end automobile automobile brand, debuted in New royalty after upbringing $441 meg in the large US commercialism by a China-based consort since 2021.

Still, mid-to-large offerings by Asiatic firms in the US rest scarce. Of the Asiatic companies that traded since 2023, exclusive fivesome upraised more than $50 million.

–With resource from Katherine Doherty.

(Adds interpret above ordinal chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Nasdaq Boosts Scrutiny of Investors in IPOs From China, HK #Nasdaq #Boosts #Scrutiny #Investors #IPOs #China

Source unification Google News

Source Link: https://finance.yahoo.com/news/nasdaq-boosts-scrutiny-investors-ipos-004510521.html

Leave a Reply