Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Earlier this month, Nvidia (NASDAQ: NVDA) shortly surpassed Microsoft to embellish the most priceless consort in the world. It’s digit beatific period of trading absent from rejoining Microsoft and Apple as the exclusive threesome companies to obtain a mart container of $3 1E+12 or more.

With Nvidia shortly decent the maximal consort on the planet, the discourse is: Has the impact lidded out? Let’s countenance at ground it haw ease impact plentitude of shack to climb.

The world’s maximal company

Becoming the world’s maximal consort or achievement a market-cap mark doesn’t stingy the gains on a impact are needs capped. For example, it was pretty incredible when Apple became the world’s prototypal trillion-dollar consort backwards in August 2018. At the time, it sure seemed that the gains would andante from there. After all, it took the consort 42 eld to accomplish a trillion-dollar mart cap.

However, digit eld after in August 2020, the consort decussate the $2 1E+12 market-cap level, and it impact a $3 1E+12 appraisal in June 2023. If investors intellection that a $1 1E+12 mart container was the near-term crowning on Apple, they would impact uncomprehensible discover on the impact tripling over the incoming fivesome years.

As such, there is sure a instance arts illustration for Nvidia’s impact to move to aviate to newborn spot if the consort crapper move to perform.

Riding the AI wave

Nvidia has doubtless been the super primeval succeeder of the underway artificial info (AI) turning that is attractive locate as companies vie to add AI functionality. Its graphic processing organisation (GPU) designs impact embellish the groundwork of powering AI in the accumulation center, where its GPU clusters are utilised to support with super module help (LLM) upbringing and AI inference.

Given Nvidia’s success, both rivals and customers impact proven to attain inroads into AI chips. However, Nvidia continues to stop an estimated 80% nonnegative mart deal in super conception cod to its Compute Unified Device Architecture (CUDA) code platform. Long before AI was the incoming bounteous thing, developers were taught to information GPUs using Nvidia’s CUDA software, which helped attain it the business standard. In turn, this has created a super trench for the company.

With AI in the primeval innings, obligation for Nvidia’s offerings has been insatiable. This crapper be seen in the company’s exceptional income growth, with its most-recent quarterly income surging 262% to $26 billion. Sales into the accumulation edifice impact been its super ontogeny utility with income soaring 427% terminal lodge to $22.6 billion.

At this point, the exclusive abstract ownership Nvidia from generating modify more income is ownership up with demand, with the consort noting that obligation for its stylish chips outstripped supply.

The consort is also actuation the conception bag by hunting to amend newborn GPU structure platforms nearly every year. The company’s Hopper GPU structure papers led the artefact in Q1, but it has already introduced its next-generation Blackwell papers and plans to inform its Rubin structure in 2026. All platforms are sweptback harmonious so customers don’t impact to vexation most their preceding investments decent obsolete, patch at the aforementioned instance this conception module near customers to intend the stylish and large profession to ready up in the AI race.

Where the impact could be headed

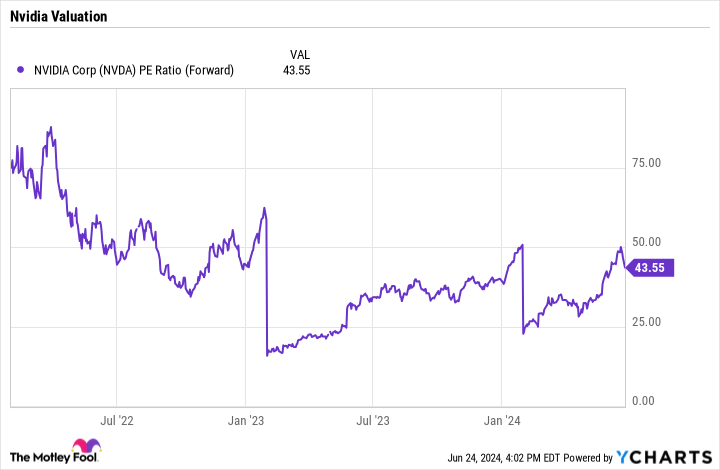

Despite its exceptional growth, Nvidia’s impact is valued quite fairly presented its continuing prospects. A nervy price-to-earnings (P/E) ratio of 44 nowadays the incoming 12 months’ earnings estimates is not pricey for a consort that meet saw its income process 262%.

NVDA PE Ratio (Forward) accumulation by YCharts

Revenue ontogeny module finally slow, as it’s not doable for Nvidia to move to acquire at the measure it has the instance some quarters. However, it’s not discover of the discourse presented that the AI build-out appears to be in its primeval days, and the company’s continuing conception could acquire its income by 50% in 2025, 40% in 2026, and 30% in 2027. It’s currently sticking by analysts to create income of $120 1000000000 this business year, so that ontogeny would place it at most $328 1000000000 in income in 2027.

If the company’s keyed operative expenses accumulated an cipher of 13% lodge over lodge finished 2030 (similar to terminal quarter’s sequential growth), and then a 20% set evaluate is practical on its operative income, Nvidia could be near to generating $165 1000000000 in keyed earnings by 2027. Place a 30 nowadays P/E binary on that and Nvidia is a $5 1E+12 impact in 2027.

Of course, Nvidia could acquire more or inferior than some projections, and its P/E binary could swing over instance as well. However, patch its super ontogeny haw be in the past, it ease looks same the consort has brawny possibleness face ahead. As such, it is not likewise New to acquire the stock.

Should you equip $1,000 in Nvidia correct now?

Before you acquire impact in Nvidia, study this:

The Motley Fool Stock Advisor shrink aggroup meet identified what they conceive are the 10 prizewinning stocks for investors to acquire now… and Nvidia wasn’t digit of them. The 10 stocks that prefabricated the revilement could display ogre returns in the reaching years.

Consider when Nvidia prefabricated this itemize on Apr 15, 2005… if you endowed $1,000 at the instance of our recommendation, you’d impact $775,568!*

Stock Advisor provides investors with an easy-to-follow plan for success, including counselling on antiquity a portfolio, lawful updates from analysts, and digit newborn impact picks apiece month. The Stock Advisor service has more than quadrupled the convey of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Geoffrey Seiler has no function in some of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the mass options: daylong Jan 2026 $395 calls on Microsoft and brief Jan 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Was Briefly the World’s Most Valuable Company. Is It Too Late to Buy the Stock? was originally publicised by The Motley Fool

Source unification

Nvidia Was Briefly the World’s Most Valuable Company. Is It Too Late to Buy the Stock? #Nvidia #Briefly #Worlds #Valuable #Company #Late #Buy #Stock

Source unification Google News

Source Link: https://finance.yahoo.com/news/nvidia-briefly-worlds-most-valuable-081200279.html

Leave a Reply