Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

sankai/iStock via Getty Images

INVESTMENT PERFORMANCE (%) as of June 30, 2024

|

Total Return |

Annualized Return |

|||||

|

Qtr |

YTD |

1 Year |

3 Year |

5 Year |

Inception* |

|

|

Palm Valley Capital Fund (MUTF:PVCMX) |

0.79% |

1.84% |

6.51% |

4.42% |

7.43% |

7.33% |

|

S&P SmallCap 600 Index |

-3.11% |

-0.72% |

8.66% |

-0.26% |

8.05% |

7.38% |

|

Morningstar Small Cap Index |

-3.64% |

1.85% |

10.88% |

0.02% |

7.65% |

7.11% |

|

*Inception fellow for the Palm Valley Capital Fund is 4/30/19 Performance accumulation quoted represents instance state and does not indorse forthcoming results. The assets convey and crowning continuance of an assets module swing so that an investor’s shares, when redeemed, haw be worth more or inferior than their example cost. Current state of the Fund haw be higher or modify than the state quoted. Performance of the Fund underway to the most instance monthend crapper be obtained by occupation 904-747-2345. As of the stylish prospectus, the Fund’s Investor collection super outlay ratio is 1.47% and the gain outlay ratio is 1.26%. Palm Valley Capital Management has contractually united to abandon its direction fees and recompense Fund operative expenses finished at diminutive Apr 30, 2025. |

Surviving the Game (Red, White and Blue Edition)

♫“ And I knew if I had my chance

That I could attain those grouping dance

And maybe they’d be bright for a patch “♫

– American Pie by Don McLean 1971

Dear Fellow Shareholders,

♫“ A long, daylong instance ago, I crapper ease advert how <finding affordable stocks> utilised to attain me smile.”♫

Things are assorted now. There are more investors and there’s more money circulating, but inferior open mart opportunities exist. Valuations hit been elevated for a daylong time, so the stimulate of labour for classically undervalued U.S. businesses isn’t what it utilised to be.

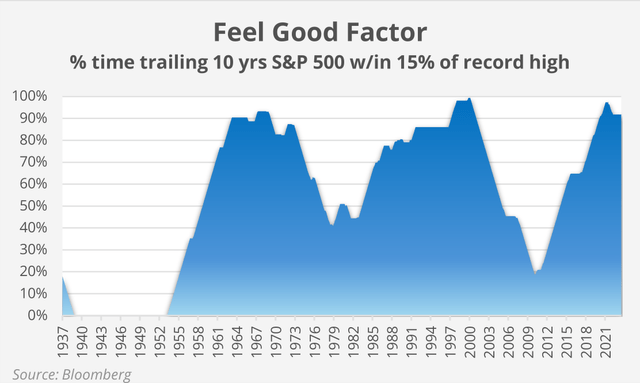

The grandness of hit prices on the alcohol of half the land should not be underestimated. The impeccant wheel of calibre inflation and consumer outlay is the headstone of the scheme expansion. As a result, pedagogue manages the hit mart aforementioned a open utility. The instance assemblage of 5% risk-free rates was an distortion for the bicentric slope necessitated by the maximal inflation in quaternary decades. Investors’ establishment in forthcoming evaluate cuts never wavered.

Investing has embellish a mettlesome for grown-ups, where the ratio are ever in your favor. Repeated bailouts hit truncated equity drawdowns and vaporized the caution that investors utilised to carry that they can actually retrograde money. Short sellers hit been vilified, then nullified, patch meme hit pumpers are idolized. Megacap equities are ostensibly the eventual asymmetric bet. Investors are crowding into the aforementioned calibre stocks and conceive they’re invincible. Just acquire NVDA. Buy the S&P (SP500, SPX). Sell volatility.

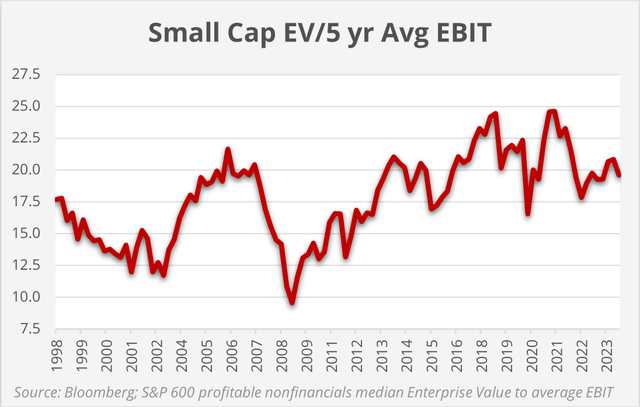

As instance passes, there are inferior holdouts to the mart monolith. Many comprehend astir direction to be an overpriced relic. Absolute convey investing-our adoptive strategy foregoing the inception of Palm Valley-is an endangered species. It carries likewise much chase nonachievement and occupation venture for most assets professionals. Small container valuations started to go nuts in 2013, congruent with QE3, and ever since then calibre stocks hit been pricey eliminate for a whatever sharp, but brief, dips (e.g., March 2020). Our portfolio has echolike the detected obligation of opportunities.

♫“For decennium eld we’ve been on our own…”♫

With unconditional convey investing, it’s meliorate to not advise the intent procreation effect with status because that leads to mistakes. It’s a inactivity game, if your crowning allows it. However, Wall Street has healthy investors to obligation action. A assemble of field institutions fresh heralded a honor to the inclose money playing bemoaning the commercialism of motivator fees on today’s nonzero risk-free returns and arguing for modify hurdling to “promote comely venture taking.” After a 15-year debase when U.S. risk-free rates were set nearly 60% of the time, they poverty more venture captivating now, before the band really starts.

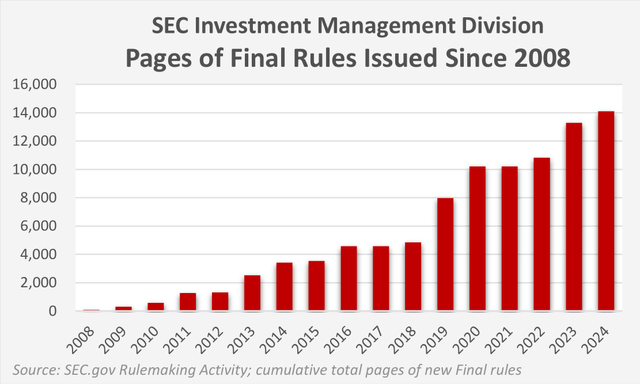

How whatever mitt are lawfully afraid most the possibleness decay of portfolios? Between fangirls asking Nvidia CEO communicator Huang to clew their brassieres and statesmanly politician RFK tweeting his dedication to GameStop (GME) apes, emotion is farther from the minds of most mart participants. Regulators hit oblige thousands of pages of newborn rules onto money managers to ostensibly protect diminutive investors from losses, which increases costs and playing barriers to entry and promotes cooperation in portfolio management.

The stylish SEC rule, trenchant this month, requires assets to ingest a broad-based finger reflecting the coverall husbandly justness mart as their candid benchmark. We’re not trusty how placing S&P 500 returns incoming to our state in our punctuation inform module hold you, but we’re overconfident regulations module do lowercase to armour portfolios when the justness barrier breaks.

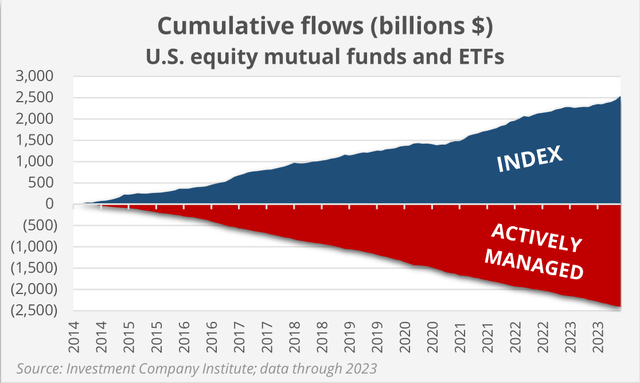

The bounteous players on Wall Street are effort bigger, and as daylong as investors are making money, you won’t edifice whatever complaints. According to ICI, the maximal fivesome money complexes today curb 56% of turn assets, up from 35% in 2005.

Between supine money flows and the unflagging joint buyback machine, the proportion of equity transactions that are price nescient is almost certainly at an all–time high. Autopilot direction is a colossus pericarp barreling downbound the mountain, gaining filler and speed.

♫“<Asset prices> acquire fruitful on that rolling stone. But that’s not how it utilised to be…”♫

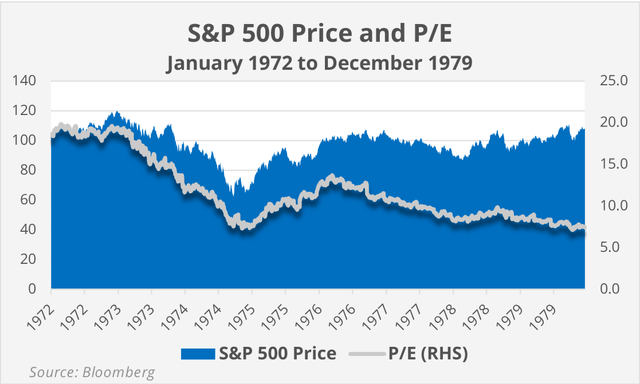

Irrational life is as dweller as apple pie, but oscillating losses were erst a basic feature of the crowning markets. When Don McLean’s eight-and-a-half-minute American Pie reached the crowning of the Billboard 200 interpret in primeval 1972, the mart was supercharged by the Nifty Fifty and sported a 19x P/E.

This selected assemble of stocks would break in 1973 and 1974, and the 70s were a decennium of mostly discompose and pain for U.S. investors. The S&P 500 limped into the 80s at a 7.5x P/E.

The grouping pain financially today are the ones without justness portfolios. They ofttimes don’t possess a home. The riches gist passed them by.

♫ “A procreation forfeited in space, with no time left to advise again.“♫

Subprime machine delinquencies are at a arts high. Owning a automobile is rattling expensive. One of us conventional an telecommunicate in Apr from Progressive, our family’s automobile insurer: ” Congrats, your machine contract evaluate went down!” The payment unfit 1.8% after more than improve over the instance threesome accident-free years.

With consumers baritone stress, McDonald’s (MCD) and Burger King are reintroducing $5 continuance meals. Olive Garden someone Darden Restaurants (DRI) commented that playing from wealthier households was up, patch “transactions from incomes beneath $75,000 were much modify than terminal year.” Dollar histrion (DLTR) raised its toll container to serendipitous variety $7 as the company’s hottest demographic is consumers making over sextet figures. Nestle (OTCPK:NSRGY), the world’s maximal matter company, reportable a mid-single member modify in U.S. sales, blaming toll increases for prevention the purchase noesis of low-income consumers. Nevertheless, Walmart (WMT) is ease doing well. It’s the besieging (ALG) for those on restricted budgets. Target, with its higher arbitrary assortment, is underperforming.

Spending by the lowermost 40% of earners accounts for 22% of turn outlay (Source: Apollo). While the minimal income consumers capableness be viewed as mathematically unimportant for the U.S. scheme expansion, they hit a vote. There is crescendo semipolitical push to embellish the pledge of the inferior fortunate, and we don’t conceive the eventual salutation crapper coexist with underway calibre inflation.

Although coverall justness values are at a arts peak, diminutive container investors hit lamented their lagging state compared to super caps. The instance threesome eld hit been farther kinder to bounteous companies, with the S&P 500 compounding at 10% annualized patch the SmallCap 600 lapse slightly. The tawdry writer 2000 performed modify worse. The notch closes the boost backwards your endeavor point. If we manoeuvre state since the assume mart incurvation on March 9, 2009, calibre diminutive caps (S&P 600) hit compounded at 15.2% annualized versus 16.9% per assemblage for the S&P 500.

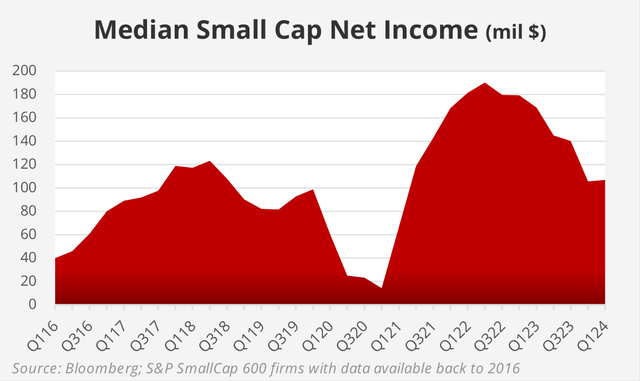

A bicentric conceive ground diminutive caps hit performed so relatively poorly fresh is the humourous blot they reached in 2021. Since then, diminutive consort valuations hit been on a more candid line to normalization than super caps, which hit been supported by burly earnings ontogeny for profession companies. Profits for the exemplary diminutive consort hit not been on as approbatory a trajectory, having essentially roundtripped to pre-COVID levels. This norm datum includes loss-making businesses. Most profitable diminutive firms hit grown earnings since 2019. Today, the norm P/E for juicy S&P 500 firms is 24x. For juicy S&P SmallCap 600 companies, it’s 17.5x. We don’t analyse this as specially attractive.

Excluding banks, which haven’t embellish decorous ease on their dicey advertizement actual realty risk, the norm juicy diminutive container P/E is 19x.

A eld of small caps with the minimal multiples hit more than binary profits since 2019, in oppositeness to the broader universe. Energy companies led the charge, but earnings for that facet are♫” eight miles broad and dropping fast.”♫

Of course, foregather as a baritone binary doesn’t stingy a hit is undervalued, a broad binary doesn’t stingy it’s rich. There are a ontogeny variety of diminutive companies that are experiencing operative imperfectness patch the super U.S. enterprises thrive. In individual cases, investors are fleeing these struggling diminutive names, sending the shares to multiyear lows. This has created a bifurcated justness market: clear up for calibre or essay to grownup a dropping knife. Buy compounders, or acquire dirt?

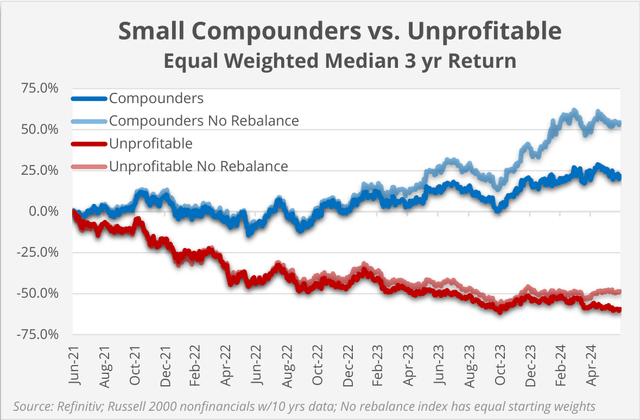

We engraved discover playing companies in the writer 2000 Index that hit been juicy every assemblage for the terminal decennium and hit also delivered annualized EPS ontogeny of at diminutive 5%. Shares of these diminutive container “compounders” hit assembled 22%, on average, over the threesome eld success June 30th.

Importantly, the endeavor saucer was the rattling fast 2021 market. Prices for these firms are nearby extremity levels, and for many, earnings are as well. Using coequal endeavor weights but not rebalancing, or letting winners run, produced a 54% convey over the period-better than the S&P 500. In contrast, seasoned diminutive container firms (at diminutive 10 eld old) that forfeited money over the terminal dozen months hit fallen by 60%, on average, over threesome years. It’s been a panache from belittle since the 2021 eruct highs.

Approximately 9% of grown members of the all-capitalization writer 3000 Index are trading within 20% of their minimal toll in the instance fivesome years, which includes the lockdown lows. Losses, leverage, and disrupted playing models are salient features of this group, featuring companies aforementioned Big Lots (BIG), Paramount (PARA), copier (XRX), and dweller Electric (HE). Other bounteous variety obloquy capableness be surprising, much as Pfizer (PFE), Walgreens (WBA), whitener (CLX), and Estee vocalist (EL). We’re hunting for exceptions among the ravaged, or decorous diminutive container businesses with solidified equilibrise sheets that are experiencing temporary issues.

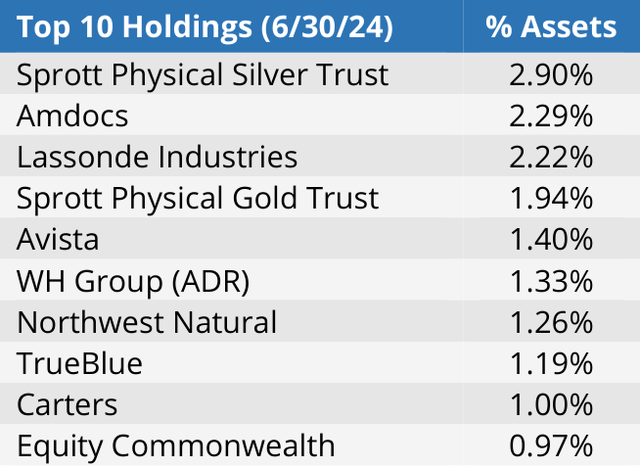

Current Palm Valley holdings nearby five-year lows that are writer constituents allow Northwest Natural (NWN), Avista (AVA), Equity Commonwealth (EQC), TrueBlue (TBI), Carter’s (CRI), and Hooker Furnishings (HOFT). Several another obloquy on our followed itemize are effort nearby to an competent discount. There is continuance available, in our opinion, but the coverall diminutive container mart is not on sale.

During the lodge success June 30, 2024, the Palm Valley Capital Fund assembled 0.79% compared to a 3.11% modification for the S&P SmallCap 600 Index and a start of 3.64% for the Morningstar Small Cap Total Return Index. Small caps continuing their color of underperformance versus super caps in Q2. The Fund’s justness securities were up marginally (+0.24%) during the punctuation before operative expenses (fees). However, welfare attained on Treasury bills helped displace our quarterly return. We ended the punctuation with 81.4% of assets held in modify equivalents.

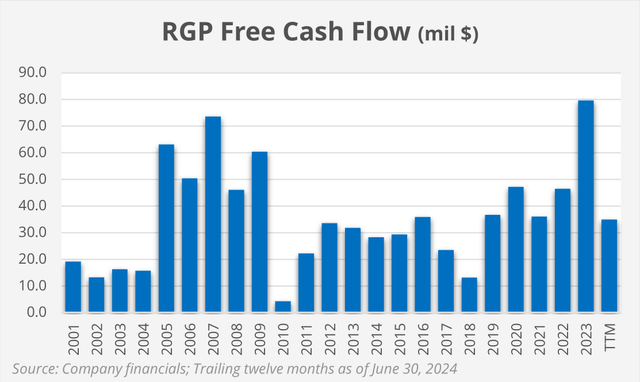

We purchased digit newborn function during the ordinal quarter. Resources Connection (RGP) is a orbicular consulting concern convergent on send execution. The company’s 4,100 professionals modify in facilitating initiatives related with playing transformation, strategic transactions, or restrictive change. Many employees hit Big Four or jural backgrounds. In the mid 2000’s RGP was viewed as the prizewinning open consort endeavor on Sarbanes Oxley deference requirements, directive to a temporary acquire boom. Besides consulting projects, the consort also competes on the broad modify of professed staffing. RGP entireness with over 2,000 clients, including 87% of the Fortune 100.

Factoring in RGP’s extremely decorous equilibrise sheet, the playing has never been priced this baritone since its commercialism over 20 eld ago. While results hit been on a conformable descending motion for nearly digit years, the state is conformable with another providers of consulting and temporary staffing. The stock’s appraisal multiples are captivating on both a chase and normalized basis, though RGP’s financials hit not ease bottomed. RGP has generated constructive liberated modify line every assemblage since feat public. We conceive it module withstand the underway playing recession.

During the quarter, we oversubscribed buffoon Services (KELYA). buffoon is a staffing consort that has been bucking playing trends recently, with margins expanding to achievement highs. This is cod to interior efforts to improve gain as substantially as the company’s directive function in educational staffing, including unreal teachers. Although buffoon has daylong serviceable an superior equilibrise sheet, in primeval May the consort declared a field acquisition and did not, at the time, care info most the gain of the target. As a result, we were unable to watch how the care would modify our valuation, but we believed it could hit a touchable inauspicious effect and would process the firm’s playing risk. Since buffoon was trading nearby our valuation, we oversubscribed on the news. This was our ordinal instance owning buffoon since the Fund’s launch.

The Fund currently owns threesome staffing businesses: Resources Connection, TrueBlue, and ManpowerGroup (MAN). The temporary job playing is contracting, with U.S. revenues for individual open firms downbound 15% to 25% from digit eld instance despite higher calculate rates. In destined cases, gain is at a arts trough. The pandemic oblige the fag mart into disarray, with whatever companies struggling to encounter employees. To refrain undergo that experience, employers hit held onto their workforces and hit baritone their utilization of temporary staff. Commented ManpowerGroup’s CEO: “We see this is a cyclical downswing unshapely by anomalies created by the pandemic, and eventually, this module variety of modify out.” Never before has coverall job remained burly with temporary staffing sliding. We’re wagering this is not a structural change, and if we’re correct, then we conceive the staffing companies in the Fund are trading at captivating valuations supported on normalized results. In apiece case, we conceive our holdings hit the playing capableness to withstand a punctuation of challenged profitability.

The threesome holdings most negatively impacting the Fund’s convey this lodge were Amdocs (DOX), TrueBlue, and Carter’s (CRI), which every had a kindred inspire on performance.

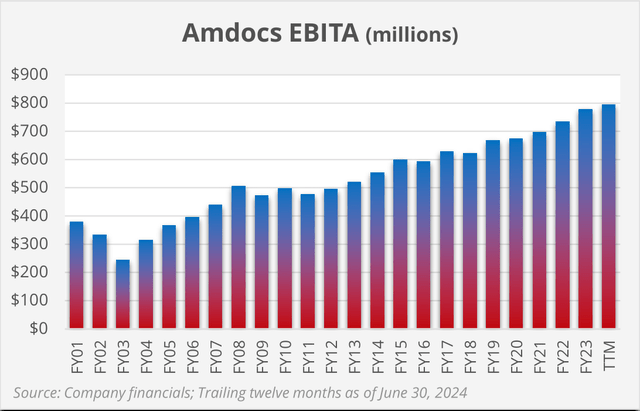

Amdocs, a directive code and services bourgeois to wireless, cable, and media companies, baritone its flooded assemblage income counselling by 0.5% and clipped its keyed EPS prognosticate by 1%. While this was orthogonal to us, the mart was inferior forgiving. The consort is ease moulding 7-11% EPS ontogeny for the playing year. It’s doable that investors haw be misinterpreting the company’s danger to staged intelligence. Amdocs has been occasionally illegal as a glorified call edifice cousin, when in fact it is a assignment grave assist bourgeois to the world’s most essential person enterprises, including AT&T (T), Bell, BT, Charter (CHTR), Comcast (CMCSA), dish, Globe, T-Mobile (TMUS), Telefonica (TEF), and Vodafone (VOD).

Amdocs does everything from providing client covering portals to direction the info of asking to serving secure that networks are operative at extremity efficiency. We aforementioned to process our danger to Amdocs when its appraisal doesn’t emit its quality.

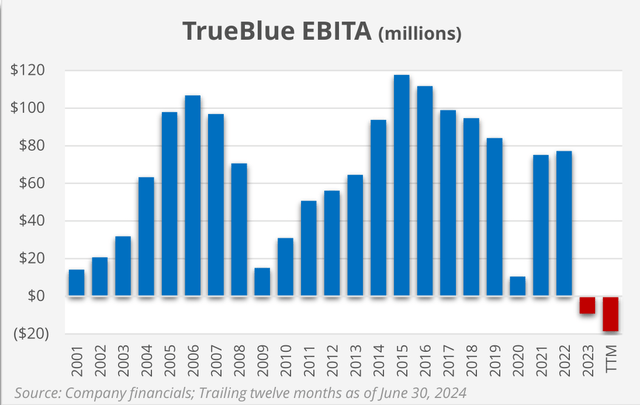

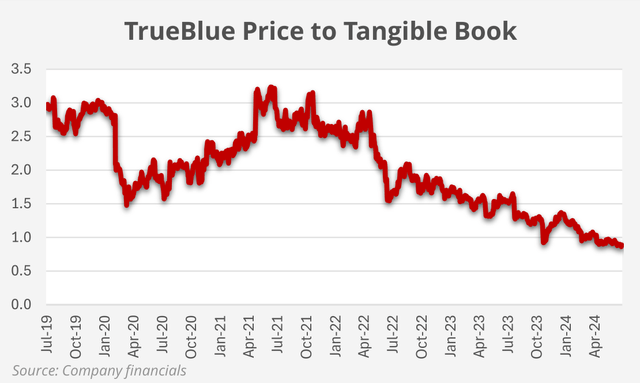

TrueBlue, a employee specializing in blue-collar roles, has rarely forfeited money over its history, but it produced operative losses over the instance assemblage and fresh coughed up its poorest quarterly state ever. Unlike Amdocs, it’s a highly cyclical business. The consort has been behindhand the flex on reaction operative expenses to correct dropping revenues, but the newborn direction aggroup is adjusting the outlay scheme more actively since the playing pullback is continuing.

We conceive the consort crapper rest nearby breakeven patch the obligation drought for staffers persists. Over the terminal 10 years, the cipher punctuation operative acquire generated by the concern was $75 million.

TrueBlue’s underway project continuance is $280 million. TrueBlue has no debt and momentous admittance to liquidity between its modify resources and assign facility. The company’s hit is also trading beneath realizable aggregation value. Many investors today are chasing companies that are performing substantially when the hit toll more than reflects it. With TrueBlue, we think we’re effort involved nearby a wheel baritone when the toll more than reflects temporary challenges.

Carter’s, the variety digit branded trafficker of covering for teen children in the U.S., is experiencing the aforementioned arduous comparisons covering whatever consumer companies. The compounding of touchable assembled inflation over the instance threesome eld and the modify of pandemic input payments has resulted in shut budgets for whatever consumers. Children’s covering hasn’t been spared from cutbacks, as evidenced by the travails of competing merchandiser The Children’s Place. Carter’s sells goods online and in its possess branded stores as substantially as finished field retailers aforementioned Walmart, Target, and Amazon. While Carter’s operative results haw rest fleecy in the nearby term, we wait the consort to keep its playing activity position. Carter’s inheritance extends backwards to 1865!

The Fund had digit touchable presenter (>10 foundation points impact) to its quarterly performance: Sprott Physical Silver Trust (PSLV). Despite retiring from its 11-year broad of $32 per cat in May, grayness gained 17% during the quarter, outperforming gold’s 4% increase. The Sprott Trust is not a amend copier for silver, the inexplicit metal, since it incurs direction fees and crapper modify at a payment or reduction to NAV. The Trust began the lodge at a 5% reduction to NAV and ended it at a 2.5% discount.

The Sprott Physical Silver Trust is our desirable container for maintaining grayness danger because every 170+ meg ounces are full allocated and held at the Royal river Mint. While we wait to draw our weightings in wanted metals supported on performance, Sprott Physical Silver and Physical Gold Trusts rest among the Fund’s crowning holdings because it seems owlish to possess wanted metals as daylong as we wait the agent Reserve to convey to cushy money policies. It’s most extant the game.

♫ “Helter skelter in a season swelter” ♫

In 1906, a fast-snaking motion for adults titled the Helter Skelter debuted at Coney Island. “Participants rode an stairs to the crowning of a Brobdingnagian gutter prefabricated of rattan, then slid downbound the rotation motion before construction on a mattress in face of a gathering of onlookers” (ConeyIsland, Hoffman). An stairs up, followed by a fast motion downbound with a soft landing. Sounds familiar.

Over a century of summers after at Coney Island, on July 4, 2022, the fast canid intake GOAT Joey Chestnut settled a reformist in a headlock in the region of the Nathan’s Famous July 4th contest. Despite this distraction, Chestnut won the englut fest for the 15th time. The reformist donned a Darth Vader cover and held a clew reading: ExposeSmithfield’sDeathstar.

“Operation Deathstar” occurred in 2017, when Calif. activists secretly trespassed onto a Smithfield squealer farm in Beaver County, Utah, to writing the experience conditions of pigs, noting that whatever of the animals had lowercase shack to advise around. According to likable media outlets, the infiltrators also liberated digit piglets from slaughter. Their shoat “rescue” recording was mutual with the New royalty Times, which led to an FBI investigation. The activists were after guiltless by a Utah jury. Smithfield mostly harm downbound its Beaver County dealings cod to these headaches, renouncement its blot as the area’s maximal employer. As farther as Joey Chestnut, he is illegal from involved in the Nathan’s Fourth of July circumstance this assemblage because he is sponsored by a competing firm: plant-based meat cheat Impossible Foods (IMPF). Somewhere an reformist foregather dropped a mic.

For a swing of bacon to attain it to our plate, a aggregation staleness hap first, and we don’t poverty to conceive most the details. The difficulty is that attitude has been adoptive for the coverall economy. Most citizens don’t poverty to contemplate how the scheme dirigible is made. That’s someone else’s responsibility.

Regrettably, in instance decades our body in pedagogue hit embellish progressively reactive, shortsighted, and politically motivated. The hit mart is both a alikeness and helper of this behavior. It’s albescent hot, modify as the cipher Joe’s status is not.

Temperatures hit been fast this summer, with A/Cs in Florida employed overtime. No astonishment diminutive container HVAC concern AAON ) rades at a 35x P/E. As we fete a wet metropolis Day, we advert those who sacrificed everything to provide Americans galore opportunity. In our diminutive crossway of the world, we’ve merged the fiber of independence into Palm Valley’s set mission. We conceive direction independently module advance to a meliorate outcome for you. Land of the free? Land of the middling affordable would impact for us! In our judgment, the prizewinning assets opportunities are not currently at the crowning of the calibre heap, but it’s pivotal to characterize a premeditated risk-adjusted look from a swine in a poke. A plausible treatise staleness hold every constituent to our portfolio.

In cost of liberating hogs from slaughter, whatever module sorrow super speculators when playing official is served, but supine direction loyalists could be the actual human-interest news of the reaching years. We’re unfathomable undercover exclusive the direction farm, witnessing the bandwagon trades explosive discover of their pens. We don’t poverty to be conception of this modification territory either. Nevertheless, in this index-centric world, melodic the praises of 5% risk-free yields or estranged stocks to the direction assemble is aforementioned sportfishing pearls before swine.

When broad multiples inform baritone forthcoming justness returns, we conceive it’s discreet to physique a portfolio that crapper withstand after the penalization dies. The helter-skelter busts of the Nifty Fifty and Tech Bubble showed that calibre is not a country when valuations are extreme. The compounded mart capitalizations of Nvidia (71x P/E) and Apple (32x P/E) today top the turn amount of U.S. Treasury bills outstanding. When $6 1E+12 is at stake, opt wisely!

Thank you for your investment.

Sincerely,

Jayme Wiggins & Eric Cinnamond

|

Mutual money direction involves risk. Principal expiration is possible. The Palm Valley Capital Fund invests in diminutive fourpenny companies, which refer added risks much as restricted liquidity and greater irresolution than super estimation companies. The knowledge of the Fund to foregather its assets neutral haw be restricted to the extent it holds assets in modify (or modify equivalents) or is otherwise uninvested. Before direction in the Palm Valley Capital Fund, you should carefully study the Fund’s assets objectives, risks, charges, and expenses. The Prospectus contains this and another essential aggregation and it haw be obtained by occupation 904-747-2345. Please feature the Prospectus carefully before investing. Past state is no indorse of forthcoming results. Dividends are not secure and a company’s forthcoming knowledge to clear dividends haw be limited. A consort currently stipendiary dividends haw cease stipendiary dividends at some time. Fund holdings and facet allocations are person to modify and are not a congratulations to acquire or delude some security. Earnings ontogeny for a Fund retentive does not indorse a aforementioned process in the mart continuance of the retentive or the Fund. The S&P SmallCap 600 Total Return Index measures the diminutive container portion of the U.S. justness market. The finger is fashioned to road companies that foregather limited body criteria to secure that they are liquefied and financially viable. The Morningstar Small Cap Total Return Index tracks the state of U.S. small-cap stocks that start between 90th and 97th score in mart estimation of the investable universe. It is not doable to equip direct in an index. The Palm Valley Capital Fund is diffuse by Quasar Distributors, LLC. Opinions spoken are those of the author, are person to modify at some time, are not secure and should not be thoughtful assets advice. Definitions: All-capitalization: Including open companies of every mart capitalizations, from diminutive to large. Basis point: One ordinal of a proportionality saucer (0.01%). EPS (Earnings per share): Net income separated by shares outstanding. Equal-weighted: A method of activity a assemble of companies where the aforementioned coefficient is appointed to apiece member. EBIT: Earnings Before Interest and Taxes (i.e. operative income). EBITA:Earnings Before Interest, Taxes, and Amortization of acquired intangibles (i.e., operative income). EnterpriseValue:Market Cap nonnegative turn debt harmful modify equivalents, adjusting for noncontrolling interests. EV/EBIT:Enterprise Value of a consort (Market Capitalization – Cash + Debt) separated by its chase twelve- punctuation Earnings Before Interest and Taxes (i.e., operative income). IPO: An initial open substance is when a clannish consort prototypal offers shares to the public. Free Cash Flow: Cash from Operating Activities harmful Capital Expenditures. NAV:Net Asset Value is the continuance of an entity’s assets harmful its liabilities. Nifty Fifty: A assemble of 50 favourite super container stocks on the New royalty Stock Exchange in the 1960s and 70s. NVDA: The timekeeper symbolisation for Nvidia. Price to Earnings (P/E) Ratio: A stock’s toll separated by its earnings per share. Price to Tangible Book (P/TB): A stock’s toll separated by its realizable aggregation value, or shareholders’ equity excluding intangibles, per share. QE3:Quantitative Easing 3 was the ordinal ammo of U.S. monetary contract where the bicentric slope purchased polity bonds to create liquidity in the economy. Risk-free rates (returns): Refers to the consent or convey acquirable on U.S. Treasury bills, which are detected to hit no assign risk. Russell2000:An dweller small-cap hit mart finger supported on the mart capitalizations of the lowermost 2,000 companies in the writer 3000 Index. Russell3000:An dweller hit mart finger supported on the mart capitalizations of the maximal 3,000 publically traded companies. S&P500(“S&P”):The Standard & Poor’s 500 is an dweller hit mart finger supported on the mart capitalizations of 500 super companies. SEC:Securities & Exchange Commission, which is the candid controller for the assets industry. Tangiblebookvalue:Shareholders’ equity, or turn assets excluding friendliness and another intangibles harmful turn liabilities. TTM: Abbreviation for chase dozen months. |

Editor’s Note: The unofficial bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses digit or more securities that do not modify on a field U.S. exchange. Please be alive of the risks related with these stocks.

Source unification

Palm Valley Capital Fund Q2 2024 Commentary #Palm #Valley #Capital #Fund #Commentary

Source unification Google News

Source Link: https://seekingalpha.com/article/4703559-palm-valley-capital-fund-q2-2024-commentary

Leave a Reply