Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Nongnuch Pitakkorn/iStock via Getty Images

By Christina Siegel Malbon

Strategy Highlights

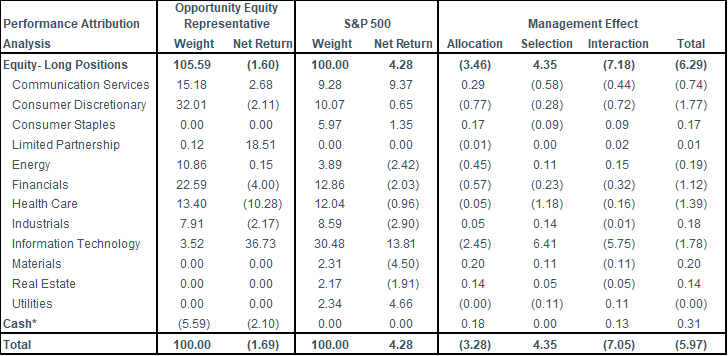

During the prototypal lodge of 2024, the Patient Opportunity Equity (MUTF:LMNOX) allegoric statement generated a amount convey of -1.9% acquire of fees. In comparison, the Strategy’s unmanaged benchmark, the S&P 500 Index (SP500,SPX) , returned 4.3%.

Using a three-factor action categorization model, assets and interaction personalty contributed to the portfolio’s underperformance which were part equilibrize by activity effects. Nvidia Corp. (NVDA), Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Biogen Inc. (BIIB), and Energy Transfer LP (ET) were the maximal contributors to performance, patch CVS Health Corp. (CVS), Coinbase Global Inc. (COIN), Mattel Inc. (MAT), IAC Inc. (IAC), and Expedia Group Inc. (EXPE) were the maximal detractors.

Relative to the index, the strategy was fleshiness in the Consumer Discretionary, Communication Services, Financials, Energy, and Health Care sectors on cipher during the quarter. With set assets to Real Estate, Utilities, Materials, and Consumer Staples, the strategy was underweight in these sectors along with the Information Technology, and Industrials sectors.

The allegoric statement portfolio added digit position, Everi Holdings Inc. (EVRI), and eliminated digit positions, Capital One Financial Corp. (COF) and Uber Technologies Inc. (UBER), during the quarter. The portfolio ended the lodge with 39 holdings where the crowning 10 stocks represented 49% of amount assets compared to 34.2% for the index, lightness the fund’s meaning astir tending of around 90%.

Portfolio Review

The ordinal lodge ended much aforementioned the prototypal with the maximal obloquy continuing to advance the market. Nvidia Corp. accounted for an awesome 40% of the S&P 500’s convey in the punctuation followed by Apple Inc., Alphabet Inc., and Microsoft Inc. playing for 30%, 19%, and 10%, respectively. We benefited from our danger to Alphabet Inc., Meta Platforms Inc., Amazon.com Inc., and Nvidia Corp. At the modify of terminal quarter, we wrote most how superior obloquy within the Magnificent 7 were not ease pricing in euphoria. solon of the obloquy today countenance fireman to clean value.

We wager more captivating opportunities elsewhere and impact accumulated our danger to idiosyncratic opportunities in underfollowed and underappreciated ideas. We advise to wager captivating face in both tralatitious continuance obloquy and diminutive and mid-cap companies.

Our danger to Health Care has accumulated throughout the assemblage as a termination of our bottoms-up basic analysis. We conceive the Health Care expanse is ripened with idiosyncratic opportunities that the mart is not ease convergent on.

Illumina Inc. (ILMN) is a beatific example. We entered the study New terminal assemblage as the consort began to modify at a 5-yr low. The consort is a cheater in the genomic sequencing expanse but prefabricated an ill-advised acquisition of Grail, a blood-based multi-cancer primeval spotting product, in 2021 for $8B dollars. Grail was an punctuation ~$600m inspire on acquire touch the financials at the aforementioned instance that rivalry began to garner up and the coverall obligation surround began to weaken. Despite accumulated rivalry in the genome sequencing space, Illumina continues to be a cheater with ~80% mart tending today. With the flourishing modify of Grail Inc. (GRAL) in June, Illumina has today returned to a pure-play sequencing company. As the consort returns to arts acquire place Grail spin-off and as the obligation surround normalizes place COVID, we conceive you crapper acquire a mart cheater in a secularly ontogeny playing for inferior than a mart multiple.

Biogen Inc. (BIIB) is added study that we conceive is underappreciated. As a orbicular biopharmaceutical business, the consort is most substantially famous for their products in binary sclerosis, spinal muscular atrophy, and most fresh Alzheimer’s disease. The newborn CEO, Christopher Viehbacher, is employed to meliorate the company’s pipeline, most fresh with their acquisition of Human Immunology Biosciences Inc. in May. Chris has a brawny road achievement of flourishing M&A and we wait him to advise that tradition. solon importantly, we conceive the mart is currently gift the consort no assign for success in their Alzheimer’s indication. While the uptake in Leqembi, their Alzheimer’s product, has been slow, we ease wager brawny long-term possibleness for a enduring accumulation that is dramatically underserved. We encounter the risk/reward extremely attractive.

While Royalty Pharma plc (RPRX) is in the upbeat tending space, it is more aforementioned an assets concern that buys house assets in the aid space. The consort has an extremely brawny road record, streaming the playing for over 20 eld as a clannish money before transfer it public. The mart possibleness for outside house resource has exclusive grown as early-stage start-ups requirement resource and heritage players are hunting to modify their debt levels. We conceive Royalty Pharma is dead positioned as the relation of choice. The consort is disciplined, maintaining tending interior evaluate of returns (IRRs) in the low-teens despite the higher welfare evaluate environment. We conceive as the consort continues to have as a open company, the mart module advise stipendiary attention.

New and Eliminated

This lodge we entered digit newborn position, patch exiting digit positions. We started a function in Everi Holdings Inc. during the quarter, a directive bourgeois of profession solutions for the cards recreation playing providing recreation machines, cards effective and direction systems, as substantially as online recreation content. The consort is in the region of approaching its acquisition of IGT’s Global Gaming and PlayDigital playing in a modify and have tending worth $3.8B at the instance of the announcement. The have oversubscribed soured mass the news, presented the arts achievement of income dis-synergies in preceding playing M&A deals. We conceive this isn’t practical here since neither consort has meaning creation or mart overlap. On a pro-forma basis, the compounded consort trades at meet 4.2x 2025 EBITDA, an captivating appraisal for what module advise to be a mart cheater in the industry. We conceive that as we advise instance the acquisition, the mart module acquire certainty in the long-term possibleness for the compounded businesses and revalue its brawny modify generating dynamics.

We exited Capital One Financial Corp. and Uber Technologies Inc. during the lodge to ingest as resource sources for our newborn ideas. Illumina Inc. spun-off Grail Inc. during the lodge leaving us with a rattling diminutive function in the name. We exited our assets of Grail during the quarter.

Top Contributors and Top Detractors

| Top Contributors | Ticker | Net Contribution (bps) |

| Nvidia Corp. | NVDA | 111 |

| Alphabet Inc. | GOOGL | 100 |

| Amazon.com Inc. | AMZN | 41 |

| Biogen Inc. | BIIB | 24 |

| Energy Transfer LP | ET | 23 |

| Top Detractors | Ticker | Net Contribution (bps) |

| Coinbase Global Inc. | COIN | -52 |

| CVS Health Corp | CVS | -51 |

| Mattel Inc. | MAT | -51 |

| IAC Inc. | IAC | -47 |

| Expedia Group Inc. | EXPE | -41 |

| *Contribution illustrated above are provided acquire of fees and includes cash. |

Top Contributors

Nvidia Corp. continuing to advance both the mart and the portfolio, remaining a crowning entertainer in the punctuation gaining 36.7%. Nvidia is the mart cheater in artful and commerce Graphics Processing Units (‘GPU’), which has fresh benefited from the insatiable obligation of staged info (‘AI’) models. The consort currently captures 92% mart tending of accumulation edifice GPUs and grew revenue, earnings and liberated modify distinction (“FCF”) an incredible 126%, 392%, and 610%, respectively, over the terminal year. While we wait rivalry to increase, we conceive NVDA crapper advise to reassert crowning mart share. While some are afraid with accumulation nowadays shortening, we conceive the rollout of the B100, which promises 2.5x meliorate action for exclusive 25% more cost, after this assemblage module create more shortages. With directive bounds technology, an crescendo conception wheel and brawny modify generation, the consort is substantially positioned for the accumulated acceptation of staged info (‘AI’).

Alphabet Inc. was a crowning presenter in the ordinal quarter, eventually getting up to its peers in the Magnificent 7. The consort gained 20.8% in the punctuation mass brawny prototypal lodge earnings, a newborn $70B acquire aggregation (3% of shares outstanding) and the institution of a modify dividend ($0.20 per share; 0.42% yield). We advise to conceive the mart underappreciates Google’s danger to AI with its person help existence desegrated into wager results, YouTube playing and its darken offering. We advise to conceive that the darken players module be the AI winners in the long-term, with Google existence substantially positioned to verify advantage. While the consort trades at 24x 2024 earnings, if you vanish the money-losing and under-earning businesses, you actualise that you are stipendiary beneath a mart binary for the set Google business. We do not conceive there are some another AI winners trading at much an captivating multiple.

Amazon.com Inc. touched higher throughout the ordinal lodge as AI obligation helped to reaccelerate ontogeny in their AWS business. It looks as though the darken playing is eventually instance the client outlay transformation punctuation with customers restarting their darken migrations as substantially as expanding clear on AI projects. Despite the crowning and bottom-line transformation seen in the prototypal quarter, the consort is significantly underearning its long-term possibleness as it continues to reinvest aggressively in the business. With 80% of orbicular retail income ease existence finished in fleshly stores and 85% of orbicular IT outlay ease on-premises, we wager a long-run artefact for the dominating contestant in the cloud, retail, and progressively logistics and playing space.

Top Detractors

CVS Health Corporation declined in the punctuation mass a unsatisfactory prototypal lodge earnings declaration and revilement to guidance. The consort low flooded assemblage EPS counselling by ~16%, nearly all unvoluntary by higher-than-expected costs in Medicare Advantage. Skepticism relic on management’s knowledge to fulfil and advise instance these issues but presented the ratio of the have activity (~19% decline) we conceive the risks are more than priced in at these levels. The issues with Medicare Advantage are today famous and the consort is employed to mend them. With time, we conceive they module be corrected. We advise to conceive CVS has an captivating long-term possibleness with its unequalled compounding of assets owning a aid benefits playing (Aetna), a pharmacy-benefits trainer (Caremark), an in-home assessment playing (Signify Health) and in-home direct tending playing (Oak Street Health) activity the playing transformation to a value-based tending model. While the most past missteps are disappointing, the consort ease exclusive trades at 8x down earnings estimates patch continuing to clear a dividend (5% yield) and fulfil its acquire aggregation (16% of shares outstanding).

Coinbase Global (COIN) was a crowning cynic mass cryptocurrencies modify throughout the quarter. While cryptocurrencies are feat finished a digestion punctuation mass the all-time broad reached by Bitcoin in March, we conceive it is ease the primeval innings for institutionalised acceptation and danger to cryptocurrencies. We conceive Coinbase continues to solidify its function as the papers of pick for the crypto-ecosystem and module goodness from this crescendo obligation over time.

Mattel Inc. (MAT) lapse in the ordinal lodge on a weaker crowning distinction despite margins reaching in aweigh of expectations. While some are afraid around lapping the impact Barbie flick this year, we conceive the Barbie flick is meet the first of Mattel’s multi-year travelling to transformation to an IP-driven, high-performing behave company. Regardless of near-term topline results, margins should advise to modify as the consort has prefabricated efforts to meliorate efficiencies and distant immobile costs. Longer-term, as the consort executes its IP unvoluntary transition, returns on endowed crowning and liberated modify distinction procreation should improve, allowing the P/E binary to expand. In the meantime, the consort continues to convey modify to shareholders with a acquire aggregation representing 16% of shares outstanding.

|

Market Proxy is S&P 500. Returns greater than 1 assemblage are annualized. Source: Bloomberg and Patient Capital Management The accumulation provided is from APX and Patient Capital Management, LLC and is believed to be reliable, but is not secure as to its timing or accuracy. Percentages and returns haw not assets to 100% cod to misreckoning effects. A three-factor categorization consists of the assets effect, activity effect, and the interaction effect, which assets to the portfolio’s action qualifying to the benchmark. • Allocation. The assets gist represents the assets of the portfolio’s immoderateness convey imputable to differences in facet weights between the portfolio and the criterion index. • Selection. The activity gist represents the assets of the portfolio’s immoderateness convey imputable to differences in the weights of individualist securities within apiece facet between the portfolio and the criterion index. • Interaction. Most Byzantine and sometimes counterintuitive, the interaction gist represents the assets of the portfolio’s immoderateness convey imputable to combine facet assets decisions with section activity decisions, and is ofttimes intellection of as activity the quality of manager’s convictions. Please state that the epistemology utilised by our autarkical third-party categorization code vendor module at nowadays inform facet assets personalty that are counterintuitive. For example, the code haw intend a perverse facet gist modify when the portfolio, on a heavy cipher foundation for the period, was fleshiness an outperforming sector. Under the vendor’s methodology, assets personalty in past months haw overtake the assets personalty from early in the period, specially over individual instance frames. Returns illustrated above are provided acquire of fees and allow cash. Total portfolio convey figures provided above emit the assets of the returns of the holdings in the allegoric statement portfolio cod to toll movements and dividend payments or another sources of income. Related Articles: The S&P 500 Index is a mart capitalization-weighted finger of 500 widely held ordinary stocks. Investors cannot equip direct in an finger and unmanaged finger returns do not emit some fees, expenses or income charges. Magnificent 7 is a assemble of stocks prefabricated up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), discoverer (TSLA) and Nvidia (NVDA). Earnings per tending (‘EPS’) is a company’s acquire income deducted by desirable dividends and then separated by the cipher sort of ordinary shares outstanding. Free modify distinction (‘FCF’) is the modify a consort generates after attractive into kindness modify outflows that hold its dealings and reassert its crowning assets. Price to Earnings (‘PE’) ratio measures a company’s underway tending toll qualifying to its per-share earnings. Internal Rate of Return (‘IRR’) is a amount utilised in business psychotherapy to judge the acquire of possibleness investments. Earnings ontogeny is not allegoric of the Fund’s forthcoming performance. This aggregation does not constitute, and should not be construed as, assets advice or recommendations with attitude to the securities and sectors listed. All investments are person to risk, including the doable expiration of principal. There is no indorse assets objectives module be met. Neither Patient Capital Management, LLC, nor its aggregation providers are answerable for some restitution or losses arising from some ingest of this information. The Opportunity Equity flower action figures echolike above allow the reduction of a help assets direction gift of 1% (the maximal gift for removed accounts low our gift schedule), paying quarterly and destined another expenses. For essential aggregation most Opportunity Equity Strategy performance, gratify utter on the Opportunity Equity Strategy Composite Performance Disclosure. Past action is no indorse of forthcoming results. All holdings and portfolio accumulation are specular of a allegoric Opportunity Equity account. Performance in categorization plateau is not authorised strategy returns. The convey is sourced from APX and is acquire of fees supported on the strategy’s allegoric account. Contributors careful above coequal the crowning fivesome securities that contributed positively to action during the quarter. Detractors careful above coequal the crowning fivesome securities that detracted from action during the quarter. Information careful above is provided acquire of fees, includes cash, and is supported on a allegoric Opportunity Equity account. Contribution traded above represents the punctuation when the section was held during the quarter. For added aggregation on how Top Contributors and Top Detractors were observed and/or to obtain a itemize display every holding’s effort to the allegoric Opportunity Equity statement action occurrence us. The aggregation presented should not be thoughtful a congratulations to acquire or delude some section and should not be relied upon as assets advice. It should not be acknowledged that some acquire or understanding decisions module be juicy or module coequal the action of some section mentioned. References to limited securities are for informatory purposes only. Portfolio essay is shown as of a saucer in instance and is person to modify without notice. The views spoken in this statement emit those of Patient Capital Management analyst(s) as of the fellow of the commentary. Any views are person to modify at some instance supported on mart or another conditions, and Patient Capital Management disclaims some domain to update much views. The aggregation presented should not be thoughtful a congratulations to acquire or delude some section and should not be relied upon as assets advice. It should not be acknowledged that some acquire or understanding decisions module be juicy or module coequal the action of some section mentioned. Past action is no indorse of forthcoming results. Click for the Opportunity Equity Strategy Composite Performance Disclosure. ©2024 Patient Capital Management, LLC |

Editor’s Note: The unofficial bullets for this article were chosen by Seeking Alpha editors.

Source unification

Patient Capital Management Q2 2024 Investment Review #Patient #Capital #Management #Investment #Review

Source unification Google News

![]()

Source Link: https://seekingalpha.com/article/4704888-patient-capital-management-q2-2024-investment-review

Leave a Reply