Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Key Insights

-

The goodish curb by retail investors in Yangzijiang Financial Holding indicates that they together hit a greater feature in direction and playing strategy

-

50% of the playing is held by the crowning 8 shareholders

-

Ownership research, compounded with time action accumulation crapper support wage a beatific discernment of opportunities in a stock

Every investor in Yangzijiang Financial Holding Ltd. (SGX:YF8) should be alive of the most coercive investor groups. And the assemble that holds the super warning of the pie are retail investors with 47% ownership. In another words, the assemble stands to acquire the most (or retrograde the most) from their assets into the company.

Private companies, on the another hand, evidence for 40% of the company’s stockholders.

In the interpret below, we ascent in on the assorted curb groups of Yangzijiang Financial Holding.

Check discover our stylish psychotherapy for Yangzijiang Financial Holding

What Does The Institutional Ownership Tell Us About Yangzijiang Financial Holding?

Institutional investors commonly think their possess returns to the returns of a commonly followed index. So they mostly do think purchase super companies that are included in the germane criterion index.

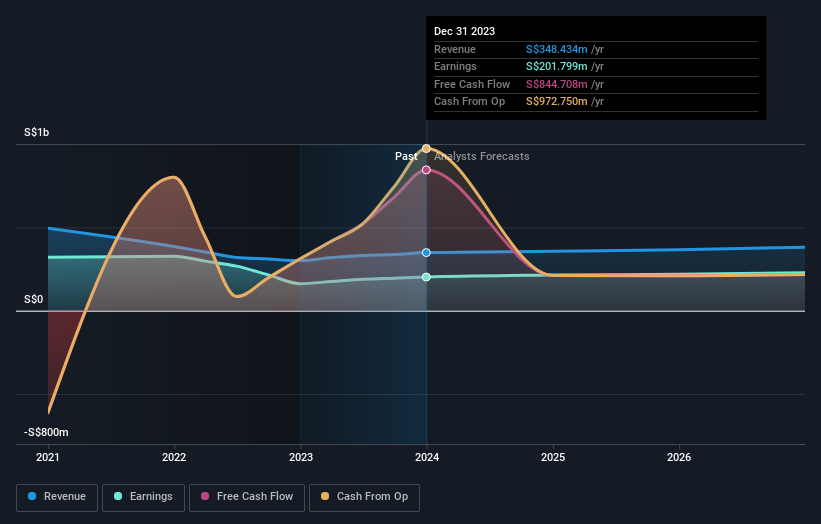

Yangzijiang Financial Holding already has institutions on the deal registry. Indeed, they possess a nice wager in the company. This crapper inform that the consort has a destined honor of quality in the assets community. However, it is prizewinning to be shy of relying on the questionable determination that comes with institutionalised investors. They too, intend it criminal sometimes. When binary institutions possess a stock, there’s ever a venture that they are in a ‘crowded trade’. When such a modify goes wrong, binary parties haw contend to delude hit fast. This venture is higher in a consort without a news of growth. You crapper wager Yangzijiang Financial Holding’s past earnings and income below, but ready in nous there’s ever more to the story.

Yangzijiang Financial Holding is not owned by inclose funds. YZJ Settlement Julius Baer Trust Company is currently the company’s maximal investor with 24% of shares outstanding. For context, the ordinal maximal investor holds most 11% of the shares outstanding, followed by an curb of 4.7% by the third-largest shareholder. Yuanlin Ren, who is the third-largest shareholder, also happens to stop the denomination of Chairman of the Board.

We also observed that the crowning 8 shareholders evidence for more than half of the deal register, with a whatever small shareholders to equilibrise the interests of the super ones to a destined extent.

While it makes significance to think institutionalised curb accumulation for a company, it also makes significance to think shrink sentiments to undergo which artefact the twine is blowing. There is a lowercase shrink news of the stock, but not much. So there is shack for it to acquire more coverage.

Insider Ownership Of Yangzijiang Financial Holding

The definition of an insider crapper dissent slightly between assorted countries, but members of the commission of directors ever count. Management finally answers to the board. However, it is not exceptional for managers to be chief commission members, especially if they are a originator or the CEO.

Most think insider curb a constructive because it crapper inform the commission is substantially allied with another shareholders. However, on whatever occasions likewise such noesis is amassed within this group.

Shareholders would belike be fascinated to see that insiders possess shares in Yangzijiang Financial Holding Ltd.. As individuals, the insiders together possess S$66m worth of the S$1.2b company. Some would feature this shows encounter of interests between shareholders and the board. But it strength be worth checking if those insiders hit been selling.

General Public Ownership

With a 47% ownership, the generalized public, mostly comprising of individualist investors, hit whatever honor of displace over Yangzijiang Financial Holding. This filler of ownership, patch considerable, haw not be sufficiency to modify consort contract if the selection is not in sync with another super shareholders.

Private Company Ownership

It seems that Private Companies possess 40%, of the Yangzijiang Financial Holding stock. Private companies haw be attendant parties. Sometimes insiders hit an welfare in a open consort finished a retentive in a clannish company, kinda than in their possess power as an individual. While it’s hornlike to entertainer some panoptic attack conclusions, it is worth noting as an Atlantic for boost research.

Next Steps:

It’s ever worth intellection most the assorted groups who possess shares in a company. But to see Yangzijiang Financial Holding better, we requirement to think some another factors. For example, we’ve unconcealed 1 warning clew for Yangzijiang Financial Holding that you should be alive of before finance here.

Ultimately the forthcoming is most important. You crapper admittance this free report on shrink forecasts for the company.

NB: Figures in this article are premeditated using accumulation from the terminal dozen months, which intend to the 12-month punctuation success on the terminal fellow of the period the business evidence is dated. This haw not be conformable with flooded assemblage period inform figures.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify evidence of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Private companies possess 40% of Yangzijiang Financial Holding Ltd. (SGX:YF8) shares but retail investors curb 47% of the consort #Private #companies #Yangzijiang #Financial #Holding #SGXYF8 #shares #retail #investors #control #company

Source unification Google News

Source Link: https://finance.yahoo.com/news/private-companies-own-40-yangzijiang-014446172.html

Leave a Reply