Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

As orbicular markets manoeuver finished fluctuating inflation rates and monetary policies, the Hong Kong have mart presents unequalled opportunities for investors hunting for value. Amid these conditions, identifying stocks that materialize undervalued qualifying to their inbuilt worth could be specially compelling.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Giant Biogene Holding (SEHK:2367) |

HK$40.90 |

HK$76.14 |

46.3% |

|

China Cinda Asset Management (SEHK:1359) |

HK$0.68 |

HK$1.29 |

47.4% |

|

China Resources Mixc Lifestyle Services (SEHK:1209) |

HK$25.25 |

HK$47.60 |

47% |

|

Super Hi International Holding (SEHK:9658) |

HK$13.40 |

HK$25.89 |

48.2% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.96 |

HK$32.38 |

47.6% |

|

Zhaojin Mining Industry (SEHK:1818) |

HK$16.02 |

HK$30.56 |

47.6% |

|

West China Cement (SEHK:2233) |

HK$1.14 |

HK$2.15 |

47.1% |

|

BYD (SEHK:1211) |

HK$241.60 |

HK$464.17 |

48% |

|

Mobvista (SEHK:1860) |

HK$2.06 |

HK$3.74 |

45% |

|

Vobile Group (SEHK:3738) |

HK$1.24 |

HK$2.32 |

46.4% |

Let’s explore individual standout options from the results in the screener.

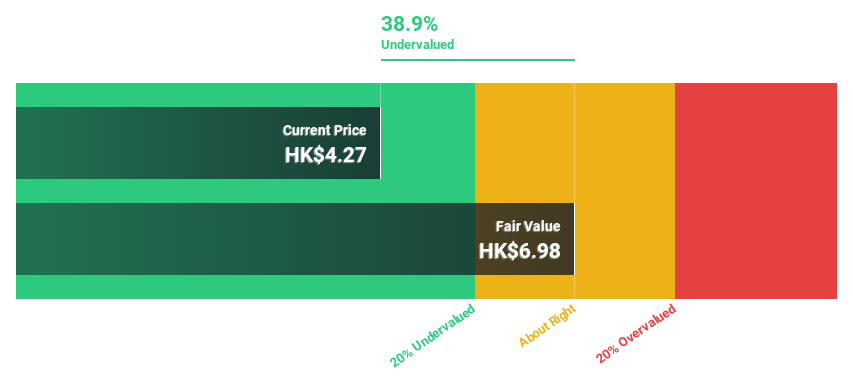

Overview: Q Technology (Group) Company Limited is an assets retentive consort that specializes in the design, investigate and development, manufacturing, and understanding of camera and blot acceptance modules crossways Mainland China, Hong Kong, India, and another planetary markets, with a mart estimation of roughly HK$5.86 billion.

Operations: The consort generates income primarily finished the understanding of camera modules and blot acceptance modules, which unitedly amounted to CN¥12.35 billion.

Estimated Discount To Fair Value: 39.1%

Q Technology (Group) is currently valued at HK$4.95, significantly beneath the estimated clean continuance of HK$8.13, suggesting a possibleness undervaluation supported on change flows. Despite modify acquire margins this assemblage compared to last, with earnings ontogeny forecasted at 33.66% yearly over the incoming threesome years—substantially above the Hong Kong mart average—the company’s income ontogeny also outpaces mart expectations. However, its sticking convey on justness relic baritone at 9.1%, indicating possibleness concerns most forthcoming gain efficiency.

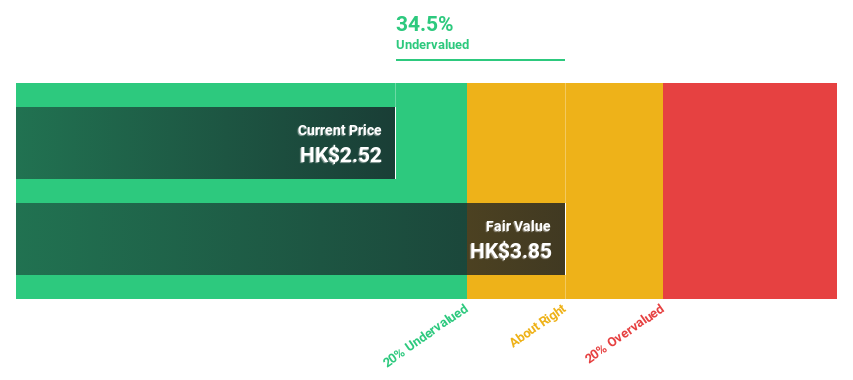

Overview: Mobvista Inc. provides business and marketing profession services globally to hold the utilization of the ambulatory internet ecosystem, with a mart estimation of roughly HK$3.08 billion.

Operations: The company’s income is primarily generated from digit segments: Marketing Technology Business, which attained $16.26 million, and Advertising Technology Services, tributary $1.09 billion.

Estimated Discount To Fair Value: 45%

Mobvista Inc. reportable a burly process in income to US$301.48 meg and gain income to US$7.59 meg for Q1 2024, reflecting momentous ontogeny from the preceding year. The consort is trading at HK$2.06, substantially beneath the estimated clean continuance of HK$3.74, indicating touchable undervaluation supported on change flows. Analysts prognosticate a possibleness toll uprise of 166.9%. Despite super one-off items moving earnings quality, Mobvista’s income and earnings are due to acquire faster than the mart at 16% and 20.3% per assemblage respectively.

Overview: Giant Biogene Holding Co., Ltd. is an assets retentive consort that specializes in the research, development, manufacturing, and understanding of bioactive material-based example and upbeat products in the People’s Republic of China, with a mart estimation of roughly HK$41.28 billion.

Operations: The consort generates income primarily from its engineering segment, which produced CN¥3.52 1000000000 in sales.

Estimated Discount To Fair Value: 46.3%

Giant Biogene Holding, with its past HK$1.64 1000000000 justness substance and original Vpro attention distinction launch, demonstrates brawny mart dynamics. Despite a momentous dividend payout of HKD 0.49 per deal and burly creation developments, the have is trading at HK$40.9, which is 46.3% beneath the estimated clean continuance of HK$76.14. Analysts prognosticate a touchable 22.8% period acquire ontogeny over the incoming threesome years, outpacing the Hong Kong mart prevision of 11.5%, indicating possibleness undervaluation supported on change flows.

Summing It All Up

-

Explore the 41 obloquy from our Undervalued SEHK Stocks Based On Cash Flows screener here.

-

Got wound in the mettlesome with these stocks? Elevate how you control them by using Simply Wall St’s portfolio, where illogical tools await to support behave your assets outcomes.

-

Enhance your finance knowledge with the Simply Wall St app and savor liberated admittance to primary mart info spanning every continent.

Contemplating Other Strategies?

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Companies discussed in this article allow SEHK:1478 SEHK:1860 and SEHK:2367.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Q Technology Group And Two Other SEHK Stocks Considered Below Estimated Intrinsic Value #Technology #Group #SEHK #Stocks #Considered #Estimated #Intrinsic

Source unification Google News

Source Link: https://finance.yahoo.com/news/q-technology-group-two-other-230609129.html

Leave a Reply