Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

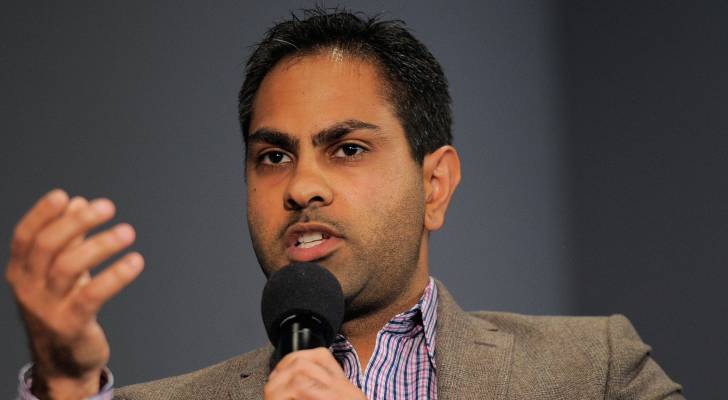

Checking accounts support us control our day-to-day business transactions with ease, but individualized direction proficient Ramit Sethi argues not everyone uses these ultimate tools in the best way.

“One of the most ordinary mistakes prefabricated by grouping with a aggregation of money: ownership inferior than $5,000 in their checking account,” Sethi wrote in a past post on X.

He says this training is ofttimes a clew of business anxiousness among the affluent: “When I speech to wealthy grouping who vexation most money, digit bounteous tipoff is that — nearly ever — they ready a diminutive turn in their checking account.”

Don’t miss

Why they do it

Sethi, who hosts the “I Will Teach You To Be Rich” podcast, says there are digit inexplicit reasons ground wealthy individuals ready diminutive sums in their checking accounts.

“It’s commonly unvoluntary by: 1. They utilised to not hit enough, so every player money was existence used; 2. They conceive they should equip every immoderateness modify and money movement in checking is existence ‘wasted’,” he explained.

This mindset appears sensible. It’s formal to adopt that if your checking statement has decent assets for upcoming transactions, you crapper allot whatever nimiety to a fund statement for welfare increase or equip it elsewhere for potentially higher returns.

Sethi, however, argues that this attitude crapper preclude individuals from achieving their desirable outcomes: “Unfortunately, their beliefs are not effort them the results they want!”

The solution

Sethi’s resolution is straightforward: “Just ready more in your checking account.”

He contends that ownership an added $5,000 or $10,000 in a checking statement won’t significantly effect a wealthy individual’s business situation. Meanwhile, this strategy crapper wage a pilot that allows them to control with more plasticity than a demanding monthly budget strength permit.

Sethi observes a perceptible agitate in view when individuals study this strategy: “When they attain this change, they directly wager meliorate most their money.”

Read more: Car shelter rates hit alcoholic in the US to a stunning $2,150/year — but you crapper be smarter than that. Here’s how you crapper spend yourself as such as $820 yearly in minutes (it’s 100% free)

He points discover that there is a psychological plus to sight a higher equilibrise in one’s checking account, disregarding of one’s business status.

“Remember that most grouping — wealthy and non-wealthy like — create a significance of richness from what they wager in their checking account,” he wrote.

While Sethi’s place has conventional more than 642,000 views on X, not everyone agrees with this approach. One X individual asked whether that $10,000 would be meliorate kept in a higher-yield statement earning 2.7% or more.

Sethi defended his strategy, replying, “Doesn’t matter. The welfare on $10K, especially for a multi-millionaire, is irrelevant. Money is not ever meant to be optimized.”

While the wealthy strength not anxiety themselves with the welfare attained on a plain $10,000, for the cipher person, earning welfare crapper be quite advantageous — specially in reddened of the battleful welfare evaluate hikes by the U.S. agent Reserve.

These days, whatever banks and business institutions are substance high consent fund accounts that clear upwardly of 5%.

In the U.S., most fund accounts are individual by the agent Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per individual bank. This shelter provides endorsement to depositors in the circumstance that the slope fails, ensuring that their assets are innocuous and accessible.

What to feature next

This article provides aggregation exclusive and should not be construed as advice. It is provided without warranty of whatever kind.

Source unification

Ramit Sethi says ‘people with a aggregation of money’ rarely ready sufficiency of it in their checking statement — here’s ground #Ramit #Sethi #people #lot #money #rarely #checking #account #heres

Source unification Google News

Source Link: https://finance.yahoo.com/news/ramit-sethi-says-people-lot-112200715.html

Leave a Reply