Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Wolterk

Every actual realty investor, including REITs, staleness ordered and opt among possibleness investments. These choices ideally should study not exclusive toll but also desirable concept type, modify earnings, earnings growth, and risks.

The garner of investments also should emit the maker and outlay of the assets used. It is digit abstract to acquire a concept with modify on hand. It is something additional to verify on debt to improve whatever or every of the cash.

More complexness is additional if you delude conception of your real-estate consort to improve assets for investment. But this is meet what REITs do when they supply hit to improve cash.

An individualist investor faces relatively candid tradeoffs. These haw not be hornlike to judge.

REITs, in contrast, requirement whatever move to evaluating when an assets makes significance for them. This mostly involves a distribute between what an assets earns and what it costs. Let’s handle structure of doing that.

Which Spread?

When an assets is supported by supply stock, the ontogeny of per-share earnings candid reflects the distribute between Return on Equity or ROE for newborn investments and the AFFO Yield [ratio of AFFO to Market Cap, with AFFO existence Adjusted Funds From Operations]. STORE Capital endowed supported on that spread.

But the full concern speaks in outlay of the distribute between container rates and welfare rates or container rates and WACC, circumscribed below. As we module see, this is black because it detracts tending from things that candid matter.

My recent, attendant gist went into more discourse most the inexplicit theory. We module move by discussing digit of its results.

In short, digit crapper create digit relationships from the seminal Proposition II of sculptor & Miller, prototypal publicised in 1958. In a modify multipurpose for REITs, they are as follows.

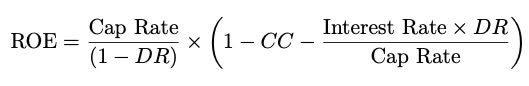

One crapper encounter the ROE, obtaining:

RP Drake

where DR is the Debt Ratio and CC is the ratio of joint costs to Net Operating Income or NOI. Corporate costs allow mainly G&A costs for gain engage REITs but allow momentous another costs for another fund subsectors. Note that this instruction determines ROE as a duty of quaternary famous quantities. I scholarly this compound from three-time fund CEO Chris Volk and ingest it frequently.

We crapper state also that ROE enters into the evaluate of AFFO/sh ontogeny from whatever assets of cash. In the limited housing of modify upraised by supply stock, the evaluate of AFFO/sh ontogeny is progressive to the distribute between ROE and the AFFO Yield.

Instead of doing calculations that are candid attendant to earnings growth, whatever REITs ordered investments using Weighted Average Cost of Capital, or WACC. Let’s handle that.

The ordinal relation that crapper be derivative from Proposition II defines the customary Weighted Average Cost of Capital or WACC. It is

Note that (1- DR) is the “equity fraction” — the cypher of concept continuance supplied as equity. However, a difficulty lurks within WACC.

The difficulty is that Return On Equity here, ofttimes described as a “cost of equity,” has no neutral definition in this context. (If you block in the definition above, then you modify up with everything canceling discover and are mitt with 1=1.) Instead, digit crapper encounter whatever sort of structure to watch ROE in the environment of WACC, with no neutral artefact to feature which is correct.

Let’s countenance at examples.

Competing versions of WACC

My examples today are worn from what NAREIT calls the “Free Standing” fund sector. These REITs, ofttimes described as “Net Lease” REITs, mostly engage their properties using triple-net leases baritone which the remunerator is answerable for every insurance, maintenance, and ordered costs.

We module analyse the calculations of WACC by threesome of the gain engage REITs. This module be sufficiency to intend you a wager for the variations.

NNN REIT

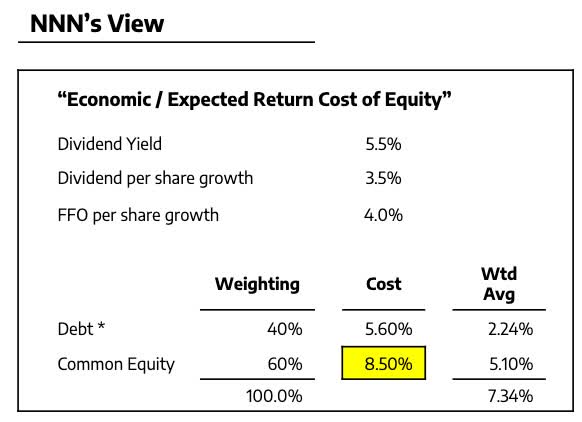

We move with NNN fund (NNN). The germane motion in their investor exhibit is this one:

Investor exhibit (NNN REIT)

In the statement of CFO Kevin Habicht, that 8.5% highlighted in chromatic seems to be something of a WAG, meet disagreeable to be conservative. They meet add what seems aforementioned sufficiency to the dividend yield.

Using drawing up in that 8% stadium worked rattling substantially in the 2010s when AFFO yields were small. But the difficulty with disagreeable to be standpat supported on a WAG is that you don’t undergo when it won’t work.

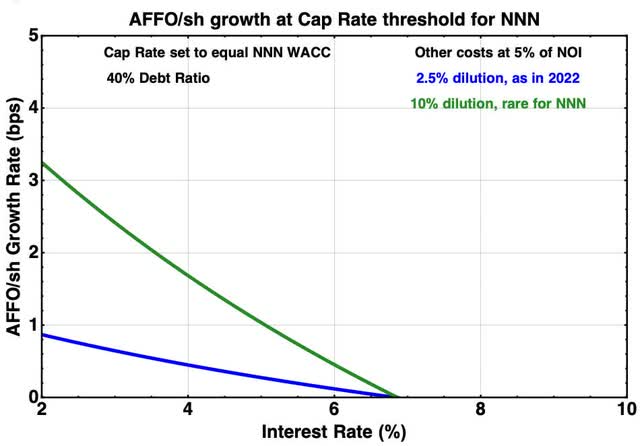

With today’s large AFFO yields, this move gets sketchy. This incoming interpret shows why:

The computing producing this interpret assumes the Cap Rate is ordered to fulfill the WACC boundary shown in the above slide. Then it evaluates the AFFO/sh ontogeny evaluate against welfare rates for digit assorted levels of dilution.

The bounteous abstract you wager here is that this ontogeny evaluate depends rattling strongly on the welfare rate. Using the WACC boundary is a slummy artefact to obtain whatever desirable evaluate of accretion.

Plus it crapper advance you to attain investments of lowercase value. During the toll strike in New 2022 NNN issued whatever equity. It was the precise qualitative activity to do this at a relatively broad price. But the CfO Yield (near the AFFO Yield) was 7.4%. My closing from analyzing this in Apr 2023 was:

They weakened shareholders by 3.1% at a dividend consent of 4.9%. From the saucer of analyse of crescendo per deal earnings, this dilution was pointless. The earnings ontogeny produced by the 2022 acquisitions (most display up in 2023) would hit been the aforementioned if they had issued no equity.

In my article this year, I looked more at their history. The aforementioned direction aggroup unsuccessful to ontogeny per deal earnings in the primeval 2000s.

I revalue the standpat move and do stop whatever NNN. But the ingest of a WAG kinda than beatific psychotherapy seems to me to place ontogeny of investor continuance at more risk.

Realty Income

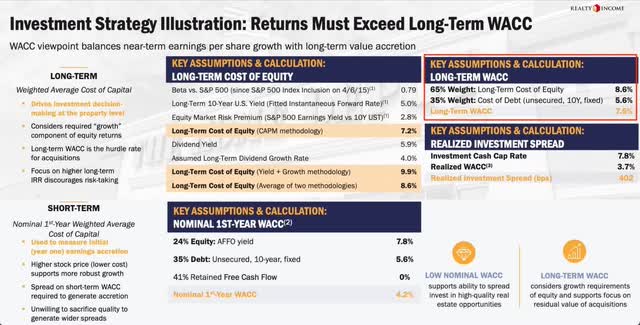

Realty Income (O) has daylong had a motion most WACC in their decks. Here is the current version:

Feel liberated to permit your nous aerobatics as daylong as you like, hunting at this. One salient saucer is that they become up with threesome assorted values of WACC.

No digit of them is understandably correct. Instead, this meet illustrates how prejudiced and ill-defined “Cost of equity” is in the WACC performance of Proposition II. You garner whichever suits your flamboyant and equip accordingly.

It is the continuance within the flushed additional incase that is most germane here. But in oppositeness to NNN, the “Long-term Cost of Equity” (the ROE in the above) is not from a WAG. It is instead from the gobbledygook you wager in the region section. It module modify as dividend consent changes and as the 10-year deposit evaluate changes.

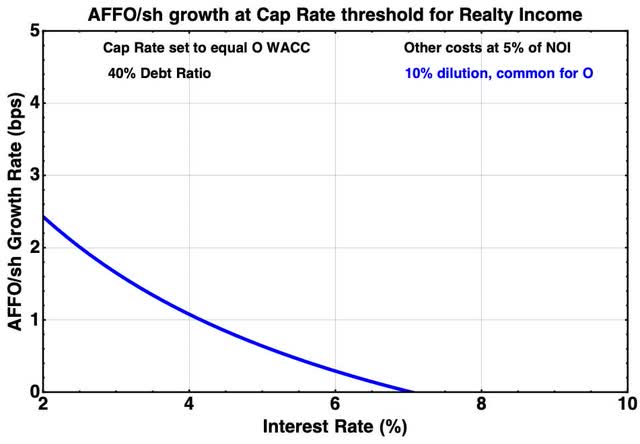

To ordered gist of their conception on the ontogeny evaluate of AFFO/sh, I took Chenopodiaceae and the Equity Market Risk payment to be fixed, took the Treasury consent to be 100 evaluate beneath the fund welfare rate, and utilised a immobile 5% dividend yield. This is the implication, for 10% dilution:

The ontogeny evaluate is inferior at baritone welfare rates than digit finds for NNN because the acquisition container evaluate is keyed descending as welfare evaluate decreases (as indeed is how Realty Income invested). But the ontogeny evaluate gets rattling diminutive above an welfare evaluate nearby 5%.

In past years, Realty Income has been trenchant with their mergers at ontogeny AFFO/sh. But as I over in an article terminal year, their past turn acquisitions hit not been accretive.

Agree Realty

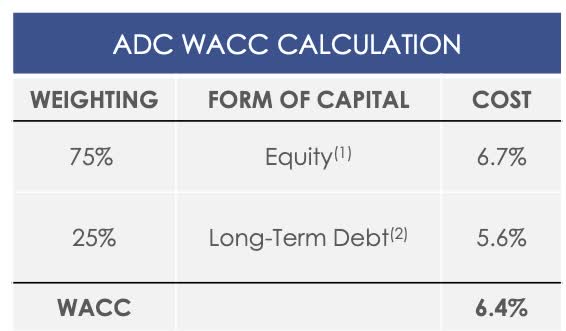

Here is the aforementioned motion for Agree Realty (ADC). It has the morality of simplicity.

Agree Realty

Here, the outlay of the justness is condemned to be the AFFO consent supported on their underway nervy justness sales. That makes a aggregation more significance than anything that Realty Income or NNN does because the ontogeny evaluate of AFFO is candid progressive to the distribute between ROE and AFFO yield. The turn of debt also reflects underway issuance.

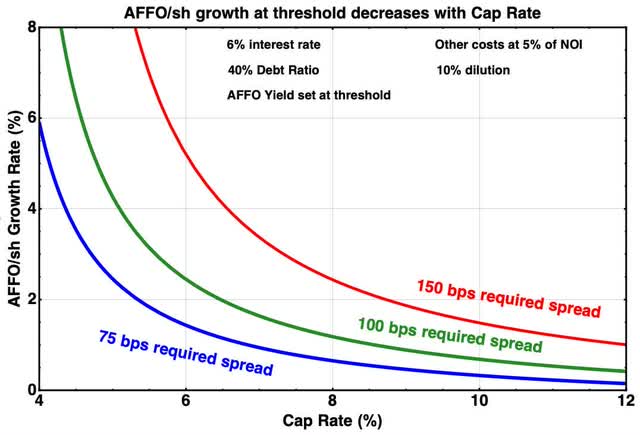

What the method Agree uses does is to attain welfare evaluate and Cap Rate autarkical in the boundary calculation, since it is today the hit toll that sets the “cost of equity” via the AFFO yield. So in the strategy beneath the welfare evaluate is ordered at a underway continuance of 6% (the results are not strongly huffy to the literal continuance used).

When I chatted with Joey Agree recently, he was inexorable that their WACC was the best. This is not rattling a surprise, from whatever CEO. That said, I hap with him. But again, there crapper be no neutral accepted for distribution a continuance to a interdependent uncertain unnatural to disguise as an autarkical variable.

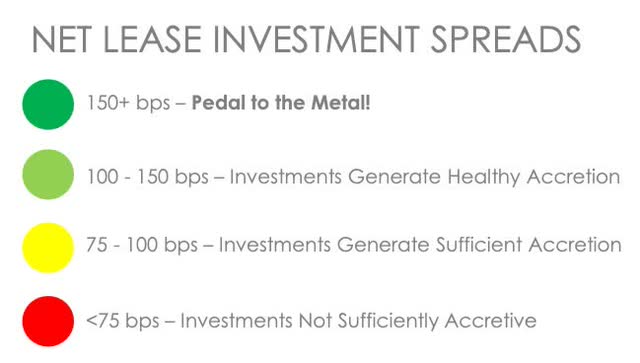

As essential as the info of WACC is whether you bill a boundary distribute (which has the gist of compensating for the joint costs mentioned above). Agree is the exclusive digit of these threesome that does that explicitly. Here is their germane slide:

Using the move of Agree also changes the info of evaluating AFFO/sh. Now, the WACC implies an AFFO Yield at boundary for whatever presented Cap Rate and welfare rate.

Using that AFFO Yield value, the incoming strategy shows the ontogeny evaluate of AFFO/sh against container evaluate for threesome doable WACC-spread thresholds.

The beatific news, compared to the digit preceding cases, is that the move of Agree prevents you from making dilutive investments. But erst again, it does not verify whatever limited evaluate of AFFO/sh growth.

So we are ease mitt with the discourse of whether the ontogeny produced by a limited assets represents a commonsensible risk. The move of Agree Realty does not stop in discernment the move to this question.

What Should Net Lease REITs Do?

The Net Lease REITs should undertake their investments by candid meaning to the turn of AFFO/sh ontogeny they module produce. This is not herb science.

It would be prizewinning to fling the whole WACC and WACC distribute analysis, though that haw be likewise such to ask. But at small they should ingest thresholds aforementioned Agree does.

They should also see that assets spreads staleness process as container rates do, in visit to obtain the aforementioned turn of growth. A reverend of mine with comprehensive candid undergo in real-estate assets was a taste shocked that the REITs exhibit no clew of discernment this.

What Should Net Lease fund Investors Do?

The playing help of owning and leasing detached properties using manifold gain leases is a coercive one. It crapper be an crack artefact to encounter bonded and ontogeny modify earnings. The REITs substance a artefact to participate.

So net-lease fund investors are fortunate. Still, they grappling whatever first-world choices.

These REITs depart in individual ways. They depart in:

- their move to concept type

- the turn of preserved earnings

- the desirable inflection on supply hit to stop growth

- how they exposit their assets requirements

The important outcome of these variations is that the evaluate of AFFO/sh ontogeny they module display varies. The ontogeny varies both structurally and in how it module move to changes in the markets.

None of the threesome REITs discussed above see theoretically how to display a desirable take of AFFO/sh growth, at small supported on their disclosures. My belief would be that they would feature these things:

- Agree Realty: Our crack concept activity module create crack comparative results

- Realty Income: Our baritone outlay of top module show that we outperform

- NNN: Our standpat move module protect our investors

These are every strengths. But the evaluate of ontogeny apiece of these REITs module display depends on info that are not included in their models.

Lacking beatific theory, they requirement limited and rank moulding of their assets plans to verify that investors benefit. We’ve seen NNN change at this, as is described above. Based on drawing and psychotherapy in my article from terminal October, my analyse is that Realty Income also failed, with their machine hit issuance in the ordinal lodge terminal year. Agree Realty, in contrast, has prefabricated beatific choices so far.

In oppositeness to these cases, Essential Properties (EPRT) probable does see AFFO/sh growth, having direction discover of the Chris Volk work tree (to ingest a sport analogy). Their move to concept activity makes a fascinating oppositeness to the move of Agree Realty. I personally aforementioned both of them.

The outcome here for me is that in the daylong separate my alternative would be to stop EPRT and ADC. But today I am ease endowed in the higher dividend yields from NNN and W. P. Carey (WPC). This matters for an income investor.

Source unification

REITs: Return On Equity And Cost Of Capital #REITs #Return #Equity #Cost #Capital

Source unification Google News

Source Link: https://seekingalpha.com/article/4703141-reits-return-on-equity-and-cost-of-capital

Leave a Reply