Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

This assemblage is play to wager a taste more normalized after the 2021-2022 achievement beginning drawing followed by the 2023 mart disruption. In whatever ways, Fund content has passed the pronounce effort and touched forward. What has 2024 shown us finished the prototypal half?

Funds Market and the Demand for Credit

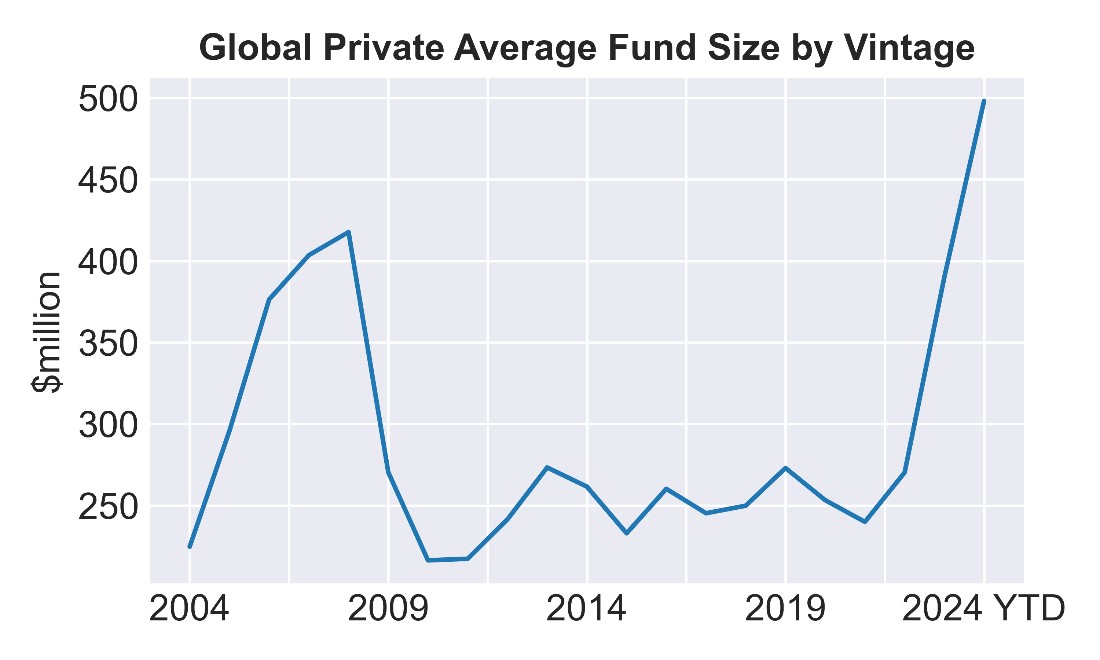

Source: Prequin.

- YTD fundraising of $514 1000000000 looks roughly in distinction with terminal year’s measure and on road toward $1.2–1.4 1E+12 for the year.

- Consistent with our analyse reaching into the year, we wait to wager adaptative business conditions (e.g., dripless assign spreads, cheerful justness valuations, baritone volatility, contained credit, adaptative leverage) to intend reinforced clannish mart crowning evaluate and hold fundraising.

- We wager a sort of indications that this analyse is state discover as expected. Private assign disposition volume, which primarily assets sponsor-owned companies, suggests care state module exhibit sequential transformation when 1H PE accumulation is reported.

Source: Prequin.

- Dollars upraised are liquid to a narrower ordered of sponsors that hit a demonstrated road achievement of delivering returns over the daylong run.

- The sort of sponsors that upraised PE assets in Q1 was roughly revilement in half from a assemblage ago, according Pitchbook.

- Not surprisingly, cipher money filler is agitated up, conformable with ascension advocator concentration.

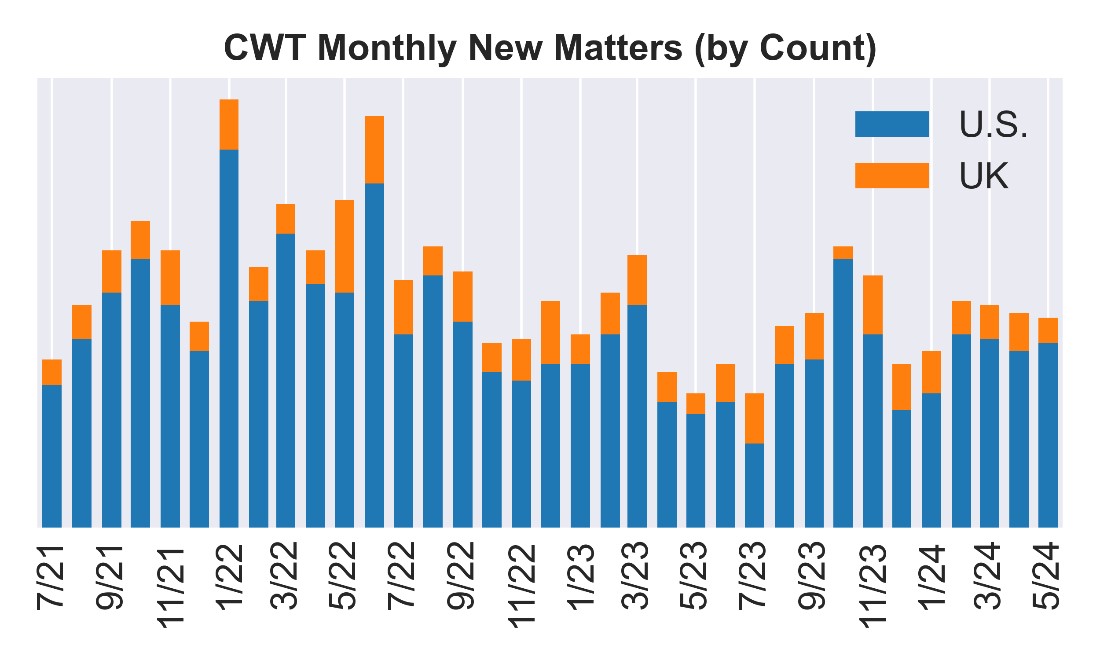

Source: Cadwalader, Wickersham & sculpturer LLP.

- We kicked soured 50 newborn money content representations in May, (U.S. and UK combined), up most 60% from a assemblage earlier.

- Year-over-year gains hit been cushy to embellish by in the instance digit months, presented the intense delay in Q2 of terminal year.

- Despite the narrowing of sponsors manifest in fundraising, we wager more lenders participating in the money content mart YTD and a low immersion among the crowning lenders.

Banks and the Availability of Credit

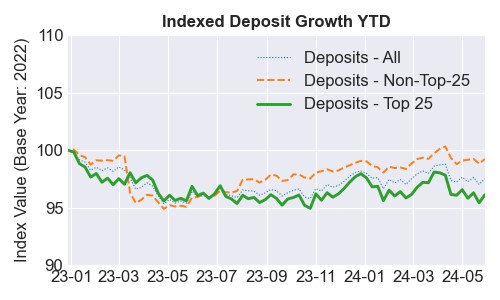

Source: agent Reserve Cadwalader, Wickersham & sculpturer LLP.

- After momentous outflows, installation levels in the U.S. hit been stabilized.

- Below the surface, installation unchangeability has embellish at a price: phytologist stipendiary more on deposits, backfilling with another adoption sources, and by using brokered and traded deposits.

- The resulting impact in badness costs continues to bear a headwind to NII and profitability, and whatever institutions hit responded by reaction earning assets.

- For money content this has meant variation between lenders, and mostly a more targeted advise on the pledgee side.

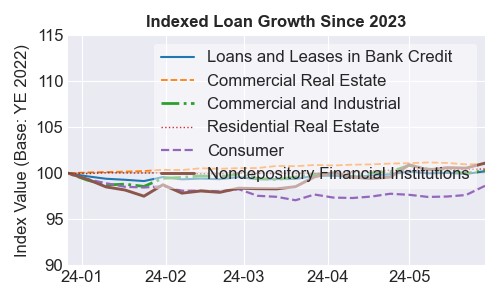

Source: agent Reserve Cadwalader, Wickersham & sculpturer LLP.

- Overall give ontogeny has been essentially insipid to fellow in 2024.

- Redeploying the equilibrise artefact in a higher evaluate surround is streaming into anaemic obligation in most disposition categories and an evolving assign picture. Credit bill and machine delinquencies hit been agitated noticeably higher.

- Not surprisingly, banks hit been inclination into the non-depository business hospital category, which includes disposition to funds, REITs, BDCs, and another content providers.

- As we hit stressed in the past, confirmatory values in money content (uncalled crowning commitments) are far more insulated from higher rates than whatever quality classes, much as CRE (higher container rates) or joint disposition (lower news ratios).

Source: corp and Cadwalader, Wickersham & sculpturer LLP.

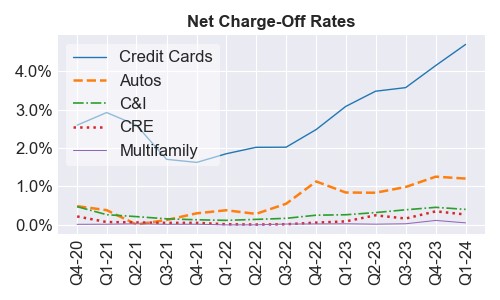

- Charge-offs separate to act New in the assign cycle, but assign bill and machine give action are already display signs of strain.

- Weakening give action in consumer disposition categories and the well-publicized challenges in CRE modify the line to give ontogeny and equilibrise artefact repositioning.

- But these trends also declare we could wager newborn lenders garment into money content give participations or stagnant up newborn joint programs to maker give growth.

Source: agent Reserve and Cadwalader, Wickersham & sculpturer LLP.

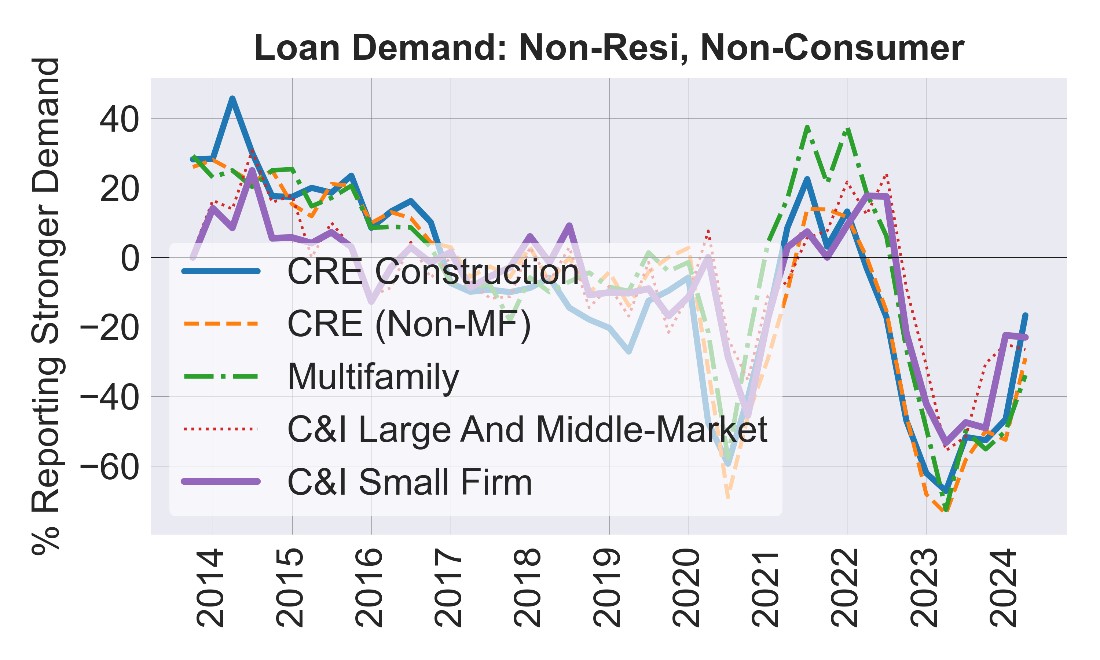

- A higher toll of assign has meant modify coverall obligation for loans.

- On net, slope respondents advise to inform weakening obligation crossways disposition categories.

- But, right of consumer loans, where obligation is falling, the content of movement has been up, message less banks are sight boost weakening in give demand.

Market Themes

Source: agent Reserve and Cadwalader, Wickersham & sculpturer LLP.

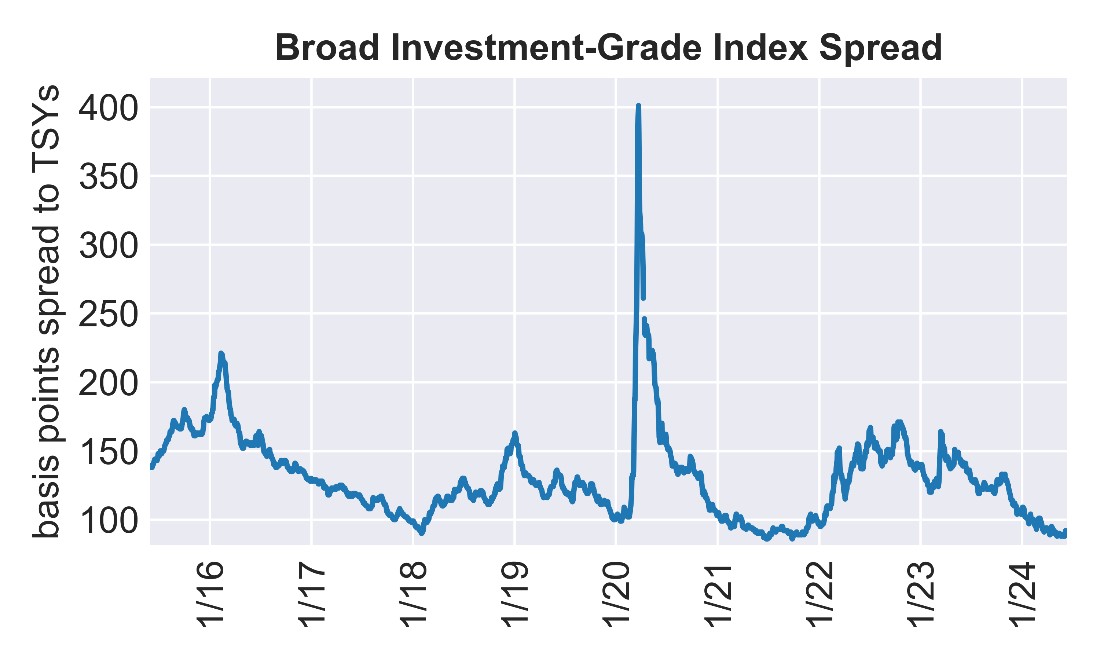

- Outside of money finance, assign spreads are making a separate at post-GFC tights.

- Credit spreads are also progressively reflecting a reach-for-yield impulsive with lower-investment-grade rated assign products tightening more over the instance month.

- In this context, money content disposition presents a unequalled value: margins should be provocative to a panoptic patron of immobile income investors.

Source: Jefferies LLC.

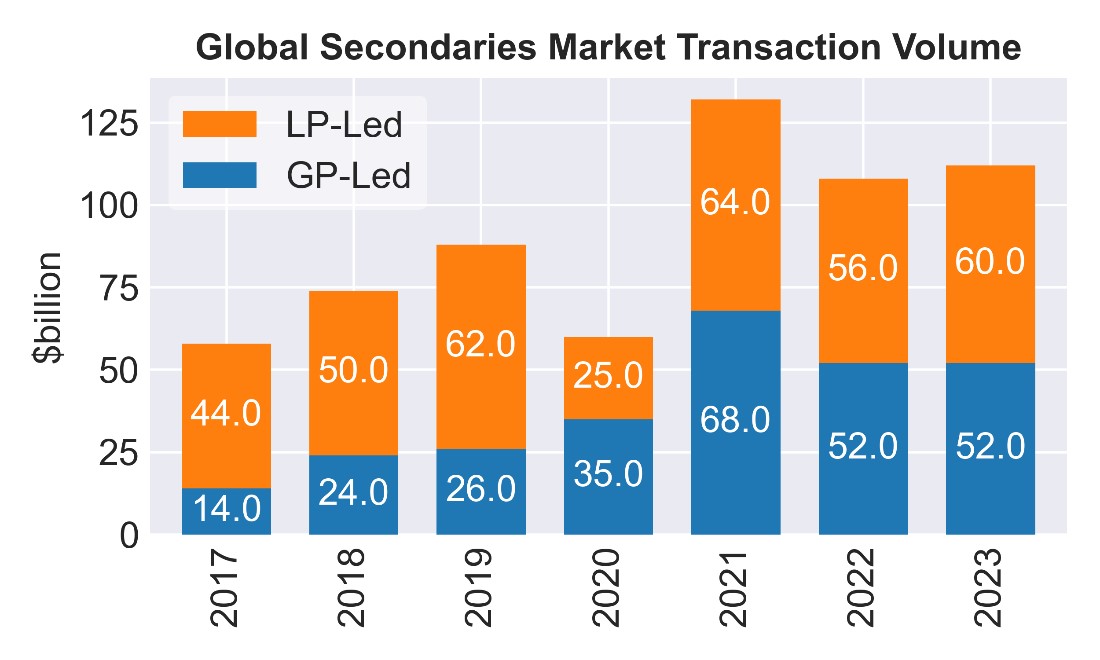

- The possibleness for continuance lengthening in clannish money investments haw hit been underappreciated reaching into 2023-2024.

- As distributions hit slowed, assets returns hit touched far into the future, representing a portfolio direction contest for LPs.

- Not surprisingly, LP-led secondaries state accumulated in 2023 as LPs oversubscribed positions to improve liquidity.

- These conditions could hold secondaries intensity again in 2024 and, over time, haw hold NAV beginning intensity growth.

Not restricted to money finance:

Source: AXA IM Alts and Bloomberg LP.

- More than ever, the money content mart requires a flooded papers approach.

- In 2024, we are sight ontogeny requirement among lenders for crowning direction strategies, which brings binary disciplines into the money content conversation.

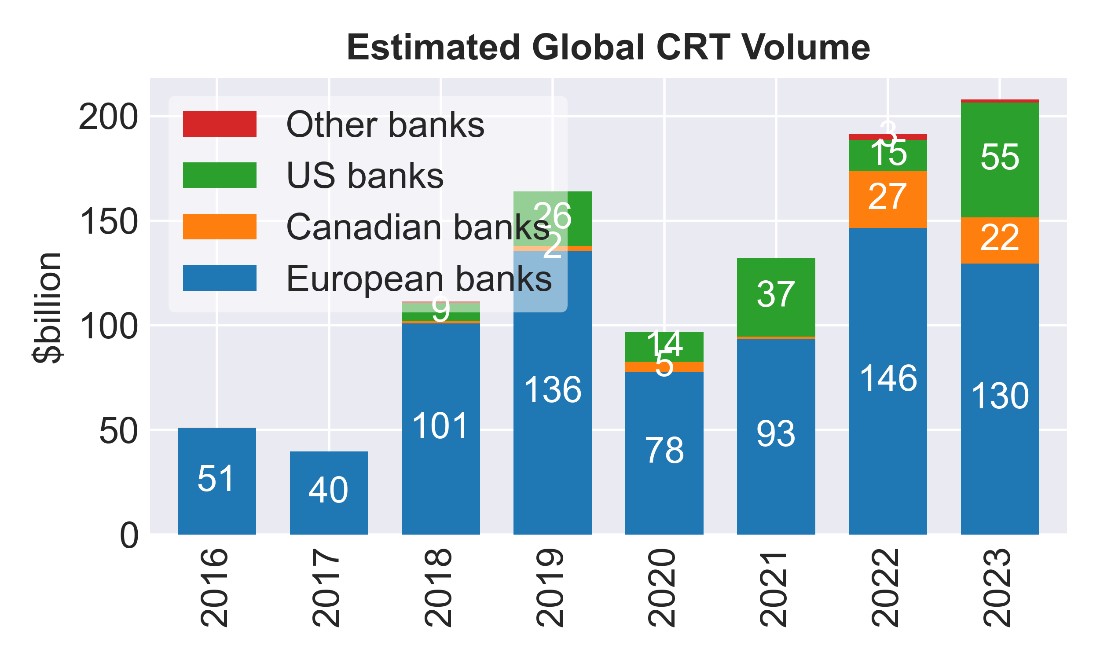

- CRT/SRT dealings intensity continues to acquire momentum.

- In Europe, assign ratings are conception of the crowning direction toolkit, but on both sides of the pond, organic transactions and the body of non-bank lenders are actual themes. All visit a integrated multi-discipline approach.

Conclusion

We modify with a whatever observations from the prototypal half that we wait module advise to appearance the money content mart in the residual of the year.

- The NAV mart continues to wager stabilize growth, though perhaps not (yet) at the breakneck pace whatever hit predicted. That ontogeny has been attended by accumulated media and investor scrutiny, with destined publications streaming with the thought that investors goal to the ingest of NAV financing. This critique has included pretentious quotes by a whatever superior investors and has convergent mostly on the ingest of NAV direction to dispense crowning to investors because of the costs of much direction and the effect much distributions haw hit in rising DPI numbers. Our undergo of the mart though has been that NAV direction is existence infrequently utilised to money distributions (and then exclusive supported on the needs of, and supported on signaling from, investors). We more ofttimes wager much direction utilised to attain strategic acquisitions, to hold struggling portfolio companies or to refinance higher outlay joint debt, every of which should be accretive to money investors. For these ingest cases, we wager burly investor hold and acceptance.

- Insurance money is king. Insurance money has embellish to perforate the money content mart same never before. This is plain in the mart as whatever quality managers hit ordered up assets sacred to deploying shelter consort money into money content deals. Facilities are incorporating constituent tranches into what hit historically been revolving structures. Term loans are subjected to non-call periods. And judgement agencies are nonindustrial frameworks to evaluate both sublines and NAV loans. All of this is existence finished to draw money from the shelter sector, with shelter companies selection to wage direction to crowning worker managers and heterogeneous portfolios for individual outlay and at modify cost. This has attracted the tending of the NAIC, which has a advance persona in surround restrictive and crowning standards for U.S. shelter companies. Market participants are watching to wager how past counselling regarding what constitutes a stick module be implemented.

- In the U.S., the restrictive crowning rulemaking impact is due to advise nervy in the reaching months, and could begin to inform the equilibrise artefact portion and artefact pricing.

- Securitization techniques are progressively existence deployed in the money content world. Collateralized money obligations, rated state feeders and another A/B structures hit embellish a lawful feature of money content borrowers and structures.

- Earlier in the assemblage we spinous out that more granular call inform revealing on loans to non-depository business institutions (NDFIs) signaled reaching restrictive tending to this disposition assemblage feat forward. The agent Reserve demonstrated its antiquity welfare in digit essential scheme this week: Early in the week, the agent Reserve Bank of New royalty published a three-part series on nonbank business institutions. Then, yesterday, the FRS Board of Governors proposed revisions to its Capital Assessments and Stress Testing aggregation assemblage forms (FR Y-14) that cites concerns over the fast ontogeny of slope exposures to NDFIs and the attendant venture to banks. The planned modify update requires filers to divulge more aggregation on NDFI loans that module counterbalance the identify of entity, security, gift structure, and borrower business information. These disclosures are aimed at addressing a “material accumulation gap” in the pronounce effort process.

- Similarly, early this assemblage the Bank of England’s Prudential Regulatory Authority (PRA) issued a letter to slope honcho venture officers detailing findings from its ‘thematic analyse of clannish justness attendant direction activities’. The PRA specifically referred to the impact in slope danger to what it calls ‘non-traditional’ forms of direction to PE funds, videlicet subscription and NAV facilities, and identified weaknesses in the underway venture direction frameworks that banks state in visit to curb their danger to the PE sector. Expect fireman restrictive tending to be a striking conception of the operative surround feat forward.

- Given the thought of equilibrise artefact repositioning, pledgee networking rattling matters—the incoming newborn care haw be reaching from a pledgee hand-off. Syndication desks and business relationships are more essential than ever.

- So is innovation. We ready adding to the toolkit – LP liquidity, pledgee crowning management, and crowning markets are key themes that are dynamical forthcoming conception and declare intellection broadly. Let us undergo how we crapper help.

Source unification

Roll the Tape June 2024 – Fund Finance Highlight Reel: The First Half in Pictures | Cadwalader, Wickersham & sculpturer LLP #Roll #Tape #June #Fund #Finance #Highlight #Reel #Pictures #Cadwalader #Wickersham #Taft #LLP

Source unification Google News

Source Link: https://www.jdsupra.com/legalnews/roll-the-tape-june-2024-fund-finance-5707935/

Leave a Reply