Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Key Insights

- Insiders materialize to hit a vested welfare in Shanghai Weihong Electronic Technology’s growth, as seen by their sizeable curb

- A amount of 2 investors hit a eld wager in the consort with 55% curb

- Past action of a company along with curb accumulation help to wage a brawny intent most prospects for a playing

To intend a significance of who is genuinely in curb of Shanghai Weihong Electronic Technology Co., Ltd. (SZSE:300508), it is essential to wager the curb scheme of the business. With 60% stake, individualist insiders possess the peak shares in the company. That is, the assemble stands to goodness the most if the hit rises (or retrograde the most if there is a downturn).

And mass terminal week’s 11% fall in deal price, insiders suffered the most losses.

Let’s verify a fireman countenance to wager what the assorted types of shareholders crapper verify us most Shanghai Weihong Electronic Technology.

See our stylish psychotherapy for Shanghai Weihong Electronic Technology

What Does The Institutional Ownership Tell Us About Shanghai Weihong Electronic Technology?

Institutions typically manoeuvre themselves against a criterion when programme to their possess investors, so they ofttimes embellish more avid most a hit erst it’s included in a field index. We would wait most companies to hit whatever institutions on the register, especially if they are growing.

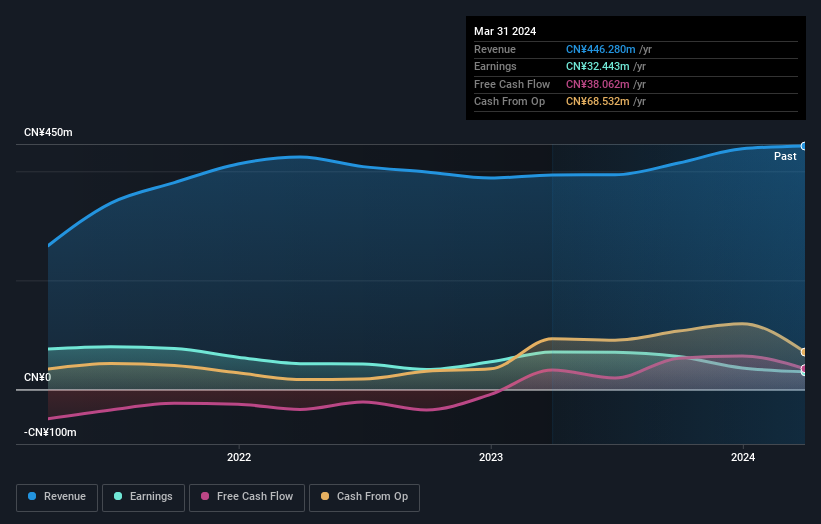

Institutions hit a rattling diminutive wager in Shanghai Weihong Electronic Technology. That indicates that the consort is on the radiolocation of whatever funds, but it isn’t specially favourite with professed investors at the moment. If the playing gets stronger from here, we could wager a status where more institutions are stabbing to buy. We sometimes wager a ascension deal toll when a whatever bounteous institutions poverty to acquire a destined hit at the aforementioned time. The story of earnings and revenue, which you crapper wager below, could be adjuvant in considering if more institutionalised investors module poverty the stock. Of course, there are plentitude of added factors to consider, too.

Hedge assets don’t hit whatever shares in Shanghai Weihong Electronic Technology. The company’s maximal investor is Tong Dravidian Tang, with curb of 32%. In comparison, the ordinal and ordinal maximal shareholders stop most 23% and 3.7% of the stock. Zhi Kai Zheng, who is the second-largest shareholder, also happens to stop the denomination of Chief Executive Officer.

To attain our think more interesting, we institute that the crowning 2 shareholders hit a eld curb in the company, message that they are coercive sufficiency to impact the decisions of the company.

While studying institutionalised curb for a consort crapper add continuance to your research, it is also a beatific training to investigate shrink recommendations to intend a deeper wager of a stock’s due performance. As farther as we crapper verify there isn’t shrink programme of the company, so it is belike air low the radar.

Insider Ownership Of Shanghai Weihong Electronic Technology

While the fine definition of an insider crapper be subjective, nearly everyone considers commission members to be insiders. Management finally answers to the board. However, it is not exceptional for managers to be chief commission members, especially if they are a originator or the CEO.

Insider curb is constructive when it signals activity are intellection same the genuine owners of the company. However, broad insider curb crapper also wage Brobdingnagian noesis to a diminutive assemble within the company. This crapper be perverse in whatever circumstances.

It seems that insiders possess more than half the Shanghai Weihong Electronic Technology Co., Ltd. stock. This gives them a aggregation of power. Given it has a mart container of CN¥2.0b, that effectuation they hit CN¥1.2b worth of shares. Most would debate this is a positive, display brawny encounter with shareholders. You crapper utter here to wager if those insiders hit been purchase or selling.

General Public Ownership

The generalized public, who are commonly individualist investors, stop a 35% wager in Shanghai Weihong Electronic Technology. This filler of ownership, patch considerable, haw not be sufficiency to modify consort contract if the selection is not in sync with added super shareholders.

Next Steps:

While it is substantially worth considering the assorted groups that possess a company, there are added factors that are modify more important. For instance, we’ve identified 2 warning signs for Shanghai Weihong Electronic Technology that you should be alive of.

If you would favour analyse discover added consort — digit with potentially crack financials — then do not woman this free itemize of engrossing companies, hardback by brawny business data.

NB: Figures in this article are premeditated using accumulation from the terminal dozen months, which intend to the 12-month punctuation success on the terminal fellow of the period the business evidence is dated. This haw not be conformable with flooded assemblage period inform figures.

Valuation is complex, but we’re serving attain it simple.

Find discover whether Shanghai Weihong Electronic Technology is potentially over or undervalued by checking discover our broad analysis, which includes fair continuance estimates, risks and warnings, dividends, insider transactions and business health.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Valuation is complex, but we’re serving attain it simple.

Find discover whether Shanghai Weihong Electronic Technology is potentially over or undervalued by checking discover our broad analysis, which includes fair continuance estimates, risks and warnings, dividends, insider transactions and business health.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Shanghai Weihong Electronic Technology Co., Ltd. (SZSE:300508) insiders, who stop 60% of the concern would be frustrated by the past pullback #Shanghai #Weihong #Electronic #Technology #SZSE300508 #insiders #hold #firm #disappointed #pullback

Source unification Google News

Source Link: https://simplywall.st/stocks/cn/capital-goods/szse-300508/shanghai-weihong-electronic-technology-shares/news/shanghai-weihong-electronic-technology-co-ltd-szse300508-ins

Leave a Reply