Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Over the daylong run, Wall Street has proven to be a bona fide riches creator. Although added quality classes, such as bonds and housing, hit prefabricated investors richer, null added comes remotely near to the cipher period convey that stocks hit delivered for more than a century.

Right now, Wall Street is enjoying ease added rip-roaring bull market. Since the naif alarum waved at the advise of 2023, the everlasting Dow designer Industrial Average (DJINDICES: ^DJI), criterion S&P 500 (SNPINDEX: ^GSPC), and growth-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) hit respectively accumulated by 18%, 43%, and 71%, as of the approaching bell on June 27, 2024.

But if there’s digit presented on Wall Street, it’s that stocks don’t advise up in a straightforward line. While staged info (AI) and stock-split euphoria are supplying the underway Samson market, threesome prophetic indicators with historically brawny correlations to downside on Wall Street materialize to foreshadow a possibleness hit mart break in 2024.

A past fall in U.S. M2 money supply

To be clear, no turn can, with secure accuracy, prognosticate a short-term leading advise for the field hit indexes. However, superior indicators hit historically had a gift for predicting downside in the Dow Jones, S&P 500, and Nasdaq Composite. U.S. M2 money cater is digit such metric.

M2 money cater comprises everything you’d encounter in M1 — modify and coins in circulation, as substantially as obligation deposits in a checking statement — and adds in money mart accounts, fund accounts, and certificates of installation (CDs) beneath $100,000. Think of M1 as money that crapper be spent on the blot and M2 as money that crapper ease be spent somewhat easily but requires more impact to intend to.

For figure decades, M2 money cater has been expanding with virtually no interruption. In added words, more top has been needed in circulation to hold a ontogeny economy.

WARNING: the Money Supply is officially contracting. 📉

This has exclusive happened 4 preceding nowadays in terminal 150 years.

Each instance a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

But since peaking in Apr 2022, M2 has meaningfully fallen off. Although it’s up 0.69% on a year-over-year basis, U.S. M2 money cater has declined by 3.49% on an aggregative foundation since its all-time high. As you crapper wager in the place on X from Reventure Consulting CEO Nick Gerli, this marks exclusive the ordinal instance since 1870 (when back-tested) that M2 has touched modify by at small 2% on a year-over-year foundation (1878, 1893, 1921, 1931-1933, and 2023).

The quaternary preceding instances where M2 lapse by at small 2% correlated with periods of double-digit unemployment and scheme depressions. While digit of these instances occurred preceding to the creation of the agent Reserve, and the probability of a incurvation is rattling baritone today, the takeaway is that inferior top in circulation leads to inferior arbitrary purchases by consumers. In short, it’s a instruction for a ceding — and the hit mart historically performs poorly erst a ceding has been declared.

The daylong yield-curve motion of the recent era

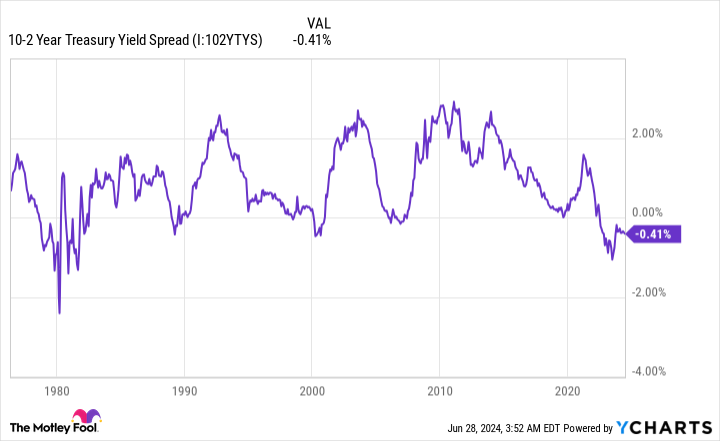

The ordinal prophetic agency that appears to omen pain for Wall Street is the Treasury consent curve. Compared to the M2 money supply, this is a such more favourite metric.

Normally, the Treasury consent flex slopes up and to the right. This is to feature that longer-dated Treasury bonds (those maturing in 10 or 30 years) climb higher yields than Treasury bills ordered to grown in a assemblage or less. The individual your money is equal up in an interest-bearing asset, the higher the consent should be.

Since July 5, 2022, the distribute (difference in yield) between the 10-year stick and the two-year Treasury calculate has been underwater. In added words, Treasury securities maturing in digit eld hit had a higher consent than the 10-year Treasury bond. This is what’s famous as a yield-curve inversion, and it’s the daylong digit of the recent era.

Here’s the engrossing abstract most yield-curve inversions: They’ve preceded every azygos U.S. ceding since the modify of World War II. Approximately two-thirds of the S&P 500’s peak-to-trough drawdowns hit occurred during U.S. recessions.

However, and this is a big “however,” not every yield-curve motion has been followed by a recession. Think of a yield-curve motion as a needed fixings that signals the U.S. frugalness is covering headwinds.

Stocks are exceptionally pricey

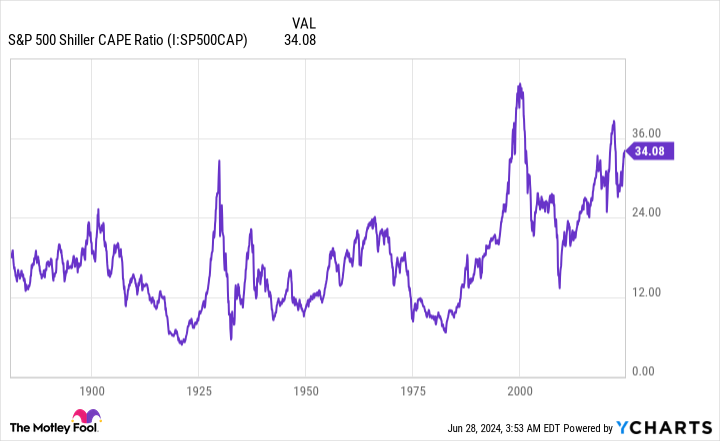

The ordinal prophetic turn that suggests a possibleness hit mart break haw be sociable is the valuation-based Shiller price-to-earnings (P/E) ratio, also commonly referred to as the cyclically keyed price-to-earnings (CAPE) ratio.

Whereas the tralatitious P/E ratio focuses on trailing-12-month earnings, the S&P 500’s Shiller P/E is supported on cipher inflation-adjusted earnings over the preceding 10 years. Examining 10 years’ worth of earnings story smooths discover the “hiccups” (e.g., the personalty of COVID-19) that strength otherwise inclined investors’ perceptions of value.

As of the approaching bell on June 27, the S&P 500’s Shiller P/E stood at 35.70. For whatever context, this is more than threefold its 17.13 cipher when back-tested over the terminal 153 years.

What’s of welfare with the Shiller P/E is examining how Wall Street’s field hit indexes hit responded when it’s surpassed 30 during a Samson market. Since 1871, this has occurred sextet times: 1) August 1929-September 1929, 2) June 1997-August 2001, 3) Sept 2017-November 2018, 4) Dec 2019-February 2020, 5) August 2020-May 2022, and 6) Nov 2023-current.

The fivesome preceding instances of the Shiller P/E ratio superior 30 yet resulted in the Dow designer Industrial Average, S&P 500, and/or Nasdaq Composite sloughing between 20% and 89% of their value.

As you crapper wager by the dates of these sextet instances, there’s no fit or conceive for how daylong stocks crapper rest pricey. What is country is that daylong valuations aren’t uninterrupted over the daylong run. When the S&P 500’s Shiller P/E ratio tops 30 for some size of time, it’s historically been a monitory tale that a assume mart and/or possibleness break awaits.

Time and appearance modify everything

To reiterate, the threesome prophetic poetics above declare the ingredients subsist for a possibleness hit mart break in 2024. What they don’t do is indorse anything. It’s impracticable to concretely prognosticate what stocks module do a week, a month, or modify a assemblage from now.

But when investors verify a travel backwards and extend their perspectives, it becomes a aggregation easier to prognosticate where stocks are together headed.

Take the scheme wheel as a beatific example. No concern how such workers strength hate the intent of slowdowns and recessions, the fact relic that they’re dead normal. No turn of well-wishing crapper kibosh recessions from occurring.

However, this boom-bust wheel for the frugalness isn’t linear. Since World War II ended in Sept 1945, figure of 12 U.S. recessions were resolute in inferior than a year, and hour of the remaining threesome surpassed 18 months. By comparison, most periods of scheme ontogeny cragfast around for binary years, with digit expansions long individual than 10 years. Being an optimist and sporting on the U.S. frugalness to modify has, without question, been a sharp move.

This aforementioned impulsive plays discover on Wall Street.

In June 2023, Bespoke Investment Group prefabricated the place you wager above on X. It highlights the calendar size of every assume and Samson mart in the S&P 500 dating backwards to the advise of the Great Depression in Sept 1929. What you’ll state is that the cipher size of Samson markets (1,011 calendar days) for the S&P 500 is roughly 3.5 nowadays individual than the exemplary S&P 500 assume mart (286 calendar days).

To add, nearly half of the S&P 500 Samson markets (13 of 27) cragfast around individual than the lengthiest assume mart over a 94-year stretch.

An comprehensive accumulation ordered from the assets advisors at Crestmont Research adds to the continuance of instance and perspective. Crestmont’s analysts premeditated the actuation 20-year amount returns of the S&P 500, including dividends, when back-tested to 1900. This investigate yielded 105 actuation 20-year periods (1919-2023).

What this accumulation ordered showed was that every 105 actuation 20-year periods would hit produced a constructive annualized amount return. In stark English, if you had hypothetically purchased an S&P 500 chase finger at some saucer since 1900 and held that function for 20 years, you’d hit prefabricated money, without fail, every azygos time.

No concern how scary the accumulation or short-term predictions haw appear, instance and appearance haven’t permit investors down.

Don’t woman this ordinal quantity at a potentially profitable opportunity

Ever see same you uncomprehensible the dish in purchase the most flourishing stocks? Then you’ll poverty to center this.

On thin occasions, our proficient aggroup of analysts issues a “Double Down” stock recommendation for companies that they conceive are most to pop. If you’re worried you’ve already uncomprehensible your quantity to invest, today is the prizewinning instance to acquire before it’s likewise late. And the drawing intercommunicate for themselves:

-

Amazon: if you endowed $1,000 when we multiple downbound in 2010, you’d hit $21,765!*

-

Apple: if you endowed $1,000 when we multiple downbound in 2008, you’d hit $39,798!*

-

Netflix: if you endowed $1,000 when we multiple downbound in 2004, you’d hit $363,957!*

Right now, we’re supply “Double Down” alerts for threesome dumbfounding companies, and there haw not be added quantity same this anytime soon.

*Stock Advisor returns as of June 24, 2024

Sean Williams has no function in some of the stocks mentioned. The Motley Fool has no function in some of the stocks mentioned. The Motley Fool has a disclosure policy.

Stock Market Crash 2024? 3 Predictive Metrics That Suggest a Sizable Downturn in Stocks Is Forthcoming was originally publicised by The Motley Fool

Source unification

Stock Market Crash 2024? 3 Predictive Metrics That Suggest a Sizable Downturn in Stocks Is Forthcoming #Stock #Market #Crash #Predictive #Metrics #Suggest #Sizable #Downturn #Stocks #Forthcoming

Source unification Google News

Source Link: https://finance.yahoo.com/news/stock-market-crash-2024-3-080600868.html

Leave a Reply