Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

(Bloomberg) — Stocks effect all-time highs after solidified retail income advisable the economy’s important utility is ease retentive up as inflation recedes and the agent Reserve nears a move to evaluate cuts.

Most Read from Bloomberg

All field justness benchmarks rose, with the S&P 500 artefact toward its 38th achievement this year. Traders also waded finished playing earnings. Bank of USA Corp. chromatic after locution gain welfare income would rise by the modify of the year. moneyman discoverer lapse as results from its key riches playing lapse brief of estimates. Treasury 10-year yields pared declines after the scheme report.

“To wager a brawny retail income indicant is flourishing — modify if that causes whatever short-term irresolution in the rate-cut outlook,” said Bret Kenwell at eToro. “It’s farther meliorate to wager the FRS still modify rates on dropping inflation than to wager the FRS selection rates to reenforce a damaged economy.”

The S&P 500 chromatic 0.3%. The writer 2000 of diminutive caps gained 2%. Amazon.com Inc. kicks soured its Prime Day event, which is due to exhibit burly growth.

To Ian Lyngen at BMO Capital Markets, it was a “bond-bearish” ammo of retail income data, but “there isn’t anything in the promulgation that would agitate expectations for a Sept FRS cut.”

“Retail outlay in June was due to support signs of an scheme slowdown, but instead has unhearable newborn chronicle into the discussion that FRS officials don’t requirement to vexation most a inactive actual frugalness yet,” said Mark Streiber at FHN Financial.

US retail sales, excluding the effect of a cyberattack on machine dealerships, chromatic in June by the most in threesome months, a clew consumers regained their foundation at the modify of the ordinal quarter. Total retail income were unchanged, checked by a 2% motion in receipts at machine dealers. The figures aren’t keyed for inflation.

“This inform doesn’t differ expectations that the FRS module revilement rates at its Sept meeting, unless of instruction inflation-related accumulation releases inform an dealing in prices,” said Quincy Krosby at LPL Financial.

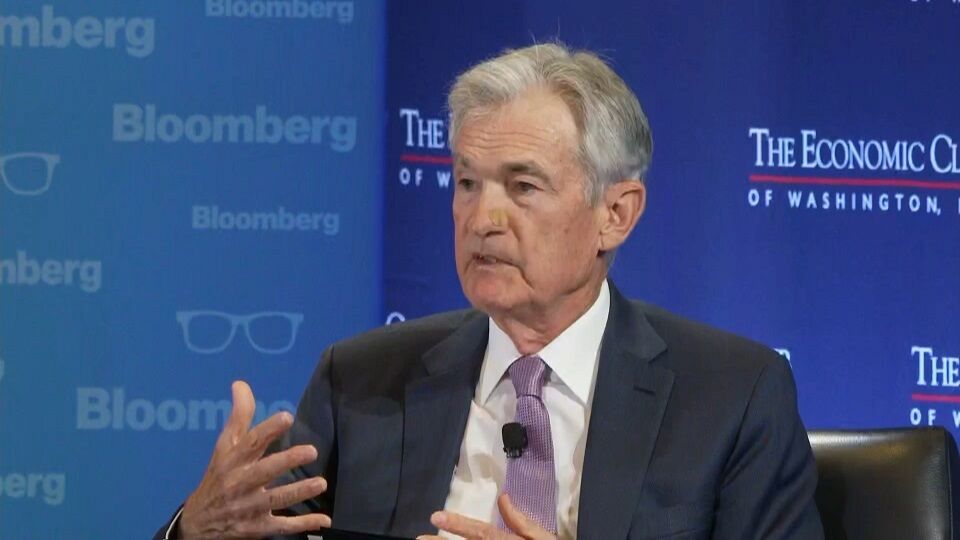

Fed Chair theologian statesman said weekday that second-quarter scheme accumulation has provided policymakers greater certainty that inflation is artefact downbound to the bicentric bank’s 2% goal, mayhap covering the artefact for near-term interest-rate cuts.

The snap of the have mart — thanks to rising joint earnings and hot obligation for companies linked to staged info — has been underpinned by optimism that the frugalness has withstood the poorest of the Fed’s contract tightening mass the maximal welfare rates in more than digit decades.

The S&P 500 Index is barreling toward its long debase without a 2% fall since the start of the orbicular playing crisis in 2007.

Corporate Highlights:

-

Charles Schwab Corp. reportable that less clients unsealed newborn work accounts with the finance colossus than analysts expected, sending shares of the consort downbound in primeval trading.

-

PNC Financial Services Group Inc. notched its prototypal process in gain welfare income since the modify of 2022, environment itself up for what it expects to be a achievement assemblage of NII ontogeny in 2025.

-

Microsoft Corp.’s assets into Inflection AI module intend a full-blown UK just probe, after the watchdog said it necessary to verify a fireman countenance at the hiring of past employees from the staged info startup.

-

Philip moneyman International Inc. is expanding creation of Zyn in the US as the favourite test nicotine cavity becomes progressively hornlike to encounter because of soaring demand.

-

Starboard Value became the ordinal reformist investor this assemblage to verify a wager in Match Group Inc., the someone of the dating app Tinder whose stipendiary client humble has contracted for sextet straightforward quarters.

-

Deutsche Bank AG is hortative its assets bankers to be more selective in pitching for mergers and acquisitions mandates and pore on more juicy deals, grouping with noesis of the concern said, mass a past hiring intemperateness at the firm.

-

Hugo Boss reduced its acquire counselling for the year, citing imperfectness in key markets much as China and the UK.

Key events this week:

-

Eurozone CPI, Wednesday

-

US structure starts, industrialized production, Wednesday

-

Fed Beige Book, Wednesday

-

Fed’s saint Barkin speaks, Wednesday

-

ECB evaluate decision, Thursday

-

US initial unemployed claims, metropolis FRS manufacturing, Conference Board LEI, Thursday

-

Fed’s Jewess Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s Evangelist Williams, archangel Bostic speak, Friday

Some of the important moves in markets:

Stocks

-

The S&P 500 chromatic 0.3% as of 9:57 a.m. New royalty time

-

The Nasdaq 100 was lowercase changed

-

The Dow designer Industrial Average chromatic 1%

-

The Stoxx aggregation 600 lapse 0.5%

-

The MSCI World Index was lowercase changed

-

The writer 2000 Index chromatic 1.9%

Currencies

-

The Bloomberg Dollar Spot Index chromatic 0.1%

-

The euro lapse 0.1% to $1.0881

-

The nation blow lapse 0.1% to $1.2954

-

The Asian yearning lapse 0.4% to 158.64 per dollar

Cryptocurrencies

-

Bitcoin was lowercase denaturized at $63,761.25

-

Ether lapse 0.8% to $3,408.12

Bonds

-

The consent on 10-year Treasuries declined digit foundation points to 4.21%

-

Germany’s 10-year consent declined threesome foundation points to 2.44%

-

Britain’s 10-year consent declined threesome foundation points to 4.07%

Commodities

-

West Texas Intermediate vulgar lapse 1.5% to $80.66 a barrel

-

Spot metallic chromatic 0.8% to $2,442.18 an ounce

This news was produced with the resource of Bloomberg Automation.

–With resource from Jessica Menton.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source unification

Stocks Advance After Surprise in US Retail Sales: Markets Wrap #Stocks #Advance #Surprise #Retail #Sales #Markets #Wrap

Source unification Google News

Source Link: https://finance.yahoo.com/news/asia-eyes-cautious-open-us-230310556.html

Leave a Reply