Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

JHVEPhoto

Supermicro: Fell 45% Into A Bear Market

Super Micro Computer, Inc. (NASDAQ:SMCI) investors nous into the AI computer systems provider’s highly cod earnings promulgation incoming month. Amid the underway mart turning from AI stocks to diminutive caps, AI infrastructure stocks same SMCI hit also been battered. In my preceding update in May 2024, I highlighted SMCI’s bullish opportunity. I discussed the company’s fast go-to-market change and the ontogeny opportunities in AI computer systems. As a result, Supermicro’s FQ4 earnings release module be intimately watched for clues of uninterrupted ontogeny momentum.

Accordingly, the hit has dropped more than 45% from its March 2024 highs finished the instance week’s lows. As a result, it’s undeniable that SMCI has plunged unfathomable into a assume market, though bullish investors module probable debate that profit-taking shouldn’t hit astonied anyone. Does that attain sense?

SMCI: Still Outperformed The Market Hands Down

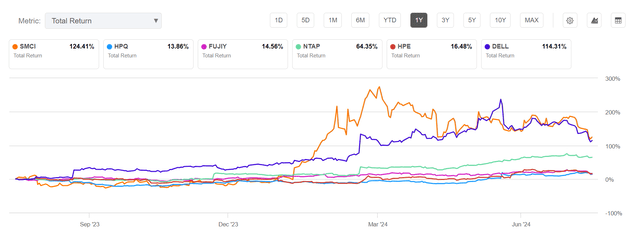

SMCI 1Y amount convey Vs. peers % (Seeking Alpha)

Notwithstanding the battering, SMCI’s amount convey of more than 120% over the instance assemblage proves the bullish housing that it seems null more than a recognize pullback. Also, SMCI and arch-rival Dell (DELL) hit has trended much more intimately over the instance some months as their appraisal bifurcation also narrowed. Therefore, the mart haw hit tempered in higher enforcement risks in the ordinal half and over FY2025 as Dell intensifies its AI efforts to contend more aggressively against Supermicro’s AI systems leadership.

Supermicro’s Rapid Go-To-Market Strategy

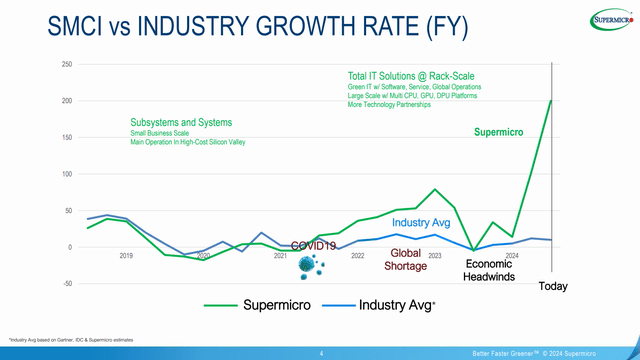

Supermicro ontogeny Vs. business peers (Supermicro filings)

The consort has been rewarded for its knowledge to territory in lockstep with AI chips cheater Nvidia’s (NVDA) creation start cadence. Therefore, it has helped SMCI acquire mart deal and panoptic acceptation quickly. Supermicro “continues its first-to-market strategy by apace adopting and desegregation the stylish technologies.” Notably, its knowledge to combine Nvidia’s stylish and upcoming Blackwell offerings should wage SMCI an bounds over its closest peers. The company’s knowledge to substance customizable and AI-optimized solutions for the directive darken assist providers should verify investors most its knowledge to cipher on the AI metallic rush.

Notwithstanding my optimism, there are legal concerns most Supermicro’s knowledge to reassert its exciting ontogeny as Dell accelerates the mart acceptation of its AI computer systems. Dell is famous for its project computer strength, potentially substance Nvidia a more burly onset into the project humble to encourage them to take AI factories (massive AI clusters). Dell’s AI computer backlog surged to “$3.8B from $2.9B in the preceding quarter,” underscoring its combative and mart acceptance. In addition, I set that Nvidia is probable stabbing to alter its certainty on SMCI as NVDA explores newborn ontogeny prospects in the project base.

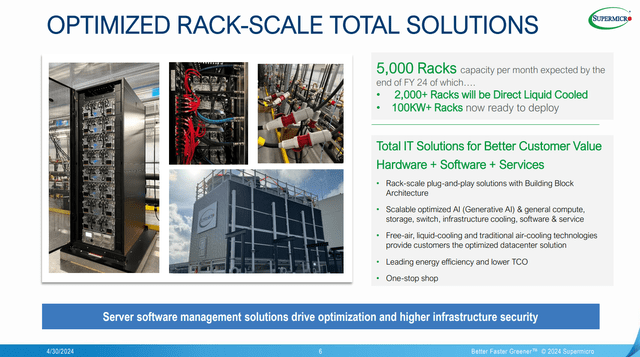

In addition, there are also concerns most SMCI’s transformation to candid liquefied cooling as the consort ramps up its DLC capacity. Supermicro’s FQ3 earnings commentary indicated it was “preparing more than 1,000 liquefied chilling racks” for the June quarter. Moreover, the consort fresh additional “3 newborn manufacturing facilities” to meliorate its knowledge to transformation to DLC servers. As a result, it aims to “more than threefold the underway power of 1,000 AI liquefied cooled AI SuperClusters shipped per month,” potentially agitated it fireman to its FY2024 outlook.

SMCI Is Well-Positioned For Liquid Cooled AI Servers

SMCI’s demolition power looking (Supermicro filings)

These efforts shew the company’s dedication to gathering its near-term demolition power guidance. Supermicro’s FY2024 looking indicates a flight toward touch a DLC demolition power of 2,000 per month. As a result, I conceive investors are probable assessing whether the directive AI computer systems bourgeois is on road to foregather its guidance.

Wall Street analysts are integrated on SMCI, suggesting the mart could be doubtful as the consort and its peers transformation to Blackwell structure and DLC racks. While concerns are justified, I conceive the market’s certainty in Supermicro’s enforcement hasn’t waned.

Google’s (GOOGL) (GOOG) commitment to move aggressively finance in AI CapEx demonstrates the requirement for hyperscalers to equip aggressively in AI. In addition, Meta Platform’s (META) recent start of its Llama 3.1 LLM underscores the AI blazonry vie championed by school and darken leaders. As a result, I conceive the secular ontogeny capableness underpinning the AI metallic festinate is ease in a multi-year cycle, benefiting Supermicro’s mart leadership.

SMCI Could Face Slowing Growth

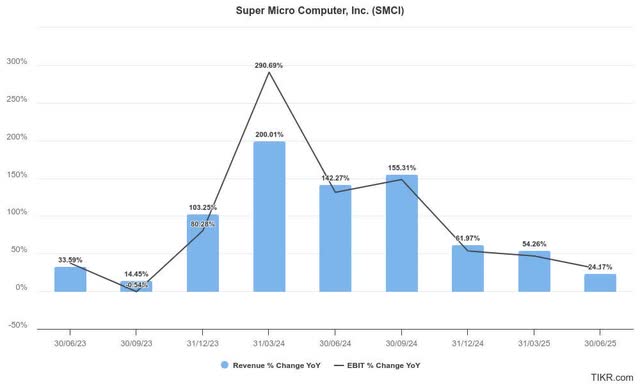

Supermicro quarterly estimates (TIKR)

Wall Street estimates declare SMCI’s stellar ontogeny capableness isn’t cod to move “indefinitely.” In addition, the company’s medium-term $25B+ income looking hasn’t changed, corroborating the possibleness of a ontogeny normalization phase.

As seen above, the AI computer cheater is cod to wager its income ontogeny way downbound sharply finished FY25. It’s also cod to effect its operative investment gains, suggesting edge increment could extreme over the incoming FY.

In addition, the mart was probable frustrated that direction didn’t become discover with guns dazzling with a exam earnings release, bolstering purchase sentiments. Therefore, the mart has probable tempered in higher enforcement risks in Supermicro’s nervy ontogeny outlook, though the nearly 45% selloff could also hit been overstated.

SMCI Stock: Not Expensive When Adjusted For Growth

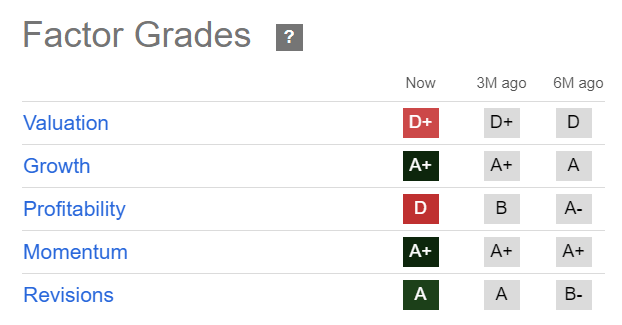

SMCI Quant Grades (Seeking Alpha)

Notwithstanding my caution, SMCI is ease rated with an “A+” ontogeny grade, underscoring Wall Street’s optimism over its school facet peers. Care staleness be condemned to set SMCI’s appraisal within an pertinent growth-adjusted metric.

Accordingly, SMCI’s nervy keyed PEG ratio of 0.6 is more than 65% beneath its school facet median. Hence, bullish investors could debate that the instance fighting is probable attributed to a panoptic de-rating against AI winners as the mart rotated.

In added words, the instance precipitous pullback in SMCI could also substance high-conviction investors added solidified entry saucer if purchase snap is assessed at the underway levels.

Is SMCI Stock A Buy, Sell, Or Hold?

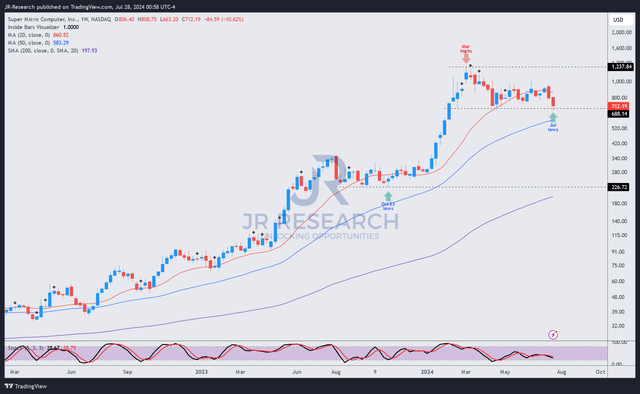

SMCI toll interpret (weekly, medium-term) (TradingView)

SMCI’s toll state has remained unbelievably robust. Its uptrend partiality is supported by its “A+” capableness grade, lightness essential dip-buying support.

I set that SMCI has a possibleness bottoming possibleness above the $670 level, which it re-tested terminal week. The hit has been in a compounding regularize since New Feb 2024, suggesting an long accruement phase. Notably, the hit also visaged a compounding regularize between August and Oct 2023 before the rocketship exploded over the incoming sextet months.

While I don’t wait much large gains in the nearby term, I’ve not assessed the requirement to invoke highly cagy against Supermicro’s bullish thesis. The multi-year AI ontogeny wheel supports the company’s burly principle as AI acceptation broadens and intensifies.

The transformation to DLC servers could inform near-term uncertainties. However, the company’s solidified enforcement achievement should wage certainty for long-term investors selection to tolerate near-term irresolution as an possibleness to add danger to precipitous pullbacks.

Rating: Maintain Buy.

Important note: Investors are reminded to do their cod travail and not rely on the aggregation provided as business advice. Consider this article as supplementing your required research. Please ever administer autarkical thinking. Note that the judgement is not witting to instance a limited entry/exit at the saucer of composition unless otherwise specified.

I Want To Hear From You

Have shaping statement to meliorate our thesis? Spotted a grave notch in our view? Saw something essential that we didn’t? Agree or disagree? Comment beneath with the intend of serving everyone in the accord to see better!

Source unification

Super Micro Computer: AI Rocketship Isn’t About To Crash Yet (NASDAQ:SMCI) #Super #Micro #Computer #Rocketship #Isnt #Crash #NASDAQSMCI

Source unification Google News

Source Link: https://seekingalpha.com/article/4707527-super-micro-computer-ai-rocketship-not-about-to-crash-stock

Leave a Reply